MSFT Stock Price: How Cloud Growth and AI Innovation Fuel Microsoft’s Long-Term Upside

Long-Term Value in Microsoft Shares Comes Into Focus

As global tech stocks enter a new AI-driven cycle, Microsoft (MSFT) has returned to center stage. While its share price has seen minor short-term fluctuations, strong fundamentals and a rapidly expanding AI ecosystem are making sub-$500 levels an especially attractive entry point for long-term investors.

With surging demand for cloud services and rapid proliferation of AI solutions, Microsoft remains one of the tech giants with the greatest structural growth potential.

Cloud and AI: Dual Engines Powering Growth

Microsoft once again delivered standout results in its latest earnings report. In the third quarter of 2025 (corresponding to the first quarter of its 2026 fiscal year), revenue reached $77.7 billion, an 18.4% year-over-year increase—its highest single-quarter growth since 2022. Notably, Azure and other cloud services revenue rose 40% year-over-year, with demand so strong that even accelerated capacity expansion couldn’t fully meet it.

Commercial backlog soared 51% to $392 billion, providing a solid foundation for future revenue growth. Windows OEM and search advertising revenue grew 6% and 16%, respectively, reflecting Microsoft’s increasingly optimized and diversified revenue mix.

Cloud Infrastructure × AI

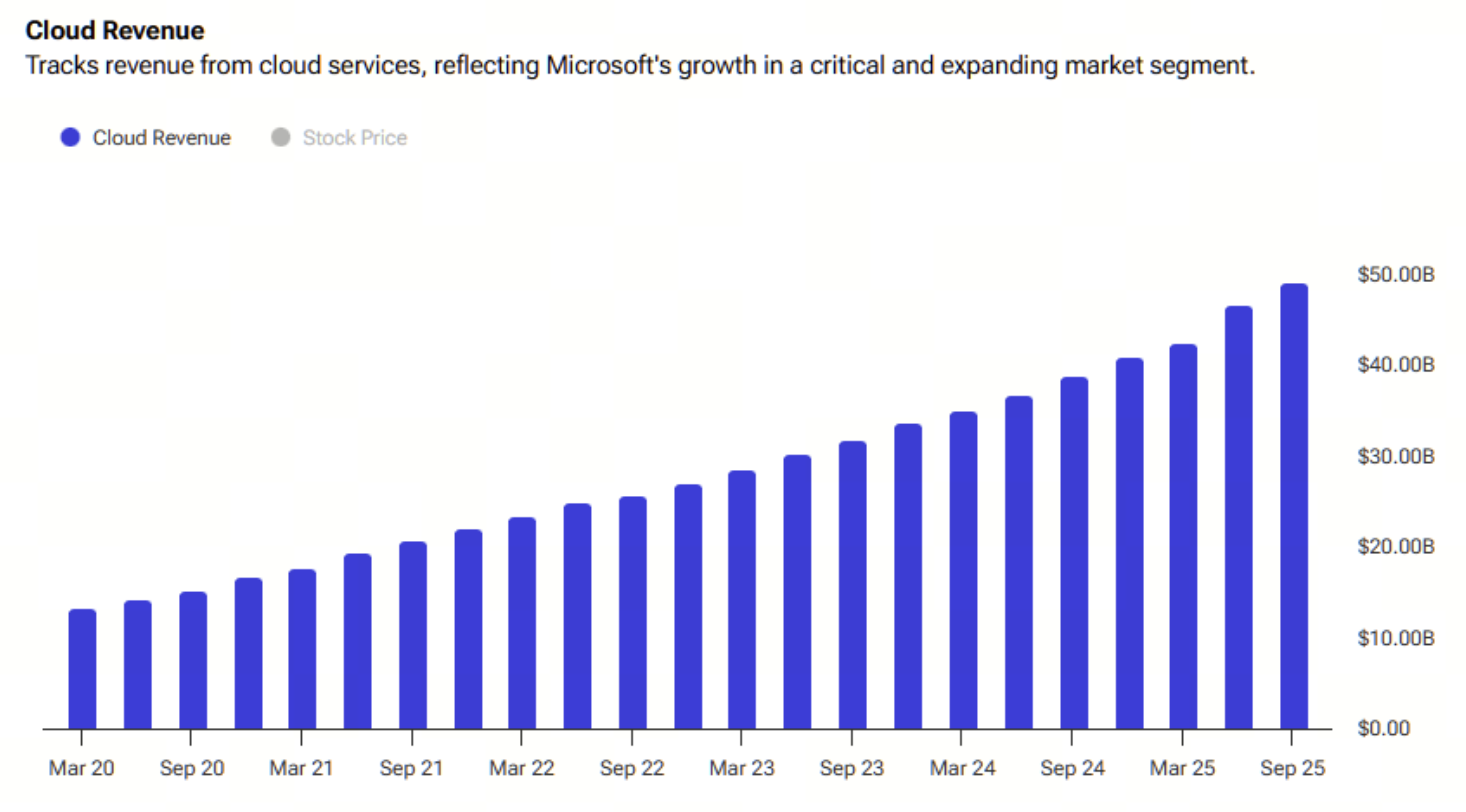

Microsoft’s cloud growth is now driven not just by AI enthusiasm around Copilot, but by deeper infrastructure upgrades and expanding enterprise demand. Revenue from the Intelligent Cloud segment reached $30.9 billion, a 28% year-over-year increase; total Microsoft Cloud revenue grew 26% to approximately $49.1 billion.

(Source: tipranks)

Microsoft is successfully building a robust growth flywheel that integrates cloud, AI, and productivity tools, prompting enterprise clients to invest even more heavily in data, computing, and automation.

Explosive Profit and Cash Flow Growth

Microsoft’s financial performance is equally impressive, with its EBITDA margin climbing to a record 60%, mainly driven by high-margin software and subscription businesses (Microsoft 365, Dynamics, GitHub) and the paid upgrade model for Copilot, its AI value-added service.

Despite ramping up infrastructure investment (with quarterly capital expenditures reaching $34.9 billion), Microsoft still delivered a robust $25.7 billion in free cash flow, underscoring its extraordinary cash generation and operational efficiency. Cloud gross margin dipped slightly to 68% in the short term, reflecting upfront costs from expanding AI server and GPU capacity, but these investments are expected to yield higher-value software and services revenue over the long term.

AI Flywheel in Full Swing

Microsoft’s AI strategy is rapidly advancing, highlighted by a long-term Azure contract with OpenAI worth up to $250 billion, which significantly enhances the visibility and sustainability of its cloud business. Additionally, Microsoft has secured a $9.7 billion, five-year deal with IREN to stabilize its GPU supply chain, while simultaneously expanding data center capacity in Texas and the UAE. These moves clearly demonstrate Microsoft’s steady reinforcement of its AI computing foundation, laying the groundwork for the next surge in revenue and profit.

Valuation and Market Perspectives

Although Microsoft’s current price-to-earnings ratio is around 31, expectations for strong double-digit revenue and EPS growth suggest the current price is not overstated. If fiscal 2026 EPS lands in the $15.5 to $16.5 range, the PEG ratio is about 2—considered reasonable, or even low, for a company with stable cash flow and ongoing AI momentum.

Analysts remain bullish. According to the latest market consensus, all 34 analysts surveyed rate Microsoft a “Strong Buy,” with an average target price of $633—implying about 25% upside.

For more on Web3, click to register: https://www.gate.com/

Conclusion

Microsoft’s growth narrative has evolved well beyond cloud expansion to encompass the integration of AI, productivity, and enterprise ecosystems. Backed by a strong financial structure, a leading product suite, and deepening AI investments, Microsoft’s upward momentum continues. For long-term investors, the current price range may represent a pivotal opportunity to participate in a core enterprise at the heart of the AI era.

Related Articles

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About

What Are Crypto Options?