2025 PROMPT Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: PROMPT's Market Position and Investment Value

Wayfinder (PROMPT) is a collection of AI agents that seamlessly transact across multiple chains, execute smart contract functions, and complete algorithmic trades on-chain. As of December 2025, PROMPT has established itself as an innovative player in the AI-powered blockchain infrastructure space. The token's market capitalization currently stands at $49 million, with a circulating supply of approximately 227.27 million tokens and a price hovering around $0.049. This asset, positioned as a bridge between artificial intelligence and decentralized finance, is playing an increasingly vital role in enabling algorithmic trading and cross-chain smart contract execution.

This article will provide a comprehensive analysis of PROMPT's price trends, historical performance patterns, market supply dynamics, ecosystem developments, and macroeconomic factors influencing the token through 2030. We will deliver professional price forecasting and practical investment strategies to help investors make informed decisions in this emerging sector.

PROMPT Market Analysis Report

I. PROMPT Price History Review and Market Status

PROMPT Historical Price Trajectory

PROMPT (Wayfinder) was launched on December 22, 2025, representing a newly entered cryptocurrency asset in the market. The token achieved its all-time high (ATH) of $0.6271 on April 12, 2025, following its initial market entry. Subsequently, the token experienced significant depreciation, reaching its all-time low (ATL) of $0.0421 on October 10, 2025. This dramatic decline from peak to trough represents an 87.0% decrease over approximately six months, reflecting considerable volatility typical of emerging AI agent-focused tokens.

PROMPT Current Market Position

As of December 22, 2025, PROMPT is trading at $0.049, reflecting a 24-hour decline of -9.4%. The token demonstrates short-term bearish pressure, with a 1-hour change of -0.24% and a 7-day decline of -21.23%. Over the 30-day period, PROMPT has depreciated by -15.17%, while the year-to-date performance shows a severe contraction of -91.80%.

The current market capitalization stands at approximately $11.14 million USD, with a fully diluted valuation (FDV) of $49 million USD. The circulating supply comprises 227.27 million tokens out of a total maximum supply of 1 billion tokens, representing 22.73% of total supply in circulation. PROMPT maintains a market dominance of 0.0015% within the broader cryptocurrency ecosystem.

Trading activity shows 24-hour volume of $202,682.99, with the token listed across 26 different exchanges. The asset maintains a holder base of 7,253 addresses, indicating limited but growing adoption. Current market sentiment reflects extreme fear conditions (VIX reading: 20), which typically correlates with broader cryptocurrency market downturn periods.

Click to view current PROMPT market price

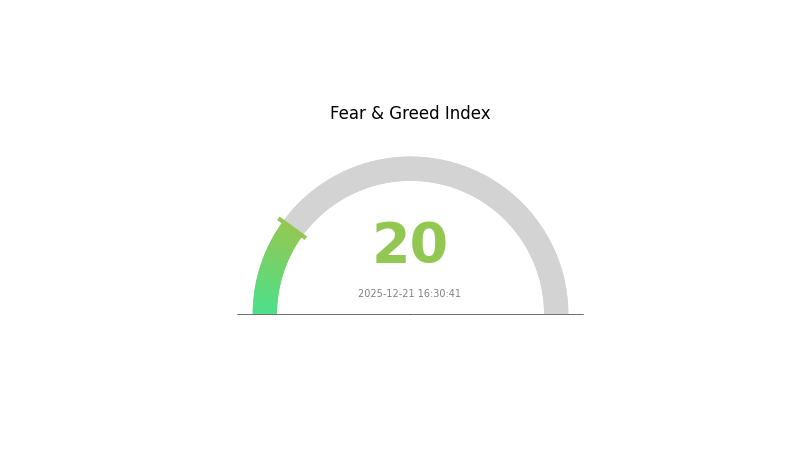

PROMPT Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with a reading of 20, signaling significant investor anxiety and pessimism. This exceptionally low index reflects widespread concern about market conditions and heightened risk aversion among traders. During periods of extreme fear, contrarian investors often view this as a potential buying opportunity, as excessive pessimism frequently precedes market rebounds. However, such conditions warrant careful analysis before entering positions. Monitor market developments closely and consider dollar-cost averaging strategies on Gate.com to manage risk effectively during this volatile phase.

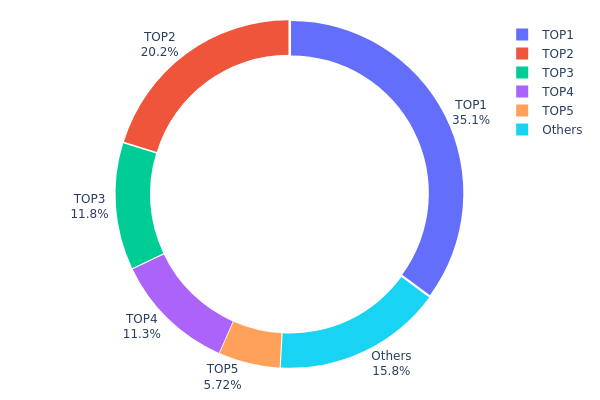

PROMPT Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the blockchain network, revealing how PROMPT tokens are dispersed among major holders and smaller participants. By analyzing the top addresses and their respective holdings percentages, this metric provides crucial insights into the token's decentralization level and potential concentration risks that could influence market dynamics and price stability.

The current holdings data reveals a significant concentration pattern, with the top four addresses collectively controlling approximately 78.45% of total PROMPT token supply. The largest holder (0x5489...08570c) commands 35.07% of all tokens, while the second-largest (0x3fb4...0c3f1c) holds 20.23%, indicating a highly centralized distribution structure. This level of concentration suggests notable whale activity within the ecosystem, where a limited number of addresses possess disproportionate control over token supply and voting power. The remaining addresses collectively account for only 21.55% of holdings, with smaller holders (categorized as "Others") representing 15.83%, further underscoring the imbalanced distribution pattern.

Such pronounced concentration presents meaningful implications for market structure and price stability. The heavy accumulation by top-tier holders elevates the potential for coordinated price movements or sudden market volatility should these addresses execute large transactions. While the presence of meaningful smaller holders (15.83%) provides some depth to the market structure, the overwhelming dominance of the top four addresses suggests limited decentralization and increased vulnerability to price manipulation. This distribution pattern reflects characteristics commonly observed in earlier-stage projects or tokens with significant institutional or founding team allocations, warranting cautious consideration regarding long-term sustainability and market resilience.

Click to view the current PROMPT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5489...08570c | 306494.46K | 35.07% |

| 2 | 0x3fb4...0c3f1c | 176855.06K | 20.23% |

| 3 | 0x2609...df13f5 | 103354.17K | 11.82% |

| 4 | 0x77a6...edb1c9 | 99053.14K | 11.33% |

| 5 | 0xa8cd...aabaee | 50000.00K | 5.72% |

| - | Others | 138078.67K | 15.83% |

II. Core Factors Influencing PROMPT's Future Price

Macroeconomic Environment

-

Market Sentiment Impact: Price fluctuations are influenced by macroeconomic factors, industry dynamics, company fundamentals, market sentiment, and unexpected news events. Market sentiment, particularly regarding technology and AI adoption trends, directly affects PROMPT valuation as investor confidence in large language model applications grows or contracts.

-

Technology Industry Cycles: As PROMPT relates to large language model development and prompt engineering optimization, broader technology sector performance and capital allocation trends significantly influence its price trajectory.

Technical Development and Ecosystem Building

-

Large Language Model Advancement: Continuous improvements in LLM architecture, training methodologies, and deployment efficiency enhance the utility and demand for prompt optimization technologies. Advancements in transformer models, tokenization processes, and output probability distribution management directly correlate with increased practical applications and market adoption.

-

Prompt Engineering Evolution: The growing sophistication of prompt optimization techniques—including structured formatting, task decomposition, few-shot learning, and chain-of-thought reasoning—creates expanding use cases across financial analysis, content generation, and automated decision-making systems. Development of domain-specific prompt frameworks for financial analysis (such as LLMFactor framework utilizing Sequential Knowledge-Guided Prompting) demonstrates ecosystem maturation.

-

AI Agent Integration: Emergence of multi-agent LLM systems with layered memory architecture and real-time feedback mechanisms expands PROMPT's applicability in quantitative finance, automated trading, and complex financial decision-making processes. Applications in factor mining, Alpha factor generation, and investment strategy automation represent significant ecosystem growth opportunities.

III. 2025-2030 PROMPT Price Forecast

2025 Outlook

- Conservative Estimate: $0.03322 - $0.04886

- Base Case Estimate: $0.04886

- Optimistic Estimate: $0.06987 (requires sustained market momentum and increased adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual appreciation phase with moderate growth trajectory, reflecting increasing market maturity and adoption expansion.

- Price Range Predictions:

- 2026: $0.04630 - $0.08252 (21% upside potential)

- 2027: $0.04682 - $0.09577 (44% upside potential)

- Key Catalysts: Enhanced ecosystem development, institutional participation growth, technology upgrades, and broader market sentiment improvement

2028-2030 Long-term Outlook

- Base Case Scenario: $0.07252 - $0.11837 (70% appreciation from 2025, assumes steady ecosystem expansion)

- Optimistic Scenario: $0.10130 - $0.15383 (155% upside potential by 2030, contingent on mainstream adoption acceleration and sustained institutional inflows)

- Transformative Scenario: $0.14927+ (105%+ gains by 2029, requires breakthrough technological innovation and significant market catalysts)

- December 22, 2025: PROMPT trading range established at $0.03322-$0.06987 (early price discovery phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06987 | 0.04886 | 0.03322 | 0 |

| 2026 | 0.08252 | 0.05936 | 0.0463 | 21 |

| 2027 | 0.09577 | 0.07094 | 0.04682 | 44 |

| 2028 | 0.11837 | 0.08336 | 0.07252 | 70 |

| 2029 | 0.14927 | 0.10086 | 0.07161 | 105 |

| 2030 | 0.15383 | 0.12507 | 0.1013 | 155 |

PROMPT Investment Strategy and Risk Management Report

IV. PROMPT Professional Investment Strategy and Risk Management

PROMPT Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: Investors with medium to long-term horizons seeking exposure to AI agent technology infrastructure

- Operational Recommendations:

- Accumulate PROMPT during market downturns to average your cost basis, given the token's current 91.80% yearly decline

- Set a multi-year investment timeline of 3-5 years to capture potential value appreciation as AI agent infrastructure matures

- Establish a fixed allocation amount (e.g., 2-5% of portfolio) to manage concentration risk

(2) Active Trading Strategy

- Technical Analysis Indicators:

- Moving Average Convergence Divergence (MACD): Use to identify momentum shifts during the token's volatile trading patterns

- Relative Strength Index (RSI): Monitor overbought/oversold conditions given the 9.4% daily volatility

- Wave Trading Key Points:

- Track support levels around the current price of $0.049 and resistance at recent highs near $0.054

- Monitor 24-hour trading volume fluctuations (current volume: $202,682.99) as indicators for breakout potential

PROMPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Active Investors: 3-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Execute regular purchases at fixed intervals to reduce timing risk and smooth entry points across volatile markets

- Position Sizing: Limit individual trade sizes to 1-3% of total portfolio to contain downside exposure

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 wallet for frequent trading and active management

- Cold Storage Option: For long-term holdings, transfer PROMPT to hardware-based solutions after accumulation phases

- Security Considerations: Enable two-factor authentication on all exchange accounts, use hardware security keys, never share private keys, and verify contract addresses before transactions (PROMPT contract: 0x28d38df637db75533bd3f71426f3410a82041544 on ETH)

V. PROMPT Potential Risks and Challenges

PROMPT Market Risks

- Extreme Volatility: PROMPT has declined 91.80% over the past year, with a trading range between $0.0421 and $0.6271, presenting significant drawdown risk for unprepared investors

- Low Trading Volume: Daily volume of approximately $202,682 indicates limited liquidity, potentially resulting in slippage on larger positions

- Market Capitalization Concentration: With only 22.73% of tokens in circulation, the token faces pressure from supply dilution as remaining tokens enter the market

PROMPT Regulatory Risks

- ERC-20 Compliance Uncertainty: As an Ethereum-based token, PROMPT faces evolving regulatory frameworks around tokenized services in different jurisdictions

- AI Agent Regulation: Emerging regulatory scrutiny on AI systems could impact WayFinder's operational status and token utility

- Compliance Timeline Risk: Rapid regulatory changes could necessitate protocol updates or jurisdictional pivots

PROMPT Technical Risks

- Smart Contract Security: As an AI-agent execution platform, smart contract vulnerabilities could lead to operational failures or fund loss

- Multi-Chain Execution Risk: WayFinder's cross-chain trading functionality introduces complexity and potential security exposure across multiple blockchain networks

- Algorithmic Trading Risk: On-chain algorithmic trading execution could generate unexpected slippage or execution failures during volatile market conditions

VI. Conclusions and Action Recommendations

PROMPT Investment Value Assessment

WayFinder (PROMPT) represents an emerging infrastructure play within the AI agents sector, offering exposure to multi-chain smart contract execution. However, the token exhibits extreme volatility and significant year-to-date losses (-91.80%), indicating either severe market correction or fundamental challenges. The current market capitalization of $49 million with 22.73% circulation supply suggests potential upside if the project achieves adoption, but also substantial downside risk. Investors should view PROMPT as a high-risk, speculative allocation rather than a core portfolio holding. Success depends heavily on WayFinder's ability to establish product-market fit and achieve meaningful adoption across blockchain ecosystems.

PROMPT Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio) through dollar-cost averaging on Gate.com; focus on understanding WayFinder's technology before expanding exposure

✅ Experienced Investors: Consider 3-5% allocation with active rebalancing; combine long-term core holdings with tactical trading around support/resistance levels; implement stop-loss orders at 15-20% below entry prices

✅ Institutional Investors: Conduct comprehensive due diligence on WayFinder's AI agent architecture and cross-chain security; establish positions gradually; consider hedging with correlated assets or protective options strategies

PROMPT Trading Participation Methods

- Gate.com Spot Trading: Direct purchase of PROMPT tokens with major trading pairs; ideal for long-term holders seeking steady accumulation

- Limit Orders: Set buy orders at key support levels ($0.045-$0.048) to optimize entry points during market weakness

- Portfolio Rebalancing: Periodically adjust PROMPT allocation based on overall crypto exposure and risk tolerance changes

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is prompt coin a good investment?

Prompt coin shows strong growth potential with increasing transaction volume and community adoption. Market analysis suggests positive momentum, making it an attractive opportunity for investors seeking exposure to emerging blockchain projects with solid fundamentals.

What is prompt crypto price prediction?

PROMPT price prediction is a market forecast analyzing Wayfinder token's future value based on current trends. As of December 2025, PROMPT is projected to trade between $0.03606 and $0.05187 in the coming year, reflecting anticipated market movements.

What factors influence PROMPT token price movements?

PROMPT token price is influenced by market demand and supply, trading volume, macroeconomic factors like interest rates and inflation, technology sector performance, and overall crypto market sentiment.

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

why is crypto crashing and will it recover ?

2025 TAO Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Crypto Ecosystem

2025 FET Price Prediction: Bullish Trends and Key Factors Driving Fetch.ai's Future Value

Is Bittensor (TAO) a good investment?: Analyzing the potential and risks of this AI-powered cryptocurrency

2025 HOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Halving Crypto Landscape

2025 NBLU Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 JUV Price Prediction: Expert Analysis and Market Outlook for Juventus Fan Token

Anoma: A Blockchain Protocol Innovating Web3 Development

Is Bella Protocol (BEL) a good investment? A Comprehensive Analysis of Risk, Potential Returns, and Market Positioning in 2024

Is DeAgentAI (AIA) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Position in the AI Agent Sector