2025 FISPrice Prediction: Analyzing Market Trends and Future Potential for FIS Token in the Evolving DeFi Landscape

Introduction: FIS Market Position and Investment Value

Stafi (FIS), as a DeFi protocol that unlocks the liquidity of staked assets, has made significant strides since its inception in 2020. As of 2025, Stafi's market capitalization has reached $13,393,562, with a circulating supply of approximately 154,606,518 tokens, and a price hovering around $0.08663. This asset, dubbed the "liquidity liberator" for staked tokens, is playing an increasingly crucial role in the DeFi and staking ecosystems.

This article will provide a comprehensive analysis of Stafi's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. FIS Price History Review and Current Market Status

FIS Historical Price Evolution

- 2020: Initial launch, price started at $0.15

- 2021: Bull market peak, price reached all-time high of $4.7 on March 19

- 2025: Bear market, price dropped to all-time low of $0.074136 on July 2

FIS Current Market Situation

As of October 7, 2025, FIS is trading at $0.08663, with a 24-hour trading volume of $73,136.25. The current price represents a 1.08% increase in the last 24 hours. FIS has a market cap of $13,393,562.67, ranking it at 1289th position in the cryptocurrency market. The circulating supply is 154,606,518.13 FIS, which is 100% of the total supply. FIS is currently down 98.16% from its all-time high and up 16.85% from its all-time low. The market sentiment for FIS is currently in the "Greed" zone, with a VIX index of 70.

Click to view the current FIS market price

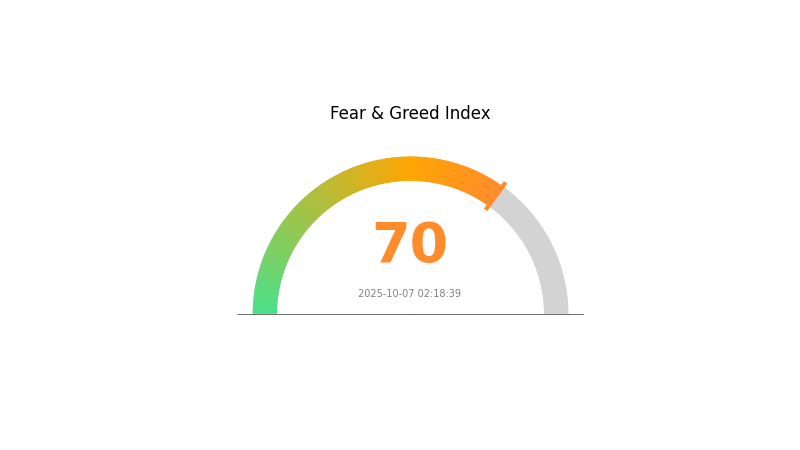

FIS Market Sentiment Indicator

2025-10-07 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a wave of optimism, with the Fear and Greed Index reaching 70, indicating strong greed. This suggests investors are becoming increasingly confident and may be prone to making emotional decisions. While positive sentiment can drive prices up, it's crucial to remain cautious and avoid FOMO-driven investments. Remember, markets often correct after periods of extreme greed. Stay informed, diversify your portfolio, and consider using Gate.com's advanced trading tools to navigate these exciting yet volatile market conditions.

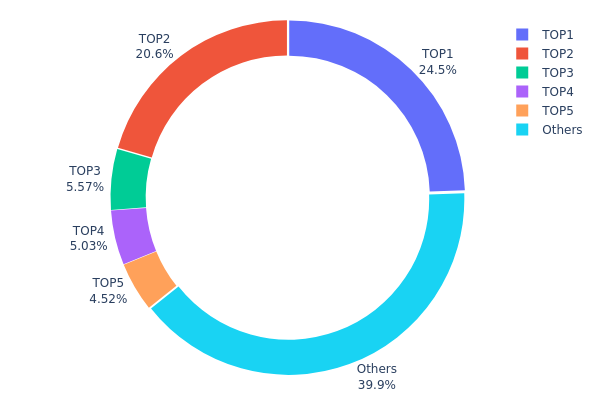

FIS Holdings Distribution

The address holdings distribution data for FIS reveals a significant concentration of tokens among a few top addresses. The top address holds 24.46% of the total supply, while the second largest holder accounts for 20.57%. Collectively, the top 5 addresses control 60.13% of all FIS tokens, indicating a high level of centralization.

This concentration of holdings could potentially impact market dynamics. With such a large portion of tokens held by a few addresses, there's an increased risk of price volatility if these major holders decide to sell or transfer their holdings. Additionally, this centralization may raise concerns about the potential for market manipulation or coordinated actions that could significantly influence FIS's price and trading patterns.

From a broader perspective, this distribution suggests that FIS's on-chain structure may be less decentralized than ideal for a cryptocurrency project. The high concentration in few hands could potentially affect governance decisions and overall market stability. Investors and analysts should closely monitor any changes in these major holdings, as they could serve as leading indicators for potential market movements or shifts in the project's direction.

Click to view the current FIS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 25465.78K | 24.46% |

| 2 | 0x28c6...f21d60 | 21416.87K | 20.57% |

| 3 | 0xd8c4...bc8530 | 5794.26K | 5.56% |

| 4 | 0xe518...a600ef | 5231.91K | 5.02% |

| 5 | 0x0419...6946ed | 4708.44K | 4.52% |

| - | Others | 41486.01K | 39.87% |

II. Key Factors Affecting FIS Future Price

Macroeconomic Environment

-

Impact of Monetary Policy: The interest rate environment is expected to significantly influence FIS price movements. Central bank policies and changes in interest rates will likely play a crucial role in shaping market sentiment and investment flows.

-

Inflation Hedging Properties: Core commodity prices have been influencing inflation trends. In 2024, rising core commodity prices initially dragged on inflation but later became a factor driving inflation in January 2025. This dynamic may impact FIS's perceived value as a potential hedge against inflation.

-

Geopolitical Factors: International political events and regulatory developments can have substantial effects on FIS price. The cryptocurrency market is particularly sensitive to global financial, regulatory, and political events.

Technical Development and Ecosystem Building

- Ecosystem Applications: The future core proposition for FIS may involve attracting ecosystem partners and leveraging ecosystem power for development. The trend towards scenario-based and ecosystem-oriented growth could be a key factor in FIS's future value proposition.

III. FIS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05196 - $0.0866

- Neutral prediction: $0.0866 - $0.09

- Optimistic prediction: $0.09 - $0.09439 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.07962 - $0.11223

- 2028: $0.07702 - $0.1353

- Key catalysts: Technological advancements, wider ecosystem integration, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.11969 - $0.12388 (assuming steady market growth and adoption)

- Optimistic scenario: $0.12807 - $0.13751 (with favorable regulatory environment and increased institutional interest)

- Transformative scenario: $0.14 - $0.15 (breakthrough use cases and mainstream integration)

- 2030-12-31: FIS $0.12388 (potential stabilization after period of growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09439 | 0.0866 | 0.05196 | 0 |

| 2026 | 0.10136 | 0.0905 | 0.08507 | 4 |

| 2027 | 0.11223 | 0.09593 | 0.07962 | 10 |

| 2028 | 0.1353 | 0.10408 | 0.07702 | 20 |

| 2029 | 0.12807 | 0.11969 | 0.06224 | 38 |

| 2030 | 0.13751 | 0.12388 | 0.07185 | 42 |

IV. Professional Investment Strategies and Risk Management for FIS

FIS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate FIS during market dips

- Set price alerts for significant market movements

- Store FIS in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor StaFi ecosystem developments and partnerships

- Pay attention to overall DeFi market sentiment

FIS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance FIS with other DeFi and non-DeFi assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for FIS

FIS Market Risks

- Volatility: High price fluctuations common in the crypto market

- Liquidity: Potential challenges in large-volume trades

- Competition: Emerging DeFi protocols may impact StaFi's market share

FIS Regulatory Risks

- Uncertain regulations: Potential changes in DeFi regulations globally

- Compliance requirements: Possible need for StaFi to adapt to new rules

- Cross-border restrictions: Varying legal status in different jurisdictions

FIS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Possible network congestion during high demand

- Interoperability issues: Risks associated with cross-chain operations

VI. Conclusion and Action Recommendations

FIS Investment Value Assessment

FIS presents a unique value proposition in the DeFi space, offering liquidity for staked assets. However, it faces significant short-term volatility and regulatory uncertainties.

FIS Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi and StaFi ✅ Experienced investors: Consider FIS as part of a diversified DeFi portfolio ✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments

FIS Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- Staking: Participate in StaFi's staking ecosystem for potential rewards

- Liquidity provision: Contribute to liquidity pools for additional yield opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for FIS coin in 2030?

Based on statistical models, FIS coin is predicted to reach around $0.0234 by mid-2030 and approximately $0.01567 by the end of 2030.

Is FIS a good stock to buy?

FIS is a promising stock with strong value and growth potential. Its solid financial performance makes it an attractive investment option.

What is the price prediction for FIS stock?

FIS stock is predicted to reach $86.50, with a forecast range of $70.00-$100.00 based on analyst consensus as of 2025-10.

Does TrueFi have a future?

TrueFi's future is promising. It's innovating in DeFi lending, with potential for growth. Market trends suggest continued development and adoption.

HAEDAL vs GMX: Comparing Next-Generation Trading Protocols in DeFi Ecosystem

Is pSTAKE Finance (PSTAKE) a good investment?: Analyzing the potential returns and risks in the liquid staking sector

2025 VNOPrice Prediction: Analyzing Market Trends and Growth Potential for VNO in the Coming Year

FST vs SNX: A Comparative Analysis of Two Leading Decentralized Finance Protocols

2025 FIS Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 MILK Price Prediction: Analyzing Market Trends and Factors Shaping the Future of Dairy Commodities

Using a Secure Key to Transfer Digital Assets in Blockchain

Exploring the Advantages of Ethereum's Significant Upgrade

What is A8: A Comprehensive Guide to Understanding This Advanced Technology Platform

What is MBL: A Comprehensive Guide to Model-Based Learning in Modern Education

What are Soulbound Tokens (SBTs), and how do they function?