#TopCoinsRisingAgainsttheTrend Even during broad market downturns, certain cryptocurrencies continue to rise against the trend, demonstrating relative strength and investor confidence. While much of the market experiences selling pressure, a select group of top coins has managed to defy gravity, attracting capital through strong fundamentals and growing real-world adoption.

Solana has emerged as one of the strongest performers, gaining momentum due to its high-speed, low-cost network and expanding ecosystem. Continued development in areas such as gaming, NFTs, and decentralized applications has reinforced its position as a leading layer-one platform. Increased developer activity and user engagement have translated into renewed investor interest, supporting price appreciation even during market weakness.

Chainlink has also shown notable resilience, driven by its critical role in providing secure and reliable oracle services. Its growing partnerships with traditional financial institutions and blockchain-based platforms have strengthened its long-term value proposition. As more real-world assets and financial products move on-chain, demand for trusted data feeds continues to rise, benefiting Chainlink’s network and token economics.

Polkadot’s performance reflects increasing interest in interoperability and cross-chain functionality. By enabling different blockchains to communicate and share data, Polkadot attracts developers seeking scalable and flexible infrastructure. Ongoing ecosystem upgrades and parachain development have supported network growth, helping maintain positive sentiment around the project.

These resilient coins share common characteristics: strong technological foundations, active developer communities, and clear real-world use cases. In uncertain markets, investors often rotate into assets with proven utility and long-term viability, viewing them as relatively safer options within the crypto space.

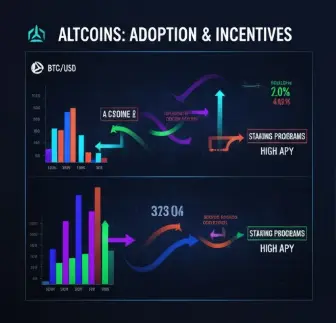

Identifying such outperformers requires consistent monitoring of on-chain activity, development progress, institutional involvement, and social sentiment. Metrics such as active addresses, transaction volume, and developer commits can provide early signals of underlying strength. At the same time, sentiment analysis helps gauge whether momentum is supported by fundamentals or driven by short-term speculation.

While the broader market may remain under pressure, these outliers can offer selective opportunities for relative outperformance. However, diversification and risk management remain essential, as even strong projects are vulnerable during major market corrections. A balanced approach allows investors to benefit from resilient assets while protecting capital in volatile conditions.

Solana has emerged as one of the strongest performers, gaining momentum due to its high-speed, low-cost network and expanding ecosystem. Continued development in areas such as gaming, NFTs, and decentralized applications has reinforced its position as a leading layer-one platform. Increased developer activity and user engagement have translated into renewed investor interest, supporting price appreciation even during market weakness.

Chainlink has also shown notable resilience, driven by its critical role in providing secure and reliable oracle services. Its growing partnerships with traditional financial institutions and blockchain-based platforms have strengthened its long-term value proposition. As more real-world assets and financial products move on-chain, demand for trusted data feeds continues to rise, benefiting Chainlink’s network and token economics.

Polkadot’s performance reflects increasing interest in interoperability and cross-chain functionality. By enabling different blockchains to communicate and share data, Polkadot attracts developers seeking scalable and flexible infrastructure. Ongoing ecosystem upgrades and parachain development have supported network growth, helping maintain positive sentiment around the project.

These resilient coins share common characteristics: strong technological foundations, active developer communities, and clear real-world use cases. In uncertain markets, investors often rotate into assets with proven utility and long-term viability, viewing them as relatively safer options within the crypto space.

Identifying such outperformers requires consistent monitoring of on-chain activity, development progress, institutional involvement, and social sentiment. Metrics such as active addresses, transaction volume, and developer commits can provide early signals of underlying strength. At the same time, sentiment analysis helps gauge whether momentum is supported by fundamentals or driven by short-term speculation.

While the broader market may remain under pressure, these outliers can offer selective opportunities for relative outperformance. However, diversification and risk management remain essential, as even strong projects are vulnerable during major market corrections. A balanced approach allows investors to benefit from resilient assets while protecting capital in volatile conditions.