2025 UTK Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of UTK

Utrust (UTK) serves as a decentralized payment solution platform designed to provide consumer protection for online transactions and enable businesses to accept cryptocurrency payments from holders worldwide. Since its inception in January 2018, Utrust has established itself as a bridge between traditional e-commerce and cryptocurrency payment infrastructure. As of December 2025, UTK maintains a market capitalization of approximately $12.18 million, with a circulating supply of around 704.1 million tokens, currently trading at $0.01218 per token. This asset, recognized for its vision to become a competitive alternative to traditional payment processors like PayPal in the cryptocurrency payment industry, continues to play an important role in the broader crypto payment ecosystem.

This article will provide a comprehensive analysis of Utrust's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasting and practical investment strategies for investors interested in UTK's long-term potential.

xMoney (UTK) Market Analysis Report

I. UTK Price History Review and Current Market Status

UTK Historical Price Evolution

- January 2018: ATH reached at $1.18 on January 9, 2018, marking the peak of early cryptocurrency enthusiasm during the market cycle.

- March 2020: ATL dropped to $0.00540831 on March 13, 2020, reflecting severe market downturn during the pandemic period.

- December 2025: Current price stabilized at $0.01218, representing a significant decline of 86.04% over the past year.

UTK Current Market Status

As of December 22, 2025, UTK is trading at $0.01218 with a market capitalization of $8,576,085.93. The token ranks 1257 by market cap globally. Over the last 24 hours, UTK experienced a slight decline of -0.97%, while the 7-day performance showed a more pronounced downturn of -11.99%. The 30-day period recorded a -18.85% depreciation.

Trading activity remains modest, with a 24-hour trading volume of $12,903.81. The circulating supply stands at 704,112,145 UTK out of a total supply of 1,000,000,000 tokens, representing a circulation ratio of 70.41%. The fully diluted valuation (FDV) is $12,180,000.

With approximately 22,594 token holders and a market dominance of 0.00037%, UTK maintains a presence across 9 exchanges. The token's liquidity metrics indicate limited trading activity, with the highest 24-hour price at $0.01252 and the lowest at $0.01167.

Click to view the current UTK market price

UTK Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index standing at 25. This indicates significant market pessimism and heightened investor anxiety. During such periods, traders should exercise caution and consider their risk tolerance carefully. Extreme fear can present both challenges and opportunities—while it signals potential downside risks, it may also create entry points for long-term investors with conviction. Monitor market developments closely and manage your portfolio accordingly on Gate.com.

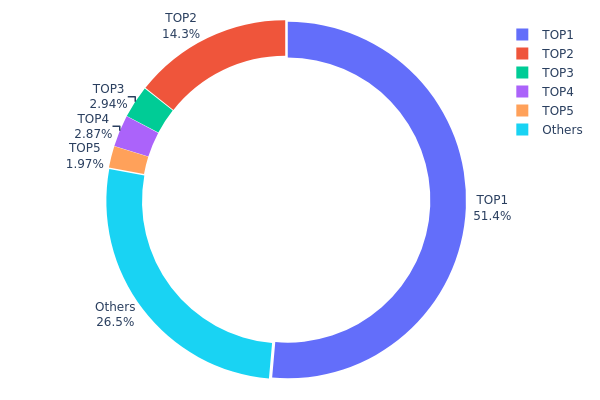

UTK Holdings Distribution

The UTK address holdings distribution represents the allocation of token ownership across the blockchain network, measured by tracking the top holders and their respective percentages of total supply. This metric provides critical insights into market concentration, liquidity dynamics, and potential systemic risks within the UTK ecosystem. By analyzing the distribution pattern, market participants can assess the degree of decentralization and identify potential vulnerabilities related to large holder influence.

UTK exhibits pronounced concentration characteristics, with the top holder commanding 51.39% of the total supply, significantly surpassing typical healthy distribution benchmarks. The cumulative holdings of the top five addresses account for 73.5% of all UTK tokens, indicating substantial centralization within the network. The second-largest holder maintains a considerable 14.34% position, while remaining top-five addresses hold between 1.97% and 2.94%. This distribution pattern raises concerns regarding token concentration risk, as a relatively small number of addresses control the majority of available supply. The remaining 26.5% dispersed among other addresses suggests limited retail participation and relatively thin distributed ownership.

The concentrated holdings structure presents notable implications for market dynamics and price stability. With over half of UTK supply concentrated in a single address, the potential for sudden liquidity events or coordinated movements exists, which could trigger significant price volatility. Large holders typically exhibit decision-making influence that disproportionately affects market sentiment and trading patterns. This concentration level indicates that UTK maintains relatively low decentralization relative to mature blockchain projects, suggesting a market structure where price discovery mechanisms may be constrained by holder concentration. Institutional or strategic holders dominating the supply distribution could create barriers to organic price formation and increase susceptibility to market manipulation scenarios.

Click to view current UTK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc3c1...636138 | 256988.23K | 51.39% |

| 2 | 0xf977...41acec | 71731.27K | 14.34% |

| 3 | 0x5a52...70efcb | 14700.00K | 2.94% |

| 4 | 0x0529...c553b7 | 14336.31K | 2.86% |

| 5 | 0xd621...d19a2c | 9865.33K | 1.97% |

| - | Others | 132378.86K | 26.5% |

II. Core Factors Affecting UTK's Future Price

Market Sentiment and Adoption

-

Positive catalysts: When the market receives favorable news about UTK's widespread adoption or major technological breakthroughs, it typically triggers optimistic market sentiment and drives UTK price increases.

-

Negative catalysts: Regulatory crackdowns and security vulnerabilities can trigger market panic and lead to price declines.

-

Investor confidence: Market sentiment and investor confidence are key factors influencing UTK's price movements. The cryptocurrency market itself exhibits high volatility, with prices potentially experiencing sharp fluctuations in the short term.

Regulatory Environment

- Regulatory impact: Regulatory policies at various levels significantly influence UTK's price trajectory. Favorable regulatory developments can support price appreciation, while restrictive policies may exert downward pressure on valuations.

III. 2025-2030 UTK Price Forecast

2025 Outlook

- Conservative Forecast: $0.00869-$0.01224

- Base Case Forecast: $0.01224

- Optimistic Forecast: $0.01457 (requires sustained ecosystem development and increased institutional adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing protocol utility and market maturation

- Price Range Predictions:

- 2026: $0.01206-$0.01917 (10% upside potential)

- 2027: $0.01400-$0.01970 (33% upside potential)

- Key Catalysts: Enhanced platform functionality, strategic partnerships, growing DeFi integration, and strengthened market positioning

2028-2030 Long-term Outlook

- Base Scenario: $0.01476-$0.02609 by 2028 (47% appreciation potential, assuming steady ecosystem expansion and moderate market conditions)

- Optimistic Scenario: $0.01278-$0.02623 by 2029 (80% upside potential, contingent on breakthrough adoption milestones and favorable macroeconomic environment)

- Transformational Scenario: $0.02052-$0.02752 by 2030 (98% upside potential, predicated on achieving mainstream enterprise adoption and becoming a cornerstone protocol in the Web3 infrastructure)

- December 22, 2025: UTK trading stability maintained at current levels with consolidation pattern evident

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01457 | 0.01224 | 0.00869 | 0 |

| 2026 | 0.01917 | 0.0134 | 0.01206 | 10 |

| 2027 | 0.0197 | 0.01628 | 0.014 | 33 |

| 2028 | 0.02609 | 0.01799 | 0.01476 | 47 |

| 2029 | 0.02623 | 0.02204 | 0.01278 | 80 |

| 2030 | 0.02752 | 0.02414 | 0.02052 | 98 |

UTK (xMoney) Professional Investment Strategy and Risk Management Report

IV. UTK Professional Investment Strategy and Risk Management

UTK Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in cryptocurrency payment infrastructure and those seeking long-term exposure to blockchain-based payment solutions.

- Operational Recommendations:

- Accumulate during market downturns when volatility is elevated, particularly when UTK trades near support levels.

- Maintain a 12-24 month holding horizon to weather short-term market fluctuations and benefit from potential ecosystem developments.

- Reinvest any rewards or earnings to compound your position over time.

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price floors and ceilings to determine entry and exit points for position management.

- Volume Analysis: Monitor trading volume on Gate.com to confirm price movements and validate trend strength.

- Wave Trading Key Points:

- Target resistance at the 24-hour high of $0.01252, with support established around $0.01167.

- Execute trades during periods of elevated volume to ensure sufficient liquidity for position entry and exit.

UTK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio allocation.

- Active Investors: 3-5% of total crypto portfolio allocation.

- Professional Investors: 5-8% of total crypto portfolio allocation based on position sizing strategies.

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Distribute UTK purchases across multiple time periods to reduce the impact of price volatility and timing risk.

- Portfolio Diversification: Balance UTK holdings with other established cryptocurrencies to mitigate concentration risk and sector-specific downturns.

(3) Secure Storage Solutions

- Cold Storage Approach: Utilize hardware wallets for long-term holdings of UTK tokens to protect against exchange hacks and cyber threats.

- Hot Wallet Management: Use Gate.com's wallet infrastructure for active trading and liquidity management while maintaining strict security protocols.

- Security Considerations: Enable two-factor authentication on all accounts, regularly audit wallet addresses, and never share private keys or seed phrases with third parties.

V. UTK Potential Risks and Challenges

UTK Market Risks

- Extreme Price Volatility: UTK has experienced an 86.04% decline over the past year, demonstrating significant downside exposure and market sentiment deterioration.

- Low Trading Volume: With only $12,903.81 in 24-hour trading volume, UTK faces liquidity constraints that may result in slippage during large transactions and difficulty exiting positions.

- Limited Market Capitalization: At approximately $12.18 million in fully diluted valuation, UTK remains a micro-cap asset with minimal institutional adoption and market depth.

UTK Regulatory Risks

- Cryptocurrency Payment Compliance: Regulatory scrutiny on payment-related cryptocurrencies may intensify as governments seek to establish clearer frameworks for digital payment tokens.

- Cross-Border Transaction Regulations: UTK's positioning around low-cost cross-border transactions may attract regulatory attention in jurisdictions with strict capital control measures.

- Blockchain Asset Classification: Uncertainty regarding how payment tokens will be classified and regulated across different jurisdictions creates ongoing compliance uncertainty.

UTK Technical Risks

- Smart Contract Vulnerabilities: The Ethereum-based token (contract address: 0xdc9Ac3C20D1ed0B540dF9b1feDC10039Df13F99c) may face technical exploits or vulnerabilities in its underlying code.

- Ecosystem Adoption: Limited merchant and consumer adoption of the Utrust payment platform reduces the practical utility and demand drivers for the UTK token.

- Network Dependency: As an ERC-20 token on the Ethereum blockchain, UTK is exposed to Ethereum network congestion and scaling limitations.

VI. Conclusion and Action Recommendations

UTK Investment Value Assessment

UTK represents a speculative micro-cap cryptocurrency focused on blockchain-based payment solutions. While the project's vision of providing buyer protection and low-cost cross-border transactions aligns with long-term cryptocurrency payment trends, the token has experienced severe underperformance (-86.04% annually), minimal trading liquidity, and limited market adoption. The project's 70.4% circulating supply ratio suggests room for dilution, and the token's market position (#1257 by market cap) indicates marginal market relevance. Investment in UTK should be approached as a high-risk, speculative position suitable only for investors with significant risk tolerance and diversified crypto portfolios.

UTK Investment Recommendations

✅ Beginners: Avoid direct UTK exposure until you establish a foundation in major cryptocurrencies. If interested, limit allocation to <1% of crypto holdings and only with capital you can afford to lose completely.

✅ Experienced Investors: Consider UTK as a speculative position within a diversified portfolio. Use dollar-cost averaging for position building and establish strict stop-loss orders at 20-30% below entry prices to manage downside risk.

✅ Institutional Investors: Conduct extensive due diligence on the Utrust platform's merchant adoption metrics and payment transaction volumes before committing capital. Evaluate the token's utility as a payment mechanism rather than purely as a speculative asset.

UTK Trading Participation Methods

- Gate.com Spot Trading: Purchase UTK directly on Gate.com's spot market using stablecoin trading pairs for immediate exposure and position management.

- Limit Orders: Set up buy orders at predetermined support levels to accumulate positions during price weakness while maintaining disciplined entry pricing.

- Portfolio Rebalancing: Periodically review UTK's allocation within your overall crypto portfolio and adjust exposure based on changing market conditions and risk parameters.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult with qualified financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is utk crypto?

UTK is the native token of Utrust, a cryptocurrency payment platform enabling e-commerce transactions with digital currencies. It bridges traditional online shopping with crypto payments, facilitating seamless merchant and consumer transactions in the digital economy.

What factors influence UTK price predictions?

UTK price predictions are influenced by market demand, overall crypto market conditions, regulatory developments, trading volume, investor sentiment, and technological updates to the platform.

What is the historical price performance of UTK?

UTK has demonstrated stable price performance, maintaining consistent value around $250.00 since late October 2025. The token has shown resilience with steady trading activity and maintained support levels throughout recent market cycles.

What are the risks of investing in UTK based on price predictions?

UTK investments carry high risk due to extreme price volatility and unpredictable market movements. Price predictions may not reflect actual performance. Market conditions, regulatory changes, and liquidity shifts can significantly impact returns. Conduct thorough research before investing.

2025 ACH Price Prediction: Bullish Outlook for Alchemy Pay Amid Growing Crypto Adoption

2025 SVL Price Prediction: Expert Analysis and Market Forecast for Savage Coin's Future Value

2025 AVA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Why is CryptoJack so hopeful about Gate.com and GT TOKEN in this bull run?

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

Exploring Yescoin: Features and Benefits of a Blockchain Platform

What is ALPHA: A Comprehensive Guide to Understanding the Leading Performance Metric in Investment and Portfolio Management

What is EVAA: A Comprehensive Guide to Electric Vehicle Advanced Analytics

Cardano Prepares for Significant Price Surge with High Trading Volume Analysis

What is WAI: A Comprehensive Guide to Web Accessibility Initiative and Its Impact on Digital Inclusion