#WalshSaysToCautiouslyShrinkBalanceSheet

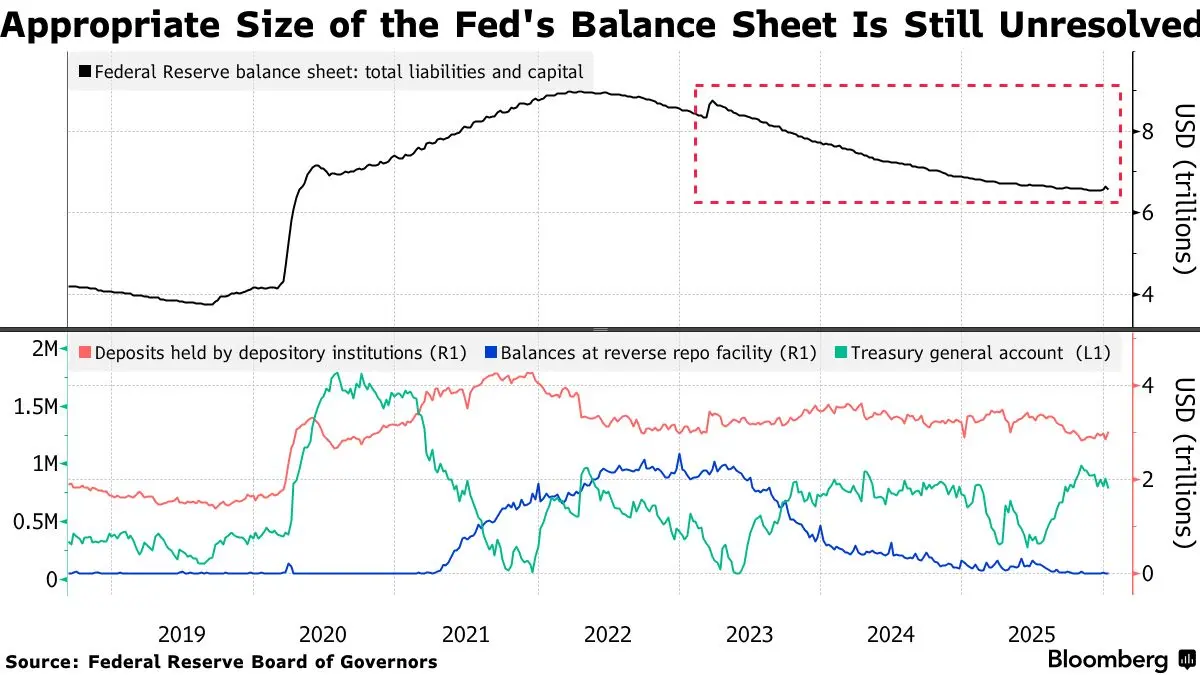

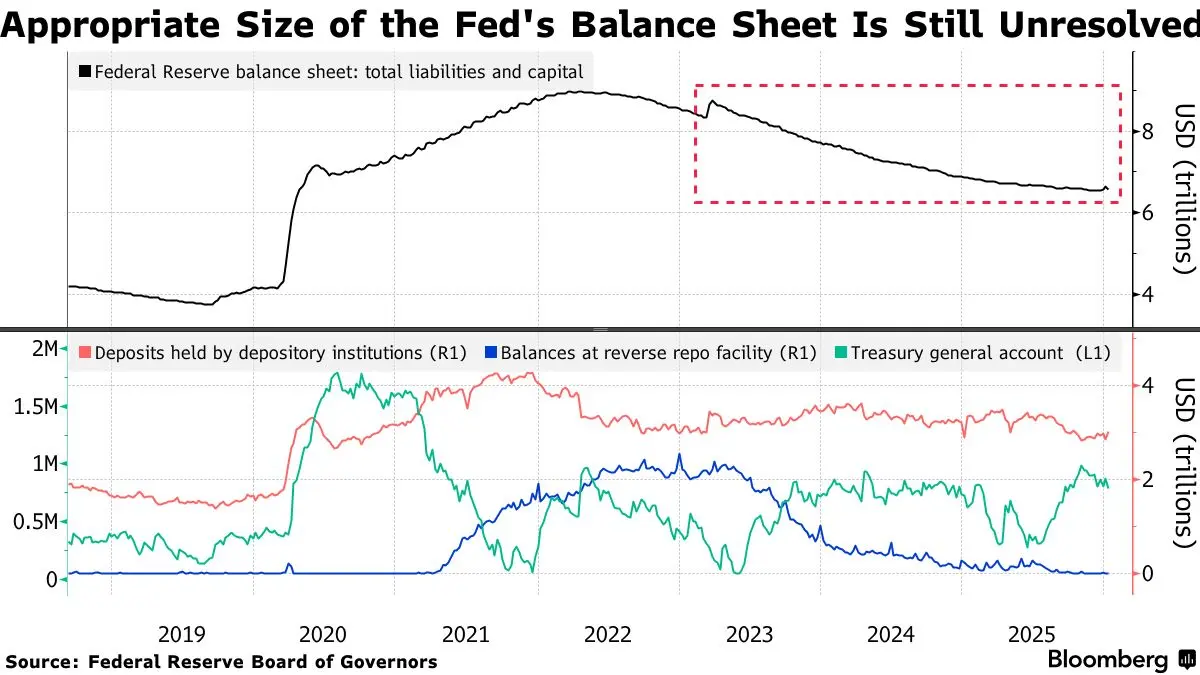

Kevin Warsh (often called "Walsh" in shorthand discussions), Trump's nominee for Fed Chair, has consistently advocated for gradually reducing the Federal Reserve's balance sheet to restore "normal" monetary policy, reduce distortions, and limit the Fed's footprint in markets. As of early February 2026, the Fed's balance sheet stands at approximately $6.61 trillion (latest weekly data around Feb 4–11 shows ~$6,605–6,611B, with slight weekly fluctuations from reserve management).

This isn't a sudden "shock" unwind — Warsh emphasizes gradual methods to avoid market disruptions like those in past QT episodes (e.g., 2018 repo squeeze or 2022 volatility).

1. “Walsh advises gradually reducing the central bank’s balance sheet.”

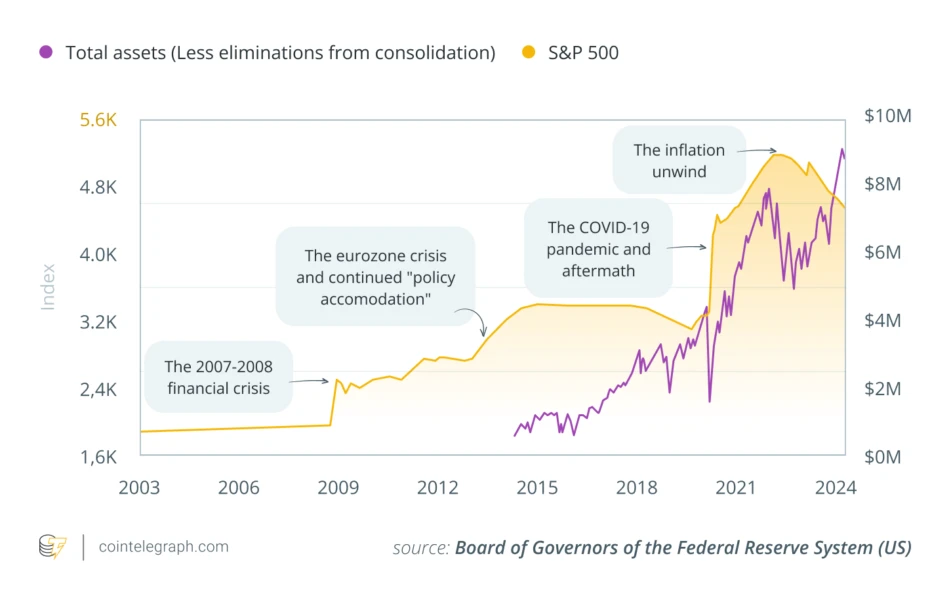

Warsh views the current ~$6.6T balance sheet (down from ~$9T peak) as excessively large and distortive — it props up asset prices, misallocates capital, and erodes Fed independence. His ideal: Shrink it toward pre-crisis norms (~$3T or ~20% of GDP if grown with economy), but slowly over years.

Why gradual? Abrupt moves risk funding stress, higher volatility, and deleveraging cascades.

His framework: Pair balance sheet discipline with rate cuts (e.g., "QT for rate cuts") to support growth/productivity while tightening long-term conditions.

Challenges: Recent Fed ended QT in late 2025 and started modest reserve purchases (~$40B/month T-bills) to keep reserves "ample." Resuming aggressive QT faces pushback from FOMC, banks, and political pressures (Trump wants lower rates/mortgages).

2. ...reducing the central bank’s balance sheet.”

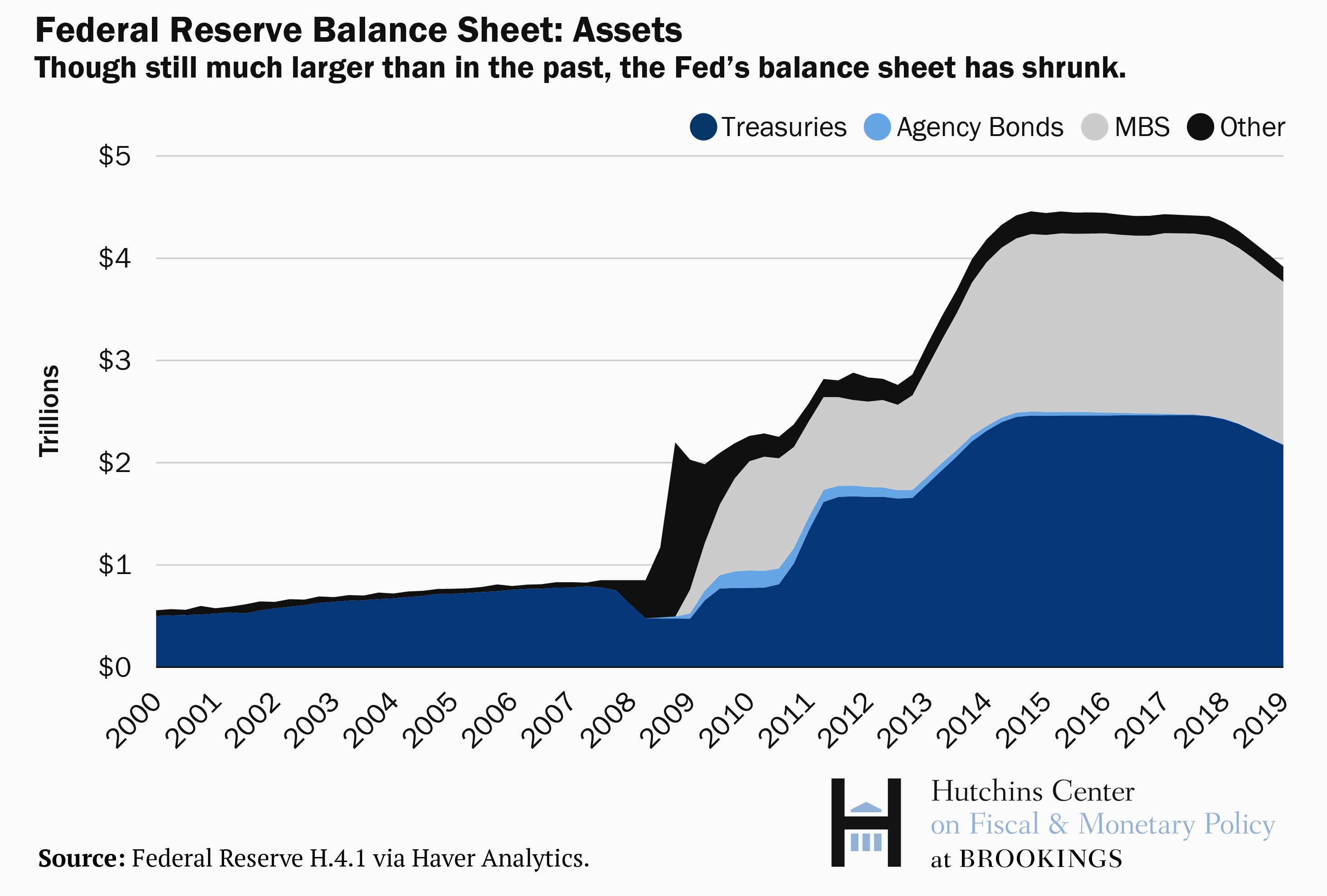

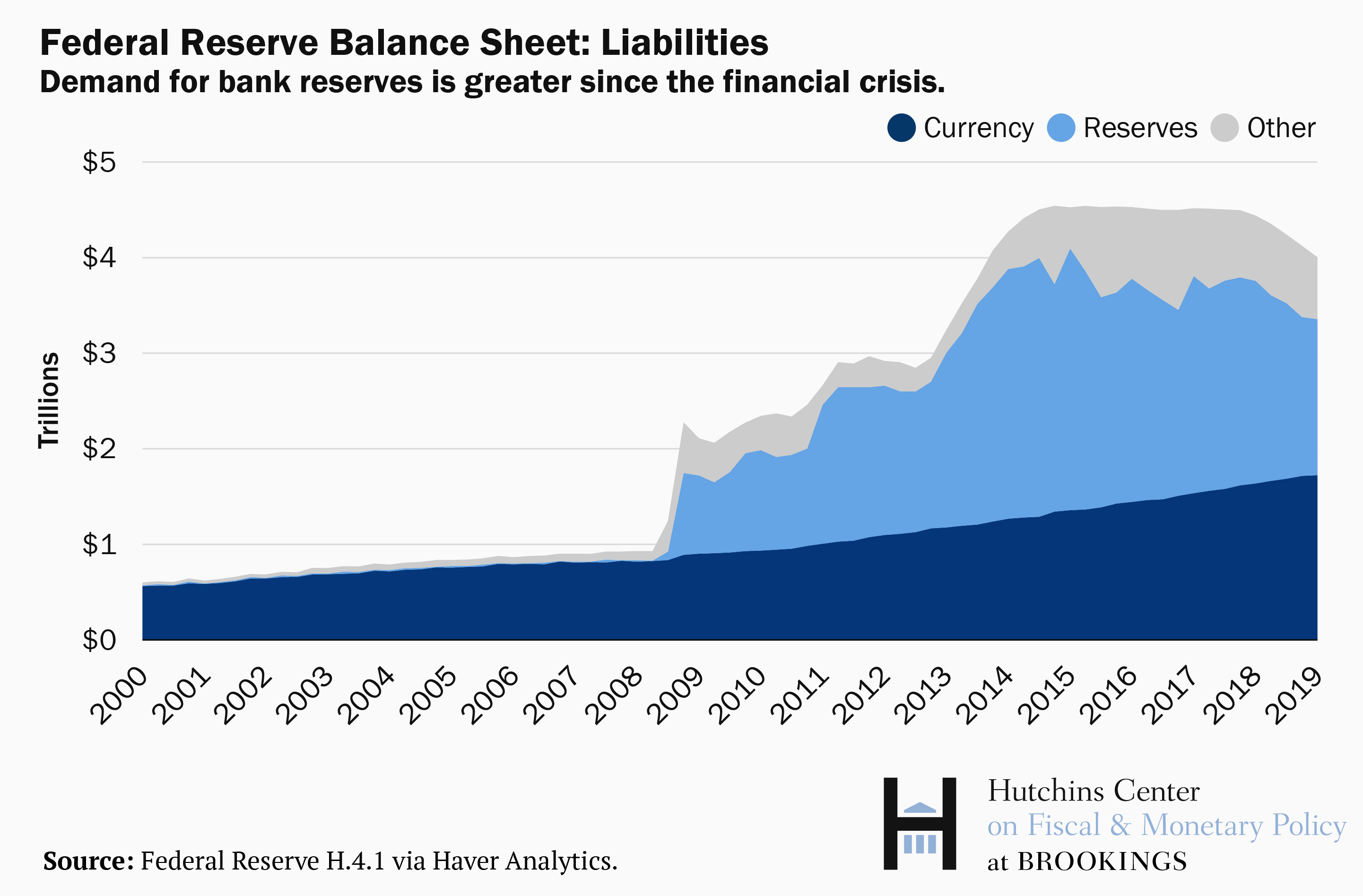

Mechanics: Fed balance sheet = assets (mostly Treasuries ~$4.28T + MBS ~$2.02T) vs. liabilities (bank reserves ~$2.9–3.7T, currency, etc.).

Reduction = tightening: Fewer assets → fewer reserves/liquidity in system → higher long-term yields, costlier borrowing, less "easy money" chasing risk assets.

Warsh's nuance: He sees it as redeploying "largesse" to lower short rates for households/SMEs, while shrinking Fed dominance.

3. In other words, slowly selling or...

Primary method (passive QT): Let maturing bonds (~hundreds of billions/year) run off without full reinvestment — drains liquidity gradually.

Secondary (if needed): Limited outright sales, but Warsh/Citi analysts note this risks money market tensions — so expect multi-year, incremental pace.

Timeline: Not overnight; could take 5–10+ years for meaningful shrinkage without overhaul.

4. ...letting assets (like government bonds) mature to tighten...

Assets targeted: U.S. Treasuries (safe, liquid) and MBS.

Tightening effect: Maturity proceeds exit system → banks hold fewer excess reserves → lending/borrowing costs rise subtly → financial conditions tighten.

Goal: Avoid "shocking" — no 2022-style rapid QT volatility.

5. ...liquidity without shocking the markets/system.

Key risk mitigation: Gradual = markets adapt (e.g., private sector absorbs more risk). But even slow QT drains excess liquidity, pressuring high-beta assets.

Extended Crypto Market Impacts (Mid-Feb 2026 Snapshot)

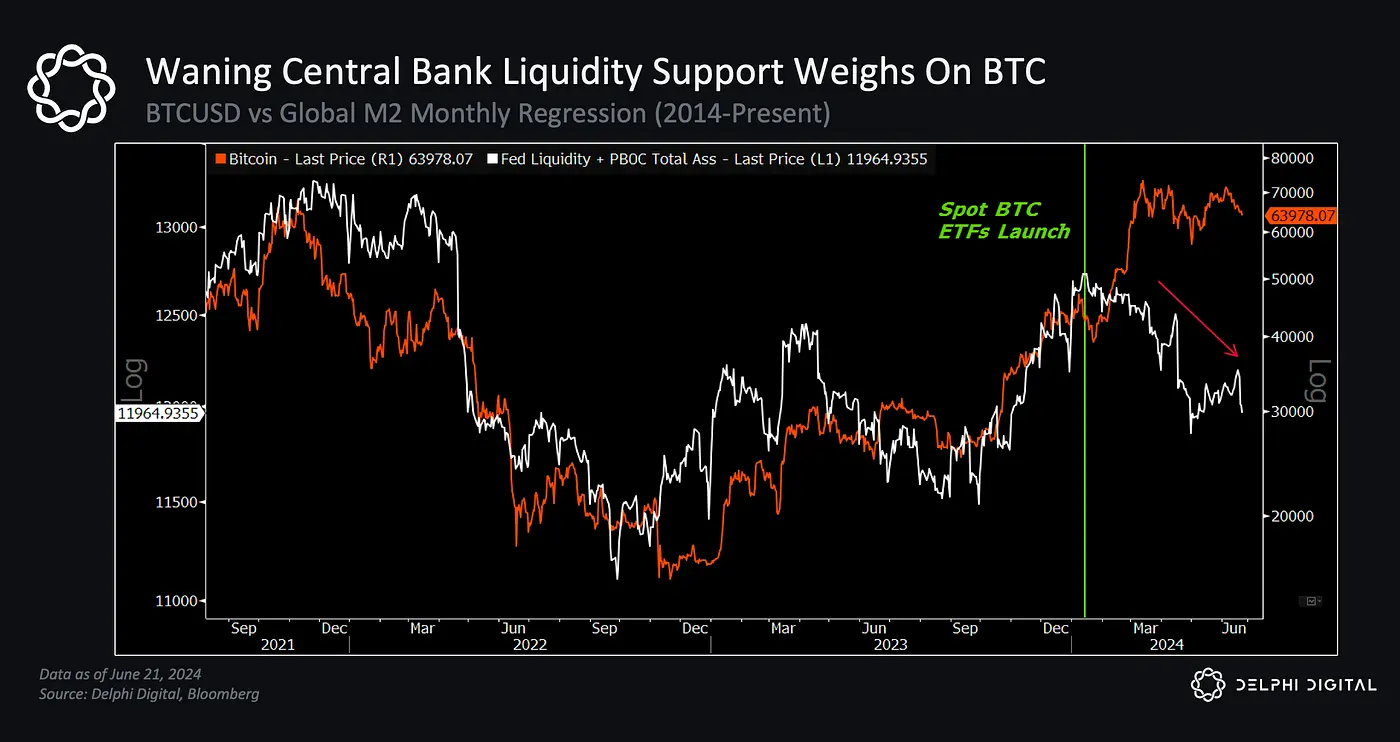

Crypto remains ultra-sensitive to global liquidity — BTC/ETH are high-beta risk assets that thrive on excess cash but suffer in tightening. Warsh's policy mix (rate cuts + gradual QT resumption) creates net cautious/bearish short-term pressure, amplified by recent deleveraging.

Current Prices & Percentage Moves:

BTC: Trading ~$67,000–$68,000 (as of Feb 12 data; recent closes ~$67,574–$68,794; down ~3–9% intraday/weekly swings in early Feb).

Recent drawdown: ~15–20% from Jan/Feb highs (~$80K–$90K peaks) to lows ~$60K–$65K during Feb 5–6 capitulation.

YTD: Down ~20%+ in some reports amid risk-off.

ETH: ~$2,000–$2,300 range (recent ~$1,878–$2,281 lows; down ~11%+ in volatile sessions).

ETH/BTC ratio weak, altcoins lagging.

Liquidity Implications:

Global liquidity drain from potential QT resumption → less excess dollars → reduced speculative inflows.

Stablecoin dominance surged to ~10.3% (highest since FTX collapse) as market cap drops while stable supply holds.

Thin liquidity exacerbates swings: Spot volumes down ~30% since late 2025 peaks (~$700B–$1T monthly to lower).

ETF flows mixed: Recent outflows (e.g., $434M BTC + $81M ETH in one session) but some rebounds.

Volume & Trading Dynamics:

Spike during deleveraging: ~$2.5–$4B+ liquidations in early Feb cascades; BlackRock IBIT hit $10B+ daily notional.

Overall: Spot/CEX volumes suppressed post-selloff; retail fading, institutional cautious.

Futures OI dropped sharply (~$61B → $49B in one week) → leverage unwind driving moves.

Broader Effects:

Bearish short-term: Tighter conditions → higher long yields → risk-off → BTC/ETH pressure (mimics 2022 QT bear).

Mixed bullish elements: Warsh views BTC as "new gold" for under-40s; potential deregulation/productivity boom tailwind.

Volatility spike: Feb "black storm" saw $2–$9B liquidations; fear gauge at lows.

Longer-term: If QT gradual + rate cuts → stabilization; BTC as "sound money" narrative strengthens vs. fiat.

Bottom Line: Warsh's gradual balance sheet reduction prioritizes discipline over floods of liquidity — expect higher volatility, suppressed explosive rallies, and downside risks in crypto (BTC testing $60K–$65K supports, ETH sub-$2K possible). Protect capital with tight risk (1–2% per trade), watch FOMC signals/Warsh confirmation. This could shape trillions in flows — not 2021 QE endless upside, but potential structural BTC strength.

Kevin Warsh (often called "Walsh" in shorthand discussions), Trump's nominee for Fed Chair, has consistently advocated for gradually reducing the Federal Reserve's balance sheet to restore "normal" monetary policy, reduce distortions, and limit the Fed's footprint in markets. As of early February 2026, the Fed's balance sheet stands at approximately $6.61 trillion (latest weekly data around Feb 4–11 shows ~$6,605–6,611B, with slight weekly fluctuations from reserve management).

This isn't a sudden "shock" unwind — Warsh emphasizes gradual methods to avoid market disruptions like those in past QT episodes (e.g., 2018 repo squeeze or 2022 volatility).

1. “Walsh advises gradually reducing the central bank’s balance sheet.”

Warsh views the current ~$6.6T balance sheet (down from ~$9T peak) as excessively large and distortive — it props up asset prices, misallocates capital, and erodes Fed independence. His ideal: Shrink it toward pre-crisis norms (~$3T or ~20% of GDP if grown with economy), but slowly over years.

Why gradual? Abrupt moves risk funding stress, higher volatility, and deleveraging cascades.

His framework: Pair balance sheet discipline with rate cuts (e.g., "QT for rate cuts") to support growth/productivity while tightening long-term conditions.

Challenges: Recent Fed ended QT in late 2025 and started modest reserve purchases (~$40B/month T-bills) to keep reserves "ample." Resuming aggressive QT faces pushback from FOMC, banks, and political pressures (Trump wants lower rates/mortgages).

2. ...reducing the central bank’s balance sheet.”

Mechanics: Fed balance sheet = assets (mostly Treasuries ~$4.28T + MBS ~$2.02T) vs. liabilities (bank reserves ~$2.9–3.7T, currency, etc.).

Reduction = tightening: Fewer assets → fewer reserves/liquidity in system → higher long-term yields, costlier borrowing, less "easy money" chasing risk assets.

Warsh's nuance: He sees it as redeploying "largesse" to lower short rates for households/SMEs, while shrinking Fed dominance.

3. In other words, slowly selling or...

Primary method (passive QT): Let maturing bonds (~hundreds of billions/year) run off without full reinvestment — drains liquidity gradually.

Secondary (if needed): Limited outright sales, but Warsh/Citi analysts note this risks money market tensions — so expect multi-year, incremental pace.

Timeline: Not overnight; could take 5–10+ years for meaningful shrinkage without overhaul.

4. ...letting assets (like government bonds) mature to tighten...

Assets targeted: U.S. Treasuries (safe, liquid) and MBS.

Tightening effect: Maturity proceeds exit system → banks hold fewer excess reserves → lending/borrowing costs rise subtly → financial conditions tighten.

Goal: Avoid "shocking" — no 2022-style rapid QT volatility.

5. ...liquidity without shocking the markets/system.

Key risk mitigation: Gradual = markets adapt (e.g., private sector absorbs more risk). But even slow QT drains excess liquidity, pressuring high-beta assets.

Extended Crypto Market Impacts (Mid-Feb 2026 Snapshot)

Crypto remains ultra-sensitive to global liquidity — BTC/ETH are high-beta risk assets that thrive on excess cash but suffer in tightening. Warsh's policy mix (rate cuts + gradual QT resumption) creates net cautious/bearish short-term pressure, amplified by recent deleveraging.

Current Prices & Percentage Moves:

BTC: Trading ~$67,000–$68,000 (as of Feb 12 data; recent closes ~$67,574–$68,794; down ~3–9% intraday/weekly swings in early Feb).

Recent drawdown: ~15–20% from Jan/Feb highs (~$80K–$90K peaks) to lows ~$60K–$65K during Feb 5–6 capitulation.

YTD: Down ~20%+ in some reports amid risk-off.

ETH: ~$2,000–$2,300 range (recent ~$1,878–$2,281 lows; down ~11%+ in volatile sessions).

ETH/BTC ratio weak, altcoins lagging.

Liquidity Implications:

Global liquidity drain from potential QT resumption → less excess dollars → reduced speculative inflows.

Stablecoin dominance surged to ~10.3% (highest since FTX collapse) as market cap drops while stable supply holds.

Thin liquidity exacerbates swings: Spot volumes down ~30% since late 2025 peaks (~$700B–$1T monthly to lower).

ETF flows mixed: Recent outflows (e.g., $434M BTC + $81M ETH in one session) but some rebounds.

Volume & Trading Dynamics:

Spike during deleveraging: ~$2.5–$4B+ liquidations in early Feb cascades; BlackRock IBIT hit $10B+ daily notional.

Overall: Spot/CEX volumes suppressed post-selloff; retail fading, institutional cautious.

Futures OI dropped sharply (~$61B → $49B in one week) → leverage unwind driving moves.

Broader Effects:

Bearish short-term: Tighter conditions → higher long yields → risk-off → BTC/ETH pressure (mimics 2022 QT bear).

Mixed bullish elements: Warsh views BTC as "new gold" for under-40s; potential deregulation/productivity boom tailwind.

Volatility spike: Feb "black storm" saw $2–$9B liquidations; fear gauge at lows.

Longer-term: If QT gradual + rate cuts → stabilization; BTC as "sound money" narrative strengthens vs. fiat.

Bottom Line: Warsh's gradual balance sheet reduction prioritizes discipline over floods of liquidity — expect higher volatility, suppressed explosive rallies, and downside risks in crypto (BTC testing $60K–$65K supports, ETH sub-$2K possible). Protect capital with tight risk (1–2% per trade), watch FOMC signals/Warsh confirmation. This could shape trillions in flows — not 2021 QE endless upside, but potential structural BTC strength.