2025 MASA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: MASA's Market Position and Investment Value

Masa Network (MASA), as a leading decentralized AI data and LLM network, has amassed over 1.4 million unique users and 48,000 node operators since its inception. As of 2025, MASA's market capitalization stands at $3,752,695, with a circulating supply of approximately 387,355,000 tokens, and a price hovering around $0.009688. This asset, hailed as the "AI Data Powerhouse," is playing an increasingly crucial role in powering AI applications through user-owned data and compute.

This article will comprehensively analyze MASA's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. MASA Price History Review and Current Market Status

MASA Historical Price Evolution Trajectory

- 2024: Initial public offering on CoinList, price reached all-time high of $1.7

- 2025: Market downturn, price declined significantly to all-time low of $0.006094

MASA Current Market Situation

As of October 13, 2025, MASA is trading at $0.009688, with a 24-hour trading volume of $564,348.11. The token has seen an 8.6% increase in the last 24 hours but has experienced significant declines over longer periods: -22.14% in the past week, -50.88% in the past month, and -87.22% over the past year.

MASA's market capitalization stands at $3,752,695.24, ranking it 1944th in the overall cryptocurrency market. The circulating supply is 387,355,000 MASA tokens, representing 24.38% of the total supply of 1,574,448,226.014406 tokens.

The token is currently trading 99.43% below its all-time high of $1.7 (reached on April 11, 2024) and 59% above its all-time low of $0.006094 (recorded on October 10, 2025).

Click to view the current MASA market price

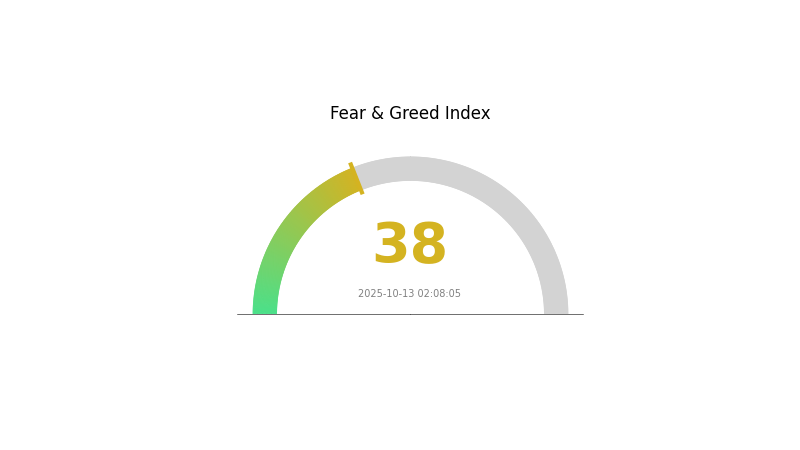

MASA Market Sentiment Indicator

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index sits at 38, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. However, it's crucial to remember that market sentiment can shift rapidly. While fear may present potential entry points for long-term investors, it's essential to conduct thorough research and consider your risk tolerance before making any investment decisions in the volatile crypto market.

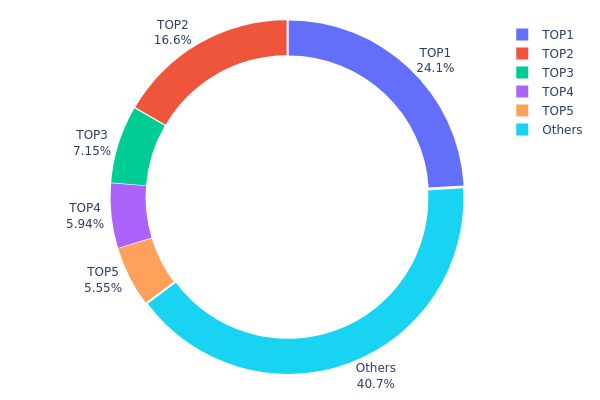

MASA Holdings Distribution

The address holdings distribution data provides insights into the concentration of MASA tokens among different wallet addresses. Analysis of this data reveals a significant level of concentration, with the top 5 addresses holding approximately 59.26% of the total supply. The largest holder alone accounts for 24.06% of all MASA tokens, followed by the second-largest at 16.59%.

This high concentration of tokens in a few addresses raises concerns about potential market manipulation and price volatility. With such a large portion of the supply controlled by a small number of entities, there is an increased risk of sudden large-scale selling or buying activities that could significantly impact the token's price. Furthermore, this concentration may undermine the project's claims of decentralization, as a few large holders could exert disproportionate influence over governance decisions or token economics.

However, it's worth noting that 40.74% of the tokens are distributed among "Others," suggesting some level of wider distribution. This broader base of smaller holders could provide some stability and resistance to extreme market movements initiated by the largest token holders.

Click to view the current MASA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1961...752486 | 376834.21K | 24.06% |

| 2 | 0x9d86...83b4ff | 259870.00K | 16.59% |

| 3 | 0x3383...d786fb | 111918.68K | 7.14% |

| 4 | 0x1892...c12884 | 93000.00K | 5.93% |

| 5 | 0x9495...787853 | 86856.55K | 5.54% |

| - | Others | 637673.40K | 40.74% |

II. Key Factors Influencing MASA's Future Price

Supply Mechanism

- Market Supply and Demand: The balance between supply and demand in the MASA market will be a crucial factor affecting its price.

- Current Impact: Changes in supply are expected to influence price movements, though specific details are not available.

Institutional and Whale Dynamics

- Corporate Adoption: The adoption of MASA by well-known enterprises could potentially impact its price, although specific companies are not mentioned.

Macroeconomic Environment

- Monetary Policy Impact: Future decisions by major central banks regarding interest rates and monetary policies will likely influence MASA's price.

- Inflation Hedging Properties: MASA's performance in inflationary environments may affect its attractiveness as an investment.

- Geopolitical Factors: International geopolitical situations could impact MASA's price, as they affect the broader cryptocurrency market.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps or ecosystem projects related to MASA could influence its future price, though specific details are not provided.

III. MASA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0059 - $0.00951

- Neutral prediction: $0.00951 - $0.01132

- Optimistic prediction: $0.01132 - $0.01312 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Gradual growth and consolidation

- Price range forecast:

- 2027: $0.00804 - $0.01294

- 2028: $0.00861 - $0.01808

- Key catalysts: Increased adoption, technological improvements, market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.01519 - $0.01648 (assuming steady market growth)

- Optimistic scenario: $0.01777 - $0.02323 (assuming strong bull market)

- Transformative scenario: Above $0.02323 (extremely favorable market conditions)

- 2030-12-31: MASA $0.02323 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01312 | 0.00951 | 0.0059 | -1 |

| 2026 | 0.012 | 0.01132 | 0.00611 | 16 |

| 2027 | 0.01294 | 0.01166 | 0.00804 | 20 |

| 2028 | 0.01808 | 0.0123 | 0.00861 | 26 |

| 2029 | 0.01777 | 0.01519 | 0.00911 | 56 |

| 2030 | 0.02323 | 0.01648 | 0.01137 | 70 |

IV. Professional Investment Strategies and Risk Management for MASA

MASA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operational suggestions:

- Accumulate MASA tokens during market dips

- Set a target holding period of at least 2-3 years

- Store tokens in a secure, non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to manage downside risk

MASA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Software wallet option: Official MASA wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MASA

MASA Market Risks

- High volatility: Significant price fluctuations common in emerging crypto projects

- Limited liquidity: Potential difficulty in executing large trades without impacting price

- Competitive landscape: Emerging AI and data projects may impact MASA's market share

MASA Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of AI and data-related crypto projects

- Data privacy concerns: Evolving regulations may impact MASA's data-sharing model

- Cross-border compliance: Varying regulations across jurisdictions may limit global adoption

MASA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Scalability challenges: Possible limitations in handling increased network activity

- Interoperability issues: Potential difficulties in integrating with other blockchain networks or AI systems

VI. Conclusion and Action Recommendations

MASA Investment Value Assessment

MASA presents a unique value proposition in the decentralized AI data and LLM network space. While it offers long-term potential in a growing market, short-term risks include high volatility and regulatory uncertainties.

MASA Investment Recommendations

✅ Beginners: Consider small, experimental positions with a long-term horizon ✅ Experienced investors: Implement a dollar-cost averaging strategy with regular small purchases ✅ Institutional investors: Conduct thorough due diligence and consider MASA as part of a diversified crypto portfolio

MASA Trading Participation Methods

- Spot trading: Purchase MASA tokens on Gate.com

- Staking: Participate in staking programs if offered by the MASA network

- Node operation: Consider running a node to support the network and earn rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is masa coin a good investment?

Yes, Masa coin shows promise. Predictions suggest a potential 170% profit by mid-2026, making it an attractive investment option in the crypto market.

Can mana reach $1?

Based on current projections, MANA is unlikely to reach $1. Experts predict it will stay below $1, with estimates suggesting a maximum of $0.37 by 2033.

Will mask crypto go up?

Mask crypto's future is uncertain. Recent forecasts suggest a potential decline, but long-term trends remain unpredictable. Always research current market conditions for the most up-to-date information.

Would hamster kombat coin reach $1?

Unlikely to reach $1 soon, but analysts project $0.67 by 2025. Growth depends on sustained interest and market conditions.

Is Flock.io (FLOCK) a Good Investment? Analyzing the Potential and Risks of This Emerging Crypto Project

Is Sahara AI (SAHARA) a good investment?: Analyzing the potential and risks of this emerging AI cryptocurrency

Is Trusta.AI (TA) a Good Investment?: Analyzing Market Potential and Long-Term Growth Prospects for the AI Security Token

2025 VADERPrice Prediction: Analyzing Market Trends and Potential Growth Factors in the Cryptocurrency Landscape

2025 AI16Z Price Prediction: Navigating the Future of AI-Driven Cryptocurrencies in a Volatile Market

2025 GAIPrice Prediction: Analyzing Market Trends and Future Valuation of GAI in the Evolving Digital Economy

DRK: Understanding the Controversial Cryptocurrency and Its Market Impact

Infrared Finance LSD: How IR Token Works in DeFi Yield Farming and Liquid Staking

How to Invest in Tokenized US Stocks on Solana With Ondo Finance ETFs

Theoriq (THQ): AI-Driven DeFi Infrastructure for Web3

Bitwise 2026 Crypto Market Forecast: Breaking the Four-Year Cycle