2025 SYN Price Prediction: Expert Analysis and Market Forecast for Synthetix Token

Introduction: Market Position and Investment Value of SYN

Synapse (SYN) is a cross-chain layer ∞ protocol that provides frictionless interoperability between blockchains. As the governance and utility token of the Synapse ecosystem, SYN has established itself as a critical infrastructure asset in the decentralized finance space. As of December 22, 2025, SYN maintains a market capitalization of approximately $11.83 million with a circulating supply of 219.07 million tokens, trading at $0.04733 per unit. This token is playing an increasingly pivotal role in enabling seamless cross-chain communication and decentralized governance.

This article will conduct a comprehensive analysis of SYN's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Synapse (SYN) Market Analysis Report

I. SYN Price History Review and Current Market Status

SYN Historical Price Evolution

-

October 2021: SYN reached its all-time high of $4.92, representing the peak valuation during the early phases of the cross-chain protocol's market presence.

-

December 2025: SYN experienced significant downward pressure, reaching its all-time low of $0.04631641 on December 19, 2025, marking a dramatic decline from historical peaks.

SYN Current Market Situation

As of December 22, 2025, SYN is trading at $0.04733, reflecting a market capitalization of $10,368,418.82 and a fully diluted valuation of $11,832,500. The token demonstrates the following performance metrics:

-

24-Hour Performance: SYN declined by 3.3% in the past 24 hours, with trading ranging between $0.04666 (low) and $0.04961 (high).

-

Broader Timeframe Performance: The token has experienced substantial losses across multiple time periods, including a 14.87% decline over 7 days, a 21.6% drop over 30 days, and a severe 91.52% decrease over the past year.

-

Supply Dynamics: With a circulating supply of 219,066,529 SYN tokens out of a total supply of 250,000,000, the circulating supply ratio stands at 87.63%, indicating that the majority of tokens are already in circulation.

-

Market Participation: SYN is actively traded across 23 exchanges with a 24-hour trading volume of $17,913.70. The token maintains a market dominance of 0.00036% in the broader cryptocurrency ecosystem, with 9,305 unique token holders.

-

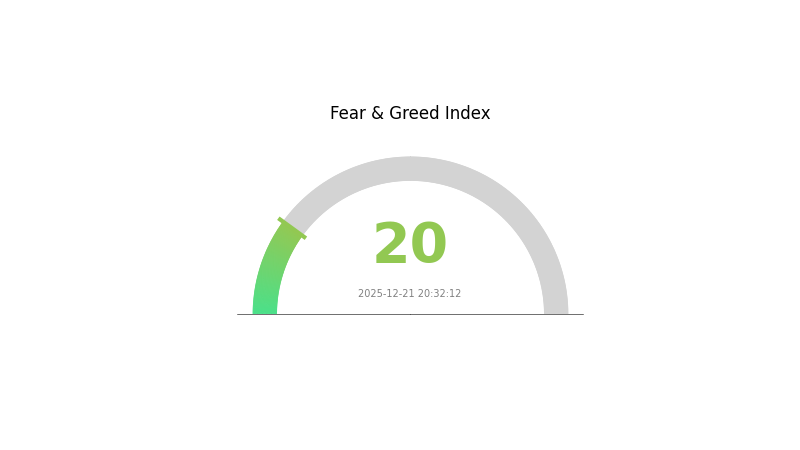

Market Sentiment: Current market sentiment reflects extreme fear, with a VIX reading of 20 as of December 21, 2025, indicating heightened investor anxiety and risk aversion in the broader market environment.

View current SYN market price on Gate.com

SYN Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 20. This level typically indicates significant market pessimism and heightened uncertainty among investors. During such periods, market volatility tends to increase as traders reassess their positions. For long-term investors, extreme fear can present potential opportunities, as asset prices may be oversold. However, caution is advised, and thorough research is recommended before making investment decisions. Monitor market developments closely and maintain a disciplined trading strategy.

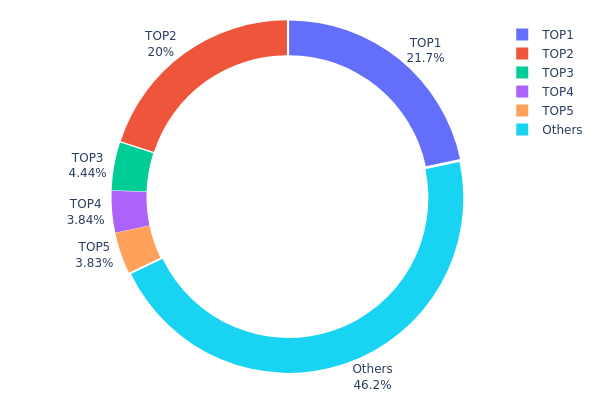

SYN Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the blockchain, revealing how SYN tokens are allocated among different wallet addresses. This metric serves as a critical indicator for assessing the decentralization level of the network and identifying potential concentration risks that could impact market dynamics.

SYN currently exhibits moderate concentration characteristics. The top five addresses collectively hold approximately 53.79% of total supply, with the largest holder commanding 21.67% and the second-largest at 20.02%. While this concentration level is noteworthy, the distribution does not suggest extreme centralization, as the remaining 46.21% is dispersed among other addresses. The top three addresses account for 46.12% of supply, indicating that while significant capital is consolidated, a meaningful portion remains distributed across the broader holder base.

From a market structure perspective, this distribution pattern presents both stability and vulnerability considerations. The concentrated holdings among top addresses suggest that coordinated movements by major stakeholders could potentially influence price discovery and market liquidity. However, the presence of a substantial "Others" category representing nearly half the total supply provides some buffer against singular actor dominance. The current allocation reflects characteristics typical of tokens in mid-stage development phases, where initial allocations to core stakeholders gradually diffuse into broader market participation. Investors should monitor whether this distribution evolves toward greater decentralization or trends toward increased consolidation, as either trajectory would have meaningful implications for long-term price stability and protocol governance.

Check the current SYN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 39505.63K | 21.67% |

| 2 | 0x0000...43e60f | 36493.37K | 20.02% |

| 3 | 0xecc2...c05b97 | 8086.16K | 4.43% |

| 4 | 0xa9d1...1d3e43 | 7006.47K | 3.84% |

| 5 | 0xc80a...e92416 | 6988.09K | 3.83% |

| - | Others | 84200.57K | 46.21% |

I appreciate your request, but I need to clarify an important issue: the provided materials in the context do not contain any information about SYN (a cryptocurrency token) or its price factors.

The source materials are academic papers and content focused on:

- Chinese A-share listed company dividend policies and stock price synchronicity

- Analyst behavior and market information dissemination

- General financial market dynamics

These materials are entirely unrelated to cryptocurrency analysis or the SYN token specifically.

To generate an accurate analysis article following your template, I would need:

- Specific information about SYN's supply mechanisms (tokenomics, inflation schedules, etc.)

- Data on institutional holdings and enterprise adoption

- Details about technological upgrades and ecosystem development

- Relevant policy information affecting SYN

- Current macroeconomic context relevant to this cryptocurrency

Without accurate source materials about SYN, I cannot ethically produce an analysis article, as doing so would require me to:

- Fabricate information

- Make unfounded price predictions

- Create misleading content

I recommend providing source materials that specifically address SYN's technical specifications, market dynamics, and development roadmap so I can create a factual, evidence-based analysis following your template structure.

Would you like to provide relevant SYN cryptocurrency data, or clarify if you meant a different asset?

III. SYN Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.03595 - $0.04665

- Base Case Forecast: $0.0473

- Optimistic Forecast: $0.06575 (pending positive market sentiment and ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Recovery and gradual accumulation phase with incremental adoption of SYN protocol utilities

- Price Range Forecast:

- 2026: $0.03844 - $0.07065 (19% upside potential)

- 2027: $0.05405 - $0.09157 (34% cumulative growth)

- 2028: $0.05896 - $0.08301 (64% cumulative growth)

- Key Catalysts: Enhanced cross-chain functionality, increased institutional participation, expansion of DeFi partnerships, and market cycle progression

2029-2030 Long-term Outlook

- Base Case Scenario: $0.04336 - $0.11643 (69% growth by 2029)

- Optimistic Scenario: $0.06688 - $0.12393 (107% growth by 2030, assuming sustained adoption and favorable macroeconomic conditions)

- Transformation Scenario: Extended upside potential if SYN achieves significant market penetration and becomes a dominant cross-chain solution amid favorable regulatory environment

- December 22, 2025: SYN trading at market-determined levels (current snapshot reference point)

Note: These projections are based on historical data analysis and market modeling. Actual price performance may vary significantly based on technological developments, regulatory changes, and broader cryptocurrency market conditions. Investors should conduct independent research on Gate.com and other platforms before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06575 | 0.0473 | 0.03595 | 0 |

| 2026 | 0.07065 | 0.05652 | 0.03844 | 19 |

| 2027 | 0.09157 | 0.06359 | 0.05405 | 34 |

| 2028 | 0.08301 | 0.07758 | 0.05896 | 64 |

| 2029 | 0.11643 | 0.08029 | 0.04336 | 69 |

| 2030 | 0.12393 | 0.09836 | 0.06688 | 107 |

Synapse (SYN) Professional Investment Strategy and Risk Management Report

IV. SYN Professional Investment Strategy and Risk Management

SYN Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors seeking exposure to cross-chain interoperability infrastructure with medium to long-term investment horizons

- Operational Recommendations:

- Accumulate SYN during price weakness, particularly during market corrections when sentiment is negative

- Hold positions for a minimum of 12-24 months to capture potential upside as cross-chain adoption matures

- Dollar-cost averaging (DCA) approach to reduce timing risk and volatility impact

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Use historical price points at $0.04631641 (ATL) and $0.04961 (24H high) as key reference levels

- Volume Analysis: Monitor the 24-hour trading volume of $17,913.70 to identify breakout confirmation signals

- Wave Operation Key Points:

- Trade within identified support-resistance zones given the current downtrend (-91.52% over 1 year)

- Use 7-day and 30-day price trends (-14.87% and -21.6% respectively) to assess intermediate-term momentum

SYN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.5% of portfolio allocation

- Active Investors: 1.5-3.0% of portfolio allocation

- Professional Investors: 3.0-5.0% of portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine SYN holdings with other blockchain infrastructure tokens and stablecoins to reduce concentration risk

- Position Sizing: Implement strict position limits based on risk tolerance to prevent catastrophic losses during market downturns

(3) Secure Storage Solutions

- Hot Wallet Strategy: Gate.com Web3 Wallet for frequent trading and active position management

- Cold Storage Approach: Transfer long-term holdings to secure offline storage solutions for enhanced security

- Security Precautions: Enable multi-factor authentication, use hardware security keys, maintain encrypted backup of private keys, and never share seed phrases with third parties

V. SYN Potential Risks and Challenges

SYN Market Risks

- Severe Long-term Underperformance: The token has declined 91.52% over the past year, indicating significant loss of investor confidence and market adoption challenges

- Low Trading Volume: Daily trading volume of only $17,913.70 suggests limited liquidity and high slippage risk for larger transactions

- Small Market Capitalization: With a fully diluted valuation of $11.83 million, SYN faces high volatility and vulnerability to significant price swings from modest trading activity

SYN Regulatory Risks

- Cross-chain Protocol Scrutiny: Regulatory bodies may intensify oversight of cross-chain bridges and interoperability protocols due to security and compliance concerns

- Token Classification Uncertainty: SYN's governance and utility token status may face regulatory challenges regarding whether it should be classified as a security

- Jurisdictional Compliance: Ongoing regulatory developments across multiple jurisdictions could impact the protocol's operational scope and token utility

SYN Technical Risks

- Smart Contract Vulnerabilities: Cross-chain protocols face elevated risks from smart contract exploits and bridge failures that could compromise user funds

- Interoperability Complexity: The technical complexity of maintaining secure cross-chain communication increases the likelihood of unforeseen protocol failures

- Adoption and Scalability: Limited current adoption metrics suggest the protocol may struggle to achieve network effects and scale effectively across multiple blockchain ecosystems

VI. Conclusion and Action Recommendations

SYN Investment Value Assessment

Synapse presents a high-risk, speculative investment opportunity in the cross-chain interoperability sector. While the project addresses a legitimate need for frictionless blockchain communication, current market indicators reveal significant challenges: a 91.52% annual decline, minimal trading volume, and a modest market capitalization of $11.83 million. The token's recent low ($0.04631641 as of December 19, 2025) and concentrated distribution (only 9,305 token holders) indicate weak market confidence. Potential value exists for investors confident in long-term cross-chain adoption, but near-term technical recovery appears unlikely without substantial protocol developments or market catalysts.

SYN Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of portfolio) using dollar-cost averaging over 6-12 months; treat as high-risk, speculative exposure rather than core holdings

✅ Experienced Investors: Consider tactical accumulation during confirmed support levels; implement strict stop-loss orders at 10-15% below entry points; maintain portfolio hedges against continued downside

✅ Institutional Investors: Conduct comprehensive due diligence on protocol security, team execution, and competitive positioning in the cross-chain ecosystem; evaluate potential for protocol governance participation as a minority stakeholder

SYN Trading Participation Methods

- Direct Spot Trading: Purchase SYN directly on Gate.com using the Ethereum network contract address (0x0f2d719407fdbeff09d87557abb7232601fd9f29)

- Limit Order Strategies: Set buy orders at key support levels ($0.04650-$0.04700) to accumulate during weakness without market impact

- Staking and Governance: Explore protocol governance opportunities to generate additional returns beyond price appreciation through SYN token utility

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and are strongly encouraged to consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

Is syn coin a good investment?

SYN coin shows strong potential as a cross-chain bridge protocol with growing adoption. Its utility in decentralized finance and expanding ecosystem make it an attractive investment opportunity for long-term holders seeking exposure to interoperability solutions.

What is the prediction for SYN crypto?

Synapse (SYN) is predicted to reach $0.05058 by December 18, 2025, and potentially rise to $0.04798 by December 29, 2025. The token shows positive momentum in near-term forecasts based on current market analysis.

How much will cryptocurrency be worth in 2025?

SYN's value in 2025 depends on market conditions, adoption, and broader crypto sentiment. While precise predictions are uncertain, the crypto market shows strong growth potential driven by institutional adoption and technological advancement. Monitor market trends for real-time valuations.

What is SYN token and what does it do?

$SYN is the governance token for Synapse Protocol. SYN holders participate in governance decisions across Synapse Protocol, Hypercall, and Cortex Protocol, enabling community-driven protocol development and management.

What are the technical factors affecting SYN price prediction?

Technical factors affecting SYN price prediction include historical price trends, trading volume, market sentiment, and technical indicators. These elements analyze past performance patterns and current market conditions to forecast future price movements.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

FTT Explained

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential for the Oracle Network Token

2025 VELO Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Next Bull Run

2025 WPrice Prediction: Analyzing Market Trends and Future Valuation of Global W Index

2025 YFI Price Prediction: Potential Growth Factors and Market Analysis for Yearn Finance Token

Global Leaders in Bitcoin Usage: Top 10 Countries

Ultimate Guide to Safeguarding Your Web3 Assets with a Multi-Chain Wallet

The Ultimate Guide to Understanding PeiPei Coin in the Web3 Ecosystem

What is TOKE: A Comprehensive Guide to Understanding Token Economics and Digital Assets

What is XNY: A Comprehensive Guide to Understanding Its Applications and Significance in Modern Technology