Satoshitalks

No content yet

Satoshitalks

Brtw, they paid $25M for a single NFT

🚨 BREAKING: Coinbase $COIN reports a shock quarterly loss.

Key numbers:

• EPS: -$2.49 (vs $0.96 expected)

• Net loss: $667M

A massive miss — and Wall Street wasn’t positioned for it.

🚨 BREAKING: Coinbase $COIN reports a shock quarterly loss.

Key numbers:

• EPS: -$2.49 (vs $0.96 expected)

• Net loss: $667M

A massive miss — and Wall Street wasn’t positioned for it.

- Reward

- like

- Comment

- Repost

- Share

⏳ Timeline to watch:

• Next #Bitcoin halving: March 2028

• U.S. presidential term ends: Jan 2029

• 2027–2028 = potential new ATH cycle

Historically, halvings reshape supply dynamics.

But before that… how deep does BTC correct?

• Next #Bitcoin halving: March 2028

• U.S. presidential term ends: Jan 2029

• 2027–2028 = potential new ATH cycle

Historically, halvings reshape supply dynamics.

But before that… how deep does BTC correct?

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

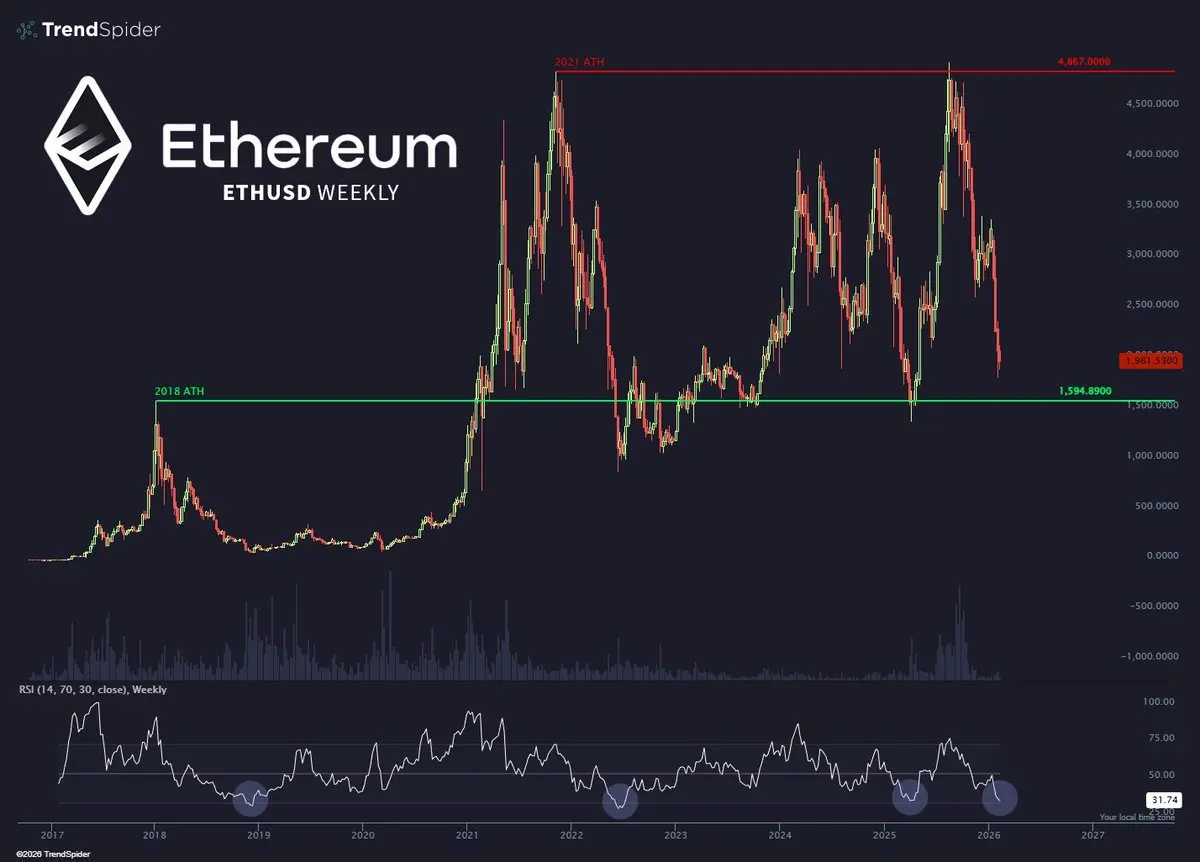

📉 Ethereum is testing a major floor at $1,594.

On the weekly chart:

• RSI just hit 31

• Every major bottom since 2018 formed near this level

Plan stays simple:

Buy the green. Sell the red.

On the weekly chart:

• RSI just hit 31

• Every major bottom since 2018 formed near this level

Plan stays simple:

Buy the green. Sell the red.

ETH-1,51%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

🚨 JUST IN: Trump-backed World Liberty Financial is launching “World Swap,” a crypto-based FX & remittance platform.

Why this matters:

Stablecoins entering global FX

Faster cross-border settlements

Political capital meets crypto rails

Why this matters:

Stablecoins entering global FX

Faster cross-border settlements

Political capital meets crypto rails

- Reward

- like

- Comment

- Repost

- Share

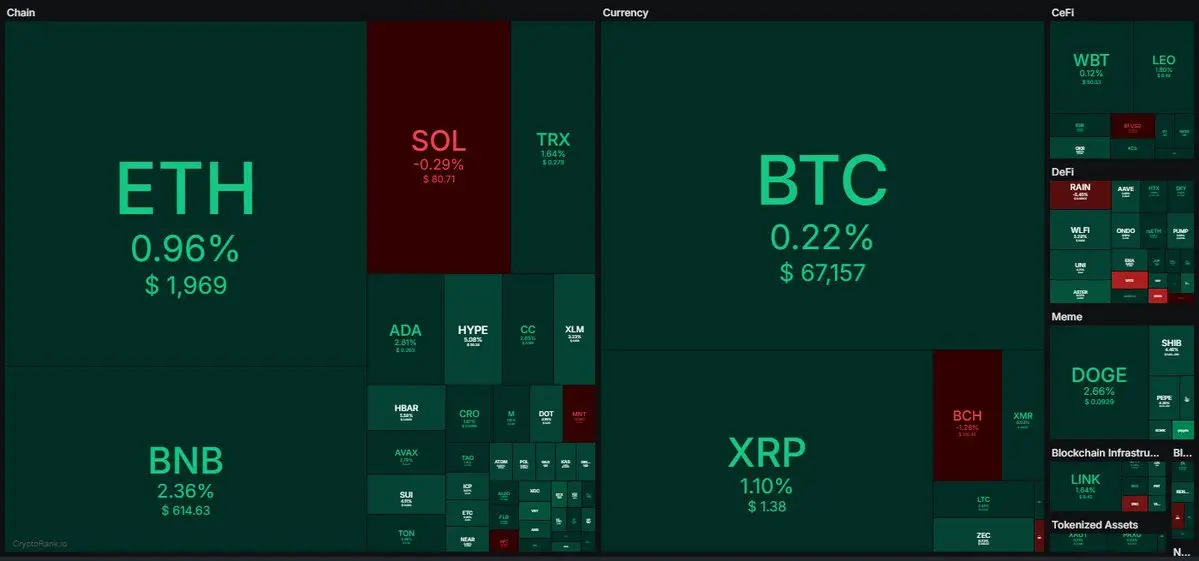

Happy Thursday 💚

Crypto is green.

Crypto is green.

- Reward

- like

- Comment

- Repost

- Share

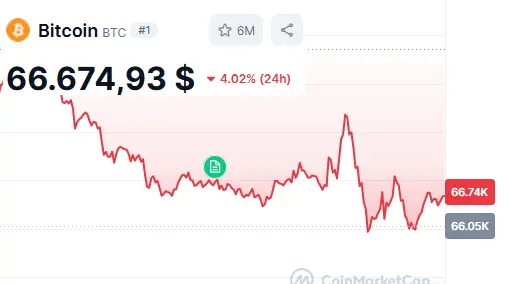

🚨 JUST IN: #Bitcoin falls below $67,000.

What to watch next:

Key support zone reaction

ETF flow data

Derivatives liquidations

Volatility is the price of admission.

What to watch next:

Key support zone reaction

ETF flow data

Derivatives liquidations

Volatility is the price of admission.

BTC-1,14%

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: President Trump is reportedly weighing an exit from USMCA — the trade deal negotiated during his first term.

Why this matters:

North American trade disruption risk

Market & supply chain uncertainty

Political leverage ahead of elections

Why this matters:

North American trade disruption risk

Market & supply chain uncertainty

Political leverage ahead of elections

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

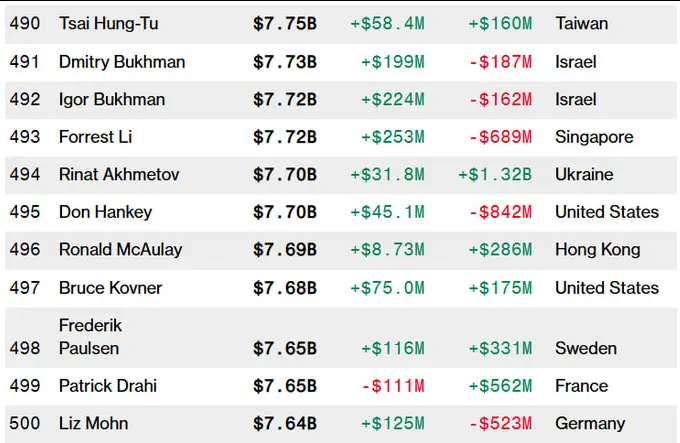

🚨 Coinbase CEO Brian Armstrong has fallen off the Bloomberg Billionaires Top 500.

His net worth:

• $17.7B last summer

• ~$7.5B today

What it shows:

1. Crypto wealth = volatility

2. Equity tied to market cycles

3. Bull markets inflate fast

His net worth:

• $17.7B last summer

• ~$7.5B today

What it shows:

1. Crypto wealth = volatility

2. Equity tied to market cycles

3. Bull markets inflate fast

- Reward

- like

- Comment

- Repost

- Share

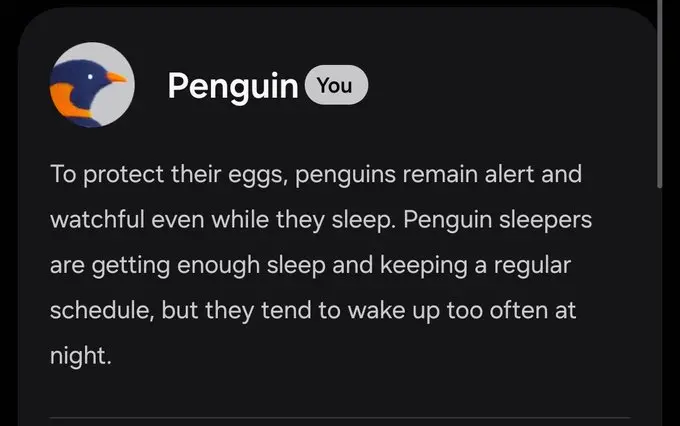

Is it because I check the charts too often?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: Sam Bankman-Fried is seeking a new trial in the SDNY crypto case.

Key points to watch:

Appeals strategy unfolds

Legal precedent matters

Market impact likely limited

Key points to watch:

Appeals strategy unfolds

Legal precedent matters

Market impact likely limited

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

REAL STORY from crypto:

$10k (2020) → $3M (2021) → $10k (2026)

Same person. Same intelligence. Same market.

Why this happens:

1. No exit plan

2. Greed beats discipline

3. Paper gains ≠ real gains

Save this. A thread explains how.

$10k (2020) → $3M (2021) → $10k (2026)

Same person. Same intelligence. Same market.

Why this happens:

1. No exit plan

2. Greed beats discipline

3. Paper gains ≠ real gains

Save this. A thread explains how.

- Reward

- like

- Comment

- Repost

- Share

It’s no shock that @ holds large token balances.

3 things often ignored in the Forbes piece:

They’re the largest exchange

Assets belong to millions of users

Custody ≠ ownership

3 things often ignored in the Forbes piece:

They’re the largest exchange

Assets belong to millions of users

Custody ≠ ownership

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More32.79K Popularity

42.26K Popularity

15.05K Popularity

41.38K Popularity

250.59K Popularity

Pin