2025 PAXG Price Prediction: Analyzing the Future of Gold-Backed Tokens in a Volatile Crypto Market

Introduction: PAXG's Market Position and Investment Value

PAX Gold (PAXG) as a virtual asset backed by physical gold, has established itself as a unique investment option since its inception in 2019. As of 2025, PAXG's market capitalization has reached $1,357,433,240, with a circulating supply of approximately 333,354 tokens, and a price hovering around $4,072. This asset, often referred to as "digital gold," is playing an increasingly crucial role in diversifying investment portfolios and providing a hedge against economic uncertainties.

This article will comprehensively analyze PAXG's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. PAXG Price History Review and Current Market Status

PAXG Historical Price Evolution

- 2023: Global economic uncertainties led to increased demand for gold-backed assets, PAXG price surged to $2,000

- 2024: Gold market volatility, PAXG price fluctuated between $3,000 and $4,000

- 2025: Bull market for precious metals, PAXG price reached all-time high of $4,854.86 before correcting

PAXG Current Market Situation

PAXG is currently trading at $4,072.04, down 2.52% in the last 24 hours. The token has seen a 2.65% increase over the past week, but a 2.94% decrease over the last 30 days. PAXG's all-time high of $4,854.86 was recorded on October 16, 2025, while its all-time low of $2,986.26 occurred on April 7, 2025. The current market cap stands at $1,357,433,240.95, with a circulating supply of 333,354.594 PAXG tokens. The 24-hour trading volume is $6,206,900.22, indicating moderate market activity.

Click to view current PAXG market price

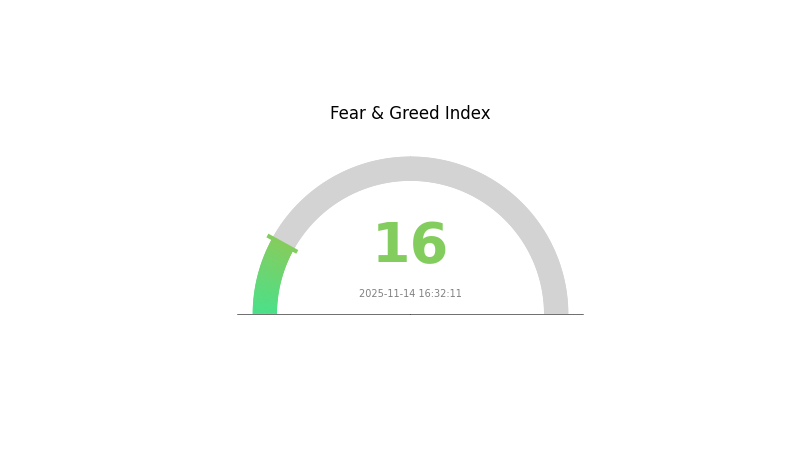

PAXG Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the Fear and Greed Index plummeting to 16. This indicates a high level of pessimism among investors, potentially creating opportunities for contrarian strategies. During such times, it's crucial to remain calm and avoid making impulsive decisions. Remember, market cycles are natural, and extreme fear often precedes significant rebounds. Savvy investors may consider this an opportune moment to accumulate PAXG, as historically, buying during periods of fear has yielded positive results in the long term.

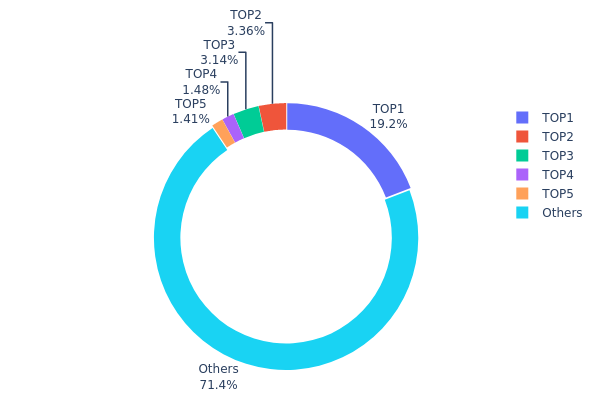

PAXG Holdings Distribution

The address holdings distribution data for PAXG reveals a moderately concentrated market structure. The top address holds a significant 19.16% of the total supply, with 63.88K PAXG tokens. This concentration is notable but not necessarily alarming for a gold-backed token. The subsequent top holders possess considerably smaller portions, ranging from 3.35% to 1.41% of the total supply.

Interestingly, the majority of PAXG tokens (71.46%) are distributed among numerous smaller holders, categorized as "Others". This distribution pattern suggests a balance between large institutional holders and a diverse base of smaller investors. While the presence of a dominant top holder could potentially influence market dynamics, the substantial distribution among smaller holders mitigates risks of market manipulation and contributes to overall market stability.

This holdings structure reflects a moderate level of decentralization for PAXG. The combination of significant institutional presence and widespread retail participation indicates a mature market with a stable on-chain structure, potentially leading to less volatile price movements compared to more concentrated token distributions.

Click to view the current PAXG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 63.88K | 19.16% |

| 2 | 0x7d76...68107d | 11.18K | 3.35% |

| 3 | 0xd2dd...e6869f | 10.47K | 3.14% |

| 4 | 0x264b...5997b5 | 4.95K | 1.48% |

| 5 | 0x7daf...706f83 | 4.71K | 1.41% |

| - | Others | 238.16K | 71.46% |

II. Key Factors Influencing PAXG's Future Price

Supply Mechanism

- Pegged Supply: PAXG's supply is directly tied to physical gold reserves.

- Historical Pattern: Supply changes have historically mirrored gold market dynamics.

- Current Impact: Supply fluctuations are expected to closely follow gold market trends.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially regarding interest rates, may affect PAXG's appeal as a store of value.

- Inflation Hedging Properties: PAXG is likely to perform well in inflationary environments, similar to physical gold.

- Geopolitical Factors: International tensions and economic uncertainties may increase demand for gold-backed assets like PAXG.

III. PAXG Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $3,393 - $4,088

- Neutral prediction: $4,088 - $4,967

- Optimistic prediction: $4,967 - $5,846 (requires sustained gold market strength)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $4,826 - $7,209

- 2028: $6,460 - $9,457

- Key catalysts: Global economic uncertainties, inflation trends, and increased adoption of gold-backed cryptocurrencies

2029-2030 Long-term Outlook

- Base scenario: $8,058 - $9,791 (assuming steady growth in gold prices and crypto adoption)

- Optimistic scenario: $9,791 - $11,523 (with favorable macroeconomic conditions and increased institutional interest)

- Transformative scenario: $10,965 - $11,523 (under extreme positive market conditions and widespread PAXG adoption)

- 2030-11-15: PAXG $9,791 (140% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 5846.48 | 4088.45 | 3393.41 | 0 |

| 2026 | 7252.5 | 4967.47 | 2781.78 | 21 |

| 2027 | 7209.78 | 6109.98 | 4826.89 | 50 |

| 2028 | 9457.03 | 6659.88 | 6460.09 | 63 |

| 2029 | 11523.59 | 8058.46 | 5882.67 | 97 |

| 2030 | 10965.95 | 9791.03 | 5189.24 | 140 |

IV. PAXG Professional Investment Strategies and Risk Management

PAXG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking gold exposure

- Operation suggestions:

- Accumulate PAXG during price dips

- Set up regular purchase plans

- Store in secure hardware wallets or custodial solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor gold market trends and macroeconomic factors

- Set clear stop-loss and take-profit levels

PAXG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-15%

- Aggressive investors: 15-20%

(2) Risk Hedging Solutions

- Diversification: Combine PAXG with other asset classes

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Custodial solution: Consider reputable digital asset custody services

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update security settings

V. Potential Risks and Challenges for PAXG

PAXG Market Risks

- Gold price volatility: PAXG value fluctuates with gold market movements

- Liquidity risk: Potential challenges in large-scale trading during market stress

- Counterparty risk: Reliance on Paxos for gold backing and token management

PAXG Regulatory Risks

- Changing cryptocurrency regulations: Potential impact on PAXG's legal status

- Gold market regulations: Changes in gold trading rules may affect PAXG

- Tax implications: Evolving tax treatment of tokenized assets

PAXG Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the PAXG token contract

- Blockchain network issues: Ethereum network congestion or upgrades may impact transactions

- Custody risks: Potential security breaches in digital wallets or custody solutions

VI. Conclusion and Action Recommendations

PAXG Investment Value Assessment

PAXG offers a unique blend of traditional gold investment and blockchain technology. It provides a hedge against inflation and currency devaluation, with the added benefits of digital asset flexibility. However, investors should be aware of the volatility in both crypto and gold markets, as well as the evolving regulatory landscape.

PAXG Investment Recommendations

✅ Beginners: Start with small allocations, focus on long-term holding strategy ✅ Experienced investors: Consider a mix of holding and active trading, utilize technical analysis ✅ Institutional investors: Explore PAXG for portfolio diversification and as a digital gold hedge

PAXG Participation Methods

- Direct purchase: Buy PAXG on Gate.com or other supported exchanges

- Dollar-cost averaging: Set up regular purchase plans to mitigate market volatility

- Gold-backed ETF alternative: Use PAXG as a more flexible, blockchain-based alternative to traditional gold ETFs

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is PaXG a good investment?

Yes, PAXG can be a good investment. It's backed by physical gold, offering stability and potential for growth as gold prices rise. It combines the benefits of gold with the convenience of cryptocurrency.

How high can PaXG go?

PAXG could potentially reach $3,000 per token by 2026, given its gold-backed nature and increasing demand for digital gold assets in the crypto market.

How much is gold worth in 2025?

Based on market trends and expert predictions, gold is expected to be worth around $2,500 to $3,000 per ounce in 2025.

Is PaXG really backed by gold?

Yes, PAXG is fully backed by physical gold. Each token represents one fine troy ounce of gold stored in Brink's vaults, ensuring its value is tied to real gold reserves.

How Does XAUT's Market Cap of $1.52B Reflect Gold-Backed Crypto Trends in 2025?

2025 PAXG Price Prediction: Analyzing Gold-Backed Token's Growth Potential in an Uncertain Economic Landscape

2025 PAXG Price Prediction: Gold-Backed Token Expected to Surge Amid Economic Uncertainty

How Does the Federal Reserve Policy Impact PAXG Price?

How Does Macroeconomic Data Impact Cryptocurrency Prices in 2025?

How Does XAUt Respond to Macroeconomic Uncertainty in 2025?

Understanding Crypto Slang: Wen Lambo, Wen Moon, and More

What Does Zcash Whitepaper Reveal About Its Zero-Knowledge Technology and Privacy Innovation in 2025?

How Does XRP Price Volatility Compare to Bitcoin and Ethereum in 2025?

Pudgy Penguins NFT Value Forecast 2025-2031: Is $1 Achievable?

The Best Bitcoin Payment Cards for All Your Transactions