2025 SLERF Price Prediction: Expert Analysis and Market Forecast for Solana's Leading Meme Token

Introduction: Market Position and Investment Value of SLERF

Slerf (SLERF) is a meme coin on the Solana blockchain that features a character modeled after the animal sloth. Since its launch in March 2024, SLERF has become part of the vibrant ecosystem of community-driven digital assets. As of December 2025, SLERF maintains a market capitalization of approximately $6,058,000, with a circulating supply of 1 billion tokens and a current price hovering around $0.006058.

This community-focused token is gaining recognition within the Solana blockchain ecosystem and the broader meme coin market segment. As an SPL-20 token, SLERF operates on one of the fastest and most cost-efficient blockchain networks available.

This article will provide a comprehensive analysis of SLERF's price trajectory and market dynamics, incorporating historical performance data, market sentiment analysis, and liquidity metrics available on major trading platforms including Gate.com. Through detailed examination of price trends across multiple timeframes—from hourly to yearly performance—this analysis aims to equip investors with evidence-based insights for informed decision-making regarding SLERF as part of their digital asset portfolio.

Slerf (SLERF) Market Analysis Report

I. SLERF Price History Review and Current Market Status

SLERF Historical Price Trajectory

Based on available data, Slerf has experienced significant volatility since its launch in March 2024:

- March 2024: SLERF launched on the Solana blockchain as a meme coin, reaching its all-time high of $1.4877 on March 19, 2024.

- December 2025: The token declined to an all-time low of $0.005477 on December 15, 2025, representing a decline of approximately 96.28% from its peak.

SLERF Current Market Status

As of December 23, 2025, SLERF is trading at $0.006058, with a 24-hour trading volume of $14,679.07. The token's market capitalization stands at $6,058,000, with a fully diluted valuation of $6,058,000, indicating that all 1,000,000,000 tokens are currently in circulation.

Price Performance Metrics:

- 1-Hour Change: -0.16%

- 24-Hour Change: -0.72%

- 7-Day Change: -10.43%

- 30-Day Change: -20.34%

- 1-Year Change: -96.28%

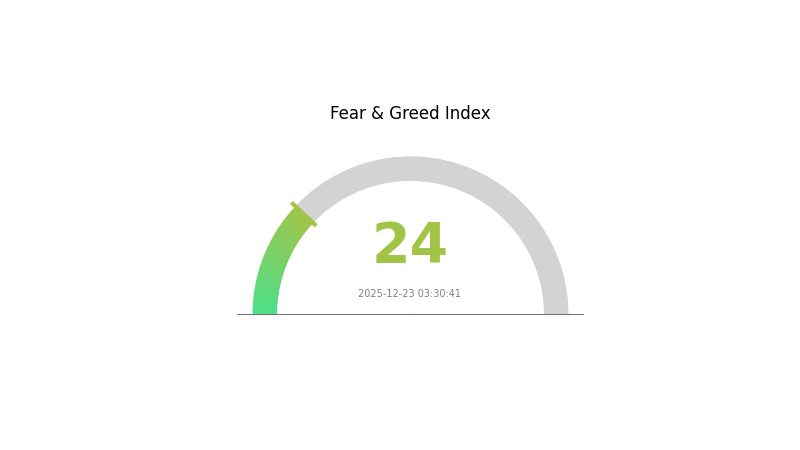

The token's 24-hour trading range was between $0.006054 and $0.00611. SLERF maintains a market dominance of 0.00018%, with listings on 4 exchanges. The current market sentiment indicators show extreme fear conditions (VIX: 24).

Click to view current SLERF market price

SLERF 市场情绪指标

2025-12-23 恐惧与贪婪指数:24(Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates severe investor anxiety and risk aversion in the market. When the index reaches such low levels, it often signals potential buying opportunities for contrarian investors, as extreme fear can precede market recovery. However, caution is advised, as further downside is possible. Investors should monitor market developments closely and consider their risk tolerance carefully. On Gate.com, you can track real-time market sentiment and make informed trading decisions based on comprehensive market data analysis.

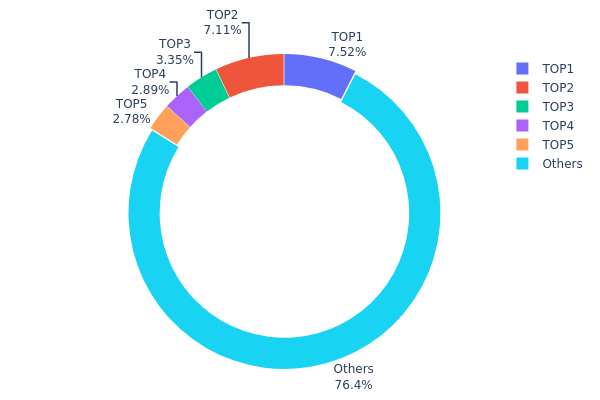

SLERF Address Distribution Analysis

Address distribution analysis provides critical insights into token concentration patterns by examining how holdings are dispersed across the blockchain network. This metric reveals the degree of decentralization within a project's token ecosystem and serves as a key indicator for assessing potential market manipulation risks and price stability.

The current SLERF distribution data demonstrates a relatively moderate concentration profile. The top five addresses collectively control approximately 23.63% of total tokens, with the largest holder maintaining 7.51% and the second-largest at 7.11%. This positioning suggests that while significant holdings exist among individual addresses, no single entity possesses overwhelming dominance over the token supply. The remaining 76.37% distributed across other addresses indicates a fairly dispersed ownership structure, which is characteristic of tokens with broader community participation and institutional adoption.

From a market dynamics perspective, this distribution pattern presents a balanced risk profile. The absence of extreme concentration among the top holders reduces the likelihood of catastrophic price manipulation through coordinated large sell-offs. However, the presence of multiple addresses each holding 2-7% of supply suggests that selective large transactions from top holders could still exert meaningful influence on spot pricing and market sentiment. The relatively high percentage of tokens in "other" addresses indicates strong decentralization tendencies, implying that SLERF maintains a structurally stable on-chain foundation with reduced counterparty concentration risk.

Click to view current SLERF Address Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 75171.06K | 7.51% |

| 2 | HLnpSz...aiTLcC | 71125.76K | 7.11% |

| 3 | 2Qb6i9...r1Ljep | 33453.89K | 3.34% |

| 4 | 6BSBS7...PDisJw | 28903.26K | 2.89% |

| 5 | CuVFLK...u5kuB7 | 27835.79K | 2.78% |

| - | Others | 763509.63K | 76.37% |

II. Core Factors Affecting SLERF's Future Price

Supply Mechanism

-

Supply-Driven Price Movement: SLERF's price trajectory is primarily driven by supply and demand dynamics. Historical price movements demonstrate this pattern, with the token experiencing a dramatic increase from an initial price of $0.02 to $1.2 at peak, representing approximately 60x growth driven by market demand and FOMO effects.

-

Current Market Impact: The token's long-term holding value is influenced by market size and demand variations. As meme market liquidity continues to evolve, SLERF remains subject to these supply-demand fluctuations that characterize the meme token sector.

Macro Economic Environment

-

Bitcoin and Mainstream Asset Correlation: SLERF demonstrates strong correlation with Bitcoin's performance. The token shows enhanced growth during Bitcoin recovery periods, indicating that mainstream cryptocurrency strength directly impacts meme token valuations on the Solana ecosystem.

-

Meme Market Liquidity Injection: The fourth quarter of 2024 witnessed significant liquidity injection into the meme market following favorable U.S. policy trends and Bitcoin's strong price action approaching $100,000. This environment created unprecedented trading activity for meme coins, with total meme market capitalization reaching $1.371 trillion on December 9, 2024, subsequently stabilizing at approximately $965 billion by late December. SLERF benefited from this market expansion through increased trading volume and exposure.

Market Sentiment and Community Dynamics

-

Community Engagement and Volatility: SLERF has experienced intense price volatility attracting substantial retail capital and community attention. Despite experiencing sharp price corrections, the project maintains community engagement through founder activities and community events, which helps sustain long-term interest despite short-term price fluctuations.

-

Real-World Event Sensitivity: SLERF's price remains vulnerable to regulatory developments, adoption announcements, and broader cryptocurrency market events. The token's trajectory can be significantly influenced by policy changes, institutional adoption trends, and exchange-related incidents.

III. 2025-2030 SLERF Price Forecast

2025 Outlook

- Conservative Forecast: $0.00461-$0.00607

- Neutral Forecast: $0.00607

- Optimistic Forecast: $0.00899 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with increasing adoption metrics and community expansion

- Price Range Predictions:

- 2026: $0.00467-$0.00926 (24% upside potential)

- 2027: $0.00588-$0.00999 (38% upside potential)

- Key Catalysts: Enhanced tokenomics implementation, strategic partnerships, increased trading volume on major platforms like Gate.com, and broader market recovery trends

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00763-$0.01195 by 2028 (51% upside), progressing to $0.00834-$0.01398 by 2030 (102% upside); assumes steady ecosystem development and moderate market growth

- Optimistic Scenario: $0.01395-$0.01398 by 2029-2030 (74-102% upside); assumes accelerated adoption, significant protocol upgrades, and favorable macroeconomic conditions

- Transformative Scenario: Extended upside potential above $0.01398; contingent on breakthrough utility achievements, mainstream institutional adoption, and exceptional market cycles

Note: All price forecasts are subject to market volatility, regulatory changes, and broader cryptocurrency market conditions. Analysis based on historical data patterns and projected growth trajectories. Investors should conduct independent research before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00899 | 0.00607 | 0.00461 | 0 |

| 2026 | 0.00926 | 0.00753 | 0.00467 | 24 |

| 2027 | 0.00999 | 0.00839 | 0.00588 | 38 |

| 2028 | 0.01195 | 0.00919 | 0.00763 | 51 |

| 2029 | 0.01395 | 0.01057 | 0.00719 | 74 |

| 2030 | 0.01398 | 0.01226 | 0.00834 | 102 |

SLERF Investment Analysis Report

IV. SLERF Professional Investment Strategy and Risk Management

SLERF Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with extended investment horizons who believe in meme coin community dynamics

- Operational recommendations:

- Dollar-cost averaging (DCA) approach to reduce timing risk during market volatility

- Establish a fixed allocation of portfolio resources and maintain discipline through market cycles

- Monitor community engagement metrics and project developments on official channels

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Identify key price points at $0.006054 (24H low) and previous resistance levels for entry and exit signals

- Volume Analysis: Track the 24-hour trading volume of $14,679 to confirm trend validity and potential breakout scenarios

- Wave operation key points:

- Execute trades during identified resistance breakouts with proper risk management

- Utilize stop-loss orders to protect capital during adverse price movements

SLERF Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0.5% to 1% of portfolio maximum

- Aggressive investors: 1% to 3% of portfolio maximum

- Professional investors: 2% to 5% of portfolio maximum with hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance SLERF holdings with established cryptocurrencies and traditional assets to reduce concentration risk

- Volatility Management: Implement stop-loss orders at 15-20% below entry price to limit downside exposure

(3) Secure Storage Solutions

- Hot Wallet Approach: Gate.com Web3 Wallet for active trading and frequent transactions with convenient access

- Cold Storage Strategy: Transfer majority holdings to hardware wallets for long-term security and reduced hacking risk

- Security precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; verify contract address (9999FVbjHioTcoJpoBiSjpxHW6xEn3witVuXKqBh2RFQ on Solana) before transfers

V. SLERF Potential Risks and Challenges

SLERF Market Risk

- Extreme Volatility: SLERF has declined 96.28% over one year from ATH of $1.4877 to current price of $0.006058, demonstrating severe price instability

- Liquidity Risk: 24-hour trading volume of only $14,679 indicates limited market depth and potential difficulty in executing large orders

- Market Cap Concentration: With a fully diluted market cap of only $6,058,000 and ranking at 1,427, the token faces significant pressure from minor trading activity

SLERF Regulatory Risk

- Meme Coin Classification: Regulatory frameworks globally are increasingly scrutinizing meme coins, potentially leading to exchange delisting or trading restrictions

- Compliance Uncertainty: Evolving cryptocurrency regulations may impact trading availability on platforms like Gate.com

- Jurisdictional Exposure: Different regions have varying stances on meme coin trading, creating uncertainty for international investors

SLERF Technology Risk

- Solana Network Dependency: The token's operations depend entirely on Solana blockchain stability and performance

- Smart Contract Risk: As an SPL-20 token, any vulnerabilities in the contract code could result in token loss or unauthorized transfers

- Blockchain Congestion: Network congestion on Solana could impact transaction execution and trading efficiency

VI. Conclusion and Action Recommendations

SLERF Investment Value Assessment

SLERF represents an extremely high-risk, speculative investment characterized by severe decline from peak valuations and limited fundamental utility. The meme coin's primary value derives from community sentiment rather than technological innovation or practical application. With a market cap of $6.06 million and minimal trading volume, liquidity constraints present substantial challenges. The 96.28% annual decline reflects the inherent volatility and speculative nature of meme coins. Investors should approach SLERF as a purely speculative position with capital they can afford to lose entirely.

SLERF Investment Recommendations

✅ Beginners: Avoid direct investment; if interested, allocate only 0.5% of total portfolio as educational exposure to meme coin dynamics

✅ Experienced Investors: Consider position sizing of 1-2% maximum with strict stop-loss discipline at 15-20% loss threshold and clear exit strategies

✅ Institutional Investors: Not recommended for institutional portfolios due to insufficient liquidity, regulatory uncertainty, and lack of fundamental value proposition

SLERF Trading Participation Methods

- Gate.com Trading Platform: Execute spot trading of SLERF through Gate.com's user-friendly interface with transparent pricing and order execution

- On-chain Swaps: Trade SLERF directly on Solana blockchain using decentralized protocols, though requiring technical knowledge and higher transaction costs

- Community Engagement: Participate in SLERF community discussions via official channels (Website: https://www.slerf.wtf/, Twitter: https://x.com/Slerfsol) to monitor project developments and sentiment shifts

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest capital that you cannot afford to lose completely.

FAQ

Is Slerf a good investment?

SLERF shows strong growth potential based on technical analysis. With increasing adoption and market momentum, it presents attractive opportunities for investors seeking exposure to emerging cryptocurrencies.

What was the highest price Slerf reached?

Slerf reached its highest price of $0.8606 in March 2024. This peak represented a significant milestone in the token's price history during its early trading period.

Is Slerf a meme coin?

Yes, SLERF is a meme coin built on the Solana blockchain, featuring a distinctive sloth mascot. It was designed to bring humor and community engagement to the crypto market while maintaining liquidity and utility within the ecosystem.

What factors influence Slerf's price movements?

Slerf's price is primarily driven by supply and demand dynamics, market sentiment, trading volume, social media activity, ecosystem developments, Bitcoin market trends, and overall crypto market conditions. Community engagement and token utility also play significant roles in price fluctuations.

What are the risks associated with investing in Slerf?

SLERF carries high volatility risk as a cryptocurrency asset. Market fluctuations, regulatory uncertainty, and liquidity challenges can impact prices significantly. Investors should only allocate capital they can afford to lose and avoid excessive leverage to manage risk exposure effectively.

2025 SLERF Price Prediction: Analyzing Market Trends and Future Growth Potential in the Expanding Digital Asset Ecosystem

2025 AURASOL Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHILLGUY Price Prediction: Will This Viral Meme Coin Reach New Highs or Face a Market Correction?

2025 NOBODY Price Prediction: Will the Token Reach New Highs Amid Market Volatility?

2025 FWOG Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 QKA Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

How Does BSU (Baby Shark Universe) Fund Flow and Holdings Concentration Affect Market Volatility in 2025?

BEAM vs UNI: Comparing Two Leading Decentralized Exchange Protocols in the DeFi Ecosystem

What Is On-Chain Data Analysis and How to Monitor Active Addresses, Transaction Volume, and Whale Movements?

BLUAI vs ICP: A Comprehensive Comparison of Two Leading Blockchain Intelligence Platforms

What is XPL (Plasma) and Why Did It Attract $2.5 Billion in Stablecoin Deposits in 24 Hours?