#美联储降息展望 An exciting moment is coming! Will the market soar to the sky, or will it experience a dramatic big dump?

$BTC $ETH $BNB

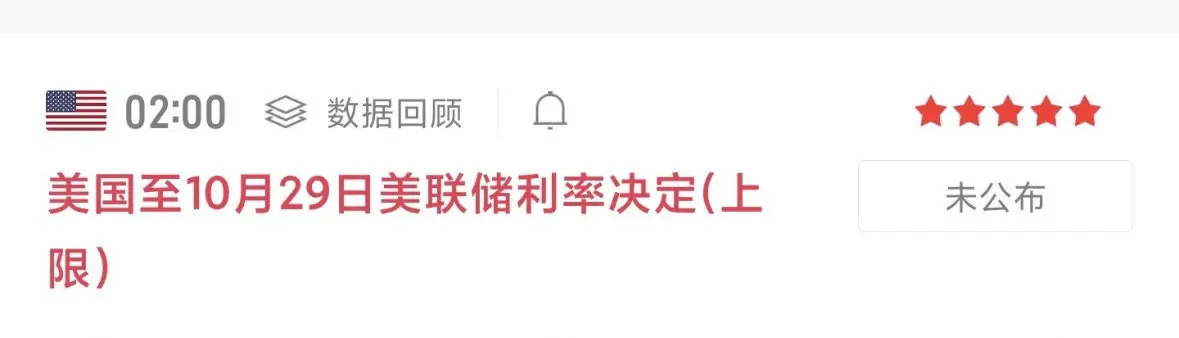

At 2 AM tonight, the Federal Reserve is about to announce a key decision:

It is expected to lower the interest rate by 25 basis points, bringing the benchmark interest rate down from 4%-4.25% to 3.75%-4%, which means a reduction in the cost of funds.

At the same time, it may announce the termination of the quantitative tightening (QT) policy, stopping the recovery of funds from the market, which effectively increases market liquidity.

Why is this decision so importa

View Original$BTC $ETH $BNB

At 2 AM tonight, the Federal Reserve is about to announce a key decision:

It is expected to lower the interest rate by 25 basis points, bringing the benchmark interest rate down from 4%-4.25% to 3.75%-4%, which means a reduction in the cost of funds.

At the same time, it may announce the termination of the quantitative tightening (QT) policy, stopping the recovery of funds from the market, which effectively increases market liquidity.

Why is this decision so importa