#HongKongPlansNewVAGuidelines

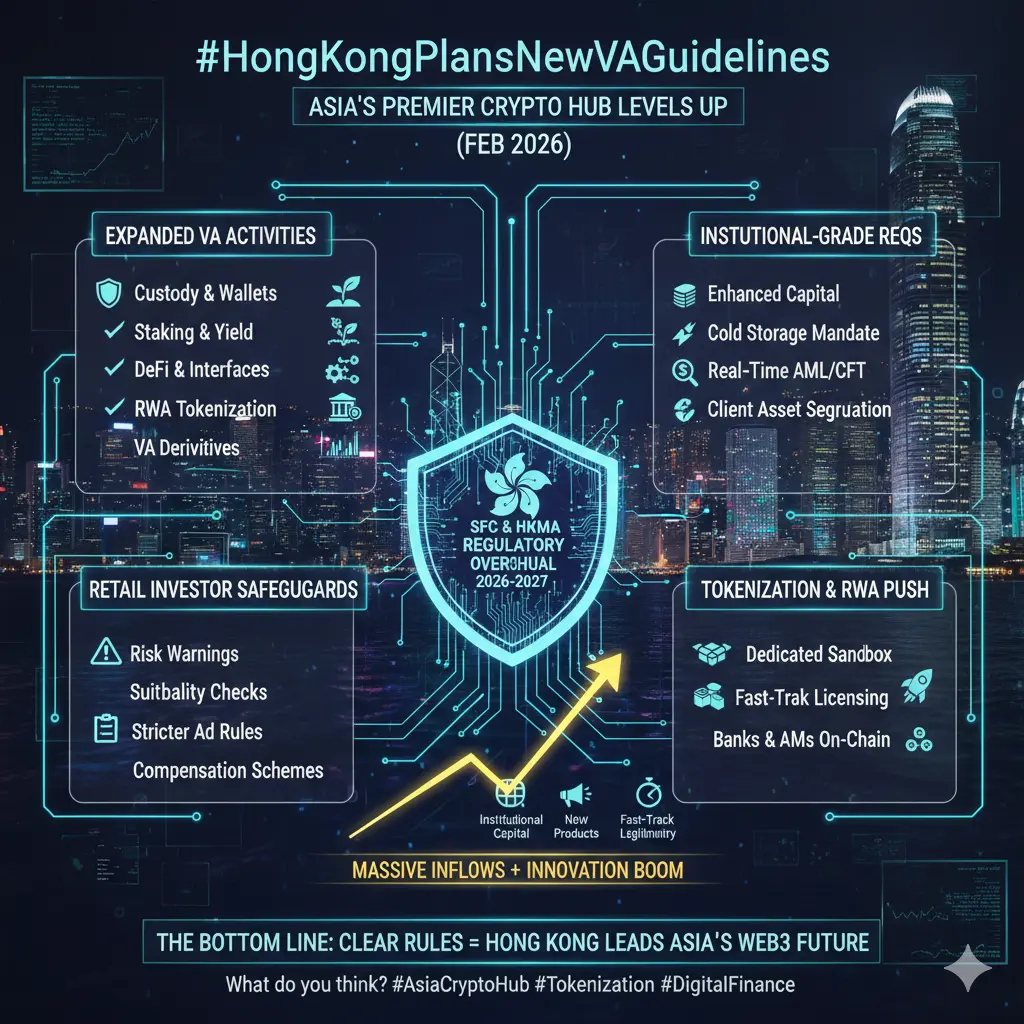

Hong Kong is stepping up again as Asia's top crypto hub with HongKongPlansNewVAGuidelines — a major regulatory upgrade that's making waves across the global digital asset industry in early 2026.

The Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA) have officially launched consultations and planning for the next-generation Virtual Asset (VA) regulatory framework, set to take effect in phases throughout 2026–2027. This isn't a small tweak — it's a full overhaul designed to make Hong Kong even more attractive for institutional players, retail investors, and innovative Web3 projects while keeping investor protection rock-solid.

What Exactly Is Being Planned?

The new VA Guidelines aim to build on the existing regime (introduced in 2023) and close remaining gaps. Key focus areas include:

Expanded VA Activities Coverage

Bringing more types of virtual asset services under regulation, including:

VA custody and wallet services (even non-custodial in some cases)

VA staking and yield-generating products

Decentralized finance (DeFi) interfaces and front-ends

Tokenization of real-world assets (RWA) platforms

VA derivatives and structured products (with stricter safeguards)

Institutional-Grade Requirements

Stricter rules for licensed Virtual Asset Service Providers (VASPs):

Enhanced capital requirements and insurance mandates

Mandatory cold storage for majority of client assets

Real-time monitoring and AML/CFT upgrades

Segregation of client assets with daily reconciliation

Retail Investor Safeguards

Mandatory risk warnings and cooling-off periods for high-risk VA products

Suitability assessments before allowing retail access to complex products

Stricter advertising rules (no misleading yield promises)

Compensation arrangements in case of platform failure

Tokenization & RWA Push

Dedicated sandbox and fast-track licensing for tokenized securities, funds, and real-world assets. HKMA and SFC are working together to create a clear pathway for banks and asset managers to issue and trade tokenized bonds, equities, and funds on licensed platforms.

Stablecoin & Payment Tokens

Separate but linked consultation on fiat-referenced stablecoin issuers (already in progress). Expect final rules requiring 100% reserves, regular audits, and redemption at par within T+1.

Why Hong Kong Is Doing This Now

Global Competition — Singapore, Dubai, EU (MiCA), and even the US are racing to become the go-to jurisdiction. Hong Kong wants to stay ahead by offering the clearest, most institution-friendly rules in Asia.

Post-2025 Momentum — After approving spot BTC & ETH ETFs, licensing 10+ major VASPs, and seeing billions in institutional inflows, regulators want to lock in that momentum.

Mainland China Alignment — With Beijing's cautious green light for Hong Kong to experiment, the city is positioning itself as China's offshore crypto gateway.

RWA & Tokenization Boom — Hong Kong aims to become the Asian hub for tokenized real-world assets (bonds, funds, real estate) — new guidelines will make that much easier and safer.

Timeline & Next Steps

Q1–Q2 2026: Public consultations close, final drafts released

Mid-2026: New licensing requirements and compliance deadlines for existing VASPs

Late 2026–2027: Full rollout of staking/DeFi/RWA rules + stablecoin regime

Ongoing: Sandbox expansions and fast-track approvals for innovative models

Bottom Line

Hong Kong isn't just regulating crypto — it's actively shaping the future of digital finance in Asia. The new VA Guidelines will make the city even more attractive for serious institutional players while protecting retail users and keeping innovation alive.

This is one of the most important regulatory developments in Asia for 2026. Clear, progressive rules + strong enforcement = massive inflows, more products, and higher legitimacy.

Hong Kong is sending a loud message: "We want to be the premier crypto and tokenization hub in the world — and we're willing to write the rulebook to make it happen."

Hong Kong is stepping up again as Asia's top crypto hub with HongKongPlansNewVAGuidelines — a major regulatory upgrade that's making waves across the global digital asset industry in early 2026.

The Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA) have officially launched consultations and planning for the next-generation Virtual Asset (VA) regulatory framework, set to take effect in phases throughout 2026–2027. This isn't a small tweak — it's a full overhaul designed to make Hong Kong even more attractive for institutional players, retail investors, and innovative Web3 projects while keeping investor protection rock-solid.

What Exactly Is Being Planned?

The new VA Guidelines aim to build on the existing regime (introduced in 2023) and close remaining gaps. Key focus areas include:

Expanded VA Activities Coverage

Bringing more types of virtual asset services under regulation, including:

VA custody and wallet services (even non-custodial in some cases)

VA staking and yield-generating products

Decentralized finance (DeFi) interfaces and front-ends

Tokenization of real-world assets (RWA) platforms

VA derivatives and structured products (with stricter safeguards)

Institutional-Grade Requirements

Stricter rules for licensed Virtual Asset Service Providers (VASPs):

Enhanced capital requirements and insurance mandates

Mandatory cold storage for majority of client assets

Real-time monitoring and AML/CFT upgrades

Segregation of client assets with daily reconciliation

Retail Investor Safeguards

Mandatory risk warnings and cooling-off periods for high-risk VA products

Suitability assessments before allowing retail access to complex products

Stricter advertising rules (no misleading yield promises)

Compensation arrangements in case of platform failure

Tokenization & RWA Push

Dedicated sandbox and fast-track licensing for tokenized securities, funds, and real-world assets. HKMA and SFC are working together to create a clear pathway for banks and asset managers to issue and trade tokenized bonds, equities, and funds on licensed platforms.

Stablecoin & Payment Tokens

Separate but linked consultation on fiat-referenced stablecoin issuers (already in progress). Expect final rules requiring 100% reserves, regular audits, and redemption at par within T+1.

Why Hong Kong Is Doing This Now

Global Competition — Singapore, Dubai, EU (MiCA), and even the US are racing to become the go-to jurisdiction. Hong Kong wants to stay ahead by offering the clearest, most institution-friendly rules in Asia.

Post-2025 Momentum — After approving spot BTC & ETH ETFs, licensing 10+ major VASPs, and seeing billions in institutional inflows, regulators want to lock in that momentum.

Mainland China Alignment — With Beijing's cautious green light for Hong Kong to experiment, the city is positioning itself as China's offshore crypto gateway.

RWA & Tokenization Boom — Hong Kong aims to become the Asian hub for tokenized real-world assets (bonds, funds, real estate) — new guidelines will make that much easier and safer.

Timeline & Next Steps

Q1–Q2 2026: Public consultations close, final drafts released

Mid-2026: New licensing requirements and compliance deadlines for existing VASPs

Late 2026–2027: Full rollout of staking/DeFi/RWA rules + stablecoin regime

Ongoing: Sandbox expansions and fast-track approvals for innovative models

Bottom Line

Hong Kong isn't just regulating crypto — it's actively shaping the future of digital finance in Asia. The new VA Guidelines will make the city even more attractive for serious institutional players while protecting retail users and keeping innovation alive.

This is one of the most important regulatory developments in Asia for 2026. Clear, progressive rules + strong enforcement = massive inflows, more products, and higher legitimacy.

Hong Kong is sending a loud message: "We want to be the premier crypto and tokenization hub in the world — and we're willing to write the rulebook to make it happen."