2025 TOWNS Price Prediction: Expert Analysis and Market Forecast for the Next Year

Introduction: TOWNS Market Position and Investment Value

TOWNS (TOWNS) is a decentralized real-time messaging protocol built on an EVM-compatible L2 with smart contracts on Base, powering ownable, revenue-generating "Spaces" through on-chain memberships, encrypted messaging, and programmable reputation mechanisms. As of December 21, 2025, TOWNS has achieved a fully diluted valuation of $55.38 million, with a circulating supply of approximately 2.11 billion tokens trading at $0.005468 per token. This innovative protocol, distinguished by its sustainable fee-burning mechanism that directs membership and transaction fees toward ETH buy-and-burns while rewarding node operators through a closed-loop incentive system, is playing an increasingly vital role in the decentralized communication infrastructure landscape.

This article will provide a comprehensive analysis of TOWNS price trends through 2030, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging protocol.

TOWNS Market Analysis Report

I. TOWNS Price History Review and Current Market Status

TOWNS Historical Price Development

TOWNS was launched on December 5, 2025, establishing its entry into the crypto market. The token has experienced significant volatility since its inception:

- August 5, 2025: All-time high (ATH) of $0.06597, representing the peak valuation during the initial market enthusiasm phase

- October 10, 2025: All-time low (ATL) of $0.00198, marking the lowest point in the token's trading history

- December 21, 2025: Currently trading at $0.005468, reflecting a substantial decline from its ATH

The price trajectory demonstrates a notable downtrend, with the token losing 82.68% of its value over the past year since its launch.

TOWNS Current Market Status

As of December 21, 2025, TOWNS exhibits the following market characteristics:

Price Performance:

- Current Price: $0.005468

- 24-Hour Change: -3.96%

- 7-Day Change: -25.49%

- 30-Day Change: -30.86%

- 1-Year Change: -82.68%

Market Capitalization & Supply:

- Market Cap: $11,533,995.89

- Fully Diluted Valuation (FDV): $55,380,873.88

- Circulating Supply: 2,109,362,819 TOWNS (20.83% of total supply)

- Total Supply: 10,128,177,374 TOWNS

- Maximum Supply: 15,327,827,980 TOWNS

Trading Activity:

- 24-Hour Trading Volume: $164,323.93

- Listed on 30 exchanges globally

- Active holder count: 50,531 addresses

Price Range (24-Hour):

- High: $0.005886

- Low: $0.005442

Market Position:

- Market Cap Ranking: 1106

- Market Dominance: 0.0017%

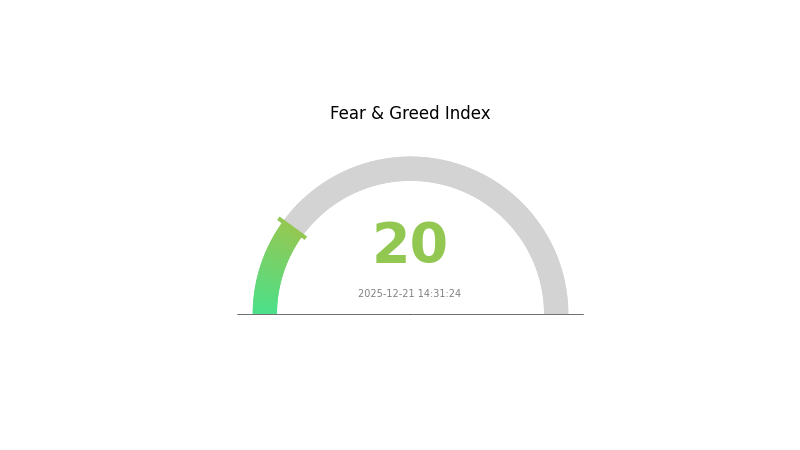

- Market Sentiment: Extreme Fear (VIX at 20)

Check current TOWNS market price

TOWNS Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 20. This indicates significant market pessimism and heightened risk aversion among investors. During periods of extreme fear, asset prices often reach attractive levels for long-term investors. However, market volatility remains elevated, and investors should exercise caution. It is advisable to conduct thorough research, diversify portfolios appropriately, and avoid making impulsive decisions driven by emotions. Those with strong conviction in fundamental value may consider this a potential opportunity, while risk-averse investors should maintain defensive positions.

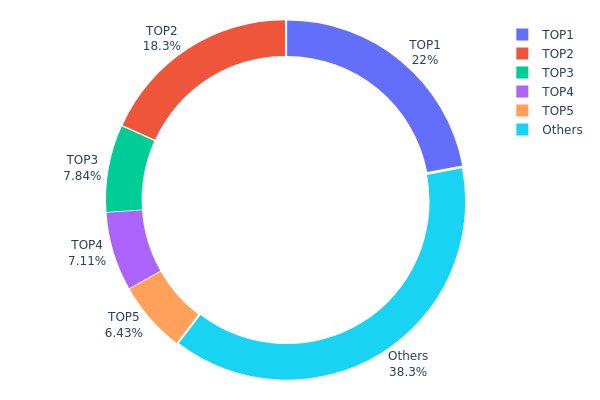

TOWNS Holdings Distribution

The address holdings distribution chart illustrates the concentration of TOWNS tokens across wallet addresses on the blockchain. It provides critical insights into token ownership patterns, capital concentration, and the degree of decentralization within the TOWNS ecosystem. By analyzing the top holders and comparing their combined holdings against the total circulating supply, investors and analysts can assess market structure health and identify potential concentration risks.

The current holdings data reveals a moderately concentrated distribution pattern. The top five addresses collectively control approximately 61.63% of TOWNS tokens, with the largest holder commanding 22.02% and the second-largest holding 18.25% of the total supply. While this concentration level warrants attention, it remains within acceptable ranges for many blockchain projects in their growth phases. The remaining 38.37% of tokens distributed across other addresses demonstrates a meaningful level of decentralization, suggesting that TOWNS maintains a reasonably diversified holder base beyond the top-tier investors.

This distribution structure presents both opportunities and considerations for market dynamics. The concentration among top addresses could potentially facilitate organized decision-making or coordinated movements, though the substantial portion held by dispersed addresses (38.37%) provides a stabilizing counterbalance. The existing holder composition suggests moderate whale influence on price action, with sufficient retail and mid-sized investor participation to maintain organic market activity. Overall, TOWNS demonstrates a blockchain asset structure that supports reasonable market stability while maintaining sufficient decentralization to align with principles of distributed governance.

Click to view current TOWNS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7c04...5b7698 | 399987.98K | 22.02% |

| 2 | 0x8ee4...6c85c0 | 331538.47K | 18.25% |

| 3 | 0xaba5...e3d47d | 142461.53K | 7.84% |

| 4 | 0xbaed...e9439f | 129144.86K | 7.10% |

| 5 | 0x1e9e...ce2ff5 | 116795.73K | 6.42% |

| - | Others | 696515.47K | 38.37% |

II. Core Factors Influencing TOWNS Future Price

Supply Mechanism

-

Token Utility Model: TOWNS tokens are designed as the core driver of the Towns ecosystem. The token can be used for staking to generate yields, unlocking exclusive features, and participating in governance decisions, serving as a long-term growth driver.

-

Historical Price Pattern: TOWNS reached a historical high of $0.06597 on August 5, 2025, but subsequently experienced significant market correction, trading at $0.03389 with a recent low near $0.0297, indicating the market is attempting to form a short-term support level at the $0.03 psychological support.

Macroeconomic Environment

-

Monetary Policy Impact: The prolonged price weakness in the current cycle is primarily driven by insufficient demand. This factor is expected to continue influencing market trends through the "15th Five-Year Plan" period, with residential demand being a critical determinant of future price movements.

-

Government Policy Influence: Government policy force and scope directly impact market recovery pace. Government regulatory measures have profound effects on price movements, as future price expectations are highly correlated with residential demand fundamentals.

III. 2025-2030 TOWNS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00476 - $0.00569

- Neutral Forecast: $0.00547 (average expected price)

- Bullish Forecast: $0.00569 (requires sustained market momentum)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with moderate growth trajectory, characterized by increasing adoption and stabilizing fundamentals.

- Price Range Forecast:

- 2026: $0.00374 - $0.00725

- 2027: $0.00353 - $0.00796

- Key Catalysts: Enhanced ecosystem development, increased institutional participation, positive regulatory developments, and growing utility adoption within the TOWNS network.

2028-2030 Long-term Outlook

- Base Case: $0.00676 - $0.00747 by 2028 (assuming steady market conditions and consistent network growth)

- Optimistic Case: $0.00746 - $0.00824 by 2030 (assuming accelerated adoption and positive market cycles)

- Transformational Case: $0.00824+ by 2030 (reflecting breakthrough technological advancements, mainstream adoption, and macroeconomic tailwinds)

Key Observation: The forecast indicates a 42% potential increase from 2025 to 2030, suggesting a measured but positive long-term outlook. The relatively stable average price levels across the forecast period indicate investor confidence in TOWNS' fundamental value proposition, with trading opportunities available on platforms like Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00569 | 0.00547 | 0.00476 | 0 |

| 2026 | 0.00725 | 0.00558 | 0.00374 | 2 |

| 2027 | 0.00796 | 0.00642 | 0.00353 | 17 |

| 2028 | 0.00747 | 0.00719 | 0.00676 | 31 |

| 2029 | 0.00821 | 0.00733 | 0.0052 | 34 |

| 2030 | 0.00824 | 0.00777 | 0.00746 | 42 |

TOWNS Investment Strategy and Risk Management Report

IV. TOWNS Professional Investment Strategy and Risk Management

TOWNS Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Early adopters interested in decentralized messaging infrastructure, protocol participants seeking exposure to Base ecosystem growth, and investors with medium to long-term investment horizons (12+ months).

- Operation Recommendations:

- Accumulate positions during market downturns, particularly when the asset experiences pullbacks exceeding 20% from recent highs, to optimize entry points for long-term holders.

- Establish a dollar-cost averaging (DCA) schedule with regular monthly or quarterly purchases to reduce timing risk and build positions systematically.

- Maintain holdings through network expansion phases, as protocol adoption and node operator participation could drive sustainable value growth through the closed-loop incentive mechanism.

(2) Active Trading Strategy

-

Technical Analysis Framework:

- Moving Average Convergence Divergence (MACD): Monitor crossovers between the MACD line and signal line to identify potential momentum shifts and entry/exit points for swing traders.

- Relative Strength Index (RSI): Utilize overbought (above 70) and oversold (below 30) conditions to time short-term trades and validate support/resistance levels.

- Volume Profile Analysis: Track trading volume patterns against price movements to confirm breakout sustainability and identify key liquidity zones for position sizing.

-

Wave Trading Key Points:

- Identify support levels near $0.0054-$0.0055 and resistance at $0.0059-$0.0060 based on recent 24-hour range data to execute range-bound trading strategies.

- Capitalize on the significant 7-day decline of -25.49% by establishing tactical positions at lower price levels, with stop-losses positioned below critical support.

TOWNS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation, focusing on small experimental positions with strict stop-loss orders at -15% to -20%.

- Active Investors: 3-8% of total portfolio allocation, with dynamic rebalancing quarterly and tactical profit-taking at predetermined resistance levels.

- Professional Investors: 8-15% of total portfolio allocation, with hedging strategies through correlated or inverse positions and systematic risk monitoring across multiple timeframes.

(2) Risk Hedging Solutions

- Dollar-Cost Averaging with Rebalancing: Execute systematic purchases across multiple price levels combined with quarterly portfolio rebalancing to reduce exposure concentration and smooth average entry costs.

- Profit-Taking Strategy: Establish predetermined profit targets at key resistance levels ($0.007, $0.010, $0.015) and scale out of positions incrementally rather than liquidating entire holdings at once.

(3) Secure Storage Solutions

- Hardware Wallet Strategy: For large position holders, consider self-custody solutions with offline key management and multi-signature configurations to minimize exchange counterparty risk.

- Custody Best Practices: Maintain only active trading liquidity on regulated exchanges like Gate.com, while storing the majority of holdings in secure self-managed wallets with strong backup protocols.

- Security Considerations: Be aware of smart contract risks on Base network, validate contract addresses before transactions (contract address: 0x00000000a22c618fd6b4d7e9a335c4b96b189a38), and never share private keys or recovery phrases with third parties.

V. TOWNS Potential Risks and Challenges

TOWNS Market Risk

- Extreme Price Volatility: TOWNS has experienced a -82.68% decline over the past year (from a high of $0.06597 to current $0.005468), demonstrating significant price instability that could result in substantial capital losses for retail investors.

- Low Trading Volume Relative to Market Cap: With 24-hour volume of $164,323.94 against a market cap of $11.53 million, liquidity concerns may restrict traders' ability to execute large positions without significant slippage.

- Market Cap Concentration Risk: Fully diluted valuation of $55.38 million with only 20.83% of tokens circulating suggests substantial dilution risk when vesting schedules release locked tokens into the market.

TOWNS Regulatory Risk

- Base Network Regulatory Uncertainty: As a protocol operating on Coinbase's Base L2, TOWNS faces evolving regulatory frameworks affecting Layer 2 solutions and their compliance requirements with global financial authorities.

- Decentralized Protocol Liability: Regulatory agencies may question the legal status of decentralized messaging protocols, particularly regarding encrypted communications and potential compliance obligations under data protection regulations.

- Jurisdiction-Specific Restrictions: Certain jurisdictions may classify TOWNS tokens as securities or restrict access to the protocol, creating geographic limitations on user adoption and trading availability.

TOWNS Technical Risk

- L2 Network Dependencies: TOWNS protocol relies on the security and stability of Base's EVM-compatible infrastructure; any critical vulnerabilities or network failures could compromise protocol functionality and token value.

- Smart Contract Vulnerabilities: As a protocol managing encrypted messaging and on-chain memberships, undiscovered bugs or exploits in TOWNS' smart contracts could result in fund loss or privacy breaches affecting users and token holders.

- Scalability Execution Risk: The protocol's success depends on achieving planned network scaling and node operator participation; failure to meet adoption targets could result in reduced utility and network effects.

VI. Conclusion and Action Recommendations

TOWNS Investment Value Assessment

TOWNS represents a speculative opportunity in the decentralized messaging infrastructure space, offering exposure to Base network growth and novel reputation mechanisms. However, the project carries substantial risks including extreme historical volatility (-82.68% annually), significant token dilution potential (only 20.83% circulating), and execution dependencies on protocol adoption by node operators. The -30.86% monthly decline and low 24-hour trading volume relative to market cap indicate limited market conviction and potential liquidity challenges. Investment in TOWNS should be considered a high-risk, long-term thesis bet on decentralized messaging adoption rather than a near-term trading opportunity.

TOWNS Investment Recommendations

✅ Beginners: Start with minimal positions (1-2% of portfolio) through micro-purchases on Gate.com during established support levels. Use strict stop-losses at -20% and focus on understanding the protocol's messaging and reputation mechanics before increasing exposure. Avoid leverage or margin trading until you develop deeper technical knowledge.

✅ Experienced Investors: Implement systematic DCA strategies over 6-12 month periods to build core positions while executing tactical swing trades around identified support ($0.0054-$0.0055) and resistance ($0.0059-$0.0060) zones. Maintain 3-8% portfolio allocation with quarterly rebalancing and predetermined profit-taking at key resistance levels.

✅ Institutional Investors: Conduct deep due diligence on Base network evolution, node operator incentive structures, and protocol governance dynamics. Consider structured positions combining core holdings with derivative hedging, maintain dedicated custody infrastructure, and allocate 8-15% strategically while engaging directly with protocol developers for network growth visibility.

TOWNS Trading Participation Methods

- Gate.com Exchange Trading: Access TOWNS with real-time order matching, competitive spreads, and comprehensive trading pairs against USDT and other major cryptocurrencies through Gate.com's professional trading interface.

- On-Chain Transactions: Trade directly through Base network DEX integrations and participate in protocol governance by holding TOWNS tokens while managing smart contract interaction risks.

- Dollar-Cost Averaging Programs: Set up systematic purchase schedules through Gate.com's recurring investment features to automate position building and reduce emotional decision-making.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

Is Towns Coin a good investment?

Towns Coin shows strong potential based on technical analysis and market trends. With positive momentum and growing adoption, it presents promising investment opportunities for long-term holders seeking exposure to emerging web3 projects.

What is the price prediction for the towns token?

Based on community consensus, TOWNS token is predicted to reach $0.009617 by 2030. This forecast reflects market sentiment and user expectations over the next five years.

What is TOWNS token and what are its use cases?

TOWNS token powers the Towns DAO ecosystem, enabling staking, delegation, and community governance. It facilitates decentralized decision-making for protocol development and management.

What factors influence TOWNS price movements?

TOWNS price movements are driven by market demand and supply dynamics, community adoption rates, trading volume, blockchain network developments, macroeconomic conditions, and investor sentiment shifts.

What are the risks associated with investing in TOWNS?

TOWNS investment risks include market volatility, liquidity constraints, regulatory uncertainty, and price fluctuations. Consider your risk tolerance before investing.

2025 BENJI Price Prediction: Analyzing Growth Potential and Market Trends for the Emerging Cryptocurrency

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 KAS Price Prediction: Analyzing Key Factors Driving the Future Value of Kaspa

What is XNY: A Comprehensive Guide to Understanding Its Applications and Significance in Modern Technology

What is MSQ: A Comprehensive Guide to Message Queue Systems and Their Real-World Applications

What is SIX: A Comprehensive Guide to Understanding the Significance and Applications of This Numerical Value

Exploring Longinus: Can Heritage Tokens Drive DeFi Expansion?

Token Unlocks: Understanding Their Influence on Cryptocurrency Prices in 2025