Trump: The next Federal Reserve Chair must be a "super dovish" who regularly consults with me on interest rates. Has the Fed's independence been destroyed?

Trump explicitly stated that the next Federal Reserve Chair must believe in "large-scale rate cuts" and will soon announce a candidate. He demands lowering interest rates to the crisis level of 1% and believes the next Chair should consult with him on rate setting. This article is sourced from Wall Street Insights, compiled, translated, and written by Foresight News.

(Previous context: Trump named Kevin Warsh as his "preferred" candidate for the next Federal Reserve Chair, with Kevin Hassett's chances dropping by 30%)

(Additional background: Trump: Rate cuts are a litmus test for the Federal Reserve Chair, and tariffs may be adjusted to lower the prices of some goods)

Table of Contents

All three candidates support rate cuts, but to varying degrees

Trump demands the Federal Reserve Chair consult with him on rate decisions

Rate cuts have limited impact on mortgage rates

On Wednesday, U.S. time, President Trump made a nationwide speech in which

動區BlockTempo·5m ago

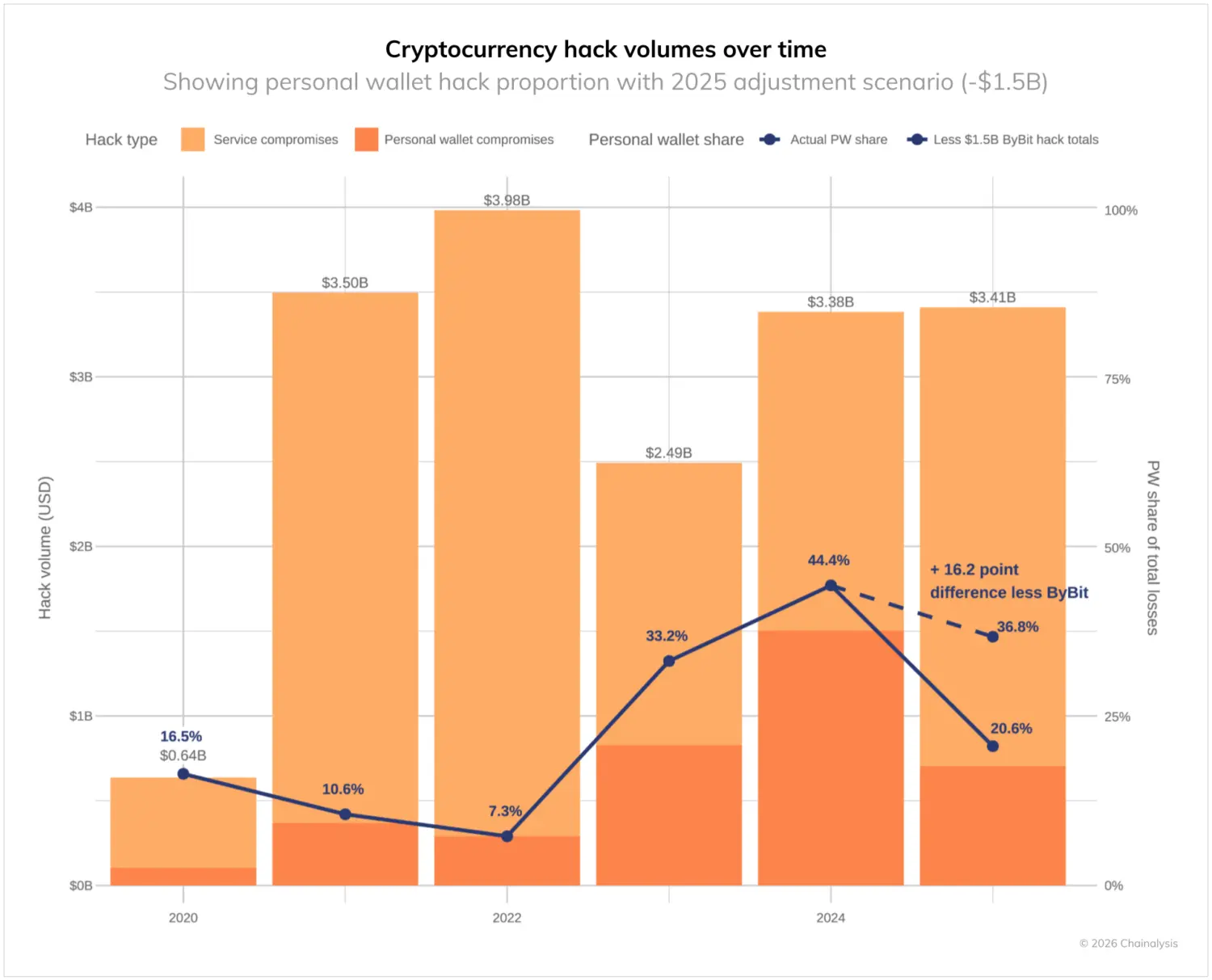

North Korean hackers set a record in 2025 by stealing $2 billion in cryptocurrency; 45-day money laundering scheme exposed

Blockchain analysis firm Chainalysis's latest report reveals that North Korea-linked hackers stole at least $2 billion in cryptocurrency in 2025, setting a record high and representing a 51% year-over-year increase, with their total stolen amount reaching $6.75 billion. The attack patterns are characterized by "small but precise" operations; despite a decrease in the number of incidents, each attack is massive, with 76% of service-layer attacks attributed to them. The $1.4 billion vulnerability incident at Bybit in March was a major driver.

The report systematically depicts North Korean hackers' unique money laundering pathways for the first time: relying on Chinese service providers and mixers, following a typical 45-day fund laundering cycle. This marks the emergence of a "super threat" in the cryptocurrency industry—state-sponsored, highly organized, and well-funded—posing unprecedented challenges to the security, protection, and compliance collaboration of global exchanges and protocols.

BAL1.05%

MarketWhisper·12m ago

New York Stock Exchange talks about investment! $5 billion valuation to acquire MoonPay's Crypto gateway

Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, is in talks to acquire a stake in crypto payment provider MoonPay, raising its valuation target for this round to $5 billion, a 47% increase from $3.4 billion in 2021. This is its latest move following its investment in the prediction market Polymarket, valued at up to $2 billion, and the institutional-grade trading platform Bakkt.

PYUSD0.08%

MarketWhisper·15m ago

Bank of Japan raises interest rate by one basis point to 0.75%, hitting a 30-year high, Bitcoin surges to $87,500

The Bank of Japan (BOJ) earlier officially announced a 25 basis point increase in the policy interest rate to 0.75%, the highest level since the 1990s. This move signifies Japan's official exit from the long-standing zero interest rate framework and sends a signal: if the economy and prices remain stable, the rate hike cycle will continue.

動區BlockTempo·15m ago

Former Pump.fun employee sentenced to 6 years in prison for embezzling 2 million USD in Solana

A London court sentenced Canadian Jarett Dunn to six years in prison for fraud and misappropriating $2 million in Solana from Pump.fun. Though he claimed to be a whistleblower, the court dismissed his defense, citing his public threats against the platform. Dunn remains detained in London.

SOL-1.49%

TapChiBitcoin·18m ago

SEC Confirms Constructive Crypto Stance as Privacy and Innovation Anchor Current Policy Direction

U.S. regulators signaled a friendlier future for crypto, emphasizing innovation, privacy, and individual empowerment as the SEC outlined potential regulatory paths that could reshape digital assets and limit surveillance-heavy oversight.

SEC Positions Crypto as a Core Driver of 21st Century

Coinpedia·19m ago

United Stables issues U stablecoin! Integrates BNB liquidity, locking AI payment economy

United Stables launched the US dollar stablecoin $U on December 18, deployed on BNB Chain and Ethereum. By aggregating top stablecoin liquidity and integrating AI Agent micro-payment protocols, it aims to establish a unified settlement layer in a fragmented market.

MarketWhisper·23m ago

Cryptocurrency: From Asset Class to Technological Field

Author: Maartje Bus @ The Medici Network, Source: Messari 2026 Crypto Thesis; Translation: Golden Finance

For years, we have regarded cryptocurrencies as a single asset class because their past market performance indeed aligned with this characteristic. But now, this label has become misleading.

The era of big differentiation is coming

Cryptocurrencies are gradually shedding the "single asset class" label, primarily because the price movements of assets within different categories are no longer converging, and their risk-return profiles are also diverging — both of which are core elements that define an asset class.

Bitcoin's current performance is increasingly resembling a macro store of value: its volatility has shown structural decline, institutional participation continues to deepen, and its price movements are becoming less correlated with other cryptocurrencies.

In contrast, Ethereum and main

金色财经_·25m ago

This Is the Bull Plan: 5 Best Cryptocoins to Hold Before a Potential 2x–5x Altseason Expansion

Altseason phases begin with capital rotation into liquid, execution-focused networks.

Infrastructure assets with steady usage often act as anchors during expansion cycles.

Mid-cap platforms may benefit once large-cap liquidity establishes directional stability.

As market structure

CryptoNewsLand·29m ago

Bitcoin ETFs Surge to $457M Inflows in Early Market Move

Institutional Interest Resurges as Bitcoin ETF Inflows Reach Over $450 Million

Spot Bitcoin exchange-traded funds (ETFs) demonstrated renewed investor confidence on Wednesday, recording net inflows of $457 million — their most substantial daily increase in over a month. This influx signals a

BTC0.55%

CryptoDaily·36m ago

$23 billion options expire next Friday! Bitcoin volatility intensifies, with $85,000 becoming the battleground for bulls and bears

The Bitcoin market is currently overshadowed by an options expiration event worth up to $23 billion, which undoubtedly adds significant uncertainty to the already tense year-end trading. The expiration volume accounts for about half of the total open interest on the largest options trading platform Deribit. Coupled with weak technical patterns and a complex macroeconomic background, Bitcoin's price remains precariously above the critical support level of $85,000.

Despite a general cooling of global inflation data, market sentiment remains defensive, with put options at the $85,000 level accumulating approximately $1.4 billion in risk exposure, potentially "pulling" the price toward that level. Analysts point out that after the options expiration, the market will also need to contend with new catalysts such as the MSCI index rebalancing in early next year, and high volatility may become the main theme of the year-end trading.

BTC0.55%

MarketWhisper·36m ago

Concerns about quantum risk are putting pressure on Bitcoin prices: Executives

Bitcoin developers face pressure from quantum computing threats, impacting prices and investments. Experts stress the importance of acknowledging potential risks and creating contingency plans to ease concerns among investors.

BTC0.55%

TapChiBitcoin·37m ago

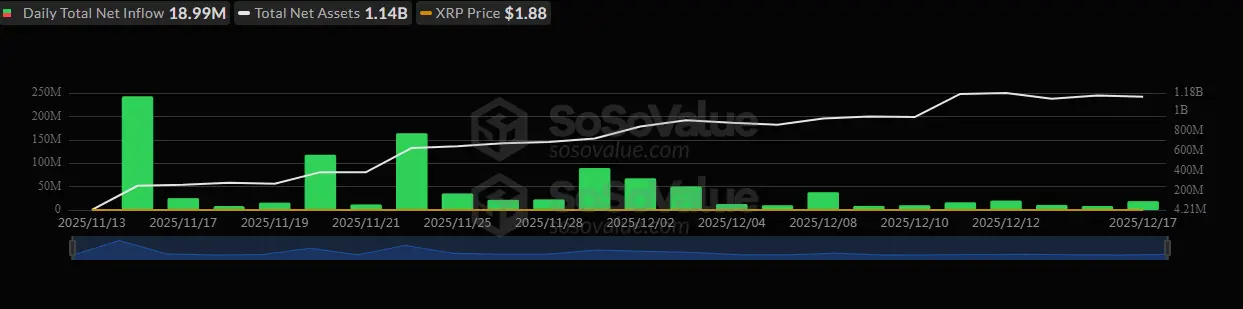

XRP Price Prediction: Bank of Japan Decision Approaching, XRP Urgently Tests $1.75 Key Support

The sudden shift in global macro policy is pushing XRP toward a critical crossroads. As the Bank of Japan可能在周五宣布加息, concerns about a large-scale unwind of "yen carry trades" have sharply increased, causing XRP to decline for two consecutive days and testing a key support level around $1.8 on December 18. In stark contrast to the short-term selling pressure, the XRP spot ETF market has shown surprising resilience, with 23 consecutive days of net inflows totaling over $1.03 billion, while progress has been made on the US Market Structure Bill. This intense collision between short-term and long-term factors makes the decision within the $1.75 to $2.0 range a key observation point for judging XRP's future trend over the coming months.

XRP-0.8%

MarketWhisper·39m ago

Bitcoin’s Volatile Moves Threaten Shorts as Price Hits $90,000

Bitcoin Bounces Back to $90,000 Amid Short Squeeze and Liquidity Fluctuations

Bitcoin has reclaimed the $90,000 level following a volatile session driven by liquidity dynamics and aggressive short-liquidations. After a recent dip that tested support levels, the leading cryptocurrency surged as

BTC0.55%

CryptoDaily·39m ago

XRP Today's News: Plunged before Bank of Japan decision, ETF inflows of 1 billion support a medium-term rebound

XRP faces intense selling pressure for the second consecutive day, testing the $1.8 support. The Bank of Japan's interest rate hike expectations have sparked concerns over yen arbitrage trade unwinding, but spot ETFs have seen 23 consecutive days of net inflows totaling $1.03 billion. Analysts are optimistic about a medium-term rebound to $2.5.

XRP-0.8%

MarketWhisper·41m ago

Syntix Returns to Ethereum Mainnet After 3 Years — What’s Next?

Ethereum Mainnet Welcomes Return of Perpetuals Trading Platform Synthetix

Synthetix, a prominent perpetual trading platform, is making a significant move back to Ethereum’s mainnet, grounded in the belief that the network now possesses the capacity to support high-frequency financial

CryptoDaily·44m ago

North Korean hackers surge 51%! Stealing $2 billion annually, Chinese money laundering network exposed

Chainalysis's latest report shows that in 2025, the total amount of stolen crypto worldwide is approximately $3.4 billion, of which at least $2.02 billion comes from North Korea-related attack activities, a 51% increase (about $681 million) compared to 2024, setting a new record. North Korean hackers account for 76% of all hacking incidents, with a total of at least $6.75 billion in crypto assets stolen to date.

MarketWhisper·46m ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Upgrade

VeChain has unveiled plans for the Hayabusa upgrade, scheduled for December. This upgrade aims to significantly enhance both protocol performance and tokenomics, marking what the team calls the most utility-focused version of VeChain to date.

2025-12-27

Litewallet Sunsets

Litecoin Foundation has announced that the Litewallet app will officially sunset on December 31. The app is no longer actively maintained, with only critical bug fixes addressed until that date. Support chat will also be discontinued after this deadline. Users are encouraged to transition to Nexus Wallet, with migration tools and a step-by-step guide provided within Litewallet.

2025-12-30

OM Tokens Migration Ends

MANTRA Chain issued a reminder for users to migrate their OM tokens to the MANTRA Chain mainnet before January 15. The migration ensures continued participation in the ecosystem as $OM transitions to its native chain.

2026-01-14

CSM Price Change

Hedera has announced that starting January 2026, the fixed USD fee for the ConsensusSubmitMessage service will increase from $0.0001 to $0.0008.

2026-01-27

Vesting Unlock Delayed

Router Protocol has announced a 6-month delay in the vesting unlock of its ROUTE token. The team cites strategic alignment with the project’s Open Graph Architecture (OGA) and the goal of maintaining long-term momentum as key reasons for the postponement. No new unlocks will take place during this period.

2026-01-28