2025 METALDR Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: METALDR's Market Position and Investment Value

BADMAD ROBOTS (METALDR), as a free-to-play multiplayer shooter game with unique characters, has made significant strides since its inception in 2022. As of 2025, METALDR's market capitalization has reached $126,055, with a circulating supply of approximately 780,530,018 tokens, and a price hovering around $0.0001615. This asset, known as the "Unique Character Shooter," is playing an increasingly crucial role in the gaming and esports industries.

This article will provide a comprehensive analysis of METALDR's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. METALDR Price History Review and Current Market Status

METALDR Historical Price Evolution

- 2024: Initial launch, price peaked at $0.111482 on March 14

- 2025: Market downturn, price dropped to its all-time low of $0.0001279 on September 27

METALDR Current Market Situation

As of November 1, 2025, METALDR is trading at $0.0001615, ranking 4810th in the cryptocurrency market. The token has experienced a significant 24-hour decline of 10.17%, with the price ranging between $0.0001573 and $0.0001815 in the past day. The current price represents a 98.65% decrease from its all-time high, indicating a substantial market correction over the past year.

METALDR's market capitalization stands at $126,055.60, with a fully diluted valuation of $444,125. The token's 24-hour trading volume is $10,669.03, suggesting moderate trading activity. The circulating supply is 780,530,018.472 METALDR, which is 28.38% of the total supply of 2,750,000,000 tokens.

Despite the recent 24-hour decline, METALDR has shown some positive momentum in the past week, with a 13.22% increase over the last 7 days. However, the token remains in a bearish trend when considering its 30-day performance (-1.77%) and its dramatic yearly decline (-98.65%).

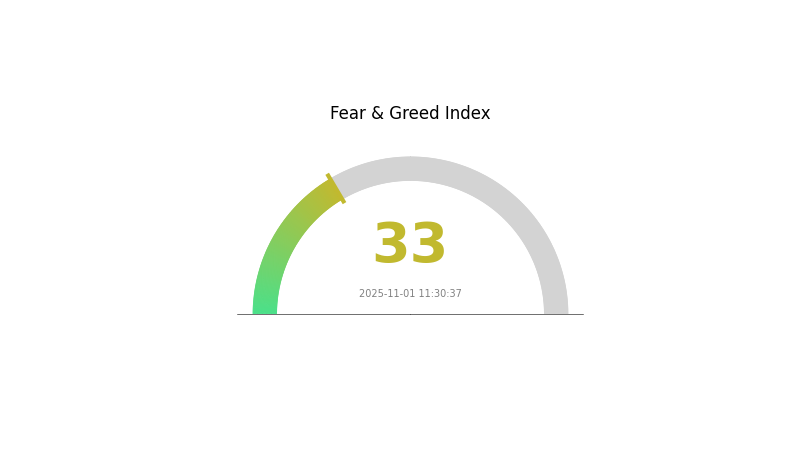

The current market sentiment for cryptocurrencies is cautious, with the VIX index at 33, indicating a "Fear" state in the market. This general market fear could be influencing METALDR's price volatility and trading patterns.

Click to view the current METALDR market price

METALDR Market Sentiment Indicator

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index registering at 33. This indicates a cautious sentiment among investors, potentially signaling a buying opportunity for those who follow contrarian strategies. However, it's crucial to remember that market sentiment can shift rapidly. Traders should conduct thorough research and consider multiple factors before making investment decisions. Gate.com offers various tools and resources to help traders navigate these uncertain market conditions.

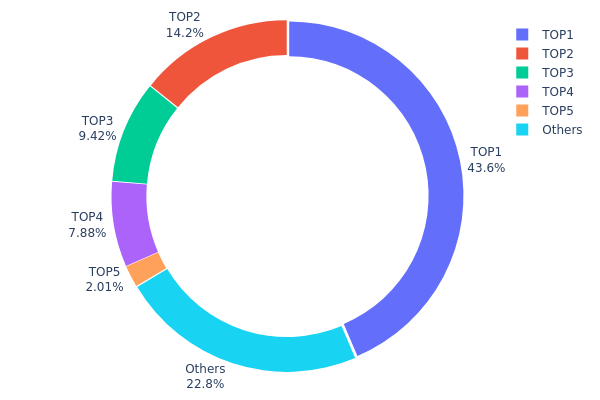

METALDR Holdings Distribution

The address holdings distribution for METALDR reveals a highly concentrated ownership structure. The top address holds a significant 43.60% of the total supply, while the top 5 addresses collectively control 77.14% of all tokens. This concentration indicates a potential centralization risk within the METALDR ecosystem.

Such a concentrated distribution can have substantial implications for market dynamics. The presence of large holders, often referred to as "whales," may lead to increased price volatility if they decide to buy or sell significant portions of their holdings. Moreover, this concentration could potentially allow for market manipulation, as large holders may have the ability to influence token prices through their trading activities.

From a broader perspective, this distribution pattern suggests a relatively low level of decentralization for METALDR. While blockchain projects often aim for wide token distribution to enhance network security and governance participation, the current state of METALDR's holdings indicates a more centralized structure. This could impact the project's resilience and decision-making processes, potentially affecting its long-term stability and adoption.

Click to view the current METALDR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3c32...1f1523 | 1199000.00K | 43.60% |

| 2 | 0x223e...342269 | 391676.59K | 14.24% |

| 3 | 0x8ac8...0d779e | 259122.64K | 9.42% |

| 4 | 0x0d07...b492fe | 216636.06K | 7.87% |

| 5 | 0x2963...dcd0ef | 55370.98K | 2.01% |

| - | Others | 628193.74K | 22.86% |

II. Core Factors Affecting METALDR's Future Price

Market Sentiment and Investor Behavior

- Short-term traders: Focus on price action and technical analysis

- Long-term holders (HODLers): Tend to analyze fundamentals for long-term prospects

- Community sentiment: News announcements and community mood can be significant price drivers

Technical Development and Ecosystem Building

- Core technology upgrades: Scaling solutions and consensus mechanism improvements are crucial for future prospects

- Decentralization: Maintaining decentralized core advantages is essential for long-term development

Macroeconomic Environment

- Market demand: Affects price volatility and trading volume

- Cryptocurrency ecosystem: Overall market trends can impact METALDR's price, similar to how major cryptocurrencies influence altcoins

Institutional and Large Holder Dynamics

- Institutional adoption: The level of acceptance by institutional funds can influence price and legitimacy

Regulatory Environment

- Global regulatory framework: Clarity in regulations can significantly impact METALDR's future development and price

III. METALDR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00011 - $0.00014

- Neutral prediction: $0.00014 - $0.00018

- Optimistic prediction: $0.00018 - $0.0002 (requires positive market sentiment and increased adoption)

2026-2027 Outlook

- Market phase expectation: Potential recovery and growth phase

- Price range forecast:

- 2026: $0.00016 - $0.00027

- 2027: $0.00017 - $0.00033

- Key catalysts: Increasing adoption, technological improvements, and overall market recovery

2028-2030 Long-term Outlook

- Base scenario: $0.00024 - $0.00035 (assuming steady growth and adoption)

- Optimistic scenario: $0.00035 - $0.00046 (with significant technological breakthroughs and wider acceptance)

- Transformative scenario: $0.00046+ (under extremely favorable market conditions and mainstream integration)

- 2030-12-31: METALDR $0.00046 (potential peak price if market conditions are highly favorable)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0002 | 0.00016 | 0.00011 | -1 |

| 2026 | 0.00027 | 0.00018 | 0.00016 | 10 |

| 2027 | 0.00033 | 0.00022 | 0.00017 | 37 |

| 2028 | 0.00032 | 0.00027 | 0.00026 | 70 |

| 2029 | 0.0004 | 0.0003 | 0.0002 | 82 |

| 2030 | 0.00046 | 0.00035 | 0.00024 | 114 |

IV. METALDR Professional Investment Strategies and Risk Management

METALDR Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate METALDR tokens during market dips

- Hold for at least 1-2 years to potentially benefit from project development

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor METALDR's price action in relation to broader market trends

- Set strict stop-loss orders to manage downside risk

METALDR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and be cautious of phishing attempts

V. Potential Risks and Challenges for METALDR

METALDR Market Risks

- High volatility: METALDR's price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades without impacting price

- Competition: Other gaming tokens may outperform METALDR

METALDR Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting gaming tokens

- Cross-border compliance: Challenges in adhering to varying international regulations

- Tax implications: Evolving tax laws may impact METALDR holders

METALDR Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the token's underlying code

- Network congestion: Issues on the Polygon network could affect METALDR transactions

- Integration challenges: Potential difficulties in implementing METALDR within the game ecosystem

VI. Conclusion and Action Recommendations

METALDR Investment Value Assessment

METALDR presents a speculative investment opportunity in the gaming token space. While it offers potential for growth tied to the success of BADMAD ROBOTS, investors should be aware of the high volatility and risks associated with small-cap gaming tokens.

METALDR Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Implement strict risk management and diversify across gaming tokens ✅ Institutional investors: Conduct comprehensive due diligence and consider as part of a broader gaming/metaverse portfolio

METALDR Participation Methods

- Spot trading: Purchase METALDR tokens on Gate.com

- Staking: Explore potential staking opportunities if offered by the project

- Game participation: Engage with the BADMAD ROBOTS game to better understand the token's utility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Are metal prices expected to rise?

Yes, metal prices are generally expected to rise due to stimulus packages and raw material shortages, though factors like a sluggish real estate sector may moderate the increase.

Will gold go to $4000 an ounce?

Yes, gold has already reached $4000 an ounce. It's currently consolidating around this level and is expected to remain stable near $4000 in the near future.

Is silver going to skyrocket in 2025?

Silver prices are likely to rise significantly in 2025 due to rate cuts, increased industrial demand, and supply constraints. Analysts predict higher prices, with potential for a major upward move.

What is the metal outlook for 2025?

The metal outlook for 2025 is stable with potential price volatility. Steel prices remain cautious, while aluminum focuses on cost factors. Buyers should stay flexible and monitor market trends closely.

2025 3ULL Price Prediction: Bullish Outlook for Emerging Crypto Asset

2025 VGX Price Prediction: Analyzing Potential Growth and Market Trends for Voyager Token

2025 WIZZ Price Prediction: Analyzing Growth Potential and Market Trends for the Budget Airline

2025 READY Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Cryptocurrency

2025 NVIR Price Prediction: Navigating the Future of AI-Driven Investments

2025 PZP Price Prediction: Analyzing Market Trends and Potential Growth Factors

Understanding Cheems: A Comprehensive Guide to Cryptocurrency Basics

Who Holds the Highest Amount of Bitcoin?

Is Moonbeam Network (GLMR) a good investment?: A Comprehensive Analysis of Features, Market Performance, and Future Potential in the Polkadot Ecosystem

Is Magma Finance (MAGMA) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Positioning in 2024

Is WazirX (WRX) a good investment?: A Comprehensive Analysis of the Indian Crypto Exchange Token's Potential Returns and Market Risks