2025 ARPA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: ARPA's Market Position and Investment Value

ARPA (ARPA) operates as a flexible, easy-to-use, and highly compatible privacy computing network that provides protocol layers for mainstream public chains. Since its launch in 2021, ARPA has established itself as a significant player in the privacy computation sector. As of December 2025, ARPA's market capitalization stands at approximately $24.52 million, with a circulating supply of around 982.17 million tokens, trading at approximately $0.01226 per token. This innovative asset, recognized for its "multi-party secure computing technology," is playing an increasingly pivotal role in enabling enterprises to achieve multi-party data integration, data sharing, and collaborative computation across financial transactions, credit assessment, marketing, and healthcare sectors.

This article will provide a comprehensive analysis of ARPA's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

ARPA Price History Review and Market Analysis Report

I. ARPA Price History Review and Current Market Status

ARPA Historical Price Evolution Trajectory

-

March 13, 2020: ARPA reached its all-time low of $0.00339441, marking the beginning of the project's price discovery phase.

-

November 3, 2021: ARPA achieved its all-time high of $0.268622, representing a peak valuation period during the broader market cycle.

-

March 2020 - November 2021: Price surged from $0.00339441 to $0.268622, demonstrating significant appreciation over this period.

-

November 2021 - December 2025: Price contracted from $0.268622 to approximately $0.01226, representing a substantial long-term decline of approximately 75.42% over the one-year period.

ARPA Current Market Status

As of December 21, 2025, ARPA is trading at $0.01226, reflecting a 24-hour price movement of -0.8%. Over the past hour, the token showed a slight gain of +0.33%, with trading range between $0.01214 (24-hour low) and $0.01325 (24-hour high).

The 7-day performance shows a decline of -8.78%, while the 30-day period reflects a decrease of -13.54%. The one-year performance indicates a significant depreciation of -75.42% from its peak.

ARPA's market capitalization stands at approximately $12.04 million, with a fully diluted valuation of $24.52 million. The circulating supply is 982,174,603 ARPA tokens, representing approximately 49.11% of the total maximum supply of 2 billion tokens. The token maintains a market dominance of 0.00075% and is currently ranked #1085 by market capitalization.

24-hour trading volume recorded $13,406.14, with the token listed on 27 exchanges. The current holder base consists of 26,276 addresses, indicating a moderately distributed token ownership.

Market sentiment currently reflects extreme fear conditions, as indicated by broader market indicators.

Click to view current ARPA market price

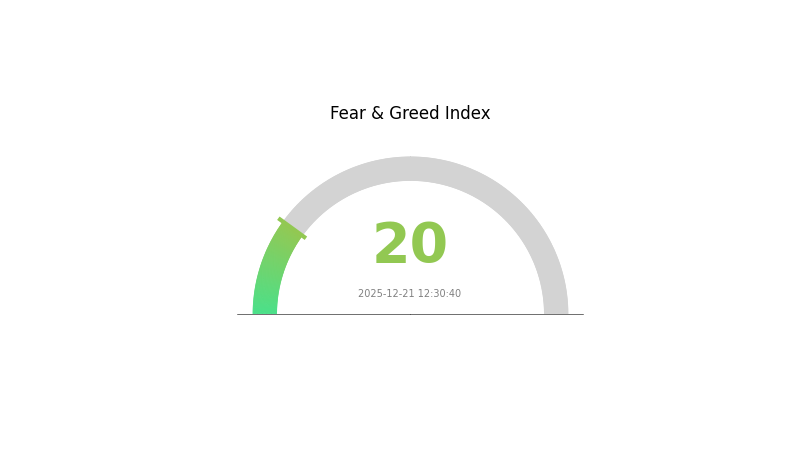

ARPA Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 20. This exceptionally low sentiment indicator suggests investors are displaying significant pessimism and risk aversion toward digital assets. When fear reaches such extremes, it often presents contrarian opportunities for long-term investors, as panic-driven selling may have pushed prices beyond fundamental valuations. However, extreme fear also warrants caution, as it can indicate deteriorating market conditions. Traders should monitor key support levels and consider diversifying their portfolio across stable assets on Gate.com to manage risk during this volatile period.

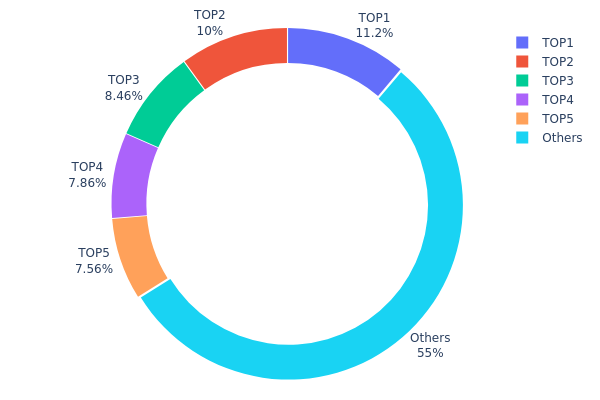

ARPA Holdings Distribution

The address holdings distribution chart illustrates the concentration of ARPA tokens across blockchain addresses, revealing the proportion of total supply held by major stakeholders. This metric serves as a crucial indicator for assessing decentralization levels, market structure, and potential systemic risks within the token ecosystem.

Current analysis of ARPA's holdings distribution demonstrates moderate concentration characteristics. The top five addresses collectively control approximately 45.03% of the total supply, with the largest holder accounting for 11.16% and the second-largest at 10.00%. While these figures indicate notable concentration among principal stakeholders, the remaining 54.97% dispersed across other addresses suggests a reasonably distributed token base. This distribution pattern reflects a structure where no single entity maintains overwhelming control, though the top tier holders retain significant influence over network decisions and market dynamics.

The existing concentration levels present both structural implications and market considerations. The presence of substantial holdings among top addresses could potentially amplify price volatility during large liquidation events or coordinated movements, yet the majority token distribution among dispersed holders provides a stabilizing counterbalance. From a decentralization perspective, ARPA exhibits intermediate characteristics—neither excessively concentrated as observed in projects with token distribution heavily skewed toward early investors or core teams, nor sufficiently atomized across millions of micro-holders. This configuration indicates an evolving market structure where institutional or significant stakeholder participation coexists with retail participation, suggesting reasonable resilience against unilateral market manipulation while maintaining room for improved decentralization as the ecosystem matures.

Click to view current ARPA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5ec0...f8d3ab | 223302.29K | 11.16% |

| 2 | 0x5a52...70efcb | 200000.00K | 10.00% |

| 3 | 0x28c6...f21d60 | 169230.39K | 8.46% |

| 4 | 0x1681...5b4f65 | 157111.11K | 7.85% |

| 5 | 0x76ec...78fbd3 | 151257.00K | 7.56% |

| - | Others | 1099099.21K | 54.97% |

II. Core Factors Affecting ARPA's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Interest rate decisions from major central banks such as the Federal Reserve, European Central Bank, and Bank of Japan are key drivers of ARPA price trends. Expansionary monetary policies—characterized by lower interest rates and asset purchases—typically create favorable conditions for cryptocurrency investments. Conversely, contractionary policies may exert downward pressure on asset prices.

-

Crypto Market Sentiment: ARPA's price trajectory is significantly influenced by overall cryptocurrency market cycles. During bull markets, increased investor interest in the project can drive price appreciation. Market participants should monitor broader crypto market trends alongside macroeconomic indicators to anticipate potential price movements.

Technology and Architecture

- Threshold BLS Signature Network: The core architecture of ARPA is built on its threshold BLS signature network, which supports a range of applications including verifiable random numbers. This technological foundation provides utility and functionality that underpins the project's value proposition.

Three, 2025-2030 ARPA Price Forecast

2025 Outlook

- Conservative forecast: $0.00797-$0.01226

- Neutral forecast: $0.01226

- Bullish forecast: $0.0179 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market stage expectations: Gradual recovery and adoption phase with increasing institutional interest

- Price range forecasts:

- 2026: $0.01041-$0.02171

- 2027: $0.01435-$0.02539

- Key catalysts: Enhanced protocol functionality, expanded partnership ecosystem, improved market liquidity, and broader cryptocurrency market recovery

2028-2030 Long-term Outlook

- Base case scenario: $0.01511-$0.03218 (assuming steady adoption and moderate market growth)

- Bullish scenario: $0.03218-$0.03681 (contingent on successful mainnet upgrades and significant enterprise adoption)

- Transformative scenario: $0.03681+ (under conditions of breakthrough technological innovation, major institutional adoption, and favorable regulatory environment)

- December 21, 2030: ARPA at $0.03681 (base case peak price scenario achieved)

Note: These forecasts are based on historical data analysis and current market conditions. Actual price movements may vary significantly based on market volatility, regulatory changes, technological developments, and macroeconomic factors. Investors should conduct thorough due diligence and consult professional advisors before making investment decisions. Trading on Gate.com or other platforms carries inherent risks.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0179 | 0.01226 | 0.00797 | 0 |

| 2026 | 0.02171 | 0.01508 | 0.01041 | 23 |

| 2027 | 0.02539 | 0.0184 | 0.01435 | 50 |

| 2028 | 0.03218 | 0.02189 | 0.01511 | 78 |

| 2029 | 0.0338 | 0.02704 | 0.01514 | 120 |

| 2030 | 0.03681 | 0.03042 | 0.01734 | 148 |

ARPA Investment Strategy and Risk Management Report

IV. ARPA Professional Investment Strategy and Risk Management

ARPA Investment Methodology

(1) Long-term Holding Strategy

-

Suitable Investors: Investors with moderate to high risk tolerance seeking exposure to privacy computing infrastructure; technology-focused portfolio builders; institutional investors interested in cryptographic innovations.

-

Operational Recommendations:

- Accumulate ARPA during market downturns when price drops below support levels, leveraging dollar-cost averaging to reduce average entry costs.

- Hold for a minimum of 12-24 months to capture potential upside from protocol adoption and enterprise integrations.

- Maintain position across multiple blockchain networks (Ethereum and BSC) to diversify counterparty risk.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions on 4-hour and daily timeframes to identify potential reversal points.

- Moving Averages (MA): Use 50-day and 200-day moving averages to confirm trend direction; trading signals generated when shorter-term MA crosses longer-term MA.

-

Range Trading Key Points:

- Current 24-hour trading range: $0.01214 to $0.01325; execute buy orders near support and sell orders near resistance.

- Monitor volume patterns; increased volume during price movements confirms trend strength.

- Set stop-loss orders 5-10% below entry points to manage downside exposure.

ARPA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate 1-3% of total portfolio to ARPA, prioritizing capital preservation over growth.

- Moderate Investors: Allocate 3-8% of total portfolio, balancing growth potential with risk mitigation.

- Aggressive Investors: Allocate 8-15% of total portfolio, accepting higher volatility for potential upside participation.

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine ARPA with established cryptocurrencies and stablecoins to reduce concentration risk and volatility exposure.

- Position Sizing: Use fixed fractional sizing (risk no more than 2% per trade) to ensure sustainable capital management across multiple positions.

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 Wallet provides secure, user-controlled token storage with direct trading integration and active ecosystem participation features.

- Cold Storage Method: For long-term holdings exceeding 12 months, consider hardware-based storage solutions for enhanced security against online threats.

- Critical Security Considerations: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify smart contract addresses before token transfers; remain vigilant against phishing attempts targeting Web3 users.

V. ARPA Potential Risks and Challenges

ARPA Market Risks

- Significant Price Volatility: ARPA has declined 75.42% over the past year and 13.54% over the past month, indicating substantial price instability and potential for further downside movements.

- Limited Liquidity Depth: With 24-hour trading volume of $13,406 and relatively low market capitalization, liquidity constraints may result in large slippage during significant trades.

- Market Sentiment Sensitivity: As a smaller-cap privacy computing project, ARPA remains susceptible to rapid shifts in market sentiment and competitive developments in the privacy infrastructure space.

ARPA Regulatory Risks

- Privacy Technology Scrutiny: Privacy-focused projects face increasing regulatory examination from authorities concerned about potential misuse in financial crime and sanctions evasion.

- Jurisdictional Compliance: Operations across multiple blockchain networks (ETH, BSC) expose ARPA to varying regulatory frameworks that could restrict trading or functionality in certain regions.

- Enterprise Adoption Constraints: Regulatory uncertainty surrounding multi-party computation and data sharing may hinder corporate adoption in regulated industries including finance and healthcare.

ARPA Technology Risks

- Cryptographic Implementation Risk: Multi-party secure computation technology requires sophisticated mathematical implementation; any vulnerabilities could compromise data security claims and erode user confidence.

- Interoperability Execution Risk: Supporting compatibility across mainstream public chains demands continuous technical maintenance and adaptation to avoid network fragmentation.

- Competition from Alternative Solutions: Emerging privacy computing platforms and established cryptographic providers present competitive threats to ARPA's market positioning and developer adoption.

VI. Conclusion and Action Recommendations

ARPA Investment Value Assessment

ARPA operates in the critical privacy computing infrastructure sector, addressing legitimate enterprise demand for secure multi-party data collaboration. The project's core technology demonstrates technical merit through cryptographic innovations. However, significant headwinds warrant cautious positioning: the token has experienced severe underperformance (-75.42% annually), market capitalization remains limited at approximately $24.5 million, and liquidity constraints present practical trading challenges. Enterprise adoption—the primary value driver—remains nascent, creating execution risk. The project functions as a high-risk, potentially high-reward bet on privacy infrastructure adoption requiring extended time horizons and substantial risk tolerance.

ARPA Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of investment capital) through Gate.com, use dollar-cost averaging over 3-6 months to establish baseline exposure, and avoid leveraged trading given volatility.

✅ Experienced Investors: Execute position trading based on technical levels (support: $0.0120, resistance: $0.0135), maintain strict position sizing (2% risk per trade), monitor enterprise adoption announcements for fundamental catalysts, and rebalance quarterly.

✅ Institutional Investors: Conduct comprehensive due diligence on multi-party computation implementation, evaluate competitive positioning against alternative privacy solutions, establish custodial arrangements through Gate.com, and consider small allocation (2-5% of blockchain infrastructure allocation) aligned with privacy computing thesis.

ARPA Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and holding of ARPA tokens with immediate settlement; recommended for long-term investors prioritizing asset ownership and security.

- Portfolio Integration: Combine ARPA with complementary privacy and infrastructure tokens to build balanced exposure across the Web3 ecosystem.

- Regular Rebalancing: Execute quarterly reviews comparing ARPA performance against privacy infrastructure benchmarks; adjust positions based on adoption metrics and competitive developments.

Cryptocurrency investments carry extreme risk and this report does not constitute investment advice. Investors must carefully evaluate risks based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose entirely.

FAQ

What is the prediction for ARPA crypto?

ARPA is projected to reach $0.014936 by 2030, with potential near-term gains of 5%, possibly hitting $0.011704 tomorrow. Forecasts suggest continued growth based on current market analysis and trading activity trends.

What is the price prediction for ARPA in 2040?

Based on current market analysis, ARPA Chain is expected to range between $0.8991 and $2.38 by 2040. This forecast reflects long-term growth potential driven by market trends and technological developments.

What is the supply of ARPA coin?

ARPA has a total supply of 2,000,000,000 coins. This represents all coins created, excluding any that have been burned.

2025 ATA Price Prediction: Analyzing Market Trends and Growth Potential for Automata Network

2025 B3X Price Prediction: Analyzing Market Trends and Potential Growth Factors

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Janitor Coin Deep Dive: Innovative Whitepaper Logic Reshaping Cryptocurrency Utility

Janitor Crypto Unveiled: How This Token Could Be The Next Blockchain Revolution

Leading Decentralized Forecast Platforms You Should Explore

深入了解 Thetanuts Finance:创新期权策略平台解析

Is Saros (SAROS) a good investment? A Comprehensive Analysis of Price Potential, Tokenomics, and Market Viability in 2024

Is PinLink (PIN) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Expert Recommendations for 2024

Exploring DMarket: Transforming the Future of Digital Asset Trading