2025 XPL Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: XPL's Market Position and Investment Value

Plasma (XPL), as a high-performance layer 1 blockchain purpose-built for stablecoins, has established itself as a significant player in the cryptocurrency market since its inception. As of 2025, Plasma's market capitalization has reached $870,300,000, with a circulating supply of approximately 1,800,000,000 tokens, and a price hovering around $0.4835. This asset, often referred to as the "stablecoin blockchain," is playing an increasingly crucial role in facilitating zero-fee USD₮ transfers and supporting confidential payments.

This article will provide a comprehensive analysis of Plasma's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. XPL Price History Review and Current Market Status

XPL Historical Price Evolution

- September 2025: XPL reached its all-time high of $1.692, marking a significant milestone for the project

- September 2025: Shortly after the peak, XPL experienced a sharp decline, hitting its all-time low of $0.075

- October 2025: The market has shown signs of recovery, with XPL price stabilizing and showing positive momentum

XPL Current Market Situation

As of October 16, 2025, XPL is trading at $0.4835, representing a 3.52% increase in the last 24 hours. The token has a market capitalization of $870,300,000, ranking it 104th in the overall cryptocurrency market. XPL's trading volume in the past 24 hours stands at $24,916,156, indicating active market interest.

Despite the recent positive short-term performance, XPL is still navigating through a challenging period. The token has experienced a significant decline of -44.5% over the past week and -41.97% over the last 30 days. However, it's worth noting that XPL has shown impressive long-term growth, with a 153.92% increase over the past year.

The current circulating supply of XPL is 1,800,000,000 tokens, which represents 18% of the total supply of 10,000,000,000 XPL. This relatively low circulation ratio suggests potential for future market dynamics as more tokens enter circulation.

Click to view the current XPL market price

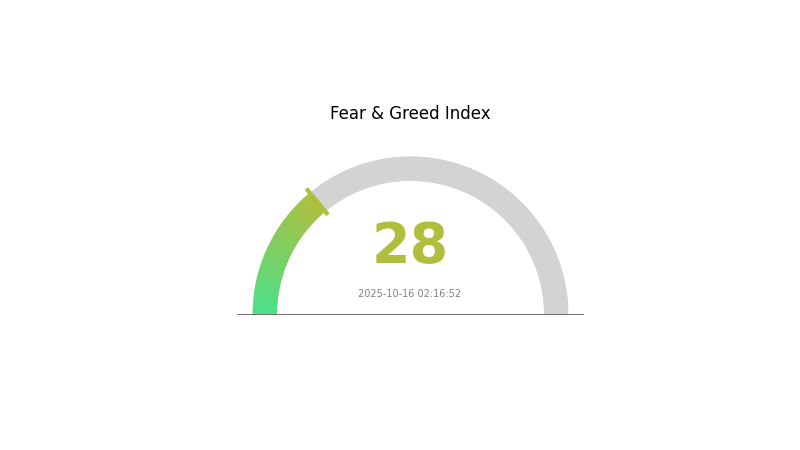

XPL Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index registering at 28. This indicates a cautious sentiment among investors, potentially signaling a buying opportunity for those who follow the "be greedy when others are fearful" mantra. However, it's crucial to conduct thorough research and consider multiple factors before making investment decisions. Keep an eye on market trends and news to gauge potential shifts in sentiment.

XPL Holdings Distribution

The address holdings distribution data for XPL reveals a highly decentralized ownership structure. With no single address holding a significant percentage of the total supply, the risk of market manipulation or price volatility due to large holders is minimal.

This distribution pattern suggests a healthy and diverse ecosystem for XPL, with ownership spread across a wide range of participants. Such a structure typically indicates strong community engagement and reduces the potential for sudden market shocks caused by the actions of individual large holders.

The absence of concentrated holdings also points to a robust on-chain stability for XPL. This decentralized structure aligns well with the principles of blockchain technology, potentially fostering greater trust and long-term sustainability in the XPL market.

Click to view the current XPL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing XPL's Future Price

Supply Mechanism

- Token Unlocks: Significant token releases scheduled for 2026, including 18 billion XPL (18% of circulating supply) for U.S. participants on July 28, 2026, and 25% of team and investor tokens starting July 2026.

- Historical Pattern: Similar projects like Avalanche experienced 20-30% price drops during unlock periods.

- Current Impact: Potential dilution risk if market demand is insufficient, but could stabilize prices if demand remains strong.

Institutional and Whale Dynamics

- Corporate Adoption: Collaborations with over 100 DeFi partners, including Aave and Ethena, expected to roll out between 2026-2027.

Macroeconomic Environment

- Geopolitical Factors: Regulatory developments, particularly in the U.S., will play a crucial role in XPL's future.

Technical Development and Ecosystem Building

- Zero-Fee Transfers Expansion: Plans to extend zero-fee USDT transfers beyond Plasma's own products to third-party applications, leveraging PlasmaBFT's high throughput technology.

- Ecosystem Applications: Potential competition with Tron for stablecoin transfer market share, as Tron currently handles about 60% of USDT transaction volume.

III. XPL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.32307 - $0.4822

- Neutral prediction: $0.4822 - $0.53042

- Optimistic prediction: $0.53042 - $0.58 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.31168 - $0.6015

- 2028: $0.32727 - $0.6488

- Key catalysts: Technological advancements, expanded use cases, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.61148 - $0.73989 (assuming steady project growth and market stability)

- Optimistic scenario: $0.73989 - $0.99145 (assuming widespread adoption and favorable market conditions)

- Transformative scenario: $0.99145 - $1.20 (assuming breakthrough innovations and mass market acceptance)

- 2030-12-31: XPL $0.73989 (projected average price for 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.53042 | 0.4822 | 0.32307 | 0 |

| 2026 | 0.58732 | 0.50631 | 0.39492 | 4 |

| 2027 | 0.6015 | 0.54681 | 0.31168 | 13 |

| 2028 | 0.6488 | 0.57416 | 0.32727 | 18 |

| 2029 | 0.8683 | 0.61148 | 0.36689 | 26 |

| 2030 | 0.99145 | 0.73989 | 0.39954 | 53 |

IV. XPL Professional Investment Strategies and Risk Management

XPL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and long-term vision

- Operational suggestions:

- Accumulate XPL during market dips

- Set up regular investment plans

- Store XPL in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to stablecoins

- Set strict stop-loss and take-profit levels

XPL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for XPL

XPL Market Risks

- Volatility: Extreme price fluctuations common in cryptocurrency markets

- Liquidity: Potential difficulties in executing large orders without significant price impact

- Competition: Emergence of new stablecoin-focused blockchains

XPL Regulatory Risks

- Stablecoin regulations: Potential for stricter oversight of stablecoin issuers and platforms

- Cross-border restrictions: Varying regulatory approaches in different jurisdictions

- AML/KYC requirements: Increased compliance burdens for users and platforms

XPL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Risk of network congestion during high-demand periods

- Interoperability issues: Potential difficulties in cross-chain interactions

VI. Conclusion and Action Recommendations

XPL Investment Value Assessment

Plasma (XPL) presents a compelling long-term value proposition as a purpose-built blockchain for stablecoins, addressing a growing market need. However, short-term risks include regulatory uncertainties and potential market volatility.

XPL Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market dynamics ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Explore partnerships and integrate Plasma into existing financial products

XPL Trading Participation Methods

- Spot trading: Buy and sell XPL on Gate.com's spot market

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance applications built on the Plasma network

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is XPL a good investment?

XPL shows promise with 4 Buy ratings and a $1.50 price target. Current trends suggest growth potential, making it an attractive investment option.

What is the price prediction for XPL stock?

XPL stock is predicted to be priced between $0.614675 and $0.824304 in 2025, with an expected 0.55% increase in the next day.

What is the price prediction for XRP in 2025?

Based on market analysis, XRP price is predicted to reach between $5.50 and $8.50 by 2025, with potential for higher growth depending on market conditions and adoption rates.

What is XPL crypto?

XPL is the native token of the Plasma blockchain, used for transactions and rewards. It's offered through public sales with specific terms. Plasma provides the underlying infrastructure for XPL.

What is the Current Market Overview for XPL Cryptocurrency in 2025?

PYUSD vs ZIL: Comparing Stablecoins and Blockchain Platforms for Digital Payments

FDUSD vs APT: Comparing Stablecoin Performance in Volatile Markets

USDP vs ZIL: Comparing Stablecoin Performance in Volatile Markets

Is MeterStable (MTR) a good investment?: Analyzing the Potential and Risks of this Stablecoin in the Crypto Market

RSR vs LTC: Comparing Risk-Sharing Reserves and Long-Term Care Insurance for Retirement Planning

What is Uniswap (UNI) price volatility: historical trends, support resistance levels, and 2025 market predictions?

Yuga Labs Sells Two NFT Games to Streamline BAYC Team

Why the Silence on W Coin's Listing Date? Understanding Cryptocurrency Exchange Delays

What is AIV: A Comprehensive Guide to Avian Influenza Virus and Its Global Impact

What is AFC: A Comprehensive Guide to the American Football Conference