2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Introduction: UNA's Market Position and Investment Value

Unagi (UNA) as a web3 gaming ecosystem token, has established itself as a universal ticket to the entire range of Unagi games since its inception. As of 2025, UNA's market capitalization has reached $5,482,794.57, with a circulating supply of approximately 129,574,008 tokens, and a price hovering around $0.042314. This asset, known as the "One token, many worlds" solution, is playing an increasingly crucial role in the gaming and blockchain sectors.

This article will comprehensively analyze UNA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. UNA Price History Review and Current Market Status

UNA Historical Price Evolution Trajectory

- 2024: UNA reached its all-time high of $0.17245 on June 12, marking a significant milestone for the token.

- 2024: The market experienced a downturn, with UNA hitting its all-time low of $0.00649 on October 8.

- 2025: UNA has shown remarkable recovery, with the price rising by 482.84% over the past year.

UNA Current Market Situation

As of October 11, 2025, UNA is trading at $0.042314, with a market cap of $5,482,794.57. The token has experienced a 15.03% decrease in the last 24 hours, indicating short-term volatility. However, UNA has shown strong performance over the past month, with a 50.48% increase in value.

The current circulating supply of UNA is 129,574,008 tokens, which represents 12.96% of the total supply of 1,000,000,000 UNA. The fully diluted market cap stands at $42,314,000.

UNA's trading volume in the past 24 hours is $22,336.14, reflecting moderate market activity. The token's market dominance is currently at 0.0010%, suggesting it's still a relatively small player in the overall cryptocurrency market.

Click to view the current UNA market price

UNA Market Sentiment Indicator

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 27, indicating a state of fear. This suggests investors are wary and potentially looking for buying opportunities. While fear can signal a good time to invest for contrarians, it's crucial to conduct thorough research and manage risks carefully. Keep an eye on market trends and fundamental factors affecting crypto assets. As always, diversification and a long-term perspective are key strategies in navigating volatile markets.

UNA Holdings Distribution

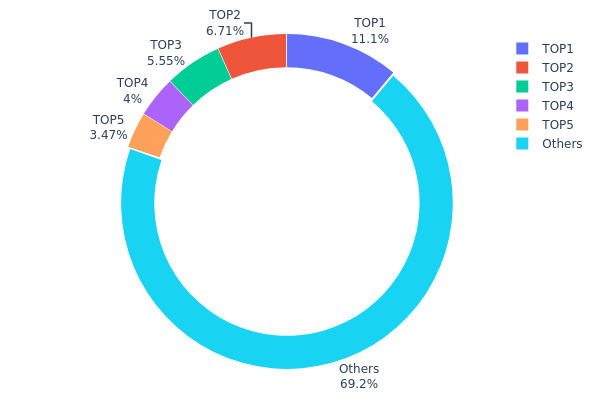

The address holdings distribution data for UNA reveals a moderately concentrated ownership structure. The top 5 addresses collectively hold 30.75% of the total UNA supply, with the largest holder possessing 11.06% of the tokens. This concentration level suggests a relatively balanced distribution, as no single address holds a majority stake.

While the top holders have significant influence, the fact that 69.25% of UNA tokens are distributed among other addresses indicates a decent level of decentralization. This distribution pattern may contribute to market stability, as it reduces the risk of price manipulation by any single large holder. However, coordinated actions by the top holders could still potentially impact market dynamics.

The current holdings distribution reflects a maturing market structure for UNA, with a balance between major stakeholders and a broader base of smaller holders. This distribution supports a degree of decentralization while maintaining the potential for institutional involvement, which could be beneficial for long-term market development and liquidity.

Click to view the current UNA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8bbc...75fd50 | 13643.68K | 11.06% |

| 2 | 0x0d07...b492fe | 8273.75K | 6.70% |

| 3 | 0x2933...fa4625 | 6844.02K | 5.54% |

| 4 | 0xde99...3b1be5 | 4929.70K | 3.99% |

| 5 | 0x01c1...44c6e6 | 4279.75K | 3.46% |

| - | Others | 85389.61K | 69.25% |

II. Key Factors Affecting UNA's Future Price

Supply Mechanism

- Market Demand: The price of UNA is influenced by market demand and acceptance level.

Institutional and Whale Dynamics

- National Policies: Environmental policies, such as the EU's carbon border adjustment mechanism, may impact mining costs and affect supply.

Macroeconomic Environment

- Monetary Policy Impact: High interest rates and credit tightening may make it more difficult to stimulate economic growth.

- Geopolitical Factors: Escalating geopolitical conflicts and weak international trade pose severe challenges to the global economy.

Technological Development and Ecosystem Building

- Technical Innovation: Technological developments can impact UNA's price.

- Ecosystem Applications: The level of acceptance and development of ecosystem applications can influence UNA's value.

III. UNA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02868 - $0.04217

- Neutral prediction: $0.04217 - $0.05166

- Optimistic prediction: $0.05166 - $0.06115 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.06038 - $0.07408

- 2028: $0.05726 - $0.09134

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.07975 - $0.09650 (assuming steady market growth and project development)

- Optimistic scenario: $0.09650 - $0.11325 (assuming strong market performance and significant adoption)

- Transformative scenario: $0.10711 - $0.11325 (assuming breakthrough innovations and mainstream integration)

- 2030-12-31: UNA $0.0965 (potential average price based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06115 | 0.04217 | 0.02868 | 0 |

| 2026 | 0.07284 | 0.05166 | 0.04339 | 22 |

| 2027 | 0.07408 | 0.06225 | 0.06038 | 47 |

| 2028 | 0.09134 | 0.06816 | 0.05726 | 61 |

| 2029 | 0.11325 | 0.07975 | 0.05583 | 88 |

| 2030 | 0.10711 | 0.0965 | 0.06948 | 128 |

IV. UNA Professional Investment Strategies and Risk Management

UNA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and gaming enthusiasts

- Operational suggestions:

- Accumulate UNA tokens during market dips

- Participate in Unagi's gaming ecosystem to maximize token utility

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Unagi game releases and updates for potential price catalysts

- Set stop-loss orders to manage downside risk

UNA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for UNA

UNA Market Risks

- Volatility: Gaming tokens can experience significant price swings

- Competition: Increasing number of blockchain gaming projects

- Market sentiment: Susceptible to overall crypto market trends

UNA Regulatory Risks

- Uncertain regulations: Potential changes in crypto gaming regulations

- Token classification: Risk of being classified as a security

- Cross-border restrictions: Possible limitations on international token usage

UNA Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: Challenges in handling increased user adoption

- Integration problems: Difficulties in seamless integration across multiple games

VI. Conclusion and Action Recommendations

UNA Investment Value Assessment

UNA presents a unique opportunity in the blockchain gaming sector with its multi-game ecosystem approach. While it offers long-term potential for growth, short-term volatility and regulatory uncertainties pose significant risks.

UNA Investment Recommendations

✅ Beginners: Start with small, affordable investments to explore the Unagi ecosystem ✅ Experienced investors: Consider a balanced approach, allocating a portion of gaming token portfolio to UNA ✅ Institutional investors: Conduct thorough due diligence and consider UNA as part of a diversified gaming token strategy

UNA Participation Methods

- Purchase on exchanges: Buy UNA tokens on Gate.com

- Earn through gameplay: Participate in Unagi games to earn UNA tokens

- Staking: Explore staking options if available to earn passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Uniswap reach $100?

Uniswap reaching $100 is possible but uncertain. It depends on market trends, capturing hot narratives like perpetuals, and positive sentiment. Current focus on prediction markets and stablecoins may impact its potential.

Can Solana reach $10,000 dollars today?

No, Solana cannot reach $10,000 today. While Solana has potential for growth, such a dramatic price increase in a single day is not realistic for any cryptocurrency.

What is the price of Una?

As of October 11, 2025, the price of Una is $0.04236 USD. The 24-hour trading volume is $201,342.22 USD.

What meme coin will explode in 2025 price prediction?

Based on current trends, Dogecoin (DOGE) and Shiba Inu (SHIB) are likely to see significant price increases in 2025. Emerging memecoins like PEPE and Bonk also show potential for explosive growth.

Is Sidus (SIDUS) a good investment?: Analyzing the Potential and Risks of this Gaming Cryptocurrency

GOG vs LINK: The Battle for Digital Distribution Supremacy in the Gaming Industry

MAVIA vs CHZ: A Comparative Analysis of Two Leading Blockchain Gaming Ecosystems

Is NEXPACE (NXPC) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is Decimated (DIO) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Moonray (MNRY) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Understanding the Proof of Stake Consensus Mechanism with Peercoin

What is JOE: A Comprehensive Guide to Understanding the JavaScript Object Notation Environment and Its Applications in Modern Web Development

What is SN: A Comprehensive Guide to Serial Numbers and Their Applications

What is BB: A Comprehensive Guide to Understanding Its Meaning, Uses, and Impact in Modern Culture

What is MAPO: A Comprehensive Guide to Multi-Agent Pathfinding and Optimization