2025 FARM Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

Introduction: Market Position and Investment Value of FARM

Harvest (FARM) serves as the governance token of the Harvest protocol, a DeFi yield optimization platform that automatically deploys capital to the highest-yielding opportunities across various decentralized finance protocols. Since its launch in 2020, FARM has established itself as a key instrument for protocol governance and fee participation. As of December 2025, FARM maintains a market capitalization of approximately $11.94 million with a circulating supply of 672,183.45 tokens, currently trading at $17.29 per token. This governance asset continues to play an increasingly important role in enabling community participation in protocol decisions and fee distribution mechanisms.

This article will provide a comprehensive analysis of FARM's price trajectory and market dynamics, examining historical performance patterns, supply and demand fundamentals, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for the period through 2030.

Harvest (FARM) Market Analysis Report

I. FARM Price History Review and Current Market Status

FARM Historical Price Movement Trajectory

Based on available data, Harvest (FARM) was launched on September 2, 2020, with an initial price of $167.67. The token has experienced significant price fluctuations since its inception:

- September 2, 2020: Project launch at $167.67, marking the beginning of the FARM token's market journey

- All-Time High (ATH): Reached $628.46 on September 2, 2020, representing a 275% gain from the launch price within the initial trading period

- Recent Period: Hit an all-time low of $16.80 on December 19, 2025, representing a 97.3% decline from ATH levels

FARM Current Market Status

Price Performance (As of December 21, 2025):

| Metric | Value |

|---|---|

| Current Price | $17.29 |

| 24-Hour Change | -2.42% |

| 7-Day Change | -9.9% |

| 30-Day Change | -13.25% |

| 1-Year Change | -65.68% |

| 24-Hour High | $17.90 |

| 24-Hour Low | $16.97 |

Market Capitalization and Supply:

- Market Capitalization: $11,622,051.86

- Fully Diluted Valuation: $11,937,361.80

- Circulating Supply: 672,183.45 FARM

- Total Supply: 690,420 FARM

- Circulating Supply Ratio: 97.36%

- Market Dominance: 0.00037%

- Current Ranking: #1,104

Trading Activity:

- 24-Hour Trading Volume: $16,203.75

- Total Token Holders: 15,414

- Listed on 12 exchanges

- Available on Gate.com for trading

Market Sentiment:

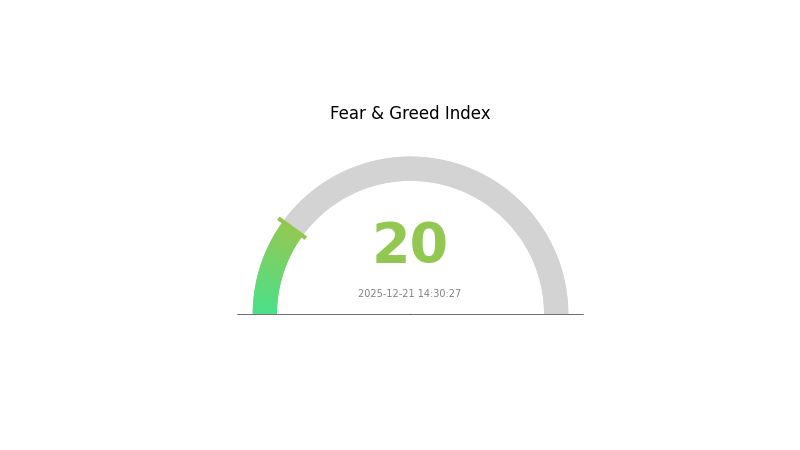

The current market sentiment indicates "Extreme Fear" (VIX: 20), reflecting cautious investor outlook in the broader cryptocurrency market.

View current FARM market price

FARM Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index standing at 20. This reading signals significant market pessimism and investor anxiety. During such periods, asset prices often reach attractive levels for contrarian investors. However, extreme fear can indicate potential capitulation, making it crucial to assess fundamentals before making investment decisions. Market participants should exercise caution while remaining alert to opportunities that may emerge from widespread fear-driven selling.

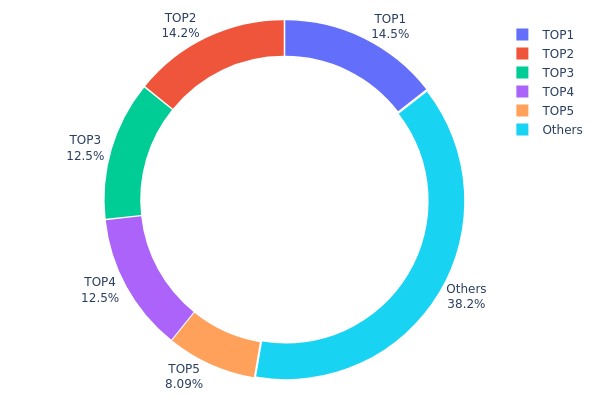

FARM Holdings Distribution

The address holding distribution map illustrates the concentration of FARM tokens across major wallet addresses, revealing the degree of token centralization and potential market control. This metric serves as a critical indicator for assessing the decentralization level and structural stability of the token's on-chain ecosystem. By analyzing the top holders and their proportional stakes, we can evaluate market concentration risk and the potential for significant price volatility driven by whale movements.

FARM's current holding distribution exhibits moderate to elevated concentration characteristics. The top five addresses collectively control 61.8% of the circulating supply, with the leading holder commanding 14.51% and the second-largest position accounting for 14.17%. This distribution pattern suggests that while no single entity maintains overwhelming dominance, a relatively small number of stakeholders possess substantial influence over market dynamics. The top four addresses alone represent 53.71% of holdings, indicating a concentration level that warrants consideration, though the remaining 38.2% distributed among other addresses provides a degree of diversification. This structure presents both opportunities and risks: concentrated holdings can facilitate coordinated liquidity provision and strategic decision-making, yet simultaneously increase vulnerability to sudden large-scale liquidations or concentrated sell pressures that could trigger significant price fluctuations.

The current distribution pattern reflects a market structure with meaningful decentralization elements offset by notable concentration among major holders. While the presence of substantial holdings distributed outside the top five addresses demonstrates some resistance to extreme centralization, the aggregate 61.8% concentration among leading positions suggests that market sentiment and price discovery remain partially influenced by coordinated actions among key stakeholders. This configuration indicates a moderately mature token ecosystem where institutional and significant retail participation coexist, though ongoing monitoring of top holder movements remains essential for understanding potential market catalysts and structural vulnerabilities.

For current FARM holdings distribution data, visit Gate.com Crypto Market Data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x365a...335059 | 102.40K | 14.51% |

| 2 | 0xf977...41acec | 100.00K | 14.17% |

| 3 | 0xaab4...f96876 | 88.50K | 12.54% |

| 4 | 0x28c6...f21d60 | 88.14K | 12.49% |

| 5 | 0x8f5a...99436c | 57.08K | 8.09% |

| - | Others | 269.17K | 38.2% |

II. Core Factors Influencing FARM's Future Price

Macro-Economic Environment

-

Monetary Policy Impact: FARM price performance is influenced by broader DeFi market dynamics and overall economic conditions. Central bank policies and interest rate environments affect investor sentiment toward decentralized finance assets and governance tokens.

-

Market Sentiment and Trends: As of March 20, 2025, FARM traded at $31.42 USD, reflecting current market trends and investor sentiment. The price dynamics of FARM are closely tied to market conditions and the broader cryptocurrency landscape.

Technology Development and Ecosystem Building

-

DeFi Market Dynamics: FARM's price is significantly influenced by DeFi (Decentralized Finance) market dynamics. As the native token of Harvest Finance, FARM's value is intrinsically linked to the growth and adoption of yield aggregation strategies within the DeFi ecosystem.

-

staking Activities and Governance Participation: FARM price performance is affected by staking activity levels and governance participation. As a governance token, increased participation in protocol decisions and staking incentives can influence token demand and price movements.

-

Utility and Governance Functions: The token's practical utility in the Harvest Finance ecosystem and its role in protocol governance are key factors driving its investment value and long-term price trajectory.

Three、2025-2030 FARM Price Forecast

2025 Outlook

- Conservative Forecast: $8.99-$17.28

- Neutral Forecast: $17.28

- Bullish Forecast: $22.46 (contingent on sustained DeFi adoption and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Consolidation period with gradual recovery, characterized by institutional interest in yield farming protocols and expanding cross-chain integration

- Price Range Predictions:

- 2026: $18.48-$26.23

- 2027: $16.60-$32.73

- 2028: $19.25-$32.91

- Key Catalysts: Protocol upgrades and feature enhancements, expansion of liquidity farming opportunities, integration with major DeFi ecosystems, and improvements in governance mechanisms

2029-2030 Long-term Outlook

- Base Case: $28.27-$33.75 (assuming steady ecosystem development and moderate market growth)

- Bullish Case: $32.91-$44.58 (assuming accelerated protocol adoption and favorable regulatory environment)

- Transformational Case: $44.58+ (contingent on FARM becoming a leading yield farming standard, widespread institutional adoption, and breakthrough technological innovations in decentralized finance)

- 2030-12-31: FARM $44.58 (representing 85% cumulative growth from 2025 baseline, indicating substantial long-term appreciation potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 22.464 | 17.28 | 8.9856 | 0 |

| 2026 | 26.23104 | 19.872 | 18.48096 | 14 |

| 2027 | 32.73316 | 23.05152 | 16.59709 | 33 |

| 2028 | 32.91296 | 27.89234 | 19.24571 | 61 |

| 2029 | 33.74694 | 30.40265 | 28.27446 | 75 |

| 2030 | 44.58397 | 32.0748 | 16.35815 | 85 |

Harvest (FARM) Professional Investment Strategy and Risk Management Report

I. Executive Summary

Harvest (FARM) is the governance token of the Harvest Finance protocol, a yield optimization platform that automatically deploys capital across the latest DeFi protocols to maximize returns. As of December 21, 2025, FARM is trading at $17.29, representing a significant 65.68% decline over the past year. The token has a circulating supply of 672,183.45 FARM tokens with a total market capitalization of approximately $11.62 million.

II. FARM Market Overview

Current Market Position

| Metric | Value |

|---|---|

| Current Price | $17.29 USD |

| 24-Hour Change | -2.42% |

| 7-Day Change | -9.9% |

| 30-Day Change | -13.25% |

| 1-Year Change | -65.68% |

| Market Cap Rank | #1,104 |

| 24-Hour Volume | $16,203.75 |

| Circulating Supply | 672,183.45 FARM |

| Total Supply | 690,420 FARM |

| Market Capitalization | $11,937,361.80 |

| Number of Holders | 15,414 |

Historical Price Analysis

- All-Time High: $628.46 (September 2, 2020)

- All-Time Low: $16.80 (December 19, 2025)

- 24-Hour High: $17.90

- 24-Hour Low: $16.97

- Publish Price (2020): $167.67

The token has experienced severe long-term depreciation, with FARM trading 97.4% below its all-time high, reflecting the challenging conditions faced by yield farming platforms in the current market cycle.

III. FARM Tokenomics and Governance Structure

Token Utility

Governance Rights

- FARM holders retain voting rights on all proposals affecting the Harvest Finance treasury and operational decisions

- Token holders have direct influence over protocol development and resource allocation

Economic Benefits

- FARM holders receive 5% of all fees generated by Harvest Finance operations

- Revenue distribution aligns incentives between token holders and platform performance

- Passive income stream through fee participation

Supply Dynamics

- Circulating Supply Ratio: 97.36% of total supply is currently in circulation

- Fully Diluted Market Cap: $11,937,361.80

- Maximum Supply Cap: 690,420 FARM tokens (fixed supply)

IV. FARM Professional Investment Strategy and Risk Management

FARM Investment Methodology

(1) Long-Term Holding Strategy

Suitable Investors

- DeFi protocol enthusiasts with multi-year investment horizons

- Governance participants interested in Harvest Finance protocol development

- Investors seeking exposure to yield optimization platforms

Operational Recommendations

- Accumulate FARM during periods of extreme market weakness, such as the current market conditions with 65.68% year-over-year losses

- Participate actively in governance votes to influence protocol direction and ensure value creation

- Monitor quarterly fee distributions to track protocol revenue and operational efficiency

- Maintain a 2-3 year holding period minimum to allow for protocol maturation and market recovery

Storage Solutions

- Gate.com Web3 Wallet: Recommended for active governance participation with integrated voting functionality

- Hardware validation via smart contract interaction for governance on Ethereum mainnet

- Ensure private key security through hardware wallet backups

(2) Active Trading Strategy

Technical Analysis Tools

- Support and Resistance Levels: Current support established at $16.97, with resistance at $17.90 within the 24-hour range

- Volume Analysis: Monitor the relatively low 24-hour volume of $16,203.75 for potential liquidity constraints

- Moving Average Crossovers: Apply 7-day and 30-day moving averages to identify trend reversals

Swing Trading Entry Points

- Enter positions when technical indicators suggest accumulation phases, particularly near all-time low support levels

- Exit positions when resistance levels approach 5-10% gains to capture volatile price movements

- Utilize 24-hour price volatility ranging from $16.97-$17.90 for micro-trading opportunities

FARM Risk Management Framework

(1) Asset Allocation Principles

| Investor Type | FARM Allocation |

|---|---|

| Conservative Investors | 0.5% - 1.0% of portfolio |

| Active Investors | 1.5% - 3.0% of portfolio |

| Professional Investors | 3.0% - 5.0% of portfolio |

Conservative investors should limit exposure given the extreme drawdown from historical highs. Active investors may increase positions selectively during market dislocations. Professional investors with dedicated research capabilities may employ higher allocations with corresponding risk management protocols.

(2) Risk Hedging Strategies

Diversification Across Yield Strategies

- Allocate FARM holdings across multiple Harvest Finance pools rather than concentrating in single yield strategies

- Balance DeFi protocol exposure with traditional asset holdings to reduce correlation risk

Stablecoin Conversion Triggers

- Establish predetermined price targets (such as 15% gains from entry) for automatic partial profit-taking into stablecoins

- Maintain 30-50% portfolio allocation in USDC or USDT for redeployment opportunities during market dislocations

(3) Secure Storage Solutions

Gate.com Web3 Wallet Recommendation

- Enables seamless governance participation and fee distribution claims

- Integrated token swapping functionality for rapid rebalancing

- Multi-chain support for cross-chain yield optimization opportunities

- Recommended security settings: Enable two-factor authentication and withdrawal whitelisting

Self-Custody Best Practices

- Utilize hardware verification for transaction signing on Ethereum mainnet

- Maintain encrypted backup of private keys in physically secure locations

- Never share seed phrases or private keys; verify contract addresses before interactions

- Test wallet recovery procedures before deploying significant capital

Primary Risk Mitigation

- Smart contract risk exposure from Harvest Finance protocol interactions

- Liquidity risk from low trading volume ($16,203.75 daily volume)

- Slippage risk during volatile market conditions

- Technical risk from Ethereum network congestion during fee distributions

V. FARM Potential Risks and Challenges

FARM Market Risks

Severe Valuation Decline The token has depreciated 65.68% over the past year and 97.4% from its all-time high of $628.46, indicating persistent market skepticism regarding yield farming platforms and DeFi protocol sustainability. Recovery may require significant catalyst events.

Liquidity Constraints With 24-hour trading volume of only $16,203.75 and 15,414 token holders, FARM exhibits relatively thin liquidity. Large position exits may encounter significant slippage, limiting institutional participation and price stability.

Platform Performance Dependency FARM token value is directly tied to Harvest Finance protocol performance and fee generation. Declining TVL (Total Value Locked) or reduced farming yields across underlying DeFi protocols directly compress fee revenue and token valuations.

FARM Regulatory Risks

Evolving Governance Token Classification Regulatory uncertainty surrounding governance token classification and potential securities law implications in major jurisdictions may impact trading venues and custodial support for FARM holdings.

DeFi Protocol Regulation Increased regulatory scrutiny of yield farming practices and DeFi protocol operations could impose operational restrictions on Harvest Finance, reducing protocol competitiveness and fee generation capacity.

Cross-Border Compliance Participation in FARM governance and fee distributions may trigger taxation and compliance reporting requirements that vary significantly across jurisdictions.

FARM Technical Risks

Smart Contract Vulnerability Exposure Harvest Finance protocol relies on multiple integrated smart contracts across various DeFi platforms. Vulnerabilities discovered in underlying protocols could result in significant capital losses and token value depreciation.

Ethereum Network Dependency FARM operates exclusively on Ethereum mainnet. Network congestion, high gas fees, and potential protocol-level issues directly impact fee distribution efficiency and platform usability.

Oracle Risk and Price Feed Manipulation Harvest Finance yield optimization strategies depend on reliable price feeds. Oracle manipulation or feed failures could cause incorrect capital allocation and yield estimation errors.

VI. Conclusion and Action Recommendations

FARM Investment Value Assessment

Harvest (FARM) presents a speculative investment opportunity in the yield farming infrastructure sector. At current valuations near all-time lows ($17.29 versus $628.46 ATH), the token reflects severe market pessimism regarding DeFi yield farming platforms. The 15,414 token holder base and relatively thin liquidity suggest limited institutional adoption.

The governance utility and 5% fee participation mechanism provide fundamental value linkage to Harvest Finance protocol economics. However, the extreme drawdown and declining market relevance of yield farming in the current market environment present significant risk factors. Recovery depends on renewed institutional interest in DeFi protocols and improved risk-adjusted returns from yield optimization strategies.

FARM Investment Recommendations

✅ For Beginners

- Limit initial allocation to 0.5% of total portfolio as educational exposure to governance token mechanisms

- Start with minimum viable positions on Gate.com to practice token management and governance participation

- Focus on understanding Harvest Finance protocol mechanics before increasing exposure

- Avoid trading on thin liquidity; consider dollar-cost averaging strategies over 6-12 months

✅ For Experienced Investors

- Evaluate FARM as a potential asymmetric risk/reward opportunity at near all-time lows

- Implement strict stop-loss disciplines at 10-15% below entry prices

- Actively participate in governance voting to influence protocol development and protect capital

- Monitor quarterly fee distributions as key performance indicators

- Consider 2-3% portfolio allocation with defined exit targets at 50-100% gains

✅ For Institutional Investors

- Conduct comprehensive due diligence on Harvest Finance smart contract security and audit history

- Evaluate correlation characteristics of FARM with broader DeFi and Ethereum ecosystem holdings

- Establish custodial arrangements through professional-grade solutions with insurance coverage

- Implement governance participation frameworks to influence protocol development

- Consider 3-5% allocations within dedicated DeFi infrastructure portfolios only

FARM Trading Participation Methods

Primary Method: Gate.com Trading Platform

- Access direct FARM/USDT and FARM/USDC trading pairs with professional-grade charting tools

- Utilize advanced order types (stop-loss, limit orders) to manage position risk

- Leverage Gate.com's 12 supported trading pairs to optimize entry and exit execution

- Access real-time market depth and volume analysis for informed trading decisions

Governance Participation Channel

- Deposit FARM holdings into Gate.com Web3 Wallet for seamless protocol interaction

- Participate in Harvest Finance governance proposals through direct smart contract voting

- Monitor fee distribution schedules and claim rewards through integrated wallet functionality

Direct Protocol Interaction

- Interact directly with Harvest Finance smart contracts via approved Ethereum addresses

- Monitor Etherscan contract verification and transaction history at contract address: 0xa0246c9032bC3A600820415aE600c6388619A14D

- Verify all contract interactions through official Harvest Finance documentation at https://harvest.finance/

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors should make decisions based on individual risk tolerance and financial circumstances. Consult qualified financial professionals before deploying capital. Never invest funds exceeding your capacity to sustain total loss. Past performance does not guarantee future results. FARM token has experienced severe drawdown, and recovery is not assured.

FAQ

What is the future outlook for FARM token price?

FARM token is expected to reach an average price of $227.1 by 2030, with potential maximum of $235.4. Long-term outlook shows strong growth potential driven by ecosystem development and increasing adoption in decentralized finance.

How much is a FARM token worth currently?

As of December 21, 2025, FARM token is trading at $17.76 with a market cap of $11.94 million and 24-hour trading volume of $617,928.

What is the Harvest Finance price prediction for 2025?

Based on technical indicators, Harvest Finance (FARM) is predicted to reach approximately $64.79 in 2025. This forecast reflects market analysis and on-chain metrics.

VINU vs STX: Comparing Two Emerging Cryptocurrencies in the Digital Asset Ecosystem

RVN vs AAVE: Which Crypto Asset Offers Better Long-Term Growth Potential?

CLORE vs RUNE: The Battle for Dominance in the Emerging Crypto Asset Management Space

Is Aerodrome Finance (AERO) a good investment?: Analyzing the potential of this DeFi protocol in the volatile crypto market

SDEX vs CRO: Comparing Two Leading Cryptocurrency Exchange Platforms

RED vs CRO: Battle of the Crypto Giants - Who Will Emerge Victorious in 2023?

What is XNY: A Comprehensive Guide to Understanding Its Applications and Significance in Modern Technology

What is MSQ: A Comprehensive Guide to Message Queue Systems and Their Real-World Applications

What is SIX: A Comprehensive Guide to Understanding the Significance and Applications of This Numerical Value

Exploring Longinus: Can Heritage Tokens Drive DeFi Expansion?

Token Unlocks: Understanding Their Influence on Cryptocurrency Prices in 2025