2025 SCOR Price Prediction: Expert Analysis and Market Outlook for SCOR Stock in the Coming Year

Introduction: SCOR's Market Position and Investment Value

SCOR (SCOR) is a Web3 infrastructure network that connects professional sports intellectual property, fans, and developers in a verified on-chain environment. Developed by Sweet, the official Web3 partner of the NHL and MLS, SCOR has established itself as a pioneering platform in the sports tokenization sector. As of December 23, 2025, SCOR's market capitalization stands at approximately $6.40 million, with a circulating supply of 688 million tokens trading at $0.0093 per coin. This innovative digital asset, recognized as a transformative force in the "fan economy," is playing an increasingly critical role in enabling sports organizations to tokenize their intellectual property and distribute value directly to fans through smart contracts.

This article provides a comprehensive analysis of SCOR's price trends from 2025 through 2030, integrating historical price patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for market participants. Through trading on platforms like Gate.com, investors can explore exposure to this emerging sports-focused Web3 infrastructure.

I. SCOR Price History Review and Current Market Status

SCOR Current Market Conditions

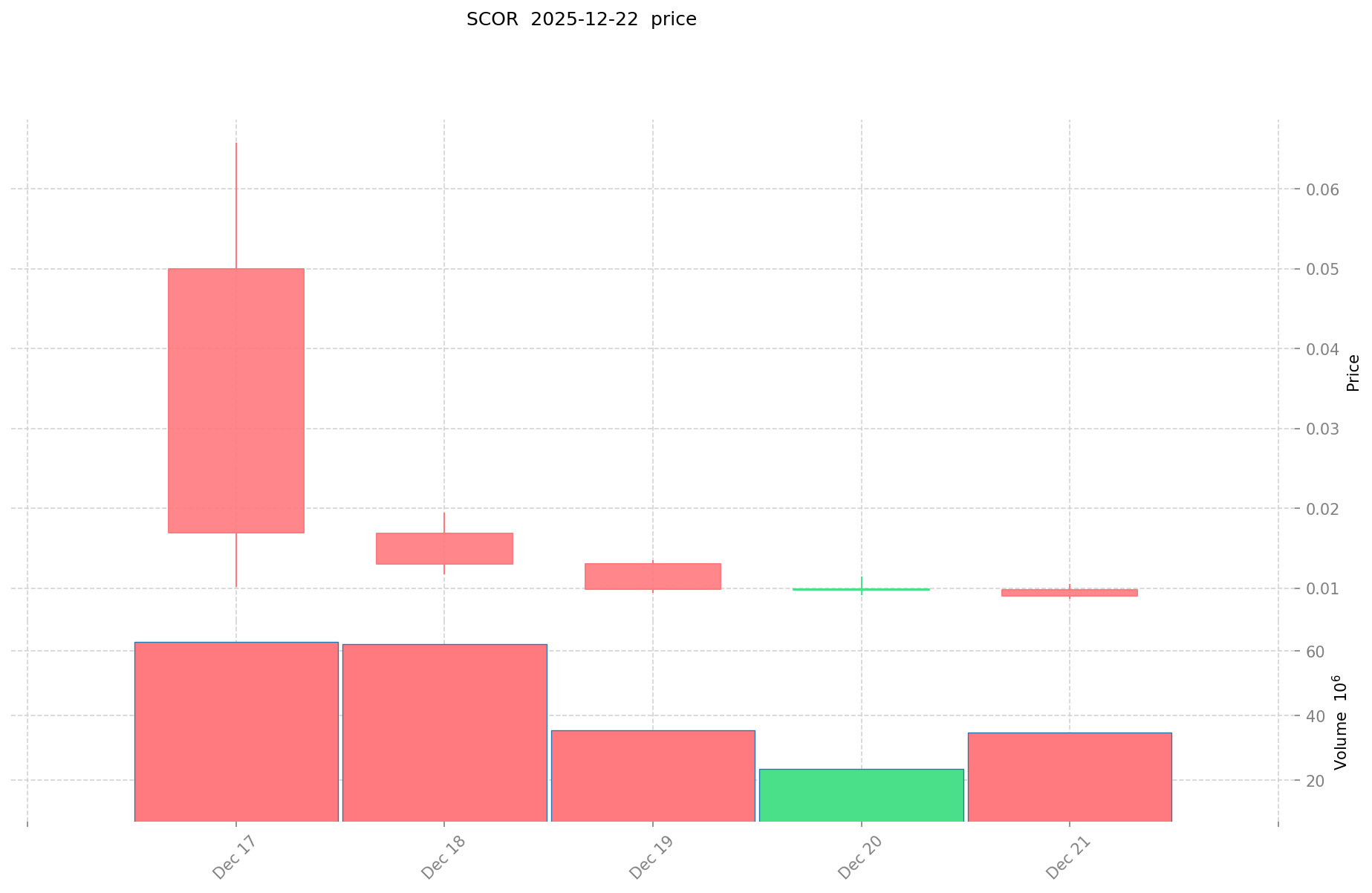

As of December 23, 2025, SCOR is trading at $0.0093, reflecting a 24-hour increase of 5.27%. The token has demonstrated volatility within a 24-hour range of $0.0088 to $0.010055.

SCOR reached its all-time high of $0.0658 on December 17, 2025, followed by a decline to its recent low of $0.0087 on December 21, 2025. This significant price correction within a five-day period highlights the token's market sensitivity and trading dynamics during its early trading phase.

The token maintains a market capitalization of approximately $6.40 million with a fully diluted valuation of $37.2 million. Currently, 688 million SCOR tokens are in circulation out of a total supply of 4 billion tokens, representing a circulation ratio of 17.2%. The token ranks 1,399 on the broader cryptocurrency market by market capitalization, with a market dominance of 0.0011%.

Trading activity shows a 24-hour volume of approximately $345,571, indicating moderate liquidity levels during the early trading period. The token is currently supported on the BASE blockchain network and is available for trading on Gate.com.

View current SCOR market price

SCOR Market Sentiment Indicator

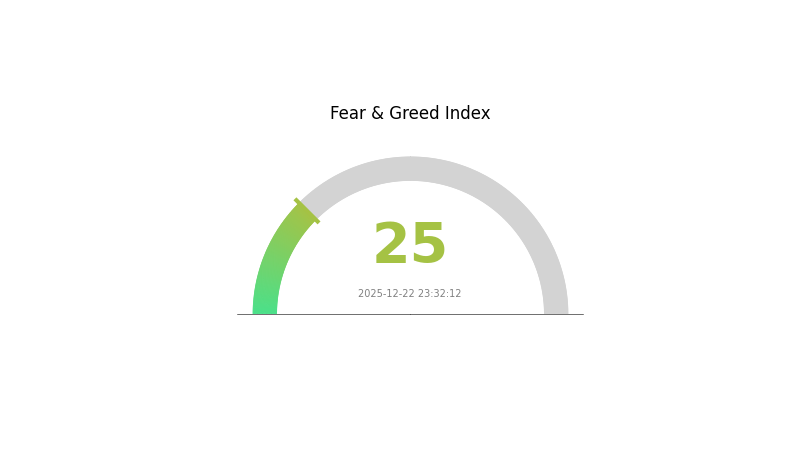

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index dropping to 25. This indicates significant market pessimism and heightened investor anxiety. During such periods, market volatility typically increases as uncertainty dominates trading sentiment. Investors should exercise caution and avoid emotional decision-making. Consider this opportunity to reassess your portfolio strategy on Gate.com and dollar-cost average into quality assets rather than panic selling. Remember that extreme fear often precedes market recoveries, so maintaining a long-term perspective is crucial during volatile periods.

SCOR Holdings Distribution

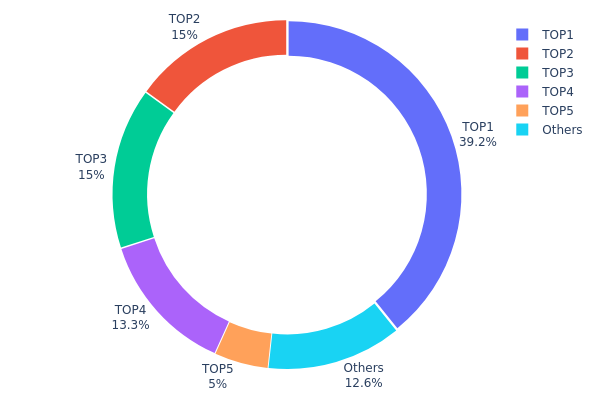

The address holdings distribution chart illustrates the concentration of SCOR tokens across on-chain addresses, revealing the degree of decentralization and the distribution pattern of token ownership. This metric is fundamental for assessing market structure maturity and identifying potential risks associated with token concentration among major holders.

SCOR's current holdings distribution demonstrates a pronounced concentration pattern, with the top five addresses collectively controlling 87.41% of the total token supply. Most notably, the leading address (0xc97a...9802c4) holds 39.16% of all SCOR tokens, representing a significant concentration of voting power and liquidity control within a single entity. The second and third largest holders each maintain 15% of the token supply, while the fourth holder controls 13.25%. This hierarchical distribution indicates that decision-making power and price influence are heavily concentrated among a limited number of addresses, which may represent institutional stakeholders, project treasuries, or early investors. The remaining 12.59% distributed across other addresses highlights that retail participation and broader decentralization remain limited.

The existing concentration structure presents notable implications for market dynamics and stability. With such substantial holdings concentrated in the top addresses, the potential for coordinated actions, whether through large sell-offs or strategic accumulation, remains elevated. The significant gap between top holders and the dispersed minority suggests that market price movements may be substantially influenced by the decisions of a few key players. This structure, while common during early project stages, indicates that SCOR's on-chain ecosystem still exhibits characteristics of centralized control rather than achieving true decentralized distribution. Further diversification and broader token dispersion among community participants would be essential indicators of improved market resilience and reduced manipulation risk.

Click to view current SCOR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc97a...9802c4 | 1566597.92K | 39.16% |

| 2 | 0xd53e...0f59d1 | 600000.00K | 15.00% |

| 3 | 0x7bc5...8a999a | 600000.00K | 15.00% |

| 4 | 0x5df1...052b0c | 530000.00K | 13.25% |

| 5 | 0x33e3...143b3e | 200000.00K | 5.00% |

| - | Others | 503402.08K | 12.59% |

II. Core Factors Affecting SCOR's Future Price

Ecosystem Development and Adoption

- Sports Web3 Infrastructure: SCOR serves as an authorized sports interaction core infrastructure, with over 2,000 professional athletes, teams, and leagues having joined the platform, validating its position in the sports Web3 ecosystem.

Market Sentiment and Supply-Demand Dynamics

-

Market Sentiment: Investor emotions and confidence directly impact SCOR price movements. Positive news regarding widespread SCOR adoption can drive price increases, while negative sentiment can lead to declines.

-

Supply-Demand Relationship: SCOR price fluctuations are influenced by market supply and demand dynamics. As an emerging sports Web3 infrastructure project, its price may experience volatility based on market conditions and investor activity.

-

Overall Market Trends: SCOR's price trajectory is significantly affected by broader cryptocurrency market trends and the general sentiment in the digital asset space.

Technology and Regulatory Factors

-

Technical Development: The underlying technology of the SCOR project influences its price stability and growth potential. Technical improvements or issues can lead to substantial price volatility.

-

Regulatory Environment: Legal and regulatory developments have a significant impact on SCOR's price movements. Changes in cryptocurrency regulations or compliance requirements can cause sharp price fluctuations, with potential for both substantial increases and decreases.

III. 2025-2030 SCOR Price Forecast

2025 Outlook

- Conservative Forecast: $0.00539 - $0.00929

- Neutral Forecast: $0.00929

- Optimistic Forecast: $0.01236 (requires positive market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with consolidation and incremental growth as market conditions stabilize

- Price Range Predictions:

- 2026: $0.00898 - $0.01342 (16% upside potential)

- 2027: $0.01079 - $0.01721 (30% upside potential)

- 2028: $0.01349 - $0.01584 (57% upside potential)

- Key Catalysts: Sustained ecosystem development, institutional adoption acceleration, and improved market liquidity through platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case: $0.01706 - $0.02008 (assuming steady protocol improvements and mainstream integration)

- Optimistic Scenario: $0.02029 with sustained momentum (assumes accelerated user adoption and strategic partnerships)

- Transformation Scenario: Potential breakthrough valuation (assumes revolutionary use cases emergence and significant market capitalization expansion)

- December 23, 2025: SCOR trading within projected 2025 range ($0.00539-$0.01236) as baseline reference point established

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01236 | 0.00929 | 0.00539 | 0 |

| 2026 | 0.01342 | 0.01082 | 0.00898 | 16 |

| 2027 | 0.01721 | 0.01212 | 0.01079 | 30 |

| 2028 | 0.01584 | 0.01467 | 0.01349 | 57 |

| 2029 | 0.02029 | 0.01525 | 0.0093 | 64 |

| 2030 | 0.02008 | 0.01777 | 0.01706 | 91 |

SCOR Investment Strategy and Risk Management Report

Four. SCOR Professional Investment Strategy and Risk Management

SCOR Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Long-term believers in Web3 sports infrastructure, institutional investors, and those with high risk tolerance seeking exposure to the sports tokenization sector

- Operational Recommendations:

- Accumulate SCOR tokens during market dips below $0.009, taking advantage of volatility to build positions at lower valuations

- Hold positions through market cycles, recognizing that Web3 sports infrastructure is in early adoption phases with significant growth potential

- Maintain positions through the development of SCOR's ecosystem integrations with major leagues and teams

(2) Active Trading Strategy

- Technical Analysis Indicators:

- Support and Resistance Levels: Monitor key levels at $0.0087 (recent low) and $0.0658 (all-time high) to identify potential reversal points

- Volume Analysis: Track the 24-hour volume of approximately $345,571 to gauge market interest and confirm breakout movements

- Wave Trading Key Points:

- Enter positions during 24-hour gains of 5%+ but consider profit-taking after 10-15% gains given current market volatility

- Monitor the circulating supply ratio (17.2% of total supply) to understand potential dilution risks during future token releases

SCOR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-8% of portfolio allocation

- Professional Investors: 8-15% of portfolio allocation (with hedging strategies in place)

(2) Risk Hedging Solutions

- Stablecoin Reserve Strategy: Maintain 30-50% of allocated capital in stablecoins to execute opportunistic purchases during market downturns

- Dollar-Cost Averaging (DCA): Implement systematic monthly purchases to reduce timing risk and smooth entry costs over extended periods

(3) Secure Storage Solutions

- Self-Custody Approach: Use Gate Web3 Wallet for non-custodial storage of SCOR tokens, enabling direct control and security of assets

- Exchange Holdings: Maintain trading portions on Gate.com for active trading strategies while keeping long-term positions in self-custody solutions

- Security Precautions: Enable multi-factor authentication, maintain backup recovery phrases in secure offline locations, and never share private keys or seed phrases with any third parties

Five. SCOR Potential Risks and Challenges

SCOR Market Risk

- Early-Stage Valuation Uncertainty: With a market cap of only $6.4 million and limited trading volume, SCOR faces significant price volatility and liquidity constraints that could result in substantial losses for investors

- Competitive Pressure: The Web3 sports infrastructure sector may attract competitors with larger funding or faster execution timelines, potentially diminishing SCOR's market share and token value

- Adoption Dependency: SCOR's success relies entirely on continued adoption by major sports leagues, teams, and athletes; any reduction in strategic partnerships could severely impact token utility and demand

SCOR Regulatory Risk

- Sports Industry Regulation: As sports organizations increasingly participate in Web3 initiatives, regulatory bodies may impose stricter compliance requirements for tokenized sports IP, potentially limiting SCOR's operational scope

- Cryptocurrency Classification: Regulatory changes regarding token classification could impact SCOR's legal status and operational framework across different jurisdictions

- Tax Compliance Challenges: Tokenized sports IP and fan economy mechanisms may face evolving tax treatments that could affect investor returns and token holder economics

SCOR Technology Risk

- Smart Contract Vulnerabilities: As a Web3 infrastructure network, SCOR relies on smart contract security; any exploits or vulnerabilities could result in significant financial losses and reputational damage

- Scalability Limitations: Current blockchain infrastructure may face scalability challenges during periods of high adoption, potentially limiting SCOR's ability to serve its growing user base

- Integration Complexity: Successfully integrating with multiple sports organizations and blockchain ecosystems requires sophisticated technical infrastructure; integration failures could delay ecosystem development

Six. Conclusions and Action Recommendations

SCOR Investment Value Assessment

SCOR presents a compelling but high-risk opportunity in the emerging Web3 sports infrastructure sector. The project benefits from strong backing by major sports organizations (NHL, MLS, MSG) and experienced investment partners, alongside a team with elite technical credentials. However, the token remains in early stages with limited liquidity, a market cap of only $6.4 million, and unproven long-term adoption metrics. The "fan economy" model represents an innovative approach to sports IP monetization, but its viability depends on sustained league and athlete participation. Investors should view SCOR as a speculative, early-stage opportunity rather than a stable investment vehicle.

SCOR Investment Recommendations

✅ Beginners: Start with minimal positions (1% of crypto allocation) through Gate.com, focus on understanding the sports tokenization narrative before increasing exposure, and use this allocation to learn about Web3 sports applications

✅ Experienced Investors: Consider 3-5% allocations with active DCA strategies, employ technical analysis to optimize entry points around support levels, and maintain tight stop-loss discipline given volatility

✅ Institutional Investors: Conduct thorough due diligence on SCOR's partnership pipeline and technical architecture, consider 5-15% allocations as part of diversified Web3 infrastructure exposure, and engage directly with the SCOR Foundation regarding ecosystem development roadmaps

SCOR Trading Participation Methods

- Exchange Trading: Purchase SCOR directly on Gate.com where the token is actively traded, providing instant liquidity and competitive pricing for position entry and exit

- Smart Contract Interaction: Engage with SCOR's protocol directly through verified contracts on BASE blockchain (contract address: 0xd67ec255100ef200a439d09ff865fbaa2ad9c730) for advanced users seeking protocol participation

- Community Participation: Join SCOR's Discord community and follow official Twitter channels (@SCORProtocol) to stay informed about ecosystem developments, partnership announcements, and governance opportunities

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and should consult professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

What is the SCOR stock price prediction for 2025?

SCOR is predicted to average $6.4457 in 2025, ranging from $4.6232 to $8.2681 based on market analysis and technical indicators.

Is SCOR a good investment opportunity based on current market analysis?

SCOR demonstrates solid growth potential with 8.5% revenue growth and 10.2% profit growth in 2024. However, its 95.0% combined ratio warrants careful consideration. Current market analysis shows mixed signals, indicating potential opportunity for strategic investors seeking long-term exposure.

What factors influence SCOR price movements and future performance?

SCOR price movements are driven by market sentiment, trading volume, regulatory developments, and macroeconomic conditions. Supply and demand dynamics, institutional adoption, and technological advancements also significantly impact its future performance trajectory.

What is XAN: The Revolutionary Blockchain Protocol Transforming Digital Finance

What is XAN: The Emerging Synthetic Cannabinoid Causing Concern Among Health Experts

What is ARK: A Comprehensive Guide to the Autonomous Reality Kit and Its Revolutionary Impact on Digital Innovation

What is LYX: A Comprehensive Guide to the Document Preparation System

What is MBL: A Comprehensive Guide to Model-Based Learning in Modern Education

Innovative Blockchain Solutions with Vertus Platform

zkPass Decentralized Zero Knowledge Verification Era

Novastro Cross Chain Real Asset Infrastructure

Blockchain Developers Architects Of Decentralized Future

Orochi Verifiable Data Privacy Infrastructure

Current XRP Price Outlook (August 10)