2025 LUCIC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: LUCIC's Market Position and Investment Value

LUCIC (Lucidum Coin) is a next-generation meme coin on Binance Smart Chain (BEP-20) that unites transparency, innovation, and ethical wealth creation. Rooted in the Latin word "lux" ("light"), LUCIC symbolizes clarity and integrity in Web3. As of December 2025, LUCIC has achieved a market capitalization of $28.23 million with a fully diluted valuation of $36.12 million, with circulating supply reaching approximately 164.1 million tokens at a price point hovering around $0.172. This deflationary asset, distinguished by its dividend-yielding NFTs and DAO governance principles, is increasingly playing a crucial role in the community-driven Web3 ecosystem.

This article will provide a comprehensive analysis of LUCIC's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

LUCIC Price History Review and Market Status

I. LUCIC Price History Review and Market Status

LUCIC Historical Price Movement Trajectory

- November 2025: LUCIC reached its all-time high (ATH) of $0.735 on November 9, 2025, marking a significant peak in the token's trading history.

- December 2025: Following the peak, LUCIC entered a correction phase, declining significantly over subsequent weeks as market sentiment shifted.

- December 19, 2025: LUCIC touched its all-time low (ATL) of $0.1627, representing a severe drawdown from the November highs.

LUCIC Current Market Status

As of December 20, 2025, LUCIC is trading at $0.172, reflecting a notable decline from its recent peak. The token has experienced substantial volatility across multiple timeframes:

- 1-hour change: -0.41%

- 24-hour change: -7.12%

- 7-day change: -30.01%

- 30-day change: -58.70%

- 1-year change: +334.73% (year-to-date performance)

The 24-hour trading volume stands at $57,113.12, with the token trading between a 24-hour low of $0.1627 and a high of $0.1931. LUCIC maintains a market capitalization of approximately $28.23 million, with a fully diluted valuation (FDV) of $36.12 million. The circulating supply comprises 164,105,395 LUCIC tokens out of a maximum supply of 210 million tokens, representing a circulation ratio of 78.15%.

The token maintains a market dominance of 0.0011% and currently ranks 724th by market capitalization. With 12,693 unique holders, LUCIC demonstrates an active but relatively modest holder base within the broader cryptocurrency ecosystem.

View the current LUCIC market price

LUCIC Market Sentiment Indicator

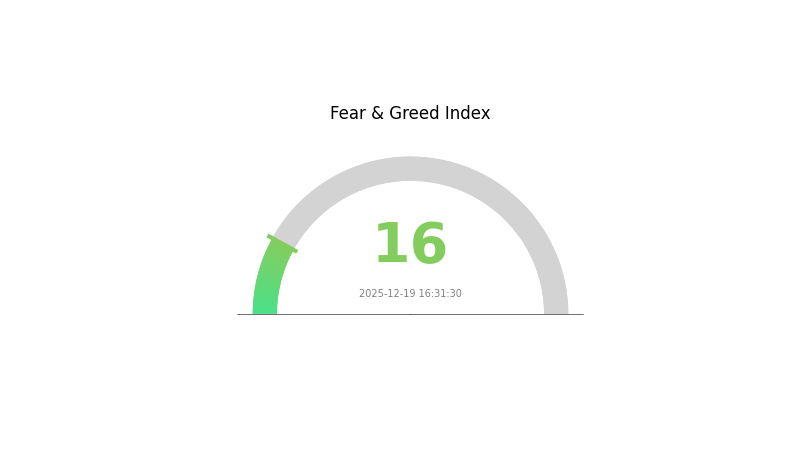

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with a fear index reading of 16. This indicates significant market pessimism and investor anxiety. During periods of extreme fear, market volatility typically increases as investors rush to liquidate positions. However, contrarian investors often view such conditions as potential buying opportunities, as assets may be undervalued. Risk-averse traders should exercise caution, while those with higher risk tolerance may consider strategic accumulation. Monitor market developments closely on Gate.com for real-time data and analysis to make informed investment decisions.

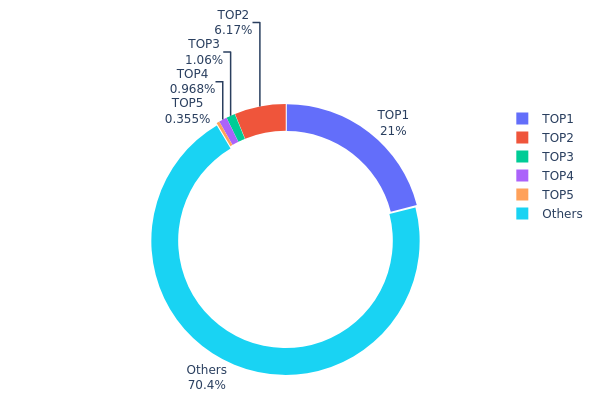

LUCIC Holdings Distribution

The address holdings distribution represents the concentration of LUCIC tokens across different wallet addresses on the blockchain. This metric is essential for assessing the decentralization level, market structure stability, and potential vulnerability to significant price fluctuations caused by large holder activities.

Analysis of the current data reveals a moderate concentration pattern in LUCIC's token distribution. The top holder controls 21.00% of total supply with 44.1 million tokens, while the second-largest holder accounts for 6.17%. Combined, the top five addresses hold approximately 29.54% of all LUCIC tokens in circulation. This concentration level indicates a structured distribution where influential stakeholders maintain substantial positions, yet the majority of tokens (70.46%) remain distributed among other addresses, suggesting a relatively healthy degree of decentralization.

The current address distribution landscape presents mixed implications for market dynamics. While the presence of a dominant holder with over one-fifth of the supply introduces potential liquidity risks and concentration-related volatility, the significant proportion of tokens held by dispersed addresses mitigates extreme centralization concerns. The distribution suggests that LUCIC maintains reasonable resistance to sudden price manipulation, though major liquidations or significant trading activity from top-tier holders could still meaningfully impact price discovery and market stability. This structure reflects a mature token economy with sufficient distribution breadth to support organic market development.

Click to view current LUCIC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4079...ee1bbe | 44100.00K | 21.00% |

| 2 | 0x8562...9a73aa | 12957.03K | 6.17% |

| 3 | 0xe9e0...179f13 | 2226.57K | 1.06% |

| 4 | 0x0000...00dead | 2032.94K | 0.96% |

| 5 | 0x34ce...86af65 | 745.90K | 0.35% |

| - | Others | 147937.57K | 70.46% |

Analysis of Core Factors Influencing LUCIC's Future Price

II. Core Factors Impacting LUCIC's Future Price

Supply Mechanism

-

Airdrop Distribution: The allocation size of airdrops significantly influences price volatility. Large airdrop distributions often lead to immediate sell-offs from early recipients, potentially causing sharp price declines at launch.

-

Current Impact: Project teams' willingness to provide price support through buyback programs and market-making activities directly affects price stability. Some projects implement continuous support mechanisms, while others may lack long-term price maintenance strategies.

Market Dynamics and Sentiment

-

Market Demand and Competition: LUCIC's future price is influenced by overall market demand, competitive positioning within its category, and consumer preferences among investors.

-

Project Team Commitment: The level of commitment from the project team regarding price support, market stabilization through buyback programs, and active market management significantly impacts long-term price trajectories.

Disclaimer: Cryptocurrency prices are extremely volatile and may be influenced by financial, regulatory, or political events. Margin trading amplifies financial risks. Before deciding to trade any financial instrument or cryptocurrency, you should fully understand the associated financial market risks. Please conduct thorough research and consider trading on reputable platforms like Gate.com to ensure security and compliance.

Three、2025-2030 LUCIC Price Forecast

2025 Outlook

- Conservative Forecast: $0.1454 - $0.1710

- Neutral Forecast: $0.1710 - $0.2274

- Optimistic Forecast: $0.2274 (subject to positive market sentiment and adoption growth)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental price appreciation, characterized by consolidation and steady accumulation

- Price Range Forecast:

- 2026: $0.1693 - $0.2889 (15% upside potential)

- 2027: $0.1855 - $0.3539 (41% upside potential)

- 2028: $0.2033 - $0.4245 (73% upside potential)

- Key Catalysts: Enhanced protocol functionality, increased institutional participation, broader market recovery, and ecosystem expansion

2029-2030 Long-term Outlook

- Base Case Scenario: $0.1881 - $0.4015 (assumes moderate adoption acceleration and stable macroeconomic conditions in 2029)

- Optimistic Scenario: $0.3587 - $0.5228 (assumes accelerated enterprise adoption and favorable regulatory environment by 2030)

- Transformative Scenario: $0.5228+ (assumes breakthrough technological advancement, mainstream institutional adoption, and paradigm shift in market structure)

- December 20, 2025: LUCIC experiencing consolidation phase (baseline market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.22743 | 0.171 | 0.14535 | 0 |

| 2026 | 0.28886 | 0.19922 | 0.16933 | 15 |

| 2027 | 0.35386 | 0.24404 | 0.18547 | 41 |

| 2028 | 0.4245 | 0.29895 | 0.20328 | 73 |

| 2029 | 0.40152 | 0.36173 | 0.1881 | 110 |

| 2030 | 0.52282 | 0.38162 | 0.35872 | 121 |

LUCIC (Lucidum Coin) Professional Investment Strategy and Risk Management Report

IV. LUCIC Professional Investment Strategy and Risk Management

LUCIC Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Community-focused participants, ethical wealth creators, DAO governance advocates

- Operational Recommendations:

- Accumulate during market downturns, particularly after significant corrections (LUCIC experienced a 30% decline over 7 days and 58.70% decline over 30 days as of December 20, 2025)

- Participate in dividend-yielding NFT opportunities designed by Michel Saja to generate additional income streams

- Engage in DAO governance activities to influence project direction and align with community values

(2) Active Trading Strategy

-

Market Observation Points:

- Monitor 24-hour volatility: LUCIC showed -7.12% change in 24H, with price range between 0.1627 and 0.1931

- Track weekly trends closely: The 7-day decline of -30.01% indicates heightened volatility requiring careful position management

- Analyze volume patterns: Current 24H volume stands at 57,113.12 against market cap of 28,226,127.94

-

Wave Trading Considerations:

- Entry points should be identified after extreme sell-offs, with resistance at the all-time high of 0.735 (November 9, 2025)

- Support levels are critical: The all-time low of 0.1627 (December 19, 2025) marks recent floor testing

- Position sizing is essential given the meme coin classification and associated volatility

LUCIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio

- Active Investors: 3-8% of total portfolio

- Experienced Traders: 5-15% of total portfolio

Note: LUCIC's meme coin classification and recent -58.70% monthly decline warrant reduced exposure for risk-averse investors.

(2) Risk Mitigation Strategies

- Position Diversification: Avoid concentrated holdings; maintain LUCIC as a satellite position within a diversified crypto portfolio

- Stop-Loss Implementation: Set protective stops at 20-25% below entry point given historical volatility

- Portfolio Rebalancing: Quarterly reviews to maintain target allocation percentages

(3) Secure Storage Solutions

- Self-Custody wallet: Gate Web3 Wallet (recommended for BEP-20 token management on Binance Smart Chain)

- Exchange Storage: Retain trading amounts on Gate.com for active trading access and liquidity

- Security Best Practices: Never share private keys; enable two-factor authentication on all exchanges; use hardware wallet backups for larger holdings

V. LUCIC Potential Risks and Challenges

LUCIC Market Risks

- Extreme Volatility: LUCIC exhibits high price swings (-7.12% in 24H, -58.70% in 30D) typical of meme coins, creating substantial liquidation risk for leveraged positions

- Low Market Capitalization: At $36,120,000 fully diluted valuation with only $28,226,127.94 circulating market cap, LUCIC remains vulnerable to significant price manipulation from concentrated trades

- Limited Liquidity: 24-hour trading volume of $57,113.11 relative to market cap indicates thin order books, potentially causing slippage on large transactions

LUCIC Regulatory Risks

- Meme Coin Classification: Regulatory scrutiny continues globally on meme-based tokens; jurisdictional changes could impact trading access or project viability

- DAO Governance Complexity: Decentralized governance structures may face regulatory challenges as authorities clarify digital asset classification and governance responsibilities

- Geographic Restrictions: Certain jurisdictions may restrict access to tokens classified as speculative or gaming-related assets

LUCIC Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on Binance Smart Chain, LUCIC depends on Solidity code security; audits should be verified before substantial investment

- NFT Integration Risk: The dividend-yielding NFT mechanism introduces additional smart contract complexity and potential technical failure points

- Chain Dependency: LUCIC's exclusive deployment on BSC creates concentration risk if the blockchain experiences operational issues or network congestion

VI. Conclusion and Action Recommendations

LUCIC Investment Value Assessment

LUCIC represents a speculative meme coin positioned at the intersection of community engagement, ethical wealth creation, and DAO governance. The project's emphasis on transparency and social impact differentiates it from typical meme coins, yet this does not eliminate the fundamental volatility and risk characteristics of the asset class. With a 334.73% gain over one year balanced against a -58.70% monthly decline and recent all-time low test, LUCIC demonstrates both potential for significant appreciation and substantial downside risk. The dividend-yielding NFT mechanism and community-focused governance offer innovative value propositions, but execution risk remains elevated given the nascent stage of DAO-governed tokenomics in broader crypto markets.

LUCIC Investment Recommendations

✅ Beginners: Allocate 1-2% of crypto portfolio as exploratory position; prioritize learning about DAO mechanics and BEP-20 standards before increasing exposure; consider LUCIC as educational investment in governance models rather than core holding.

✅ Experienced Investors: Maintain 3-8% allocation within diversified crypto strategy; use technical analysis to identify accumulation zones after 20-30% drawdowns; actively participate in governance to understand project direction and risk factors.

✅ Institutional Investors: Conduct comprehensive smart contract audits before institutional entry; evaluate the credibility and track record of French artist Michel Saja's NFT design team; assess DAO governance maturity and decision-making processes for alignment with fiduciary standards.

LUCIC Trading Participation Methods

- Direct Token Purchase: Trade LUCIC/USDT pairs on Gate.com with attention to slippage given limited 24H volume; monitor order book depth before executing large transactions

- NFT Dividend Strategy: Acquire dividend-yielding NFTs to generate passive income; evaluate contract terms and historical payout consistency before allocation

- DAO Participation: Hold LUCIC tokens to engage in governance voting; evaluate proposal quality and community participation rates as indicators of project health

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and conduct thorough due diligence. Professional financial consultation is recommended. Never invest more capital than you can afford to lose completely.

FAQ

What is LUCIC and what does it do?

LUCIC is a blockchain-based cryptocurrency token designed to facilitate decentralized transactions and smart contract operations within its ecosystem. It enables users to participate in governance, staking, and yield generation while supporting sustainable Web3 infrastructure development.

What is the current price of LUCIC?

The current real-time price of LUCIC is approximately $0.1907. LUCIC price fluctuates based on market demand and supply dynamics. For the most up-to-date pricing information, check dedicated crypto tracking platforms that provide live price updates and market data.

What is the price prediction for LUCIC in 2025?

LUCIC is estimated to achieve an average price of $0.1882 in 2025, with a high of $0.2352. This projection is based on current market trends and technical analysis of the token's performance trajectory.

What factors could affect LUCIC's price in the future?

LUCIC's price will be influenced by its fixed supply creating scarcity, market demand dynamics, trading volume, overall cryptocurrency market trends, and macroeconomic factors. Supply constraints support potential price appreciation.

Is LUCIC a good investment and what are the risks?

LUCIC shows strong potential with significant price appreciation, but carries high volatility as an emerging asset. Success depends on market adoption and project fundamentals. Investors should conduct thorough research before entering positions.

2025 LUCIC Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

What is LUCIC: A Comprehensive Guide to Understanding Lightweight Unified Computational Intelligence Framework

2025 LUCIC Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Why did Cookie DAO surge 56% in 7 days? Will it continue to rise in 2025?

Mog Coin Whitepaper Analysis: From Meme to $1.5B Market Cap in 2024

Will Crypto Recover in 2025?

Is Hippo Protocol (HP) a good investment?: A Comprehensive Analysis of Risk, Returns, and Market Potential

The Remarkable Journey of Bitcoin Pizza Day: Celebrating the Evolution of Cryptocurrency

Is Sophon (SOPH) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors for 2024

SVL vs BTC: Which Cryptocurrency Investment Strategy Offers Better Long-Term Returns in 2024?

Is OLAXBT (AIO) a good investment?: A Comprehensive Analysis of Features, Risks, and Market Potential