The Israeli military is hunting for spies on Polymarket

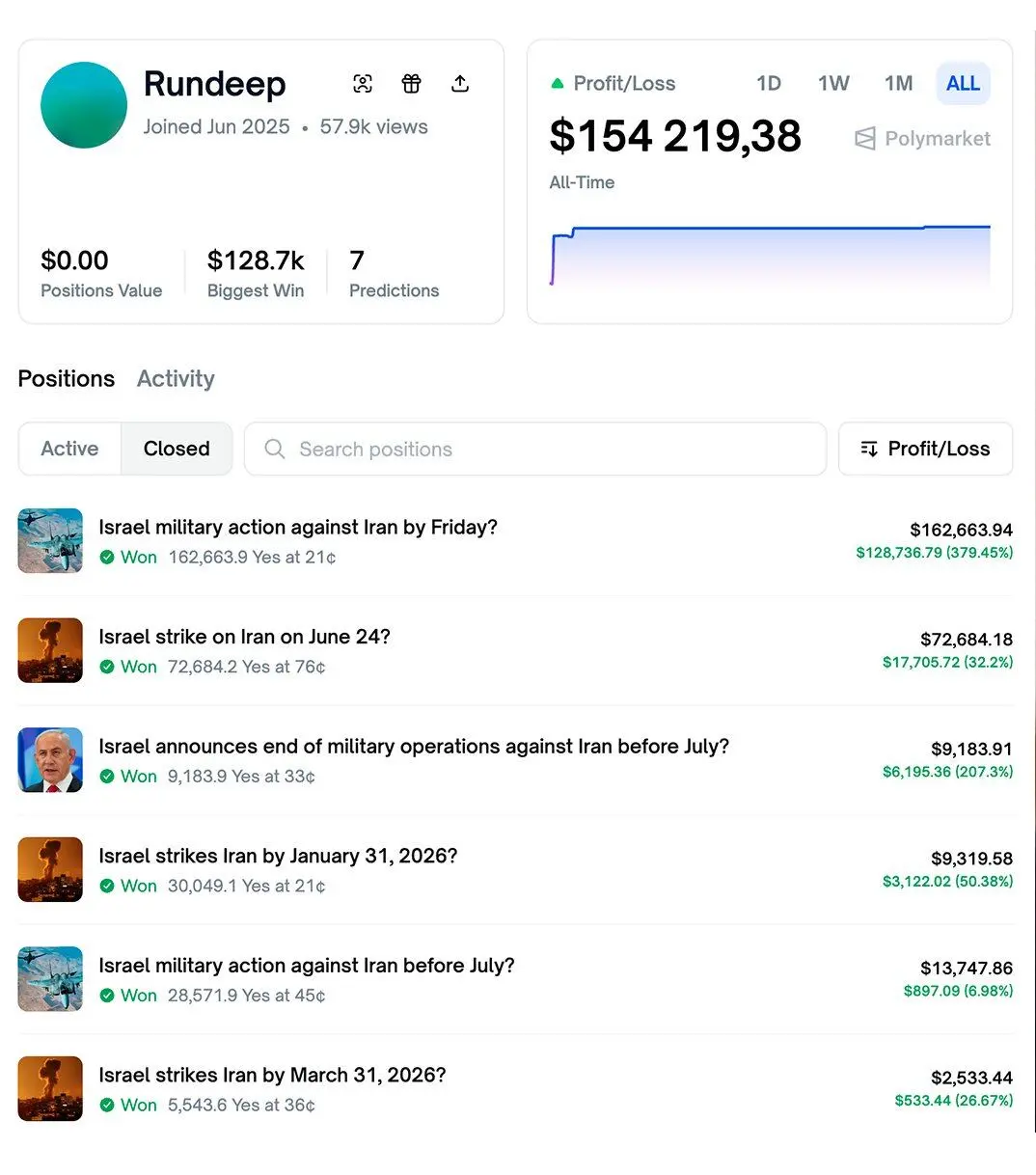

Israeli Defense Forces reservists and civilians have been charged for placing bets on military secrets on Polymarket,涉嫌 insider trading. This incident highlights the risks of unfair competition and insider involvement in prediction markets, especially in sensitive areas like war. It calls for potential future regulation to prevent similar issues.

区块客·22m ago