playerYU

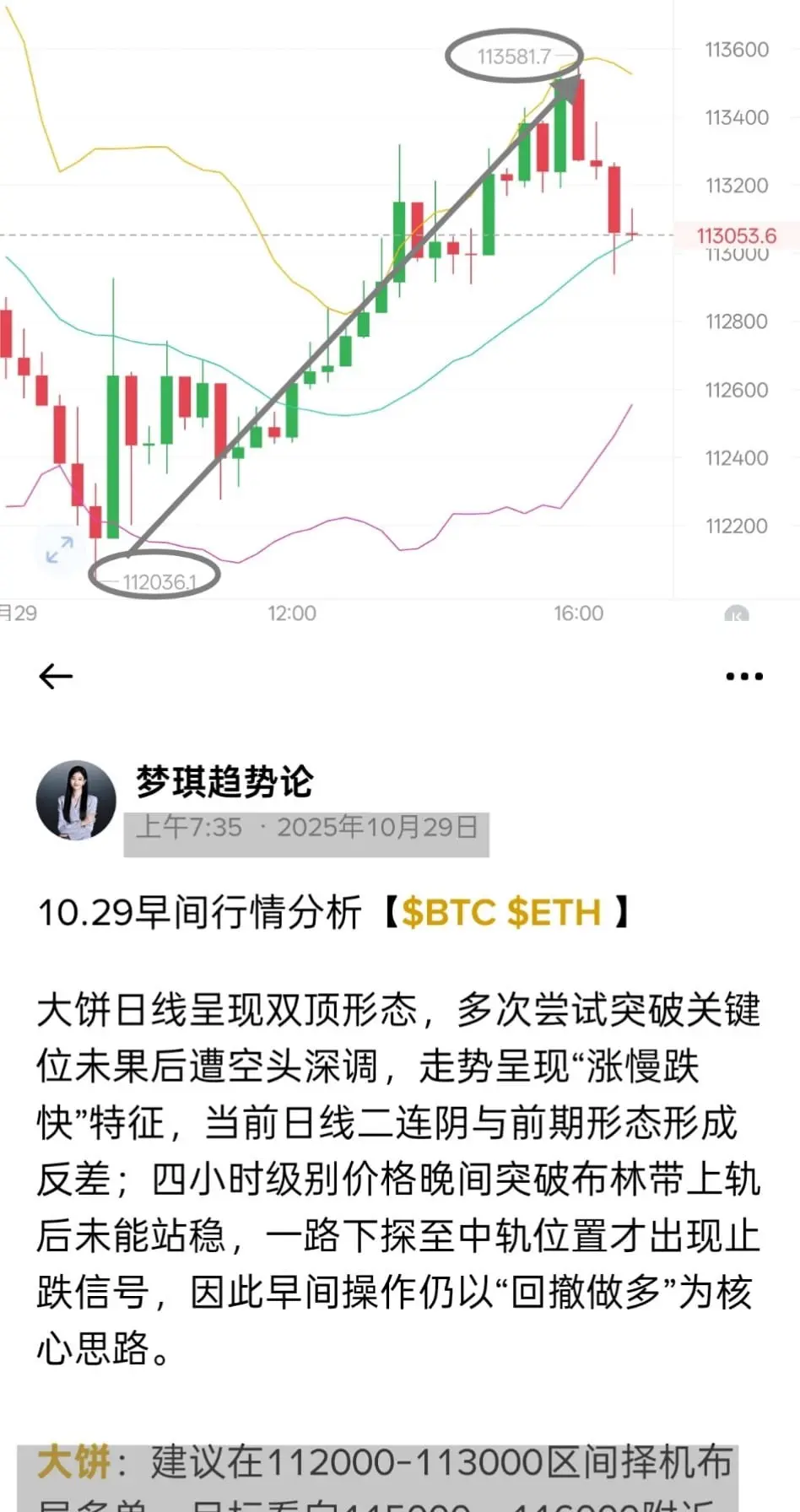

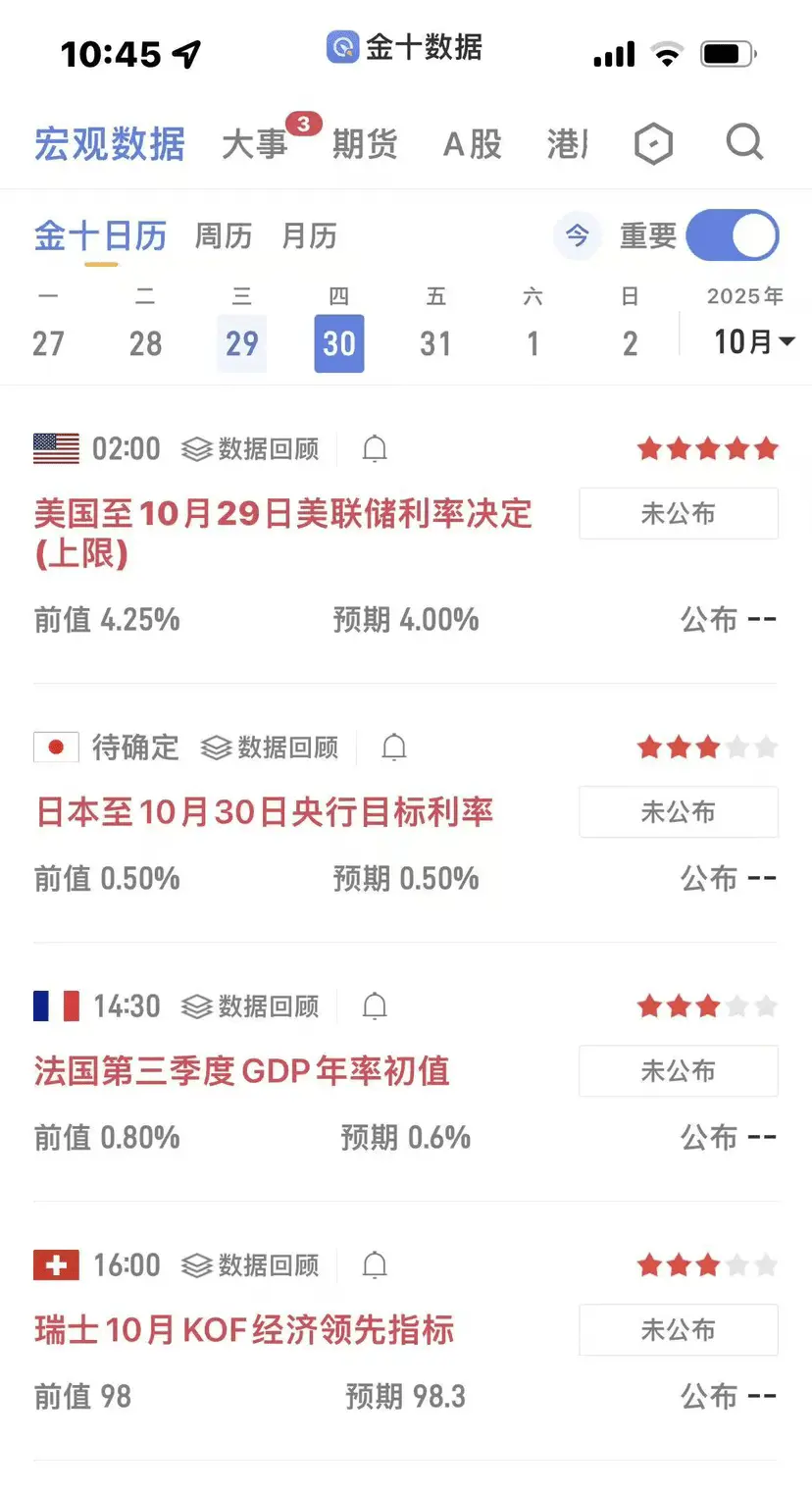

#中美贸易协商 The Fed implemented a 25 basis point rate cut, adjusting the interest rate range to 3.75%-4%. However, the market showed a reverse trend, and there is a deeper logic behind this phenomenon.

The market decline is mainly due to three core factors:

First of all, the expectation effect has been priced in ahead of time. Investors had already speculated on the interest rate cut a month ago, leading to a price increase in advance. When the policy was actually implemented, it instead became a signal for funds to take profits, triggering a "buy the rumor, sell the news" type of sell-off.

Secon

View OriginalThe market decline is mainly due to three core factors:

First of all, the expectation effect has been priced in ahead of time. Investors had already speculated on the interest rate cut a month ago, leading to a price increase in advance. When the policy was actually implemented, it instead became a signal for funds to take profits, triggering a "buy the rumor, sell the news" type of sell-off.

Secon