2025 WCT Price Prediction: Expert Analysis and Market Forecast for Worldcoin Token Growth

Introduction: WCT's Market Position and Investment Value

WalletConnect (WCT) serves as the connectivity network redefining onchain user experience, functioning as the foundational infrastructure that powers seamless interactions between wallets, applications, and blockchains across the Web3 ecosystem. As of December 2025, WCT has achieved a market capitalization of $76,360,000 with a circulating supply of approximately 186.2 million tokens, trading at $0.07636 per token. This asset, recognized as "the standard for how we connect in Web3," is playing an increasingly critical role across decentralized finance, NFT platforms, staking protocols, and trading applications globally.

With over 275 million connections and 45 million users worldwide, WalletConnect has established itself as the backbone of the onchain economy. The recent launch of the WCT token marks a significant evolution toward a decentralized, permissionless, and community-owned future of connectivity.

This article provides a comprehensive analysis of WCT's price trajectory through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors navigating the Web3 infrastructure sector.

I. WCT Price History Review and Current Market Status

WCT Historical Price Movement Trajectory

WalletConnect Token (WCT) was launched on December 14, 2024, marking the beginning of its market history. The token experienced significant price volatility in its initial phase:

- May 30, 2025: WCT reached its all-time high of $1.3968, representing a peak valuation during the early trading period.

- October 10, 2025: WCT hit its all-time low of $0.0436, marking a substantial correction from its peak value.

- Current Period (December 21, 2025): The token has recovered somewhat from its lows, trading at $0.07636, reflecting a -81.65% decline over the past year since launch.

WCT Current Market Status

As of December 21, 2025, WCT is trading at $0.07636 with a 24-hour trading volume of $706,047.19. The token shows:

Price Performance:

- 1-hour change: +0.38%

- 24-hour change: +0.91%

- 7-day change: -5.02%

- 30-day change: -45.51%

- Year-to-date change: -81.65%

Market Capitalization:

- Current market cap: $14,218,232

- Fully diluted valuation: $76,360,000

- Market cap to FDV ratio: 18.62%

- Market dominance: 0.0023%

Supply Metrics:

- Circulating supply: 186,200,000 WCT (18.62% of total supply)

- Total supply: 1,000,000,000 WCT

- Maximum supply: 1,000,000,000 WCT

- Token holders: 132,809

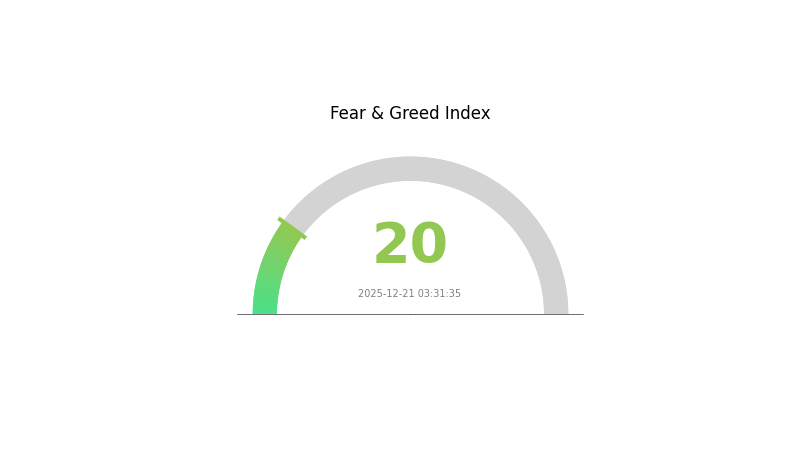

Market Sentiment: The market sentiment indicator shows extreme fear (VIX: 20), reflecting heightened market uncertainty and risk aversion across the broader cryptocurrency landscape.

WCT is currently listed on 40 exchanges, including Gate.com, providing substantial liquidity and accessibility for traders and investors.

View current WCT market price

WCT Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index hitting just 20 points. This exceptionally low reading indicates widespread panic and pessimism among investors. Market participants are retreating from risk assets, creating a highly defensive sentiment. Such extreme fear conditions often precede significant market opportunities, as excessive pessimism may be overdone. Investors should approach this period with strategic caution, considering that historical patterns show panic-driven sell-offs can present entry points for contrarian traders. Monitor key support levels and market catalysts that could shift sentiment.

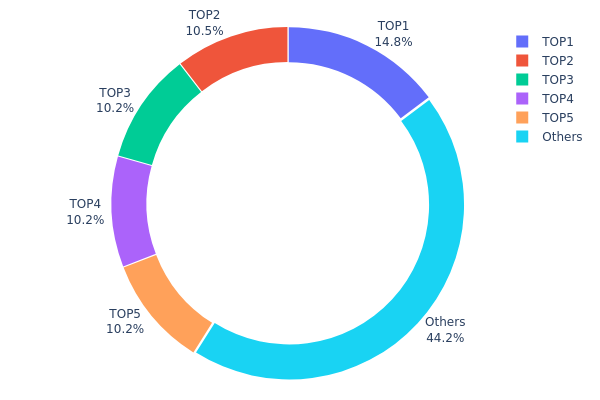

WCT Holdings Distribution

The address holdings distribution map provides a comprehensive visualization of how WCT tokens are allocated across different wallet addresses on the blockchain. This metric serves as a crucial indicator for assessing market concentration, decentralization levels, and potential systemic risks associated with token ownership structure. By analyzing the distribution patterns, investors and analysts can evaluate the degree of centralization, identify major stakeholders, and gauge the vulnerability of the token to potential market manipulation or sudden liquidity events.

Current data reveals a moderate concentration pattern in WCT's holder base. The top five addresses collectively control approximately 55.78% of the total token supply, with the leading address (0x2ff1...1e2ec2) holding 14.77% and the next two addresses each maintaining substantial positions around 10.47% and 10.18% respectively. While this concentration level indicates meaningful capital consolidation among top holders, the distribution is not severely skewed, as the remaining 44.22% of tokens are dispersed across numerous other addresses. This fragmented distribution of minority holdings provides some counterbalance to the concentrated positions held by major stakeholders.

The current distribution structure suggests a moderately decentralized market environment with manageable concentration risk. The presence of multiple large holders with relatively balanced positions—rather than a single dominant stakeholder—reduces the likelihood of unilateral market control. However, the combined 55.78% stake held by top five addresses warrants monitoring, as coordinated actions among these major holders could potentially influence price dynamics or liquidity conditions. The substantial proportion of tokens held by dispersed addresses demonstrates reasonable retail participation and suggests that the token maintains sufficient decentralization to support organic market activity and healthy price discovery mechanisms.

Click to view current WCT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2ff1...1e2ec2 | 145037.86K | 14.77% |

| 2 | 0xa86c...6ba6e7 | 102794.47K | 10.47% |

| 3 | 0xf853...b61c61 | 100000.00K | 10.18% |

| 4 | 0x9ce1...0fd60d | 100000.00K | 10.18% |

| 5 | 0x3635...0c7246 | 100000.00K | 10.18% |

| - | Others | 433561.80K | 44.22% |

II. Core Factors Influencing WCT's Future Price

Supply Mechanism

- Token Distribution & Airdrop Pressure: WCT experienced significant price decline from $0.4 to $0.3 during its initial listing phase, primarily driven by airdrop selling pressure and weak market sentiment for newly launched tokens.

- Historical Pattern: Following its April 2025 launch, WCT prices declined sharply from $0.55 to $0.2, indicating substantial volatility in early trading phases.

- Current Impact: Early-stage market dynamics continue to exert downward pressure, with airdrop-related selling being a significant factor in price volatility.

Macroeconomic Environment

- Market Sentiment Impact: WCT's price trajectory is significantly influenced by overall market sentiment and macroeconomic changes, causing considerable price fluctuations typical of cryptocurrency assets.

- Regulatory Risks: Global regulatory changes pose risks to WCT's price stability and long-term outlook as regulatory frameworks evolve.

Technology Development & Ecosystem Building

- Network Expansion & Integration: WCT's value prospects are driven by WalletConnect network usage, characterized by increasing integration between wallets and DApps across the Web3 ecosystem.

- User Growth: Expanding user adoption within the WalletConnect network directly impacts protocol utility and token demand.

- Token Utility Enhancement: WCT token utility encompasses multiple functions including transaction fees, staking mechanisms, and governance participation, strengthening its fundamental value proposition.

- Decentralized Governance: WCT holders participate in ecosystem governance through staking, enabling voting on protocol upgrades, feature implementations, and other critical protocol decisions, fostering community-driven development.

III. WCT Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.0389 - $0.0763

- Base Case Forecast: $0.0763 (average price)

- Optimistic Forecast: $0.1121 (requires market stabilization and increased adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with steady accumulation of market participants and institutional interest

- Price Range Forecast:

- 2026: $0.0744 - $0.1187 (+23% growth)

- 2027: $0.0756 - $0.1139 (+39% growth)

- 2028: $0.0848 - $0.1234 (+44% growth)

- Key Catalysts: Ecosystem expansion, partnership announcements, technology upgrades, and increased trading volume on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.1168 - $0.1343 (+52% growth by 2029, assuming continued market adoption and stable macroeconomic conditions)

- Optimistic Scenario: $0.1442 - $0.1469 (+64% growth by 2030, assuming accelerated institutional adoption and positive regulatory developments)

- Transformative Scenario: $0.1469+ (assuming breakthrough technological innovations, mainstream enterprise adoption, and favorable global cryptocurrency market conditions)

- 2030-12-31: WCT anticipated at $0.1469 (base projection at upper range of long-term estimates)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1121 | 0.07626 | 0.03889 | 0 |

| 2026 | 0.11867 | 0.09418 | 0.0744 | 23 |

| 2027 | 0.11387 | 0.10642 | 0.07556 | 39 |

| 2028 | 0.12337 | 0.11015 | 0.08482 | 44 |

| 2029 | 0.13427 | 0.11676 | 0.10625 | 52 |

| 2030 | 0.14685 | 0.12552 | 0.11422 | 64 |

WalletConnect (WCT) Professional Investment Strategy and Risk Management Report

IV. WCT Professional Investment Strategy and Risk Management

WCT Investment Methodology

(1) Long-term Holding Strategy

-

Suitable Investors: Web3 infrastructure believers, long-term crypto portfolio allocators, and investors bullish on decentralized connectivity standards

-

Operational Recommendations:

- Accumulate during market downturns when WCT trades significantly below historical highs ($1.3968)

- Establish a core position aligned with your risk tolerance, treating WCT as exposure to Web3 infrastructure adoption

- Rebalance quarterly to maintain target allocation percentages

-

Storage Solutions:

- Use Gate Web3 Wallet for secure token storage with convenient trading access

- Implement a secure backup strategy with private key management best practices

- Consider cold storage for positions exceeding your active trading needs

(2) Active Trading Strategy

-

Technical Analysis Tools:

- 24-hour Price Action: Monitor the current 24h range ($0.07567–$0.08328) to identify support and resistance levels

- 30-day Trend Analysis: Track the -45.51% decline over 30 days to assess short-term momentum and potential reversals

- Volume Analysis: Observe the 24-hour trading volume of $706,047.19 to validate breakout moves and identify liquidity levels

-

Wave Trading Key Points:

- Identify support near recent lows ($0.0436 from October 10, 2025) before initiating long positions

- Monitor resistance zones around $0.10–$0.15 for potential profit-taking opportunities

- Use 1-hour charts (+0.38%) to time entry points within daily consolidation patterns

WCT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1–3% of total portfolio

- Active Investors: 3–7% of total portfolio

- Professional Investors: 5–15% of total portfolio (with hedging strategies)

(2) Risk Hedging Solutions

- Diversification Approach: Balance WCT exposure against other Web3 infrastructure tokens and established cryptocurrencies to reduce concentration risk

- Position Sizing: Limit individual trade sizes to 2–5% of portfolio to manage volatility-related drawdowns

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet provides integrated trading, secure custody, and recovery mechanisms for seamless WCT management

- Best Practice Approach: Maintain active trading allocations on Gate.com for liquidity, while storing long-term holdings in secure wallet solutions

- Security Considerations: Enable two-factor authentication, use strong passwords, regularly update wallet software, and never share private keys or recovery phrases with third parties

V. WCT Potential Risks and Challenges

WCT Market Risks

- Extreme Price Volatility: WCT has declined 81.65% over the past year and 45.51% over the last 30 days, indicating significant downside risk and potential for further depreciation

- Low Liquidity Risk: With 24-hour trading volume of only $706,047.19 and market cap of $14,218,232, large trades may experience significant slippage

- Market Sentiment Dependency: As a relatively new token (launched May 30, 2025), WCT is highly sensitive to cryptocurrency market cycles and investor sentiment shifts

WCT Regulatory Risks

- Evolving Compliance Framework: Web3 infrastructure tokens face increasing regulatory scrutiny as governments establish clearer cryptocurrency classification standards

- Jurisdictional Uncertainty: Different countries may classify WCT differently, potentially affecting its use cases and trading availability

- Compliance Changes: New regulations could impact WalletConnect's operational model or token utility, reducing demand and token value

WCT Technology Risks

- Protocol Dependency: WCT's value depends on continued WalletConnect adoption; technical vulnerabilities or competitive threats could undermine this foundation

- Scaling Challenges: As Web3 adoption grows, WalletConnect's infrastructure must scale effectively; technical failures could damage user trust and token economics

- Integration Risk: Deprecation or replacement of WalletConnect as the industry standard connectivity solution would significantly impact token utility

VI. Conclusion and Action Recommendations

WCT Investment Value Assessment

WalletConnect represents critical Web3 infrastructure with a proven user base of 45 million users and 275 million connections globally. The WCT token's transition toward decentralization aligns with long-term Web3 adoption trends. However, the 81.65% year-over-year decline, recent 45.51% monthly loss, and relatively low trading liquidity present substantial near-term risks. WCT is suitable primarily for investors with high risk tolerance, strong conviction in Web3 infrastructure adoption, and time horizons exceeding 2–3 years. The token's current valuation reflects significant market skepticism, creating both downside risk and potential asymmetric upside for those comfortable with volatility.

WCT Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5–1% of portfolio), dollar-cost average small purchases on Gate.com during periods of market weakness, and prioritize learning about WalletConnect's role in Web3 infrastructure before expanding exposure

✅ Experienced Investors: Establish core positions (3–5% allocation) during significant drawdowns below $0.05, employ technical analysis to time entries around support levels, and consider rebalancing quarterly based on adoption metrics

✅ Institutional Investors: Conduct thorough due diligence on WalletConnect's governance structure, revenue model sustainability, and competitive positioning; consider larger allocations (5–15%) only after validating long-term protocol viability and tokenomics alignment

WCT Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of WCT tokens with immediate settlement, ideal for long-term holders and conservative traders

- Limit Orders: Set buy orders below support levels ($0.05–$0.06) to accumulate positions during downturns while managing entry prices

- Portfolio Tracking: Monitor WCT performance monthly on Gate.com's portfolio dashboard, comparing performance against Web3 benchmarks and adjusting allocation accordingly

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors must conduct independent research and consult professional financial advisors before committing capital. Never invest more than you can afford to lose. Past performance does not guarantee future results. Market conditions and regulatory environments change rapidly in crypto markets.

FAQ

What is the future of the WCT coin?

WCT coin shows strong growth potential with projected price of $0.055125 by 2027, reflecting a 10.25% growth rate. Market trends indicate positive momentum for WalletConnect's ecosystem expansion and adoption.

Is WCT a good investment?

Yes, WCT is considered a strong investment choice. Analyst consensus favors buying, with strong market fundamentals and positive growth potential making it an attractive opportunity for investors.

Is a WCT token a good investment?

WCT token presents strong investment potential as WalletConnect expands its Web3 integrations. With growing adoption and increasing transaction volume in the ecosystem, WCT demonstrates solid long-term growth prospects for investors seeking Web3 exposure.

What is the price prediction for WCT coin listing?

WCT is expected to range between $0.0760 and $0.0790 in the next 24 hours, with a predicted price of $0.0825 tomorrow, representing a 6.37% gain.

2025 RLC Price Prediction: Will RLC Reach $10 in the Next Bull Run?

2025 STOS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 PPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for Investors

2025 SQR Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 LIY Price Prediction: Navigating Market Trends and Potential Growth Factors

2025 CHAPZ Price Prediction: Analyzing Market Trends and Potential Growth Factors

Promising Affordable Cryptocurrencies Set to Surge by 2025

Evaluating the Trustworthiness of BitTorrent Token for Web3 Investors

Rizzmas Coin Overview: Essential Guide to Updates and Opportunities

2025 NETX Price Prediction: Expert Analysis and Market Forecast for the Next Generation Technology Token

Best Bitcoin Debit Cards for 2025: Your Complete Guide