2025 REQPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Request Network

Introduction: REQ's Market Position and Investment Value

Request (REQ) has established itself as a decentralized network for payment requests and financial auditing since its inception in 2017. As of 2025, Request's market capitalization has reached $91,317,086, with a circulating supply of approximately 744,291,192 tokens, and a price hovering around $0.12269. This asset, often referred to as the "PayPal of cryptocurrencies," is playing an increasingly crucial role in enterprise-level payment and financial auditing based on blockchain technology.

This article will comprehensively analyze Request's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. REQ Price History Review and Current Market Status

REQ Historical Price Evolution

- 2018: All-time high reached, price peaked at $1.059

- 2020: Market downturn, price dropped to an all-time low of $0.00454707

- 2025: Market recovery, price currently at $0.12269

REQ Current Market Situation

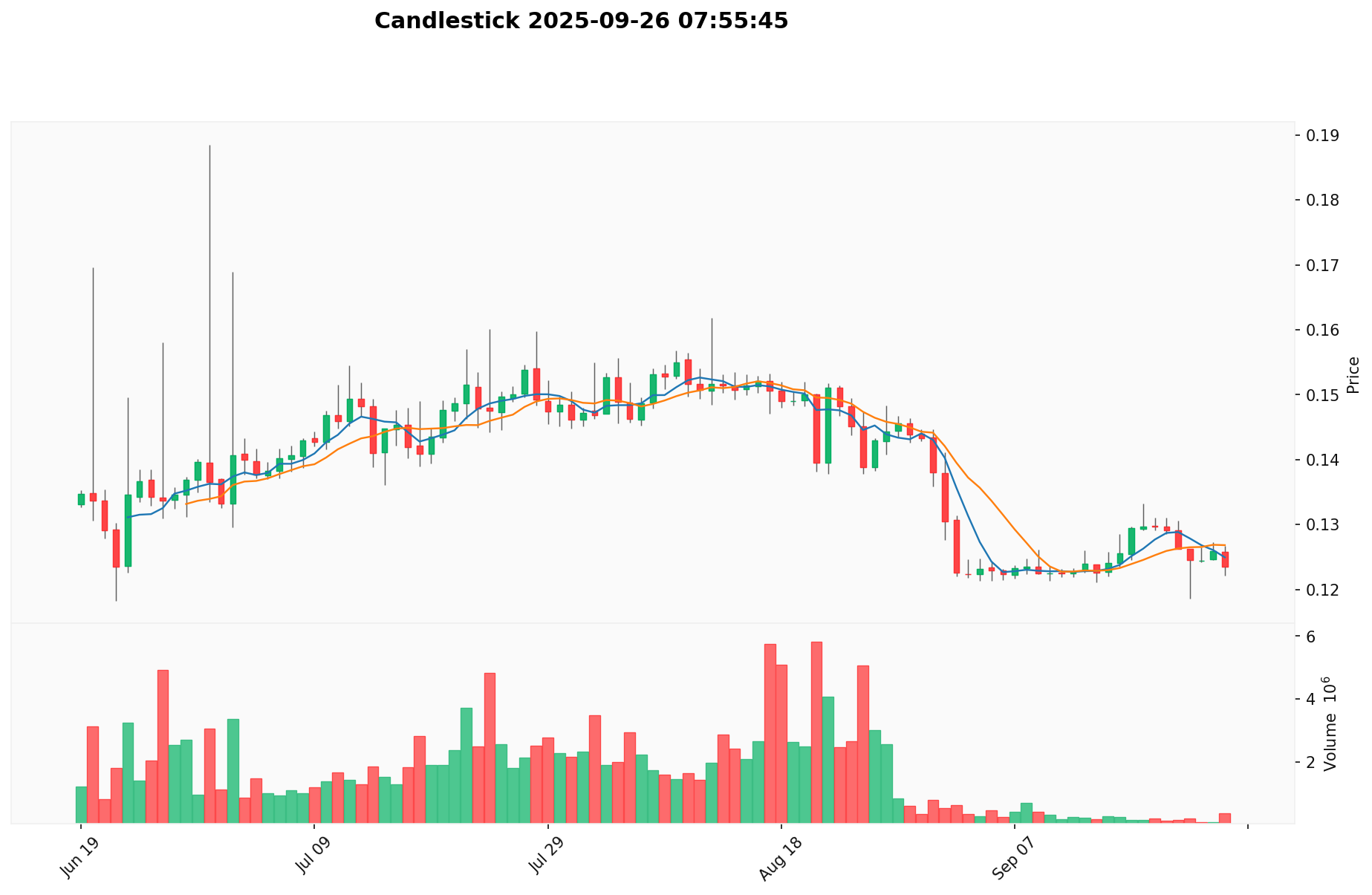

As of September 26, 2025, REQ is trading at $0.12269. The token has experienced a 2.2% decrease in the last 24 hours, with a trading volume of $48,384.43. REQ's market capitalization stands at $91,317,086, ranking it 466th in the global cryptocurrency market.

Over the past week, REQ has seen a 5.43% decline, while the 30-day performance shows a more significant drop of 13.62%. However, looking at the yearly performance, REQ has made a 16.12% gain, indicating long-term growth despite short-term volatility.

The current circulating supply of REQ is 744,291,192 tokens, which represents 74.43% of the total supply of 999,418,201 tokens. The fully diluted market cap is estimated at $122,690,000.

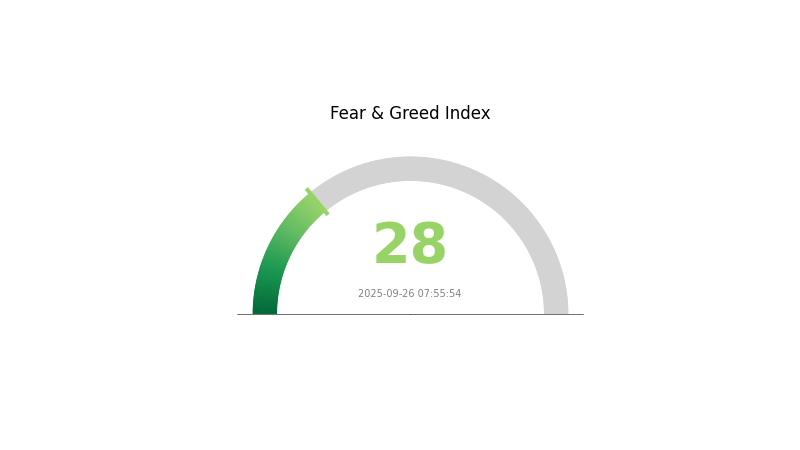

The market sentiment for cryptocurrencies is currently in the "Fear" zone, with a VIX index of 28, suggesting a cautious approach from investors in the broader crypto market.

Click to view the current REQ market price

REQ Market Sentiment Indicator

2025-09-26 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index registering at 28. This indicates a cautious sentiment among investors, potentially creating buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Traders should conduct thorough research and consider their risk tolerance before making any investment decisions. As always, diversification and a long-term perspective are key strategies in navigating volatile crypto markets.

REQ Holdings Distribution

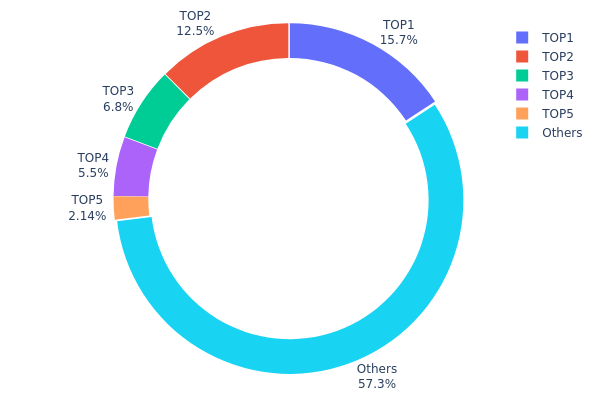

The address holdings distribution data for REQ reveals significant concentration among top holders. The top address controls 15.74% of the total supply, while the top five addresses collectively hold 42.65% of REQ tokens. This level of concentration indicates a relatively centralized ownership structure, which could potentially impact market dynamics.

Such concentration of holdings may lead to increased volatility in REQ's price movements. Large holders, often referred to as "whales," have the capacity to influence market trends through significant buy or sell orders. However, it's worth noting that 57.35% of REQ tokens are distributed among numerous smaller holders, which provides some level of decentralization and market stability.

This distribution pattern suggests that while REQ has a core group of major stakeholders, there is still a substantial portion of tokens circulating among a broader user base. This balance between large holders and wider distribution is crucial for the token's long-term stability and adoption potential, though it also underscores the need for vigilance regarding potential market manipulation risks.

Click to view the current REQ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0632...30962e | 157325.67K | 15.74% |

| 2 | 0x4919...8bfc15 | 124809.03K | 12.48% |

| 3 | 0xf977...41acec | 68000.00K | 6.80% |

| 4 | 0xda5d...71ee25 | 55000.00K | 5.50% |

| 5 | 0x5a52...70efcb | 21366.20K | 2.13% |

| - | Others | 572917.30K | 57.35% |

II. Key Factors Affecting REQ's Future Price

Supply Mechanism

- Fixed Supply: REQ has a relatively fixed supply, which limits inflation and potentially supports price stability.

- Current Impact: With a fixed supply, future price changes will primarily be driven by demand fluctuations rather than supply increases.

Institutional and Whale Dynamics

- National Policies: Regulatory policies in different countries directly impact REQ's price. Strict cryptocurrency regulations may lead to market uncertainty and price volatility.

Macroeconomic Environment

- Geopolitical Factors: International political situations can influence the broader cryptocurrency market, including REQ.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development of DApps and ecosystem projects on the REQ network could drive adoption and potentially influence price.

III. REQ Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.08711 - $0.12269

- Neutral forecast: $0.12269 - $0.15091

- Optimistic forecast: $0.15091 - $0.17913 (requires positive market sentiment)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range prediction:

- 2026: $0.13733 - $0.21127

- 2027: $0.17023 - $0.22817

- Key catalysts: Increased adoption of REQ in decentralized finance applications

2030 Long-term Outlook

- Base scenario: $0.24454 - $0.30322 (assuming steady market growth)

- Optimistic scenario: $0.30322 - $0.35174 (assuming strong market performance)

- Transformative scenario: $0.35174 - $0.36191 (assuming breakthrough in REQ technology and widespread adoption)

- 2030-12-31: REQ $0.30322 (147% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.17913 | 0.12269 | 0.08711 | 0 |

| 2026 | 0.21127 | 0.15091 | 0.13733 | 23 |

| 2027 | 0.22817 | 0.18109 | 0.17023 | 47 |

| 2028 | 0.28444 | 0.20463 | 0.12483 | 66 |

| 2029 | 0.36191 | 0.24454 | 0.18585 | 99 |

| 2030 | 0.35174 | 0.30322 | 0.1789 | 147 |

IV. Professional Investment Strategies and Risk Management for REQ

REQ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate REQ during market dips

- Set price targets and regularly review portfolio

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to Request Network

- Set stop-loss orders to limit potential losses

REQ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Use of stablecoins: Convert a portion of REQ to stablecoins during high volatility periods

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for REQ

REQ Market Risks

- High volatility: REQ price can experience significant fluctuations

- Limited liquidity: May affect ability to execute large trades quickly

- Competition: Other blockchain payment solutions could impact REQ's market share

REQ Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on cryptocurrencies

- Cross-border payment regulations: Changes could affect REQ's use case

- Tax implications: Evolving tax laws may impact REQ transactions and holdings

REQ Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Ethereum network congestion could affect REQ's performance

- Technological obsolescence: Rapid advancements in blockchain technology may require frequent updates

VI. Conclusion and Action Recommendations

REQ Investment Value Assessment

REQ offers long-term potential in the blockchain-based payment and invoicing sector but faces short-term volatility and regulatory uncertainties. Its success depends on wider adoption and technological developments.

REQ Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence and consider REQ as part of a diversified crypto portfolio

REQ Trading Participation Methods

- Spot trading: Buy and sell REQ on Gate.com

- Dollar-cost averaging: Set up regular, small purchases to mitigate price volatility

- Staking: Participate in staking programs if available to earn additional rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for GRT 2025?

Based on current projections, GRT's price in 2025 is expected to reach a maximum of $2.11, with a minimum of $1.34.

What is the top crypto price prediction in 2025?

Bitcoin (BTC) is predicted to reach $100,000, while Ethereum (ETH) is expected to hit $5,000 by 2025. These are speculative forecasts for top cryptocurrencies.

What is the price prediction for XRP in 2030?

XRP could reach between $4.67 and $26.97 in 2030, depending on institutional adoption, regulatory developments, and Ripple's expansion in cross-border payments.

What is the XRP price prediction in 2025?

XRP price in 2025 is expected to reach between $3.30 and $3.50, with current support at $2.84. Market trends remain cautiously optimistic.

2025 AMP Price Prediction: Strategic Analysis and Market Outlook for Cryptocurrency Investors

2025 WPAY Price Prediction: Analyzing Future Growth Potential and Market Trends for the Digital Payment Token

2025 UTKPrice Prediction: Analyzing Growth Potential and Market Trends for UTRUST Token in the Evolving Digital Payment Ecosystem

P vs XLM: A Comprehensive Analysis of Investment Performance in Emerging Markets

UNA vs XLM: Comparing Two Innovative Blockchain Protocols for Cross-Border Transactions

MOVE vs XLM: Comparing Two Innovative Blockchain Programming Languages

DRIFT vs ZIL: Which Layer-1 Blockchain Offers Better Performance and Scalability?

USELESS vs TRX: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Crypto Market

What is ORBR: A Comprehensive Guide to Optimizing Real-time Business Response Systems

What is WAVES: A Comprehensive Guide to Understanding Wave Technology and Its Applications in Modern Society

What is USELESS: A Comprehensive Guide to Understanding Things That Serve No Purpose in Modern Life