2025 MILADYCULT Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: Market Position and Investment Value of MILADYCULT

Milady Cult Coin (MILADYCULT) is an ERC-20 token designed to empower and fund those who build and promote a decentralized future. Since its launch in November 2024, the project has established itself within the cryptocurrency ecosystem with a focus on supporting innovative ideas that challenge existing social and economic norms. As of December 21, 2025, MILADYCULT has achieved a market capitalization of approximately $24.17 million, with a circulating supply of approximately 46.88 billion tokens and a fully diluted valuation of $24.17 million. The token is currently trading at $0.0002417, reflecting its position as an emerging asset in the digital economy.

This article will comprehensively analyze MILADYCULT's price movements and market dynamics, integrating historical price patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and actionable investment strategies for the period through 2030.

Milady Cult Coin (MILADYCULT) Market Analysis Report

I. MILADYCULT Price History Review and Market Status

MILADYCULT Historical Price Evolution

As of December 21, 2025, Milady Cult Coin has experienced significant volatility since its launch on December 8, 2024. The token reached its all-time high (ATH) of $0.004999 on January 18, 2025, representing a peak valuation period for the project. Subsequently, the token entered a correction phase, with its all-time low (ATL) recorded at $0.0002263 on December 19, 2025.

This price movement reflects the substantial decline of approximately 91.29% over the past year, indicating severe downward pressure on the asset's market value. The token's trading history demonstrates the highly volatile nature characteristic of emerging cryptocurrency projects in the current market environment.

MILADYCULT Current Market Conditions

Price Information:

- Current Price: $0.0002417

- 24-Hour Price Range: $0.0002361 - $0.000248

- All-Time High: $0.004999 (January 18, 2025)

- All-Time Low: $0.0002263 (December 19, 2025)

Market Performance:

- 1-Hour Change: +0.5%

- 24-Hour Change: +1.63%

- 7-Day Change: -9.62%

- 30-Day Change: +1.04%

- 1-Year Change: -91.29%

Market Capitalization Metrics:

- Current Market Cap: $11,330,237.83

- Fully Diluted Valuation (FDV): $24,170,000.00

- Market Cap to FDV Ratio: 46.88%

- Market Dominance: 0.00075%

- 24-Hour Trading Volume: $231,875.27

Supply Metrics:

- Circulating Supply: 46,877,276,898.21 MILADYCULT (46.88% of total)

- Total Supply: 99,999,999,999.99

- Maximum Supply: 100,000,000,000

- Number of Holders: 11,637

- Token Standard: ERC-20 (Ethereum)

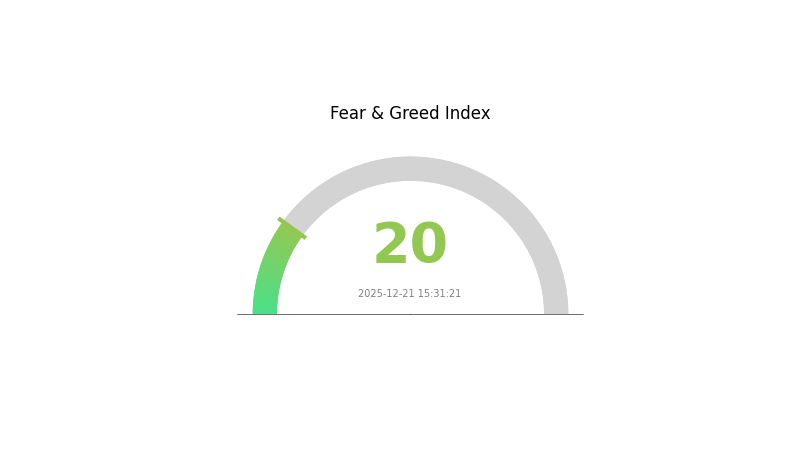

Market Sentiment: The current market sentiment reflects extreme fear (VIX score: 20), indicating heightened market uncertainty and risk-averse trading behavior among investors.

The token is currently listed on 6 exchanges and is available for trading on Gate.com.

Visit MILADYCULT Market Price on Gate.com for real-time pricing data.

MILADYCULT Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The MILADYCULT market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This reading indicates strong negative sentiment among investors, reflecting significant market uncertainty and risk aversion. During periods of extreme fear, opportunities often emerge for contrarian investors. However, caution is advised as volatility remains elevated. Monitor market developments closely on Gate.com to identify potential entry points while managing portfolio risk appropriately.

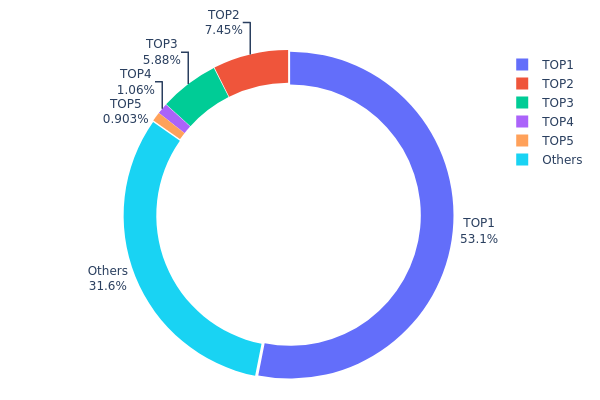

MILADYCULT Token Holdings Distribution

Address holding distribution refers to the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing the decentralization level and market structure of a cryptocurrency asset. This distribution reveals how MILADYCULT tokens are allocated among individual holders and provides insights into potential concentration risks and market dynamics.

The MILADYCULT token exhibits significant concentration characteristics, with the top address commanding 53.12% of total supply, representing an exceptionally high degree of centralization. The cumulative holdings of the top five addresses account for approximately 68.39% of all circulating tokens, while the remaining 31.61% is distributed among other addresses. This distribution pattern indicates a highly concentrated token structure where a small number of entities control the majority of available supply. Such extreme concentration raises concerns regarding market stability and decision-making power, as large holders possess substantial influence over price movements and governance outcomes.

The concentrated holder structure presents considerable implications for market dynamics and price volatility. The dominant position of the leading address creates potential for significant price manipulation and liquidity concerns, as large sell orders could trigger substantial downward pressure on token valuation. Furthermore, the limited distribution among dispersed holders constrains organic market participation and reduces true decentralization. The current allocation suggests that MILADYCULT remains in a phase characterized by high holder concentration rather than achieving genuine decentralized distribution, which may pose risks to long-term market stability and investor confidence.

Click to view current MILADYCULT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...14eca4 | 53122723.10K | 53.12% |

| 2 | 0xc4ce...b926f2 | 7445538.29K | 7.44% |

| 3 | 0x0000...2e6b76 | 5879519.34K | 5.87% |

| 4 | 0xfb03...6cbd2e | 1061194.83K | 1.06% |

| 5 | 0x6505...4b823a | 903014.45K | 0.90% |

| - | Others | 31588009.99K | 31.61% |

II. Core Factors Influencing MILADYCULT Future Price

Supply Mechanism

-

Limited Token Supply: MILADYCULT operates as a self-sustaining economic ecosystem with a fixed token supply structure, creating scarcity that supports price stability and long-term value retention.

-

Community Engagement as Price Driver: The token serves as a connector within the Remilia ecosystem, facilitating governance participation and NFT project support. Strong community engagement has historically driven price appreciation in similar digital art ecosystem tokens.

Technology Development and Ecosystem Building

-

Digital Art Ecosystem Integration: MILADYCULT functions as a governance and utility token within the Remilia NFT ecosystem, connecting community members and enabling participation in digital art projects and ecosystem decisions.

-

Ecosystem Applications: The token supports governance mechanisms and NFT project promotion within the Remilia ecosystem, creating utility beyond speculative trading and fostering organic demand from community participants.

III. 2025-2030 MILADYCULT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00023-$0.00024

- Neutral Forecast: $0.00024 (average)

- Bullish Forecast: $0.00033 (market stabilization scenario)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with modest upward momentum as market conditions stabilize and liquidity improves.

- Price Range Forecast:

- 2026: $0.00016-$0.0003 (18% upside potential)

- 2027: $0.00018-$0.00034 (20% upside potential)

- 2028: $0.00018-$0.00046 (31% upside potential)

- Key Catalysts: Enhanced tokenomics implementation, expanding community engagement, improved exchange liquidity on platforms such as Gate.com, and positive sentiment shifts in the broader altcoin market.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00026-$0.00049 (61% growth by 2029, assuming steady ecosystem development and consistent market recovery)

- Optimistic Scenario: $0.00029-$0.0005 (81% growth by 2030, contingent on successful protocol upgrades and mainstream adoption acceleration)

- Transformative Scenario: $0.0005+ (extreme bullish case with breakthrough utility adoption, significant institutional interest, and major ecosystem partnerships materializing)

- 2030-12-31: MILADYCULT targets $0.0005 as potential resistance level (long-term resistance formation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00033 | 0.00024 | 0.00023 | 0 |

| 2026 | 0.0003 | 0.00029 | 0.00016 | 18 |

| 2027 | 0.00034 | 0.00029 | 0.00018 | 20 |

| 2028 | 0.00046 | 0.00032 | 0.00018 | 31 |

| 2029 | 0.00049 | 0.00039 | 0.00026 | 61 |

| 2030 | 0.0005 | 0.00044 | 0.00029 | 81 |

Milady Cult Coin (MILADYCULT) Professional Investment Report

IV. MILADYCULT Professional Investment Strategy and Risk Management

MILADYCULT Investment Methodology

(1) Long-Term Holding Strategy

- Suitable Investors: Community-aligned participants and decentralization advocates seeking exposure to projects promoting decentralized innovation

- Operational Recommendations:

- Accumulate during periods of market weakness, targeting support levels around $0.0002361 (24-hour low)

- Implement dollar-cost averaging (DCA) to reduce timing risk over a 3-6 month period

- Secure tokens in a reliable digital wallet with strong security practices

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price points at $0.0002361 (recent support) and $0.004999 (all-time high from January 18, 2025)

- Volume Analysis: Track 24-hour volume ($231,875.27) to identify liquidity entry and exit points

- Wave Trading Key Points:

- Leverage the 1.63% 24-hour positive movement for short-term momentum plays

- Exercise caution given the -9.62% 7-day decline, indicating potential downside pressure

- Recognize the extreme -91.29% annual decline, suggesting high volatility and recovery risk

MILADYCULT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.0% of total crypto portfolio

- Active Investors: 1.0-2.5% of total crypto portfolio

- Professional Investors: 2.5-5.0% of speculative allocation, with hedging strategies

(2) Risk Hedging Strategies

- Position Sizing Control: Never allocate capital exceeding your risk tolerance threshold; maintain strict stop-loss orders at 15-20% below entry prices

- Diversification Approach: Balance MILADYCULT exposure with established cryptocurrencies and traditional assets to reduce concentration risk

(3) Secure Storage Solutions

- Digital Wallet Security: Utilize Gate.com's native wallet solutions for convenient access and integrated trading

- Private Key Management: Maintain secure offline backups of private keys in encrypted format

- Security Considerations: Never share seed phrases or private keys; enable two-factor authentication on all exchange and wallet accounts

V. MILADYCULT Potential Risks and Challenges

MILADYCULT Market Risk

- Extreme Volatility: The token has experienced a -91.29% decline over one year and trades at only 4.84% of its all-time high, indicating extreme price instability unsuitable for risk-averse investors

- Low Liquidity Depth: With 24-hour trading volume of only $231,875.26 against a $24.17M market cap, large orders could experience significant slippage

- Market Sentiment Dependency: As a community-driven project, the token is highly sensitive to social media trends and community engagement fluctuations

MILADYCULT Regulatory Risk

- Evolving Compliance Framework: Decentralized projects promoting alternative social and economic structures may face increased regulatory scrutiny in certain jurisdictions

- Classification Uncertainty: Regulatory classification as a security or commodity remains unclear in many regions, creating potential compliance challenges

MILADYCULT Technical Risk

- Smart Contract Auditing: ERC-20 token status requires verification of underlying smart contract security and audit history

- Blockchain Dependency: Token functionality remains subject to Ethereum network performance, gas fees, and potential consensus layer changes

VI. Conclusion and Action Recommendations

MILADYCULT Investment Value Assessment

Milady Cult Coin represents a speculative, community-driven digital asset with pronounced risk-reward characteristics. The project's mission to empower decentralized innovation attracts ideologically aligned participants, but the token's extreme volatility (-91.29% annually), significant distance from all-time highs, and relatively shallow trading liquidity present substantial challenges. The project shows market activity with 11,637 holders across 6 exchanges, but the limited 24-hour volume relative to market capitalization suggests potential liquidity constraints. Investment should be reserved exclusively for participants with high risk tolerance and conviction in the project's long-term vision.

MILADYCULT Investment Recommendations

✅ Newcomers: Allocate only a minimal position (0.5-1.0% of crypto exposure) after thorough project research; consider waiting for improved liquidity metrics before substantial entry

✅ Experienced Investors: Implement strict risk management protocols with clear stop-loss levels; utilize technical analysis on liquidity spikes for tactical entries; maintain awareness of community sentiment through official channels

✅ Institutional Investors: Monitor for significant improvements in trading volume and holder diversification before substantial allocation; conduct comprehensive smart contract audits and regulatory analysis before commitment

MILADYCULT Trading Participation Methods

- Gate.com Spot Trading: Access direct MILADYCULT trading pairs with competitive fees and integrated wallet functionality

- Gate.com Limit Orders: Employ precise entry and exit strategies at predetermined price levels to optimize execution quality

- Community Participation: Engage with official channels (website: https://cult.inc/, Twitter: https://x.com/MiladyCult) to stay informed on project developments and tokenomics updates

Cryptocurrency investments carry extreme risk and volatility. This report does not constitute investment advice. Investors must conduct independent research and consult qualified financial professionals before making decisions. Never invest capital you cannot afford to lose completely. Past performance does not guarantee future results.

FAQ

How much is the cult coin worth?

The cult coin is currently worth $0.000239. With a circulating supply of 46.88 billion tokens and a maximum supply of 100 billion, the 24-hour trading volume reaches $1.54M, reflecting active market participation.

What is MILADYCULT and what is its current price?

Milady Cult Coin (CULT) is a cryptocurrency token currently priced at $0.0002408 as of December 21, 2025. It has experienced a 0.82% increase in the last 24 hours with a trading volume of $1.58 million.

Will MILADYCULT reach $1 in the future?

Based on current market analysis and price prediction models, MILADYCULT is not expected to reach $1 in the foreseeable future. The token's trajectory suggests price levels will remain significantly below this threshold.

What factors influence MILADYCULT price prediction?

MILADYCULT price is influenced by supply and demand dynamics, trading volume, market sentiment, protocol updates, and overall crypto market trends. These factors combined shape price movements and future predictions.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 LTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Litecoin

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 NBLU Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 KERNEL Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 SPA Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Is Codatta (XNY) a good investment?: A Comprehensive Analysis of Price Performance, Risk Factors, and Future Growth Potential

Is BitMEX Token (BMEX) a good investment?: A comprehensive analysis of risks, opportunities, and market potential for 2024