SunnyOK

No content yet

Pin

SunnyOk

My original intention is to learn together with everyone. If you have any questions or doubts, you can click here to communicate. Let's learn and improve together. Thank you, 🙏

View Original

- Reward

- 4

- 1

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎Tonight's Federal Reserve Rate Decision

1. Core Forward-Looking Indicators (Key References)

Based on current market data, a "hold steady" decision tonight is almost a certainty.

• CME FedWatch (Federal Reserve Watch Tool):

• Currently shows a 97.2% probability that the Fed will keep rates unchanged (3.50%-3.75%), with only a 2.8% chance of a 25 basis point cut. This indicates the market has fully priced in a "pause."

• Inflation and Employment Data:

• Inflation: Core PCE remains around 2.5%-2.8%, still some distance from the 2% target.

• Employment: December non-farm payrolls show the unemploy

1. Core Forward-Looking Indicators (Key References)

Based on current market data, a "hold steady" decision tonight is almost a certainty.

• CME FedWatch (Federal Reserve Watch Tool):

• Currently shows a 97.2% probability that the Fed will keep rates unchanged (3.50%-3.75%), with only a 2.8% chance of a 25 basis point cut. This indicates the market has fully priced in a "pause."

• Inflation and Employment Data:

• Inflation: Core PCE remains around 2.5%-2.8%, still some distance from the 2% target.

• Employment: December non-farm payrolls show the unemploy

BTC-0,86%

- Reward

- 2

- 5

- Repost

- Share

ABABBABA :

:

New Year Wealth Explosion 666View More

Entering the Cryptocurrency World with AI.

Ethereum Market In-Depth Analysis: The "Bull Rebound" in Oversold Recovery

The current Ethereum market is at a very delicate juncture: short-term sentiment is extremely euphoric, but the long-term trend has yet to break through. Here is a detailed technical breakdown:

1. Market Status: Unstoppable Momentum with Hidden Concerns

From the 15-minute to daily chart levels you provided, ETH shows a strong oversold rebound characteristic.

• V-shaped Reversal Confirmed: On the 4-hour level, after hitting a low of $2,784, a clean and sharp V-shaped rally has b

Ethereum Market In-Depth Analysis: The "Bull Rebound" in Oversold Recovery

The current Ethereum market is at a very delicate juncture: short-term sentiment is extremely euphoric, but the long-term trend has yet to break through. Here is a detailed technical breakdown:

1. Market Status: Unstoppable Momentum with Hidden Concerns

From the 15-minute to daily chart levels you provided, ETH shows a strong oversold rebound characteristic.

• V-shaped Reversal Confirmed: On the 4-hour level, after hitting a low of $2,784, a clean and sharp V-shaped rally has b

ETH-0,99%

- Reward

- 3

- 1

- Repost

- Share

SunnyOk :

:

New Year Wealth Explosion 🤑- Reward

- like

- Comment

- Repost

- Share

One more, one empty, time to get off work.

View Original[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

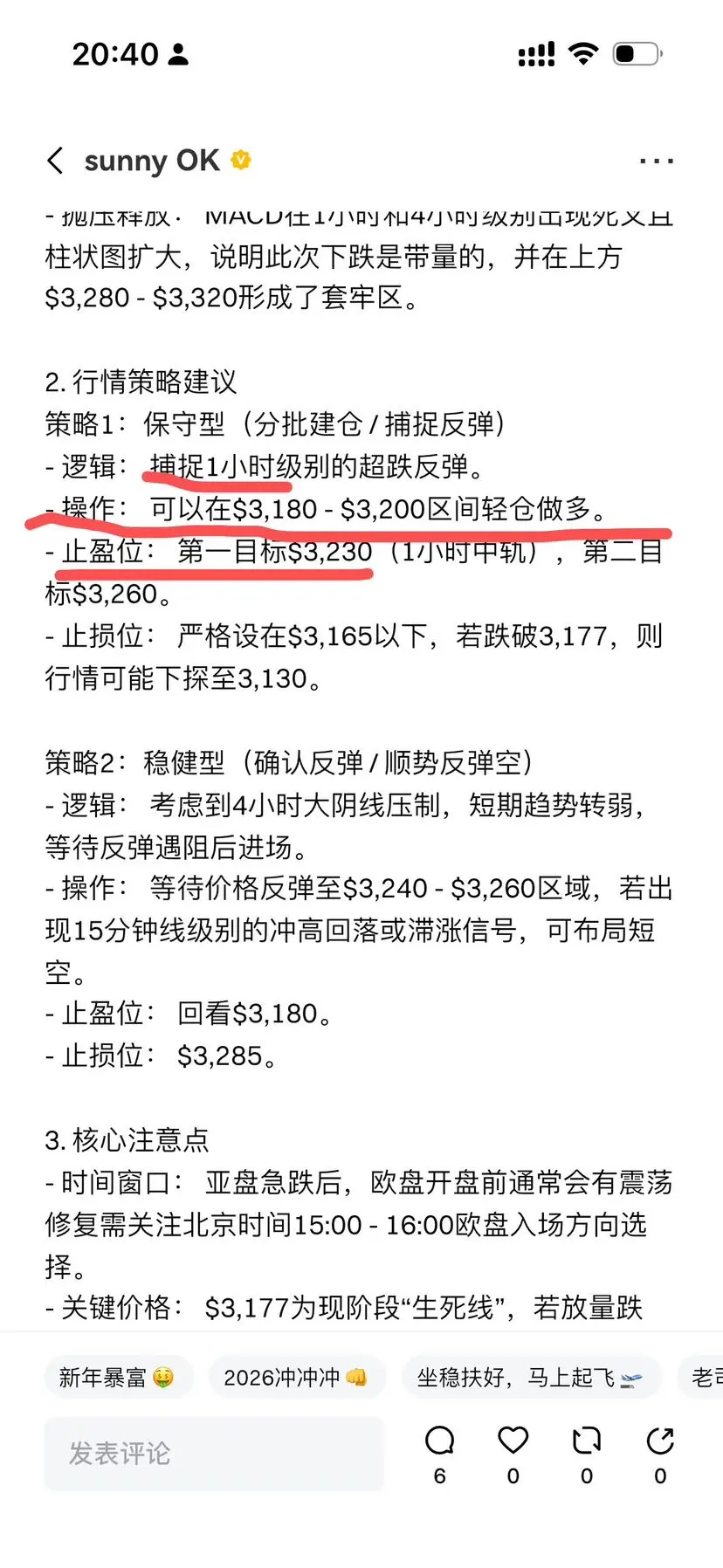

Structural weakening, short-term game of moving averages correction

Currently, the ETH/USDT market shows typical features of **“trend-based correction + extreme oversold conditions”**. After the daily structure was broken, the market entered a low-volatility bottoming phase.

1. Market structure and price action analysis (Price Action)

1. Key level shift: The previous strong support at 3,000 has officially turned into a strong resistance (Support-Resistance Flip). Until the price recovers this level with increased volume, the medium-term outlook remains Bearish.

2. Liquidity scan: After testing

Currently, the ETH/USDT market shows typical features of **“trend-based correction + extreme oversold conditions”**. After the daily structure was broken, the market entered a low-volatility bottoming phase.

1. Market structure and price action analysis (Price Action)

1. Key level shift: The previous strong support at 3,000 has officially turned into a strong resistance (Support-Resistance Flip). Until the price recovers this level with increased volume, the medium-term outlook remains Bearish.

2. Liquidity scan: After testing

ETH-0,99%

- Reward

- 3

- 3

- Repost

- Share

HaveYouEverWon? :

:

Market Analysis: On January 24th, BTC broke through $91,000 in the early morning, ETH simultaneously surpassed the psychological barrier of $3,000. The two leading assets both recovered key integer levels, and after breaking through, they experienced volume contraction and oscillation, with a balance of bullish and bearish sentiment. The Federal Reserve's rate cut expectations remain subdued, and tariff risks have not been eliminated. The domestic central bank's 900 billion MLF operation is only a sentiment boost. Trading Recommendations:

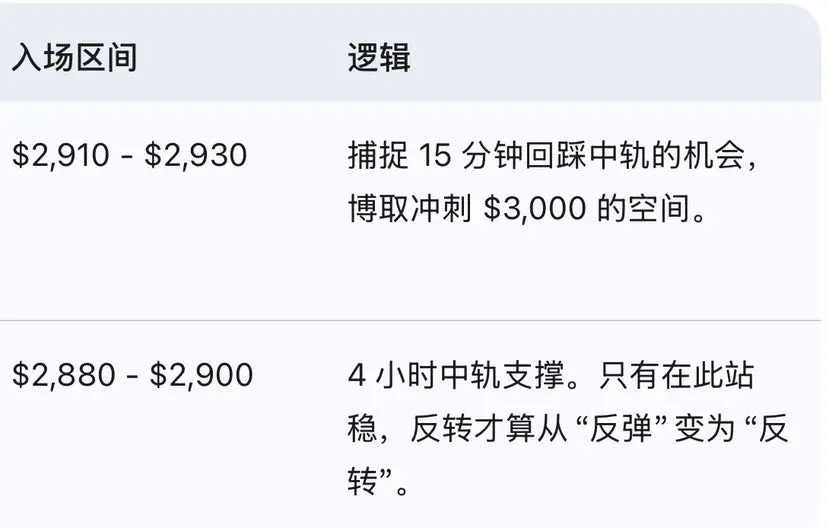

Buy on dips: BTC 88,800-89,300, ETH 2,910-2,930

Attempt short: 90,800+ , ETH 2,990+

Weekend Reminder: Institutions are exiting, liquidity is weak, hold light positions and avoid large orders!

#黄金白银再创新高 #Trump cancels EU tariff threat $BTC $ETH

View More

Currently, Ethereum is in a delicate stage of "bottoming out" or "gradual decline."

#ETH Trend Analysis

View Original#ETH Trend Analysis

Subscribers Only

Subscribe now to view exclusive content- Reward

- like

- Comment

- Repost

- Share

Oops, I thought today was the weekend.

Thanks to York for the tip. Just a quick report: money must never be lost. Bought a baby. Earn 10u to buy a small baby, earn 30u to buy a medium-sized baby, earn 100u to buy a large baby.

View OriginalThanks to York for the tip. Just a quick report: money must never be lost. Bought a baby. Earn 10u to buy a small baby, earn 30u to buy a medium-sized baby, earn 100u to buy a large baby.

- Reward

- 2

- 3

- Repost

- Share

zuyork :

:

Today, you're the main character; I'm just lending a helping hand~View More

According to the latest market data (January 22, 2026), River (RIVER) shows extremely volatile and abnormal fluctuations in funding rates across major exchanges, reflecting a fierce battle between main capital and retail investors.

Below are the specific rate conditions and the underlying market implications:

1. Funding Rate Overview (Real-time Reference)

Currently, the funding rate is on the verge of being highly negative or fluctuating sharply within a very short period:

• : The rate has temporarily reached between -1% and -2% (usually settled every 8 hours or 4 hours).

• : The rate also rem

Below are the specific rate conditions and the underlying market implications:

1. Funding Rate Overview (Real-time Reference)

Currently, the funding rate is on the verge of being highly negative or fluctuating sharply within a very short period:

• : The rate has temporarily reached between -1% and -2% (usually settled every 8 hours or 4 hours).

• : The rate also rem

View Original

- Reward

- 13

- 7

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

1. Market Trend Deep Analysis

From multi-timeframe charts, Ethereum is currently in a rebound and consolidation phase after a sharp decline.

• Daily Chart (1D): The overall trend is downward, with the price stabilizing after touching around $2837 . Although the MACD histogram is shrinking below the zero line, DIF/DEA are still in a death cross, indicating that the bearish momentum of the major trend has not fully dissipated.

• 4-Hour Chart (4H): The price rebounded after touching $2863 and is now facing resistance at MA21 (yellow line, approximately $3089). If it cannot break through and stab

From multi-timeframe charts, Ethereum is currently in a rebound and consolidation phase after a sharp decline.

• Daily Chart (1D): The overall trend is downward, with the price stabilizing after touching around $2837 . Although the MACD histogram is shrinking below the zero line, DIF/DEA are still in a death cross, indicating that the bearish momentum of the major trend has not fully dissipated.

• 4-Hour Chart (4H): The price rebounded after touching $2863 and is now facing resistance at MA21 (yellow line, approximately $3089). If it cannot break through and stab

ETH-0,99%

- Reward

- 11

- 12

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

Trading Notes: When "Drawing Gates" Becomes the Norm, How Should We View Indicators and News?

In the crypto market, we often see ETH suddenly surge violently and then quickly fall back to its original position. This "up and down drawing gates" operation confuses many traders who rely on indicators for trading. Today, let's deeply discuss the game logic between indicators and news.

1. News is the "动力" (driving force), Indicators are the "路径" (path)

Many traders find that during major news events (such as expectations of macro policy changes in early 2026), oscillators like RSI and KDJ become co

In the crypto market, we often see ETH suddenly surge violently and then quickly fall back to its original position. This "up and down drawing gates" operation confuses many traders who rely on indicators for trading. Today, let's deeply discuss the game logic between indicators and news.

1. News is the "动力" (driving force), Indicators are the "路径" (path)

Many traders find that during major news events (such as expectations of macro policy changes in early 2026), oscillators like RSI and KDJ become co

ETH-0,99%

- Reward

- 3

- 3

- 1

- Share

SlayHeavenZero :

:

New Year Wealth Explosion 🤑View More

The current market is fluctuating back and forth, and the indicators are clearly dulled, so don't worry about it, don't worry about the trend, don't worry about the direction. The simplest approach is best—trade according to the specific levels.

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- 1

- Comment

- Repost

- Share

ETH is currently in a phase of short-term volume-driven decline and medium-term retesting of key support levels. Here are some of my immature suggestions.

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- 1

- 2

- Repost

- Share

GoldenTunnel :

:

2026 Charge Charge Charge 👊2026 Charge Charge Charge 👊2026 Charge Charge Charge 👊View More

Long positions, pay attention to take profit. The first take profit level has been reached; consider reducing your position appropriately. Do not immediately enter a short position after taking profit; observe whether the market breaks through or pulls back. I hope everyone can learn together and survive in the investment circle. Surviving always offers opportunities. Understand how to cut losses and take profits. The US stock market is closed today, but market volatility should still be watched carefully. #Gate广场创作者新春激励

View Original

- Reward

- 2

- Comment

- Repost

- Share

Reminder yesterday morning, take profit at 3360, most of the push is for capital preservation.

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- like

- 6

- Repost

- Share

GoldenTunnel :

:

Skip emotions and get straight to work. The heart may break, but the hands cannot stop. One day, you will understand the saying, "Who can remain calm in chaos, not lose control in anger, and maintain judgment under severe pain, is truly a strong person." A steady heart can break through countless difficulties; a calm heart can generate infinite clarity. #执笔写人生# The power of writingView More

After a full day of low-volume consolidation on Saturday, the current K-line pattern has entered the second half of the weekend trading session, which is also the most prone to "false breakouts" or "surprise attacks."

1. Market Status: On Sunday, January 18, ETH remains oscillating around the $3,300 mark. The 4H MACD is about to complete its bottoming process, and the bearish selling pressure has already been exhausted.

2. Reversal Signal: The Bollinger Bands are narrowed to the extreme, and a directional choice may occur after 22:00 tonight. Since BTC has held above 95k, I personally lean tow

View Original1. Market Status: On Sunday, January 18, ETH remains oscillating around the $3,300 mark. The 4H MACD is about to complete its bottoming process, and the bearish selling pressure has already been exhausted.

2. Reversal Signal: The Bollinger Bands are narrowed to the extreme, and a directional choice may occur after 22:00 tonight. Since BTC has held above 95k, I personally lean tow

- Reward

- 5

- 5

- Repost

- Share

GoldenTunnel :

:

Good morning, a new day has begun. Thank you very much for your information, it's great.View More

Weekend market second half, narrow fluctuations, stay alert. How long is the horizontal, how tall is the vertical. #WeekendMarketAnalysis

View OriginalSubscribers Only

Subscribe now to view exclusive content- Reward

- like

- 1

- Repost

- Share

GoldenTunnel :

:

A new day has begun. Thank you very much for your information. Great job.1. Technical Indicator Analysis

1. 4-Hour Level: Early Sign of Trend Reversal

- From the 4-hour chart, ETH is currently oscillating within the $3,250 - $3,320 range.

- The MACD indicator shows the red histogram (selling momentum) has significantly shortened, approaching the zero line, which usually indicates downward pressure has exhausted and is in the “bottoming” phase.

- Bollinger Bands: Price is close to the middle band. Due to decreased volatility over the weekend, Bollinger Bands are narrowing, suggesting a small-scale “breakout rebound” may occur.

2. 1-Hour Level: Oversold Correction Co

View Original1. 4-Hour Level: Early Sign of Trend Reversal

- From the 4-hour chart, ETH is currently oscillating within the $3,250 - $3,320 range.

- The MACD indicator shows the red histogram (selling momentum) has significantly shortened, approaching the zero line, which usually indicates downward pressure has exhausted and is in the “bottoming” phase.

- Bollinger Bands: Price is close to the middle band. Due to decreased volatility over the weekend, Bollinger Bands are narrowing, suggesting a small-scale “breakout rebound” may occur.

2. 1-Hour Level: Oversold Correction Co

- Reward

- 5

- 9

- Repost

- Share

VvRetroStyleExperienceTheCharm :

:

2026 Go Go Go 👊View More