Trading Moment: Japan's rate hike triggers, Bitcoin faces a critical test at $81,000, Ethereum's rebound is weak

Daily Market Highlights and Trend Analysis, produced by PANews.

1. Market Observation

Despite the US November CPI year-over-year unexpectedly dropping to 2.7%, with core CPI falling to 2.6%, hitting a new low since 2021, fueling market expectations of the Federal Reserve accelerating rate cuts, the reliability of this report has been widely questioned due to data collection disruptions caused by the government shutdown. The market wavers amid complex signals; on one hand, White House officials believe the Fed has "ample room to cut rates"; on the other hand, the Bank of Japan raised its benchmark interest rate to 0.75%, a 30-year high, continuing to tighten global liquidity. On the regulatory front, the CLARITY Act, aimed at clarifying rules for the crypto market, is expected to enter the Senate for review in January next year, bringing positive industry expectations. However, the financial markets are facing the largest-ever quarterly concentrated derivatives settlement, with approximately $7.1 trillion in risk exposure.

PANews·1m ago

Why Holding 2,314 XRP Places You in the Elite Top 10% of Holders

As the XRP market evolves in 2025, the focus shifts from price speculation to wealth distribution, with 2,314 XRP marking entry into the top 10% of holders. This milestone highlights the concentrated ownership and growing barriers for retail investors amid increasing demand and institutional adoption.

Cryptoknowmics·1m ago

Santiment: Widespread pessimistic sentiment could be a reversal signal for Bitcoin and the crypto market

Pessimistic sentiment is increasing on social media after Bitcoin dropped to $84,800, with concerns from retail investors. However, data shows that this fear often signals the market bottom, paving the way for a price recovery.

BTC0.55%

TapChiBitcoin·2m ago

When the Federal Reserve is hijacked by politics, is the next Bitcoin bull market coming?

The Federal Reserve has cut interest rates, but the market is in panic.

On December 10, 2025, the Federal Reserve announced a 25 bps rate cut and purchased $40 billion in short-term debt within 30 days. Traditionally, this is a major positive signal, but the market reaction was unexpected: short-term interest rates fell, while long-term Treasury yields rose instead of falling.

Behind this abnormal phenomenon lies a more dangerous signal: investors are pricing in the structural risk of "loss of Federal Reserve independence." For crypto investors, this is a critical moment to reassess asset allocation.

Rate Cuts Are Not Simple

On the surface, a 25 bps rate cut is a routine response to economic slowdown. From an economics textbook perspective, rate cuts are usually seen as standard tools to stimulate the economy, reduce corporate financing costs, and boost market confidence.

But the timing is too "coincidental."

Before the decision was announced, Trump's economic aides and the Federal Reserve...

区块客·9m ago

What Is Chainalysis' 2025 Report on North Korean Crypto Hacks? DPRK-Linked Theft Hits $2 Billion – Up 51% YoY

According to blockchain analytics firm Chainalysis' latest report , hackers linked to North Korea stole approximately $2 billion in cryptocurrency assets throughout 2025—a 51% increase from 2024 levels.

CryptopulseElite·12m ago

Gate Institute: BTC and ETH fluctuate and consolidate, while AI and privacy computing sectors show structural strength

Cryptocurrency Market Overview

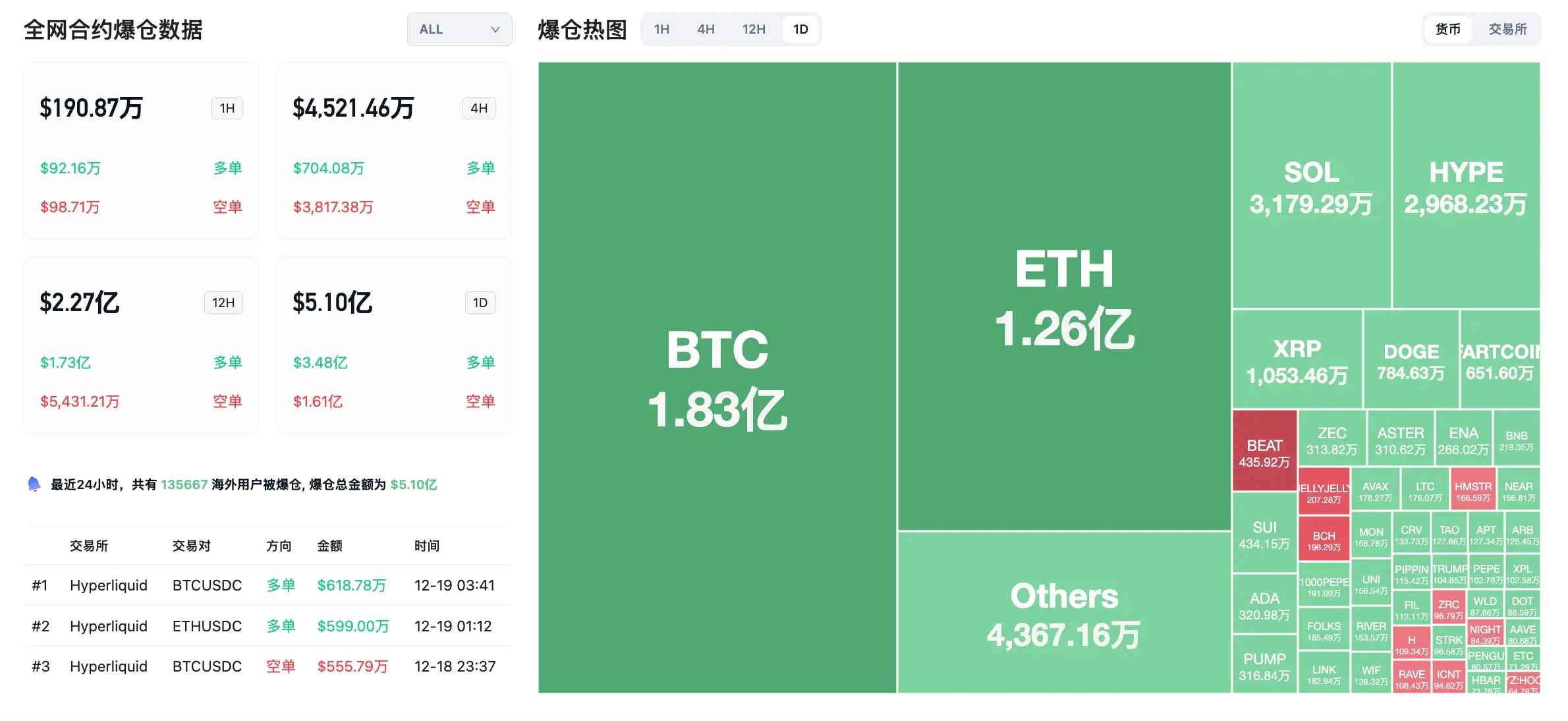

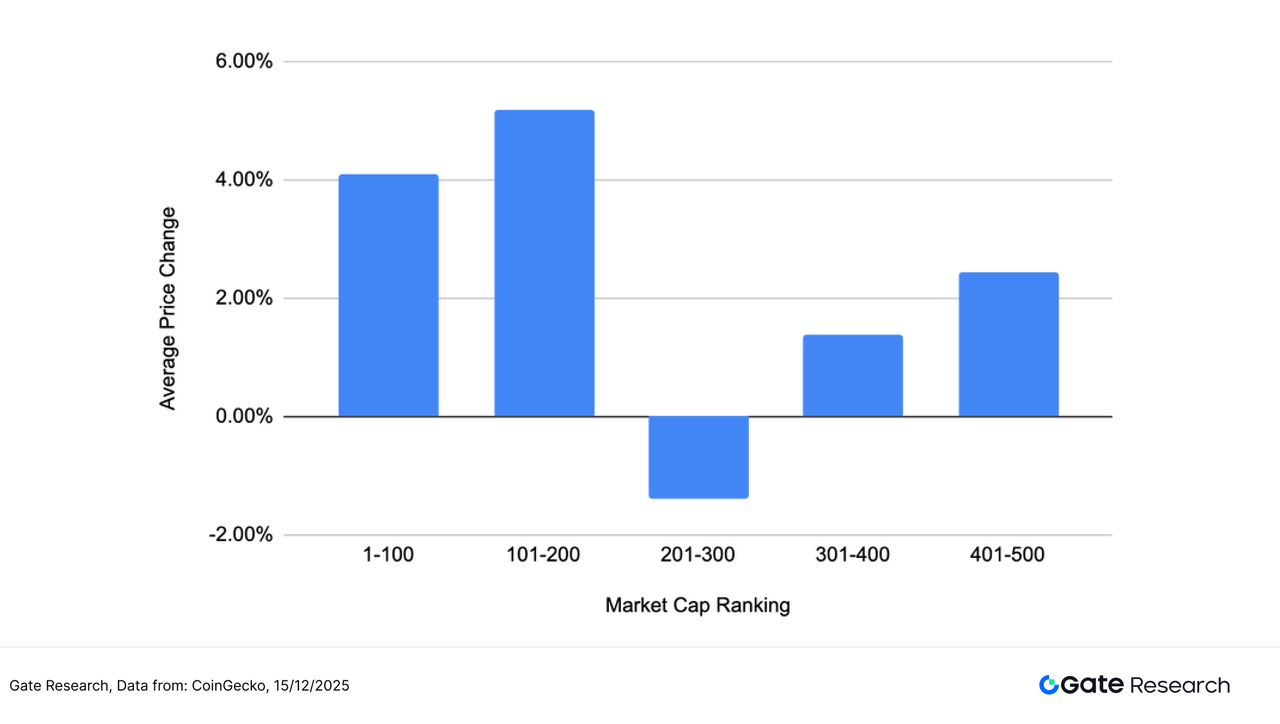

According to CoinGecko data, from December 2 to December 15, 2025, the global market trend was mixed. Despite the Fed's rate cuts as scheduled, policy disagreements and expectations of pausing rate cuts suppressed risk appetite; gold led traditional assets with an annual increase of over 60%, stock markets hit new highs but AI infrastructure sector sentiment cooled. Fear sentiment in the crypto market has risen, trading volume is concentrated in mainstream assets and stablecoins, and overall funds are leaning towards defensive and volatility hedging.【1】

In terms of market structure, BTC surged above $94,000 but then significantly retreated, forming a lower high structure on the 4-hour chart, with the $90,000–$91,000 range shifting from support to resistance; ETH retreated from around $3,400 but remains above $3,000, oscillating with a relatively more stable price structure. Some

GateResearch·13m ago

2026 Crypto King Competition: Bitcoin, Ethereum, XRP, who will win the next bull market?

On the eve of 2026, the crypto market has gradually entered a consolidation and maturity phase after reaching a new all-time high. Bitcoin, relying on the consensus of "digital gold," has repeatedly solidified its support around the $80,000 key level; Ethereum, benefiting from the Pectra upgrade and the landing of spot ETFs, has stabilized its ecosystem around $2,900; XRP, after making favorable progress in the US SEC lawsuit, is once again attracting institutional attention. This article will analyze the technical patterns, growth engines, and potential risks of the three core assets, and explore how the turning point in global liquidity and the formation of regulatory frameworks will shape the market landscape in 2026.

MarketWhisper·15m ago

The largest trial in the history of money laundering cases! 1,601 witnesses set a record, with the main suspect denying all charges.

Taiwanese currency suspected of money laundering, a major case involving 2.3 billion yuan, enters preparatory procedures. The main suspect, Shi Qiren, fully denies the charges and has summoned 1,601 witnesses. The Shilin District Court has approved all requests, with the scale of the trial creating a record in domestic judiciary. The court session may be scheduled for April next year.

MarketWhisper·17m ago

Gate Research Institute: CPI Surge and Reversal | Options Selling Pressure and Risk-Aversion Sentiment Resonance

Cryptocurrency Asset Overview

BTC (-0.91% | Current Price 85,356.6 USDT)

BTC has experienced a continuous pattern over the past two days of “failed to break higher → rapid volume-driven decline → weak rebound at lows.” In the past 24 hours, boosted by short-term sentiment from CPI data, BTC briefly surged above $89,000; however, in the $89,000–$90,000 range, structural selling pressure was evident, followed by several large-bodied 1H candlesticks, causing the price to fall quickly. During the decline, coupled with short-term leveraged positions being liquidated and long stops being triggered, BTC briefly dipped to $84,460. The current price is in a low-level technical correction phase after the decline, with limited rebound from the lows and no trend reversal signals yet. From a technical perspective, the moving averages still show MA5

GateResearch·22m ago

Bankless's Top 10 Crypto Predictions for 2026: Bitcoin Breaks Cycle, ETFs Dominate Supply, and More Bold Calls

Renowned crypto research and media platform Bankless published its highly anticipated "Top 10 Crypto Predictions for 2026" , outlining an optimistic vision for the industry amid institutional maturation and regulatory progress.

CryptopulseElite·22m ago

Why does the Japanese Central Bank's interest rate hike first target Bitcoin?

Author: David, Deep Tide TechFlow

On December 15, Bitcoin dropped from $90,000 to $85,616, a decline of over 5% in a single day.

There were no major crashes or negative events that day, and on-chain data did not show any abnormal selling pressure. If you only follow crypto news, it's hard to find a "plausible" reason.

But on the same day, gold prices were at $4,323 per ounce, only down $1 from the previous day.

One dropped 5%, the other hardly moved.

If Bitcoin truly is "digital gold," a hedge against inflation and fiat currency devaluation, then its performance in risk events should resemble gold more. But this time, its movement clearly looks more like high Beta Tech Stocks on the Nasdaq.

What is driving this round of decline? The answer might be found in Tokyo.

Tokyo's Butterfly Effect

BTC0.55%

区块客·24m ago

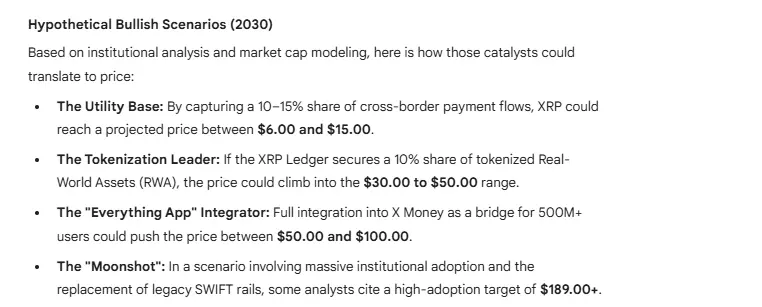

Here’s 1 XRP Price if It Captures Opportunity Around Tokenization and X Money Integration

With the DTCC breaking into the tokenization market and X Money looking to launch publicly, XRP has an integration opportunity in both areas.

Notably, XRP has stayed under strong selling pressure amid a broader market downturn. Over the past three months, the price has dropped about 35%, falling to

XLM1.14%

TheCryptoBasic·26m ago

The first unconditional income country is born! The people of the Marshall Islands receive $800 annually, payable in Crypto.

The Marshall Islands recently launched the world's first national unconditional basic income (UBI) program, providing residents with $800 annually. The program aims to alleviate living cost pressures, with funding coming from U.S. reparations. Although crypto options are available, most residents still prefer traditional payout methods. The IMF has expressed concerns about this program, citing financial and legal risks.

CryptoCity·27m ago

Bank of Japan Hikes Rates to a 30-Year High, but Bitcoin and Ethereum Stay Resilient

Date: Fri, Dec 19 2025 | 05:45 AM GMT

In a move that many had been anticipating for weeks, the Bank of Japan (BOJ) announced on December 19, 2025, that it was raising its key short-term interest rate by 25 basis points to 0.75%. This marks t

CoinsProbe·27m ago

What Is DAWN? Decentralized Wireless Network Project Raises $13 Million Series B Led by Polychain Capital

DAWN, a pioneering decentralized autonomous wireless network project, announced on December 19, 2025, the successful closure of a $13 million Series B funding round led by Polychain Capital.

CryptopulseElite·28m ago

Bear market venture capital cooling: Changes in crypto VC investment logic, where is the turning point in 2026?

As the cryptocurrency market enters a downtrend cycle, the movements of venture capital (VC) become a barometer for the industry. Since Bitcoin hit a record high of $126,000 in October 2025, its price has retraced approximately 25%, with the ripple effect quickly spreading to the primary market. This article delves into three major trends currently shaping the crypto VC market: downward revisions in startup valuation expectations, investment transactions concentrating on leading projects, and liquidity challenges following token generation events (TGE). Industry experts point out that the market downturn is prompting investors to shift from chasing short-term momentum to focusing on project fundamentals and long-term utility. The integration of artificial intelligence with blockchain, as well as the fusion of real-world assets (RWA) and blockchain, are seen as the most promising growth tracks for 2026.

MarketWhisper·28m ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28