2025 RITE Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

Introduction: RITE's Market Position and Investment Value

Ritestream (RITE), as an ecosystem platform for creating, monetizing, and consuming movie and TV content in Web3, has made significant strides since its inception in 2022. As of 2025, RITE's market capitalization has reached $739,788, with a circulating supply of approximately 806,220,859 tokens, and a price hovering around $0.0009176. This asset, often referred to as the "Web3 content creation enabler," is playing an increasingly crucial role in democratizing the creator economy and generating income for creators and communities through NFTs in the metaverse.

This article will comprehensively analyze RITE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. RITE Price History Review and Current Market Status

RITE Historical Price Evolution

- 2024: All-time high of $0.081853 on January 30, followed by a sharp decline

- 2024: All-time low of $0.00016697 on January 12, marking extreme volatility

- 2025: Continued downtrend, price stabilized around $0.0009176

RITE Current Market Situation

RITE is currently trading at $0.0009176, with a 24-hour trading volume of $9,307.38. The token has experienced a slight increase of 0.57% in the last 24 hours but shows significant losses over longer periods: -16.5% in the past week and -24.92% over the last month. The market capitalization stands at $739,788.26, ranking RITE at 2890th position in the global cryptocurrency market. With a circulating supply of 806,220,859.24 RITE tokens out of a maximum supply of 1,000,000,000, the project has a circulating ratio of 80.62%. The fully diluted valuation is $917,600.00, indicating potential for future growth if market conditions improve.

Click to view the current RITE market price

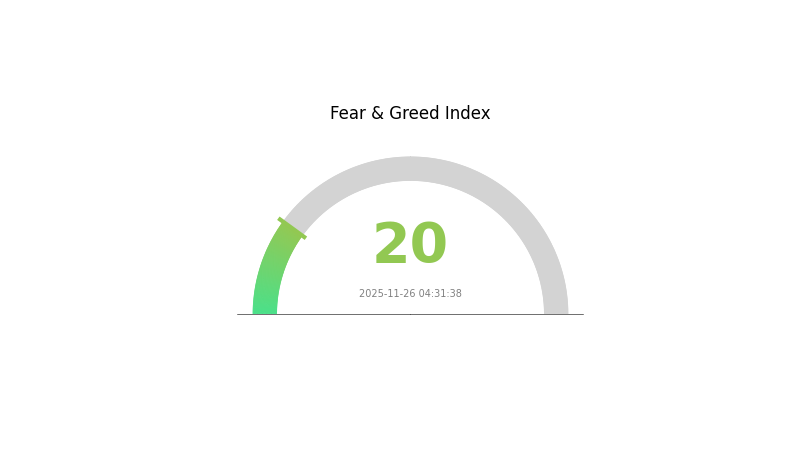

RITE Market Sentiment Indicator

2025-11-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting a low of 20. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. For those considering entering the market, Gate.com offers a secure platform with a wide range of trading options. Always practice responsible investing and never risk more than you can afford to lose.

RITE Holdings Distribution

The address holdings distribution chart provides insights into the concentration of RITE tokens among different addresses. Based on the data, the top 5 addresses hold a combined 28.48% of the total RITE supply, with the largest holder possessing 11.10%. This indicates a moderate level of concentration, as no single address controls an overwhelming portion of the tokens.

The distribution pattern suggests a relatively balanced market structure, with 71.52% of tokens held by addresses outside the top 5. This diversification can contribute to market stability and reduced vulnerability to large-scale manipulations. However, the presence of a few significant holders (particularly the top two with 11.10% and 6.50%) could still influence price movements if they decide to make substantial trades.

Overall, the current RITE token distribution reflects a moderate degree of decentralization. While there are some prominent holders, the majority of tokens are spread across numerous addresses, potentially indicating a healthy ecosystem with active participation from various stakeholders. This structure may help maintain a more resilient on-chain environment and support long-term market stability.

Click to view the current RITE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x387d...4af45b | 111028.39K | 11.10% |

| 2 | 0x2e8f...725e64 | 65028.55K | 6.50% |

| 3 | 0x0d07...b492fe | 37597.01K | 3.75% |

| 4 | 0x5f93...1cabfd | 35852.85K | 3.58% |

| 5 | 0xa9f1...f3cb3c | 35542.27K | 3.55% |

| - | Others | 714950.93K | 71.52% |

II. Key Factors Affecting RITE's Future Price

Supply Mechanism

- Fixed Supply: RITE has a fixed maximum supply, which can potentially create scarcity as demand increases.

- Historical Pattern: Limited supply typically leads to price appreciation if demand grows over time.

- Current Impact: The fixed supply may contribute to price stability and potential long-term value increase.

Macroeconomic Environment

- Hedge Against Inflation: Cryptocurrencies like RITE may be viewed as a potential hedge against inflation in uncertain economic times.

Technical Development and Ecosystem Building

- Ecosystem Applications: RITE is likely used within its native blockchain ecosystem, potentially including DApps and other blockchain-based services.

III. RITE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00054 - $0.00092

- Neutral prediction: $0.00092 - $0.00110

- Optimistic prediction: $0.00110 - $0.00126 (requires positive market sentiment and project developments)

2026-2027 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2026: $0.00090 - $0.00116

- 2027: $0.00065 - $0.00155

- Key catalysts: Project milestones, market trends, and overall crypto adoption

2028-2030 Long-term Outlook

- Base scenario: $0.00134 - $0.00161 (assuming steady market growth)

- Optimistic scenario: $0.00161 - $0.00207 (with favorable market conditions and project success)

- Transformative scenario: $0.00207+ (with exceptional project achievements and widespread adoption)

- 2030-11-26: RITE $0.00161 (75% increase from 2025, reflecting long-term growth potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00126 | 0.00092 | 0.00054 | 0 |

| 2026 | 0.00116 | 0.00109 | 0.0009 | 18 |

| 2027 | 0.00155 | 0.00113 | 0.00065 | 22 |

| 2028 | 0.00177 | 0.00134 | 0.00082 | 45 |

| 2029 | 0.00166 | 0.00155 | 0.00081 | 69 |

| 2030 | 0.00207 | 0.00161 | 0.00117 | 75 |

IV. Professional Investment Strategies and Risk Management for RITE

RITE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operation suggestions:

- Accumulate RITE tokens during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor 50-day and 200-day MAs for trend identification

- RSI: Use overbought/oversold levels for potential entry/exit points

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor project developments and market sentiment closely

RITE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: Up to 10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official project wallet (if available)

- Security precautions: Enable 2FA, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for RITE

RITE Market Risks

- High volatility: Significant price fluctuations common in small-cap tokens

- Low liquidity: Limited trading volume may lead to slippage

- Market sentiment: Susceptible to broader crypto market trends

RITE Regulatory Risks

- Uncertain regulations: Potential for new laws affecting NFTs and Web3 projects

- Cross-border compliance: Challenges in adhering to various international regulations

- Tax implications: Evolving tax treatment of crypto assets and NFTs

RITE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability issues: Challenges in handling increased user adoption

- Interoperability: Potential difficulties integrating with other blockchain networks

VI. Conclusion and Action Recommendations

RITE Investment Value Assessment

RITE presents a high-risk, high-potential opportunity in the Web3 content creation space. Long-term value hinges on ecosystem growth and adoption, while short-term risks include market volatility and regulatory uncertainties.

RITE Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio; focus on learning about the project ✅ Experienced investors: Consider a moderate position with a long-term outlook; actively monitor project developments ✅ Institutional investors: Conduct thorough due diligence; potentially engage with the project team for deeper insights

RITE Participation Methods

- Token purchase: Buy RITE tokens on Gate.com

- Ecosystem participation: Engage with the platform as a content creator or consumer

- Community involvement: Join official social media channels for updates and discussions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

Pudgy Penguins (PENGU) Price Forecast for February 2024

How to earn $300 in one hour

2025 RARE Price Prediction: Analysis of Growth Potential and Market Factors Impacting Token Value

2025 VSN Price Prediction: Navigating the Future of Digital Assets in a Volatile Crypto Market

2025 RARI Price Prediction: Analyzing Growth Potential and Market Dynamics for Rarible's Native Token

2025 TNSRPrice Prediction: Analyzing Market Trends and Key Factors Influencing Future Valuation

APR Meaning in Crypto Explained: How Annual Percentage Rate Really Works

# What Are the Security Risks and Smart Contract Vulnerabilities in CARV Token?

What is CARV coin and how does its gaming and AI data layer protocol work?

What are the major security risks and smart contract vulnerabilities in AVAX Avalanche network?

How to Analyze On-Chain Data: Active Addresses, Whale Movements, and Transaction Trends on Avalanche