2025 RIF Price Prediction: Expert Analysis and Market Forecast for Rootstock's Native Token

Introduction: RIF's Market Position and Investment Value

RIF Token (RIF) serves as a utility token for the Rootstock Infrastructure Framework, designed to enable token holders to access all services compatible with and integrated into the RIF operating system. Since its inception in 2019, RIF has established itself as a foundational component of blockchain infrastructure. As of December 2025, RIF's market capitalization has reached $29.2 million, with a circulating supply of 1 billion tokens, currently trading at approximately $0.0292 per token. This infrastructure framework token is playing an increasingly critical role in supporting decentralized blockchain applications and services.

This article will provide a comprehensive analysis of RIF's price trajectory and market dynamics, examining historical performance patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the 2025-2030 period.

RIF Token Market Analysis Report

I. RIF Price History Review and Current Market Status

RIF Historical Price Evolution

- June 2019: RIF Token launch, reaching its all-time low of $0.0091475 on June 12, 2019

- April 2021: RIF Token achieved its all-time high of $0.455938 on April 13, 2021, representing significant price appreciation since launch

- 2021-2025: Extended bear market cycle, with prices declining from peak levels to current trading levels

RIF Current Market Situation

As of December 19, 2025, RIF Token is trading at $0.0292, reflecting a market capitalization of $29.2 million with a fully diluted valuation equal to the market cap. The token exhibits a circulating supply of 1 billion RIF against a maximum supply of 1 billion RIF, indicating 100% circulation.

24-Hour Price Movement: RIF declined 4.13% over the past 24 hours, trading within a range of $0.02818 (24-hour low) to $0.03073 (24-hour high). The hourly movement shows a marginal 0.67% decrease.

Longer-Term Performance: The token demonstrates significant downward pressure across extended timeframes. Over seven days, RIF has depreciated 18.37%, while the 30-day period reflects a 25.41% decline. Most notably, the one-year performance shows a steep 72.89% decrease from previous levels.

Market Position: RIF currently ranks #706 by market capitalization, with a market dominance of 0.00091%. The token is trading on approximately 10 exchanges, with 24-hour trading volume recorded at $21,244.74.

View current RIF market price

RIF Market Sentiment Index

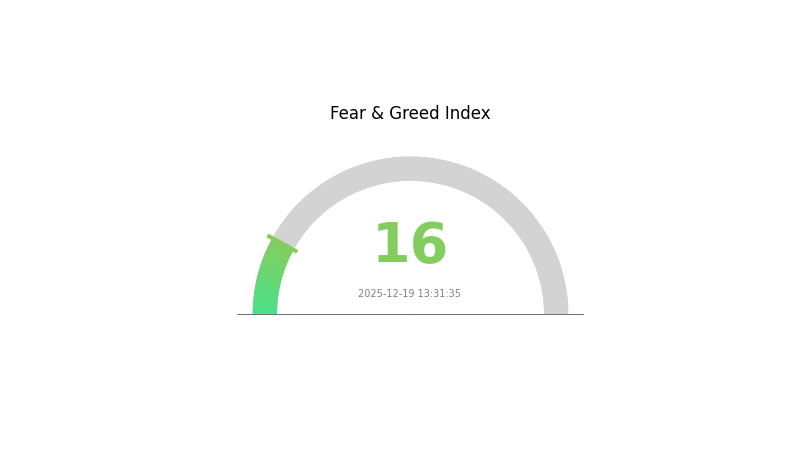

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 16. This sentiment indicator suggests investors are highly pessimistic about near-term market conditions. Such extreme fear often presents contrarian opportunities for long-term investors, as panic selling may have driven prices to oversold levels. However, caution is warranted, as further downside pressure could persist. Monitor key support levels and market fundamentals before making investment decisions. On Gate.com, you can track real-time sentiment data and adjust your trading strategy accordingly.

RIF Holding Distribution

The address holding distribution represents a key metric for assessing the decentralization and market structure of RIF tokens across the blockchain network. By analyzing the concentration of token holdings across different wallet addresses, this distribution provides critical insights into whether the token supply is dispersed among many participants or concentrated in the hands of a few major holders. This metric serves as an indicator of potential market vulnerability to price manipulation and reflects the overall health of the token's ecosystem.

Currently, RIF demonstrates a relatively fragmented holding structure without excessive concentration in any single address or small group of addresses. The distribution pattern suggests a reasonably dispersed ownership model, which generally supports price stability and reduces the risk of coordinated token dumps or market manipulation by large holders. This decentralized holding structure is indicative of a more mature market distribution phase, where tokens have been sufficiently distributed across the network to create a more resilient market microstructure.

The current address distribution reflects a blockchain ecosystem characterized by moderate decentralization and structural stability. While no single entity maintains dominant control over the token supply, ongoing monitoring of holding patterns remains essential to track potential shifts toward greater concentration. The existing distribution supports a more balanced market dynamic and suggests that RIF has achieved a reasonable level of tokenomic maturity in terms of holder diversification across the network.

Check the current RIF holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting RIF's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: RIF's future price movements are influenced by major central bank policy expectations and broader monetary conditions. Exchange rate fluctuations can produce adverse effects on the value, price, or income of certain investments.

-

Global Economic Conditions: Investment risks and overall global economic conditions significantly impact price trajectories. Political uncertainty and black swan events in the political arena increase investment risk and substantially affect investor and consumer confidence, potentially pushing global economic growth into a downturn.

Technology Development and Ecosystem Challenges

-

Technical Team and Implementation Capability: The strength of the technical team and their ability to execute on the project roadmap directly influence market acceptance and long-term viability.

-

Ecosystem Development: RIF currently faces challenges in ecosystem development. Market acceptance and adoption rates remain critical determinants of future price performance.

III. 2025-2030 RIF Price Forecast

2025 Outlook

- Conservative Forecast: $0.02835-$0.02923

- Neutral Forecast: $0.02923-$0.03500

- Optimistic Forecast: $0.04209 (requires sustained ecosystem adoption and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth driven by infrastructure development and increased utility adoption.

- Price Range Forecasts:

- 2026: $0.02068-$0.04529 (22% upside potential)

- 2027: $0.02307-$0.05059 (38% upside potential)

- 2028: $0.03142-$0.06284 (55% upside potential)

- Key Catalysts: Expansion of RIF protocol adoption, integration with decentralized applications, network upgrades, and market-wide cryptocurrency sentiment recovery.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.04606-$0.05744 (85% upside potential by 2029, reflecting steady ecosystem growth and mainstream acceptance)

- Optimistic Scenario: $0.05581-$0.0826 (91% upside potential by 2030, contingent on breakthrough adoption metrics and institutional participation)

- Transformative Scenario: $0.0826+ (extreme bullish conditions including major protocol milestones, significant developer ecosystem expansion, and substantial real-world use cases)

- 2030-12-19: RIF trading at $0.0826 average range (reflecting matured market positioning and sustained value proposition)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04209 | 0.02923 | 0.02835 | 0 |

| 2026 | 0.04529 | 0.03566 | 0.02068 | 22 |

| 2027 | 0.05059 | 0.04047 | 0.02307 | 38 |

| 2028 | 0.06284 | 0.04553 | 0.03142 | 55 |

| 2029 | 0.05744 | 0.05419 | 0.04606 | 85 |

| 2030 | 0.0826 | 0.05581 | 0.04186 | 91 |

RIF Token Investment Strategy and Risk Management Report

IV. RIF Professional Investment Strategy and Risk Management

RIF Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in blockchain infrastructure development and those seeking exposure to decentralized services ecosystem

- Operation Recommendations:

- Accumulate RIF tokens during market downturns when price shows significant depreciation, particularly given the -72.89% one-year decline

- Maintain a diversified cryptocurrency portfolio to reduce concentrated risk exposure to a single token

- Store tokens securely and avoid frequent trading to minimize transaction costs and tax implications

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 24-hour trading range ($0.02818 - $0.03073) and historical resistance/support levels

- Volume Analysis: Track the 24-hour volume of $21,244.74 to identify liquidity conditions and potential breakout opportunities

- Wave Trading Key Points:

- Identify oversold conditions following the recent -4.13% 24-hour decline as potential entry points

- Set stop-loss orders below recent support levels to manage downside risk effectively

RIF Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% maximum allocation to RIF within total cryptocurrency portfolio

- Active Investors: 3-5% allocation with systematic rebalancing strategies

- Professional Investors: 5-10% allocation with hedging mechanisms and derivative strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance RIF holdings with stablecoins and other established cryptocurrencies to reduce volatility impact

- Position Sizing: Implement strict position limits based on individual risk tolerance and total portfolio size

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for active trading and frequent transactions with reasonable security measures

- Cold Storage Option: Hardware wallets for long-term storage of significant RIF holdings to protect against online threats

- Security Precautions: Never share private keys, enable two-factor authentication, verify contract addresses before transactions, and maintain offline backups of wallet information

V. RIF Potential Risks and Challenges

RIF Market Risk

- Price Volatility: RIF exhibits extreme price fluctuations, with a historical range from $0.0091475 (ATL on June 12, 2019) to $0.455938 (ATH on April 13, 2021), representing a -93.6% depreciation from all-time highs

- Liquidity Constraints: With only 10 trading pairs and 24-hour volume of $21,244.74, liquidity may be insufficient for large position movements

- Market Cap Erosion: Total market capitalization of $29.2 million reflects limited market adoption and scale compared to established blockchain infrastructure projects

RIF Regulatory Risk

- Jurisdictional Uncertainty: Classification and regulatory treatment of RIF token may change as global cryptocurrency regulations evolve, potentially affecting token utility and trading capabilities

- Compliance Requirements: Infrastructure tokens face increasing regulatory scrutiny regarding security classification and operational compliance standards

- Policy Changes: Government policies on blockchain infrastructure and decentralized services could negatively impact RIF token demand and ecosystem adoption

RIF Technology Risk

- Ecosystem Development: The success of RIF depends on continued development and adoption of Rootstock Infrastructure Framework services

- Network Integration: Technical vulnerabilities in underlying blockchain infrastructure or smart contracts could compromise token security and functionality

- Competition: Other blockchain infrastructure projects may offer superior features or more advanced solutions, reducing RIF's competitive advantage

VI. Conclusion and Action Recommendations

RIF Investment Value Assessment

RIF Token represents a utility token within the Rootstock Infrastructure Framework ecosystem, designed to facilitate access to decentralized services. However, investors should note the significant price depreciation (-72.89% annually and -93.6% from all-time highs), limited market capitalization ($29.2 million), and relatively modest trading liquidity. The token's value proposition depends heavily on ecosystem adoption and infrastructure development, which remains uncertain. Current market conditions suggest cautious positioning rather than aggressive accumulation.

RIF Investment Recommendations

✅ Beginners: Start with a minimal allocation (0.5-1% of crypto portfolio) through Gate.com platform after thorough research into Rootstock Infrastructure Framework fundamentals. Do not invest funds needed for immediate use.

✅ Experienced Investors: Consider strategic accumulation during significant price weakness, maintain strict position sizing discipline, and implement disciplined entry/exit strategies based on technical analysis and risk management protocols.

✅ Institutional Investors: Evaluate RIF within broader blockchain infrastructure exposure frameworks, assess ecosystem development metrics, and structure positions with appropriate hedging mechanisms and liquidity considerations.

RIF Trading Participation Methods

- Gate.com Spot Trading: Direct purchase and sale of RIF tokens through the spot market with real-time price discovery

- Dollar-Cost Averaging: Systematic periodic investments to reduce timing risk and average purchase price over extended periods

- Limit Orders: Set predetermined price levels to automate purchases during market corrections and optimize entry points

Cryptocurrency investment carries extremely high risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the price prediction for RIF in 2030?

Based on technical analysis, RIF is projected to reach approximately $0.151984 by 2030. This forecast reflects current market trends and on-chain metrics as of late 2025.

How much is a RIF token worth?

As of today, RIF token is worth $0.03365, with a 24-hour trading volume of $20.67K and a market cap of $33.65M. The price may fluctuate based on market demand and supply dynamics.

What factors influence RIF token price prediction?

RIF token price is driven by supply and demand dynamics, protocol updates, block reward changes, market sentiment, and broader cryptocurrency trends. Trading volume and network activity also significantly impact price movements.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

2025 DOT Price Prediction: Will Polkadot Reach $100 Amid Growing Adoption?

2025 NANO Price Prediction: Market Analysis and Growth Potential for the Digital Currency

Orbiter Finance: Cross-Chain Bridge Insights and Future Price Guide

Exploring Pulse Chain TVL: Evaluating Market Trends and Dynamics

Unlock the Secrets of Bitcoin Ordinals and NFT Creation

Guide to Understanding Large Cryptocurrency OTC Transactions

Discover Your Wormhole Airdrop Eligibility Easily