Post content & earn content mining yield

placeholder

thecurrencyanalytics

Coinbase Cuts UK Ads After Regulator Attack - #bbc #sec #uk

View Original

- Reward

- like

- Comment

- Repost

- Share

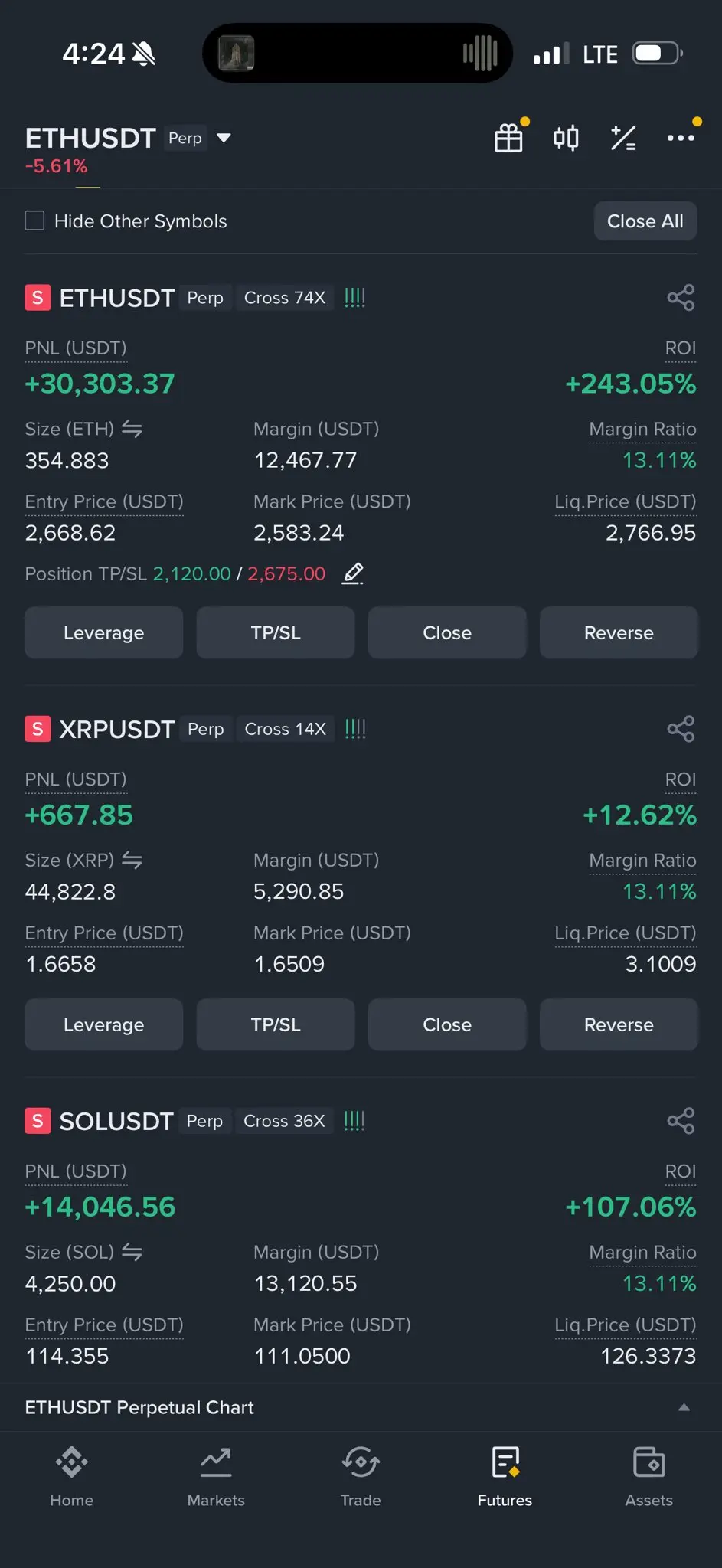

today my open position

- Reward

- like

- Comment

- Repost

- Share

being a $neet looks good here at 6.7m

- Reward

- like

- Comment

- Repost

- Share

鸡你太美

鸡你怎么那么美

Created By@WuMingchao

Listing Progress

0.00%

MC:

$0.1

Create My Token

📊 BTC | Liquidity Map

* 🔺 Upside: Dense liquidity cluster in the $79,000 – $82,000 zone.

* 🔻 Downside: Key liquidity cluster situated between $75,000 – $73,500.

📌 Key Takeaways:

Following a sharp sweep of the downside (stop-hunting), the price has reversed upward. Long positions have already been purged, and the market is now gravitating toward the buy-side liquidity (upper stops).

⚠️ Outlook:

A continued move toward the immediate upside liquidity is likely. Following this "liquidity grab," expect a pause or a potential pullback if sellers begin to distribution/offload at those higher le

* 🔺 Upside: Dense liquidity cluster in the $79,000 – $82,000 zone.

* 🔻 Downside: Key liquidity cluster situated between $75,000 – $73,500.

📌 Key Takeaways:

Following a sharp sweep of the downside (stop-hunting), the price has reversed upward. Long positions have already been purged, and the market is now gravitating toward the buy-side liquidity (upper stops).

⚠️ Outlook:

A continued move toward the immediate upside liquidity is likely. Following this "liquidity grab," expect a pause or a potential pullback if sellers begin to distribution/offload at those higher le

BTC2.42%

- Reward

- like

- Comment

- Repost

- Share

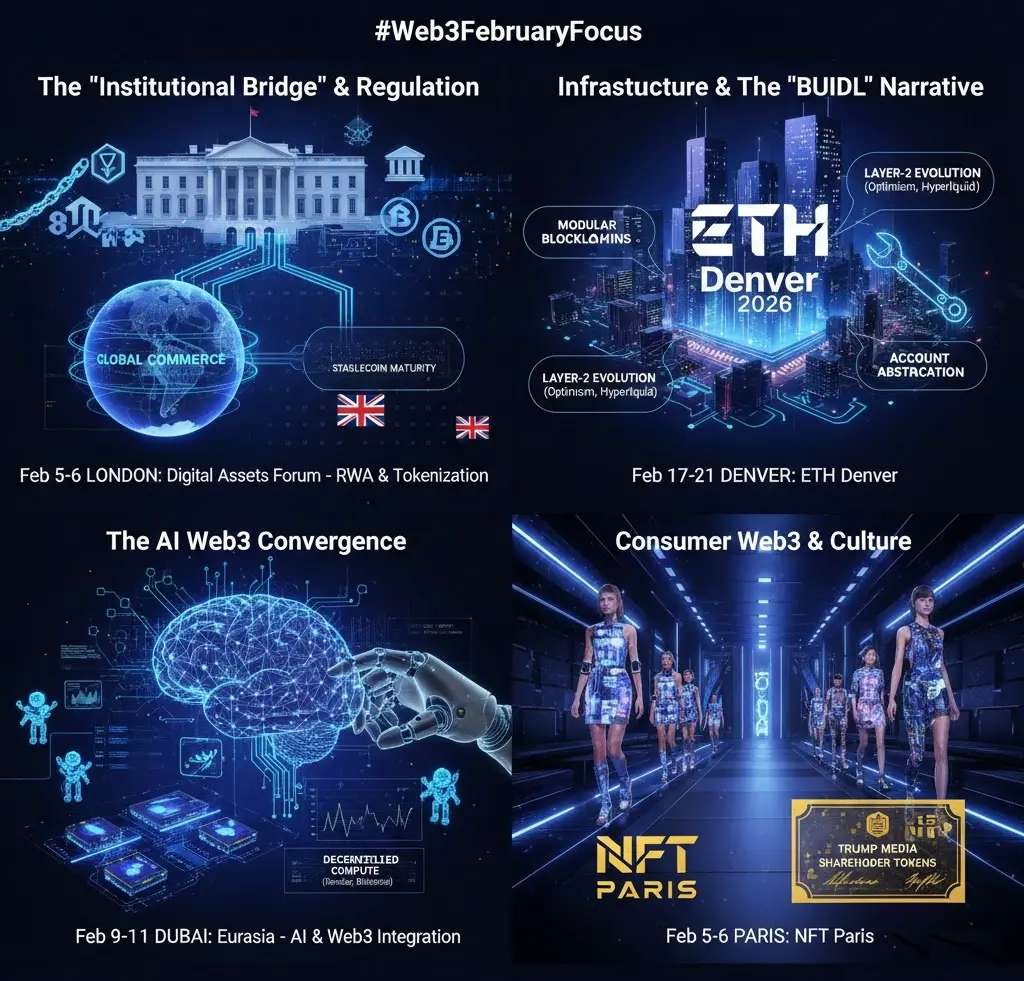

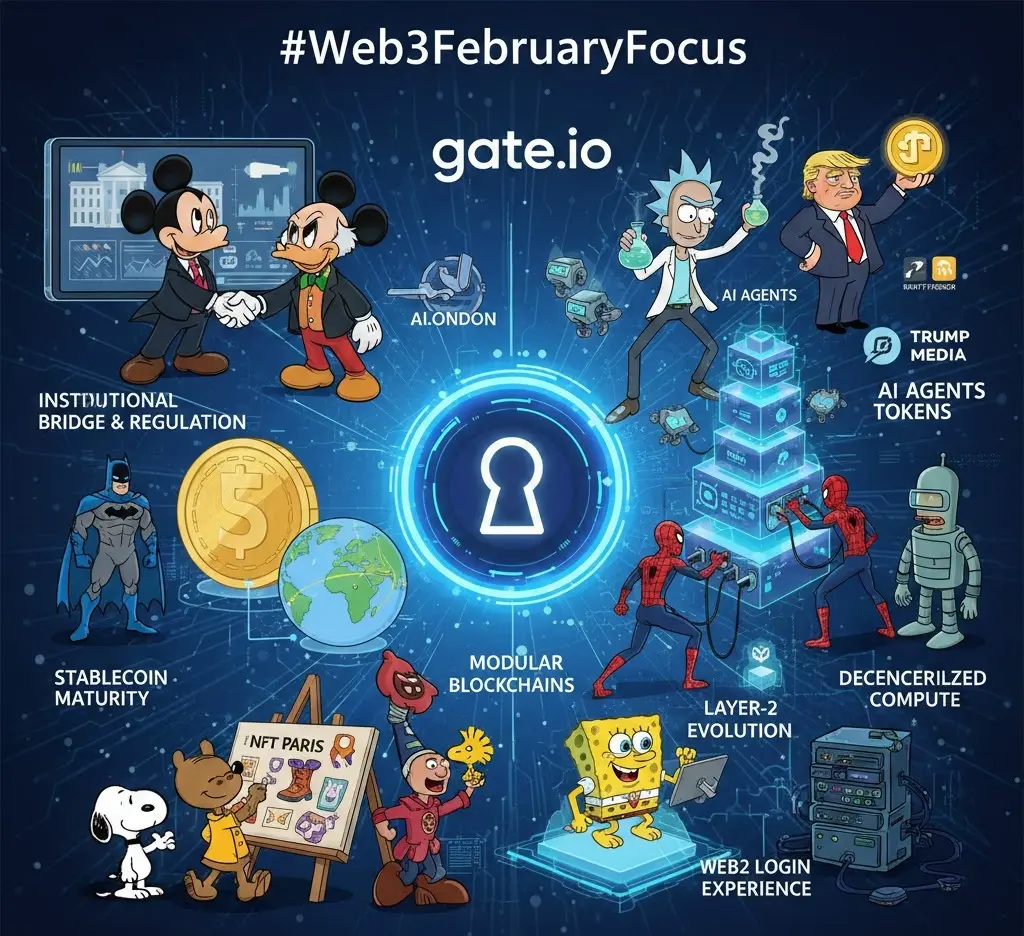

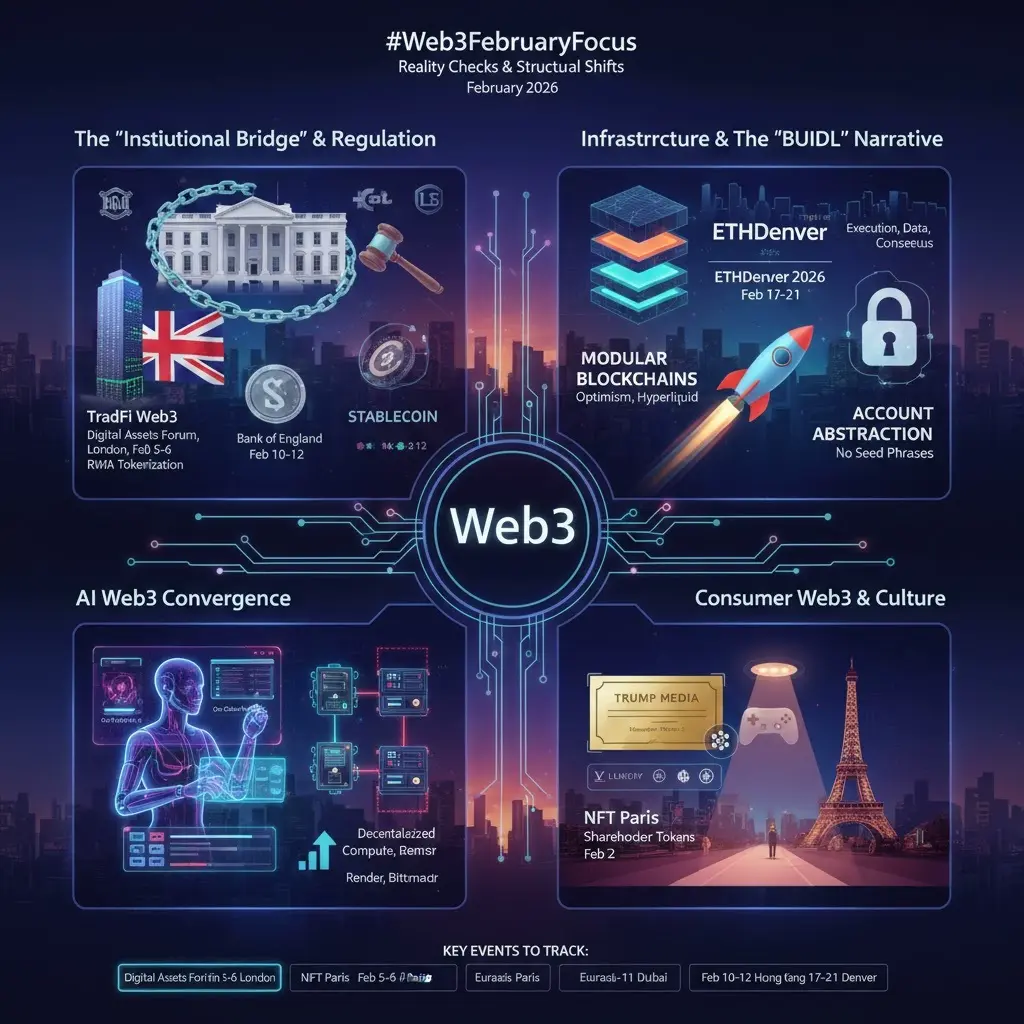

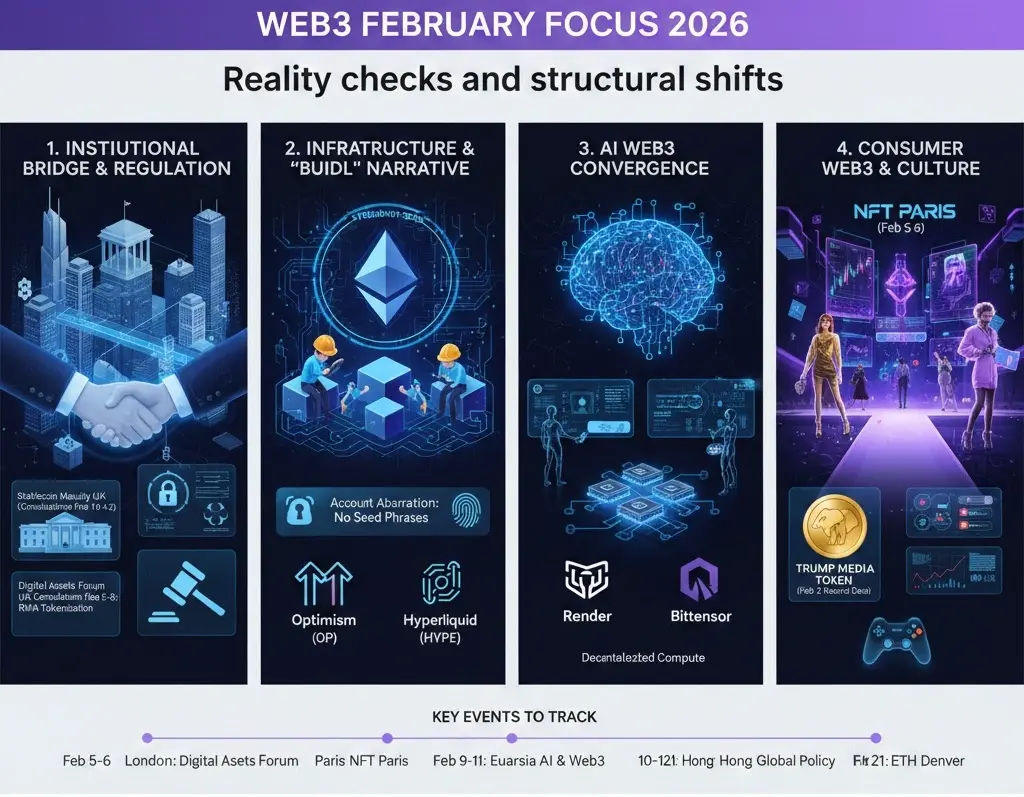

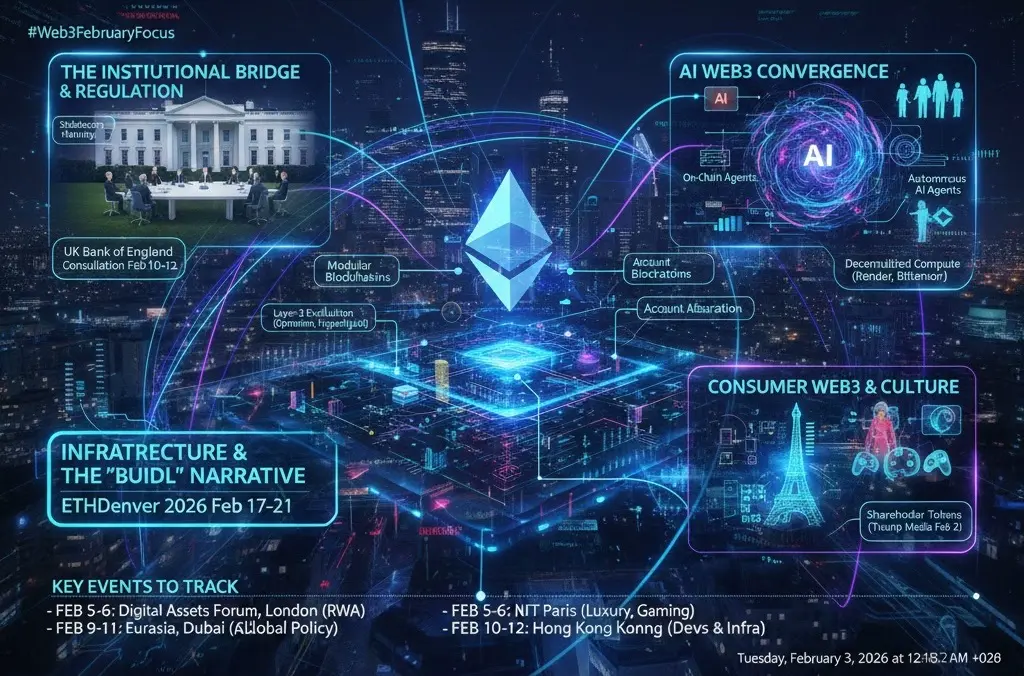

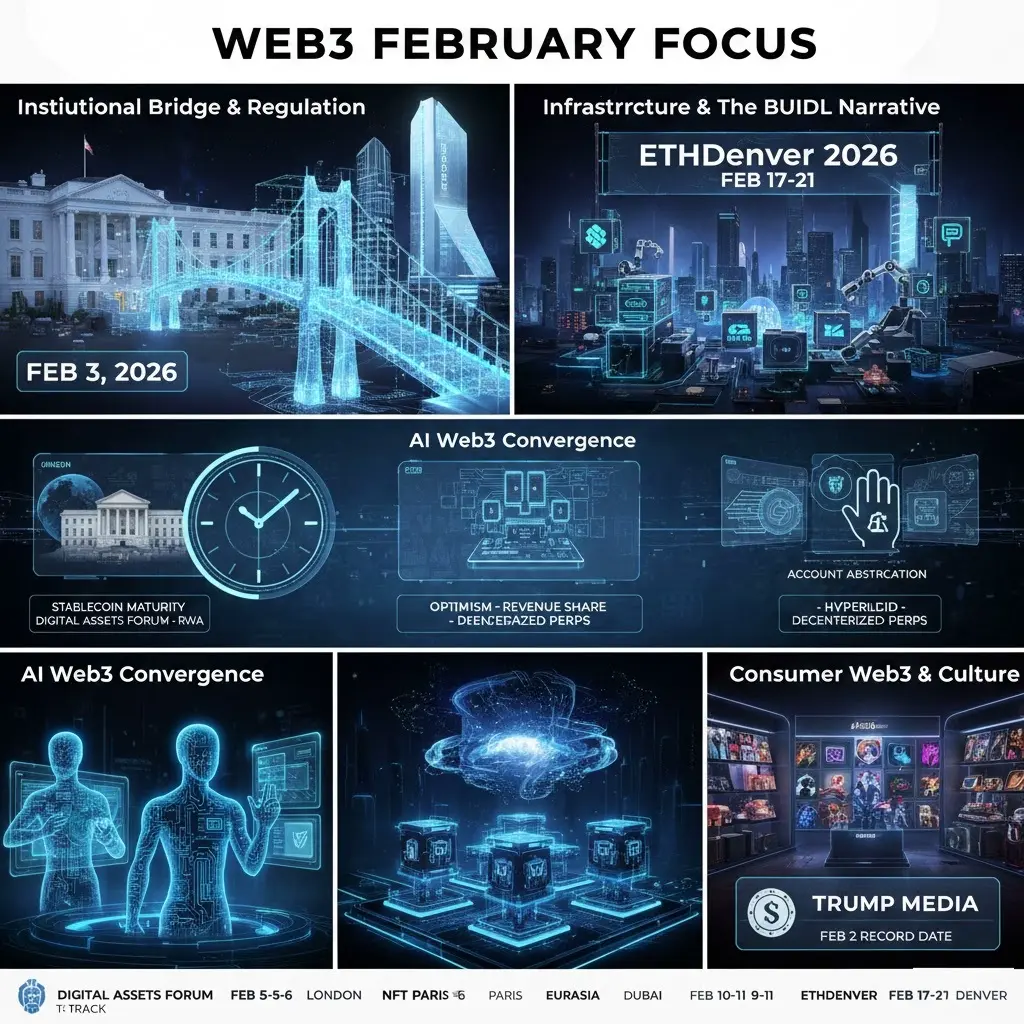

#Web3FebruaryFocus

Web3 February Focus is shaping up to be a critical month of "reality checks" and structural shifts. While January saw some market turbulence, February 2026 is where the industry is pivoting toward institutional integration and deep technical building.

Here are the four key sectors and narratives I’m watching most closely:

1. The "Institutional Bridge" & Regulation

February is a heavyweight month for policy. The narrative is shifting from "wild west" speculation to "regulated integration."

The White House Meeting: Early February kicked off with a high-stakes meeting between

Web3 February Focus is shaping up to be a critical month of "reality checks" and structural shifts. While January saw some market turbulence, February 2026 is where the industry is pivoting toward institutional integration and deep technical building.

Here are the four key sectors and narratives I’m watching most closely:

1. The "Institutional Bridge" & Regulation

February is a heavyweight month for policy. The narrative is shifting from "wild west" speculation to "regulated integration."

The White House Meeting: Early February kicked off with a high-stakes meeting between

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 3

- 2

- Repost

- Share

User_any :

:

Happy New Year! 🤑View More

Tonight's 100 points were earned in this way:

View Original

- Reward

- 1

- Comment

- Repost

- Share

$ETHETH Chart simplified.

- Reward

- like

- Comment

- Repost

- Share

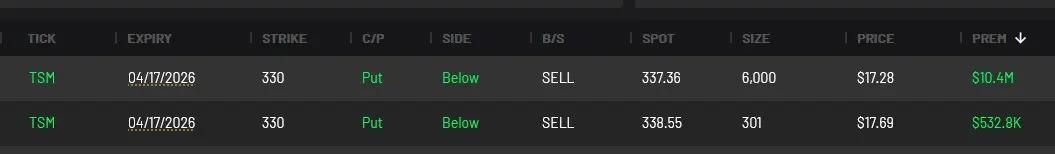

ballsy $TSM

- Reward

- like

- Comment

- Repost

- Share

Tom Lee says crypto has taken it worse than expected because the market doesn’t have any leverage right now. Broader economy is in pretty good shape.

- Reward

- like

- Comment

- Repost

- Share

#GateLunarNewYearOn-ChainGala

🎉Gate Live is kicking off the 2026 Lunar New Year On-Chain Gala, offering an exciting mix of trading, rewards, and interactive activities. Here’s a full guide to everything happening during the festival period.

🛠 Event Overview

The Lunar New Year On-Chain Gala is Gate Live’s holiday-themed celebration for traders and streamers. Unlike other exchanges that may pause activities during holidays, Gate keeps markets open, enabling users to continue trading and participating in reward campaigns.

Event Period: During Lunar New Year 2026

Platform: Gate Live

Special Foc

🎉Gate Live is kicking off the 2026 Lunar New Year On-Chain Gala, offering an exciting mix of trading, rewards, and interactive activities. Here’s a full guide to everything happening during the festival period.

🛠 Event Overview

The Lunar New Year On-Chain Gala is Gate Live’s holiday-themed celebration for traders and streamers. Unlike other exchanges that may pause activities during holidays, Gate keeps markets open, enabling users to continue trading and participating in reward campaigns.

Event Period: During Lunar New Year 2026

Platform: Gate Live

Special Foc

- Reward

- like

- Comment

- Repost

- Share

hjm

哈基米

Created By@UB资本IKUN

Listing Progress

0.00%

MC:

$0.1

Create My Token

BTC ETH XRP Markets Analysis

- Reward

- like

- Comment

- Repost

- Share

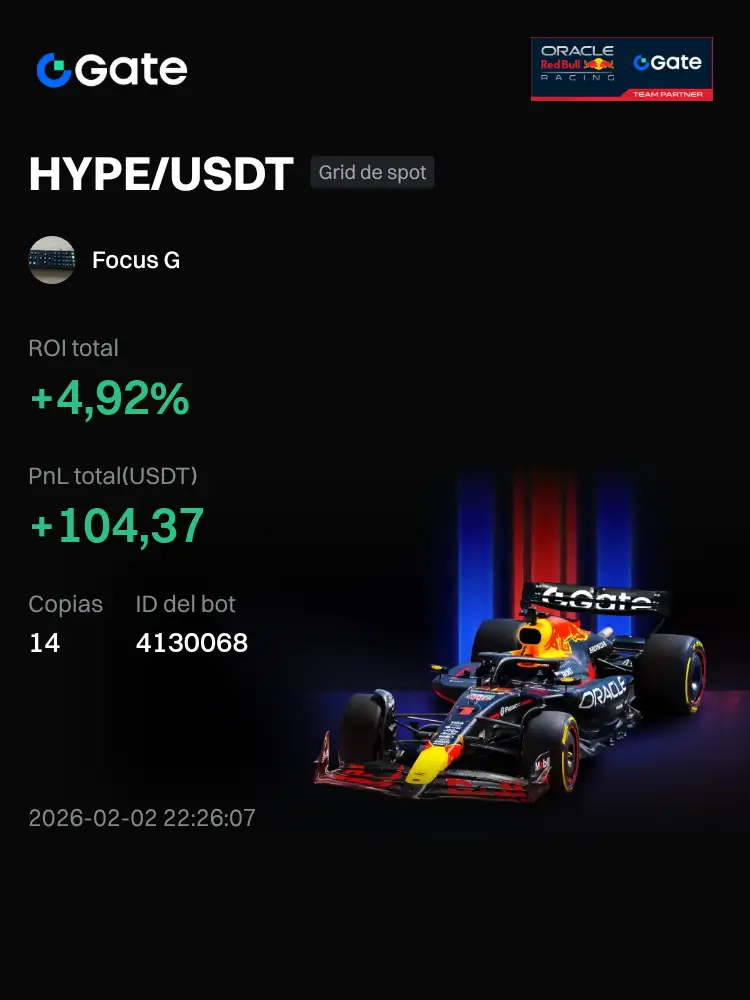

#Bots#Actualmente I'm using the HYPE/USDT Spot Grid bot on Gate. The ROI since the bot was created has reached +4.92%. We're in the right place. All aboard.

HYPE10.76%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN | ARENAR INTEL:🇺🇸 President Trump says talks with Iran are underway while a U.S. naval fleet heads toward the region amid tensions.#BreakingNews #USIran #Diplomacy #Tensions

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Technical Outlook on Altcoins: Ethereum and XRP Maintain Stability Near a Key Support Level.

Ethereum is trading above the $2200 mark but remains below the immediate resistance level at $2300. The daily low at $2157 acts as a support level. However, the overall trend remains predominantly bearish, as indicated by the MACD indicator on the daily chart.

A potential move below the MACD signal line, along with increasing red histogram bars, may prompt traders to adopt a defensive stance to reduce their risk exposure. If the support level tested at $2111 in June is broken, Ethereum's decline coul

View OriginalEthereum is trading above the $2200 mark but remains below the immediate resistance level at $2300. The daily low at $2157 acts as a support level. However, the overall trend remains predominantly bearish, as indicated by the MACD indicator on the daily chart.

A potential move below the MACD signal line, along with increasing red histogram bars, may prompt traders to adopt a defensive stance to reduce their risk exposure. If the support level tested at $2111 in June is broken, Ethereum's decline coul

- Reward

- 2

- Comment

- Repost

- Share

During the Chinese New Year, never tell your relatives that you're in the crypto world. Once your identity is exposed, a large crowd will gather around you. The first question is often: “You must have a lot of Bitcoin, right? Come on, let me see what Bitcoin looks like.” In the last bull market, Bitcoin soared to 69,000, but the most heartbreaking question from relatives and friends was: “Aren't you in the crypto world? Why didn't you get rich in this bull market?” I can't answer this question. Just like when I tell relatives that I’m working hard in Shanghai, they naturally think of the bustl

BTC2.42%

- Reward

- 1

- 2

- Repost

- Share

SanjinCapital :

:

这是我小Z,不是吗?View More

- Reward

- like

- Comment

- Repost

- Share

JUST IN: ⚡️ President Trumps White House executive director says:“Todays meeting between the crypto and banking industries was constructive, fact-based, and solutions-oriented.”

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More382.12K Popularity

12.39K Popularity

11.65K Popularity

7.35K Popularity

5.12K Popularity

Hot Gate Fun

View More- MC:$2.88KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.87KHolders:00.00%

News

View MoreFederal Reserve has a 91.1% probability of maintaining interest rates unchanged in March

2 m

Trump's dispute with Powell has become a "stumbling block" for Wash's appointment.

27 m

Trump: Working with House Speaker Johnson to push the funding bill

28 m

SpaceX memo confirms merger with xAI, valuation reaches $1.25 trillion

29 m

New York Attorney General Criticizes GENIUS Stablecoin Bill: Insufficient Consumer Protection

30 m

Pin