Search results for "ROSE"

MSCI temporarily does not exclude "coin-holding stocks," Strategy closes up more than 6% after hours! Analyst: The battle is not over yet

The index compilation company MSCI (Morgan Stanley Capital International) announced that it will temporarily not remove "Digital Asset Treasuries (DATs)" from its index products. Once the news was disclosed, the stock price of Strategy (MSTR), the publicly traded company holding the most Bitcoin globally, immediately rose.

Encouraged by the positive news, as a constituent of the MSCI index, Strategy's stock price surged over 6% to $168.4 in after-hours trading on Tuesday, strongly recovering from the approximately 4% decline during the day. Market sentiment instantly shifted from tense to optimistic.

Looking back to October last year, MSCI

区块客·10h ago

[Korean Stock Market Closing] Korea Composite Stock Price Index closes higher for the 4th consecutive day… Foreign investors net buy 1.2 trillion KRW, semiconductor and transportation equipment stocks perform strongly

The Korean stock market, driven by optimistic expectations for the AI industry and foreign capital inflows, has risen for four consecutive days to 4,551.06 points on the KOSPI. Despite some Asian stock markets declining due to the impact of China-Japan trade frictions, the transportation and semiconductor sectors performed strongly. The KOSDAQ index declined for two consecutive days, mainly due to selling pressure on machinery and electrical electronics stocks. The Korean won against the US dollar remains strong, and international oil prices have fallen. The US stock market rose, while the Japanese and Hong Kong markets declined.

TechubNews·12h ago

2026 Start of the Year Observation: Geopolitical Changes and Rate Cut Expectations Intertwined, Bitcoin Cautiously Moves Above $90,000

Writing by: Yangz, Techub News

At the start of 2026, the cryptocurrency market opened with a gentle upward trend. Bitcoin rose above $94,000 on January 5th, up about 8% from $87,000 at the end of last year. Although it has now retreated to around $93,000, the overall upward trend at the beginning of the year undoubtedly injects positive signals into the market. Behind this steady start, there are multiple undercurrents including macro policies, geopolitical tensions, and regulatory developments.

Macroeconomic Background: Interplay of Rate Cut Expectations and Geopolitics

Behind the calm rise at the start of the year, two major narrative threads are unfolding, influencing the direction of the crypto market in early 2026.

First is the monetary policy of the Federal Reserve in 2026 and the selection of the next chair. Goldman Sachs recently pointed out in a research report that the cooling labor market may force

TechubNews·12h ago

MSCI temporarily lifts ban! MicroStrategy surges 5% after hours, Bitcoin-related stocks escape unscathed

MSCI will not remove the digital asset universe (DAT) from the index for now, and MicroStrategy (MSTR) rose 4.36% after hours. MSCI's proposal in October to exclude companies with digital asset holdings over 50% faced a backlash. Currently, the approach to DAT companies remains unchanged, but ongoing review will continue.

MarketWhisper·19h ago

Global Index Maker MSCI Defers Decision on Dropping Crypto-Focused Companies

In brief

MSCI said it will not change the index treatment for digital-asset treasury companies in its February 2026 review.

Initial consultation flagged investor concerns that some DATs appear to be investment vehicles rather than operating firms.

Shares of Strategy rose after the

Decrypt·19h ago

Risk asset appetite: USD-KRW exchange rate closes at 1,447 KRW... influenced by the warm US stock market

The USD-KRW exchange rate temporarily rose and then partially retraced in the New York foreign exchange market, ultimately closing at 1,447 KRW. Analysts believe that the strong performance of the New York stock market stimulated risk asset appetite, leading to a relatively strong Korean won.

As of 2:00 a.m. on the 7th (Korea time), the USD-KRW exchange rate closed at 1,447.10 KRW, up 3.30 KRW from the previous day's Seoul foreign exchange market close of 1,443.80 KRW. On the same day, in early trading in New York, the euro weakened due to soft European economic indicators, and the dollar remained strong, with the USD-KRW rate rising to a high of 1,449.30 KRW during the session.

However, as the US stock market showed an upward trend afterward, investors shifted their investment focus from safe assets to risk assets such as stocks, and demand for the dollar began to decrease. Notably, the Philadelphia Semiconductor Index, composed of representative US semiconductor stocks, surged 2.84% intraday, indicating a clear lead by tech stocks.

TechubNews·01-06 18:27

KOSPI breaks 4,500 points to hit a record high... Semiconductors and AI lead the rally

In the New Year of 2026, the Korea KOSPI Index rose for the first time above 4500 points due to the spread of the AI industry and optimistic expectations for semiconductors. Experts point out that semiconductor stocks such as Samsung and SK Hynix have strongly driven the market. Although the rise has been rapid in the short term, caution is needed regarding potential volatility risks. Future performance prospects and economic recovery will influence the index's direction.

TechubNews·01-06 17:26

XRP Surges 12%: ETF Inflows Hit 5-Week Peak

_XRP rose 12.5 per cent to 2.38 following ETF inflows amounting to 46.1 million. The bullish trends indicate a potential 15% upswing as institutional buying gains pace._

The price increased by 12.5 percent over 24 hours to $2.38 as a result of restored demand in XRP ETFs. CoinMarketCap reports t

LiveBTCNews·01-06 16:05

ChatGPT Predicts Bitcoin, and Ethereum Prices If the Venezuela Crisis Escalates Further

The arrest of Venezuela’s longtime leader triggered more than political shockwaves. Crypto markets also reacted as Bitcoin price rose above $94,000 and Ethereum followed upward, even as headlines pointed to airstrikes, arrests, and rising regional tension.

That reaction turned attention

CaptainAltcoin·01-06 15:05

Bitcoin bulls shrug off Venezuela shock as stocks, oil and gold rally

Global stocks, along with Bitcoin, rose despite U.S. military actions in Venezuela, driven by strong performances in energy and tech sectors. Investors maintain optimism about earnings while cautiously balancing geopolitical risks.

BTC-1.17%

Cryptonews·01-06 14:06

SK Hynix hits a new all-time high... surpassing 720,000 KRW driven by individual net buying

On January 6th, SK Hynix's stock price rose by over 4%, reclaiming the 700,000 KRW mark. In the afternoon, the stock reached a new high, and investor expectations for semiconductor stocks surged. The Korea Composite Stock Price Index increased by 1.52%, with a significant net buy-in from individual investors, despite large-scale selling by foreign and institutional investors, which had a positive impact on market sentiment.

TechubNews·01-06 13:52

Whale Buys EDEL as Holders Jump 126% in 3 Days and Edel Finance Testnet Tops 26K Users

_Whale wallet dtht bought 2.29M EDEL for 65,000 USDC as Edel Finance testnet users passed 26,000, and holders rose 126%._

Market activity around Edel Finance increased after a tracked whale transaction drew attention across crypto platforms worldwide.

At the same time, user participation and h

USDC0.05%

LiveBTCNews·01-06 11:15

Crypto Market Cap Surpasses $3.2T As Optimism Leads to Price Surge

The crypto market surged in the past 24 hours, with a total market cap reaching $3.21T. Bitcoin rose by 1.08% and Ethereum by 1.83%. Top gainers include $TURBO, $TRUMP, and $BEER. DeFi TVL and NFT sales also increased, alongside notable developments in the sector.

BlockChainReporter·01-06 10:23

Metaplanet 狂掃 4279 BTC!總持倉 3.5 萬枚,股價飆 10.7%

Japan Bitcoin Vault Metaplanet's stock price rose 10.7% on Tuesday, and US OTC increased 19.17% on Monday. In Q4, 4,279 BTC were purchased, bringing the total holdings to 35,102 BTC. MicroStrategy rose 4.81%, Mara Holdings increased 6.86%, and Bakkt surged 31.47%. Goldman Sachs upgraded Coinbase to "Buy," with the stock price up 7.77%.

MarketWhisper·01-06 06:37

[Cryptocurrency Ecosystem Map] Cryptocurrency sector rebounds strongly within 7 days... Bitcoin ecosystem up 36% · NFT and AI sectors increase by over 30%

Within a week, the cryptocurrency market rebounded strongly, with the Bitcoin ecosystem experiencing the highest increase (+36.1%). NFTs and AI rose by 33.6% and 31.5% respectively. Risk appetite has recovered, and capital is flowing into growth sectors. The overall trend shows a diffusion-type increase, and the rotation trend centered on AI, NFTs, and the Bitcoin ecosystem is expected to continue in the short term.

TechubNews·01-06 06:09

XRP Jumps 11% as Buyers Push Token Back Toward a $140B Market Cap

XRP surged 11% to $2.39, driven by improved market sentiment as Bitcoin and Ethereum rose. Factors influencing this rebound include tighter supply dynamics, U.S. regulatory clarity, and the potential for ETF filings, highlighting XRP's volatility as a high-beta asset.

CryptometerIo·01-06 04:18

MICA Daily|U.S. stock indices hit new highs, BTC back to $94,000

Although there was breaking news over the weekend about the US invading Venezuela, everyone was worried that the market might become risk-averse due to concerns over worsening global situations. However, as the US responded quickly to the situation, the market saw a significant rally on Monday, with US stock indices once again hitting new highs. BTC started from 86,000 on Sunday and rose all the way to 94,000 USD. ETH also recovered the 3,100 USD level. Meanwhile, gold and silver also began to regain ground. The rebound and upward momentum continued on Monday, which is a normal response given the unstable global situation.

Since a sharp decline on October 10, BTC has been in a downward trend on the daily chart. Yesterday marked the first time it broke through the short-term downtrend line. If BTC can stabilize above 91,000 in the next few days, it would be considered an effective breakout of the short-term downtrend. This could give it the opportunity to stabilize and challenge the long-term downtrend line, breaking the two-month downward trend.

区块客·01-06 04:15

2026, the Year of Hard Assets! Gold and silver enter a continuous ten-year super cycle

In 2025, silver rose by 165%, and gold increased by 66%, marking the best performance since 1979. Gold hit 91 new highs within 27 months, nearly breaking records every week. Experts point out that this is a structural re-pricing of global capital shifting towards hard assets. Goldman Sachs states that the market is still in the "beginning of a super cycle that could last ten years."

MarketWhisper·01-06 02:46

The United States, after Maduro was expelled, oil prices soared... The change of government in Venezuela triggered turmoil in the oil market.

After the United States expelled Venezuelan President Maduro, uncertainty increased in the international crude oil market, and oil prices rose nearly 2%. Although Maduro has stepped down, sanctions remain, and market sentiment is tense. Experts warn that restoring production will require significant investment and good security, and the outlook is uncertain as sanctions have not been lifted.

TechubNews·01-05 21:08

Affected by foreign investment buying, government bond yields partially declined... The 2-year government bond closed at 2.831%.

On January 5th, the first national bond auction of 2026 was held. On that day, the South Korean bond market's government bond yields rose across the board in the morning, but in the afternoon, due to foreign investors' buy-in and capital inflows, some of the gains were recovered, and the market closed higher. As the first bond issuance of the year, this day attracted the attention of bond market participants.

A 28 trillion won (KRW) 2-year government bond auction was conducted on that day. During the bidding process, demand for short-term bonds was relatively weak, with the 2-year yield rising 3.9 basis points (1 basis point = 0.01 percentage points) from the previous trading day, closing at 2.831%. This was the largest increase among major maturity bonds. Conversely, the 3-year yield fell 0.2 basis points, closing at 2.933%, showing mixed movements within short-term bonds.

The 10-year government bond yield rose 1.0 basis point to 3.396%; the 5-year yield was 3.249% (up 1.0 basis point); the 20-year yield was 3.373%.

TechubNews·01-05 16:29

Nikkei 225 Index, driven by semiconductor positive news, approaches 52,000 points after two months... The all-time high is within reach.

The Japan Nikkei 225 Index rose nearly 3% on the first day of the new year, approaching 52,000 points, boosted by strong performance in the US stock market and positive expectations for the semiconductor industry. Related companies such as Kioxia and SoftBank saw significant stock price increases, supporting the index's rise. Meanwhile, long-term interest rates rose to a 27-year high, and the market generally expects the Bank of Japan to raise interest rates, leading to a depreciation of the yen. The future performance of the Japanese stock market will be influenced by central bank policies and the US interest rate outlook.

TechubNews·01-05 14:22

1.4 million electronics is just around the corner… The reason behind Samsung Electronics' 7% surge in a single day

Samsung Electronics stock price rose over 7% in a day, approaching 140,000 KRW, driven by the recovery of the semiconductor industry and AI investments. The KOSPI index hit a record high, with net foreign capital inflows indicating a rebound in market confidence. Overall, this reflects expectations of long-term growth in the semiconductor industry.

TechubNews·01-05 12:46

Meme coin price forecast: DOGE, SHIB, and PEPE rise together, Maduro becomes the key driver

After the United States arrested Maduro, DOGE, SHIB, and PEPE experienced a rally. PEPE surged 77% in four days, SHIB rose 12% on Sunday breaking out of the downtrend channel, and DOGE increased for five consecutive days, breaking above $0.15. The market reflects that the US may absorb or freeze 600,000 Bitcoin from Venezuela, reducing supply and triggering demand.

MarketWhisper·01-05 09:49

Meme coin market cap surges by $12 billion in 4 days! PEPE soars 65%, retail investor frenzy returns

In early 2026, the meme coin market cap increased by 30%, breaking $47 billion, with a daily trading volume of $9.2 billion. DOGE rose 20%, SHIB increased 18.9%, and PEPE surged 65.6%. Compared to altcoins (TOTAL3), which only increased by 7.5%, this indicates a shift of funds toward speculative assets. Analysts point out that the US IRS does not apply the 30-day wash sale rule to cryptocurrencies, leading investors to re-enter the market immediately in January after year-end tax clearing.

MarketWhisper·01-05 05:21

War becomes a catalyst! Influenced by the United States taking military action in retaliation against Venezuela, Bitcoin price breaks through $91,000

Bitcoin prices rise again, breaking the $91,000 mark during Sunday’s Asian morning trading session, continuing the rebound trend since early 2026. Market analysis indicates that approximately $180 million worth of cryptocurrencies were liquidated in the past 24 hours. Besides technical and capital factors forcing forced liquidations, recent geopolitical tensions and statements from the Trump administration about taking over Venezuela have also contributed to the market risk sentiment shift.

Bullish Liquidation, Bitcoin Breaks the $90,000 Barrier

According to the latest market quotes at press time, Bitcoin (BTC) briefly rose to about $91,300, with a daily increase of approximately 1.4%, and a cumulative gain of over 4% in the past week. Other major cryptocurrencies also strengthened, with Ethereum (ETH) rising about 1%, approaching $3,150, with a weekly increase of about 7%; Solana (SOL) was also

ChainNewsAbmedia·01-05 01:46

MicroStrategy's collapse countdown? Once "this indicator" drops below the critical point, holding the stock will be meaningless

Michael Saylor's MicroStrategy (MSTR) rose 1.22% in early trading today, but has plummeted 66% since its peak in July 2024. The key indicator mNAV is only 1.02; once it falls below 1, it indicates that the company's value is less than the Bitcoin it holds, and the holding becomes illogical, potentially triggering a sell-off.

MarketWhisper·01-04 06:29

Bitcoin returns to $91,000! The "sober rebound" of the attacking army and the new situation in 2026

Bitcoin breaks through $91,000, but futures basis is only 4%, and leverage levels are low, indicating that the spot buying demand after the end-of-2025 washout is leading.

(Background: Trump orders bombing of Caracas! Bitcoin drops below 90,000, ETH holds firm at 3100)

(Additional context: Global ETF growth in 2025 "attracts $1.5 trillion in funds," with BlackRock Bitcoin IBIT being the only one in the top 15 to incur losses)

Table of Contents

Low basis highlights spot buying

Capital flows back after ETF year-end settlement

Calm in the options market

As of January 4, 2026, Bitcoin (BTC) price steadily rose past $91,000 during Asian morning hours, hitting a nearly three-week high. Unlike typical sentiment-driven rallies, on-chain and derivatives data indicate this is a wave of deep deleveraging at the end of 2025.

動區BlockTempo·01-04 05:50

Bitcoin returns to $90,000! ETF attracts $459 million in a single week, ending two weeks of outflows

Bitcoin first returned to $90,000 on December 12 and rose to $91,518 on January 4. As of the week ending January 2, the US spot ETF saw a net inflow of $459 million, ending two weeks of outflows. The decline in the 10-year Japanese government bond yield has driven an influx of yen arbitrage trading. Despite the fear index dropping to 25, technical and fundamental divergences suggest a short-term target of $95,000.

BTC-1.17%

MarketWhisper·01-04 05:42

ETH Accumulation Surges as Staking Locks Supply

_Ethereum has experienced unprecedented inflows of accumulation, and staking of validators is constraining the supply. ETH has been trying to break critical support levels as the market dynamics change._

Ether rose over $3,100 and then fell last night. The asset has now been placed in a very

ETH-2.55%

LiveBTCNews·01-04 03:35

2026 Cryptocurrency Bull Market Begins: Focus on BTC, ETH, XRP, SOL Upward Trends

Week 1 of 2026, the overall cryptocurrency market rose, with Bitcoin and Ethereum steadily recovering, and Ripple experiencing the largest increase. Experts believe that institutional investor participation will enhance market stability and recommend selective investments in projects with substantial value.

TechubNews·01-03 16:28

New York Stock Market's First Day in 2026 sees Fluctuations and Volatility... AI and Semiconductor Strengths Lead to Divergent Opening Trends

The New York stock market has exhibited strong volatility since the first trading day of 2026, opening with an unstable trend. Although some indices rebounded after the previous trading day's decline, high-level pressure and profit-taking selling continued to emerge, leading to a pattern of fluctuations.

As of 10:17 AM local time on January 2, the Dow Jones Industrial Average fell 37.54 points (0.08%) to 48,025.75 points. On the other hand, the S&P 500 index rose 16.49 points (0.24%) to 6,861.99 points; the Nasdaq Composite index increased 111.83 points (0.48%) to 23,353.82 points, showing strong performance. However, intra-day movements remained unstable, with gains narrowing or turning into declines repeatedly.

Previously, the New York stock market had declined for four consecutive trading days, dampening investor sentiment.

TechubNews·01-02 16:31

AVAX ETF Surge Sparks Trading Volume Jump to $546 Million

Avalanche (AVAX) rose 11% after Grayscale's S-1 filing to convert its trust into a spot AVAX ETF, boosting trading volume by 140%. This highlights growing institutional interest and confidence in AVAX's long-term potential as a viable investment.

AVAX-2.76%

Coinfomania·01-02 10:20

14,445,863,488,009 SHIB in Day: Shiba Inu Open Interest Jumps 20% in 2026 Start - U.Today

Shiba Inu is experiencing a significant surge in trader participation, evidenced by a 20% increase in open interest to $103.87 million. Following a price reversal, SHIB's trading volume rose by 20.34%. Community leaders express optimism for the future, highlighting Shiba Inu as a community-driven ecosystem.

UToday·01-01 15:02

Crypto Market Records Cautious Momentum on New Year’s Eve With Slight Dip

The crypto market has seen caution on New Year's Eve, with a 0.71% drop in market cap to $2.96T. Bitcoin decreased by 0.91%, while Ethereum slightly rose. Notable gainers include $BPX and $DOGO. NFT sales plunged 66.27%, and the U.S. Senate is reviewing crypto regulations.

BlockChainReporter·01-01 11:03

Pi coin revives on New Year's Eve! Social buzz skyrockets 10 times, Morning Star pattern pushes to $0.22

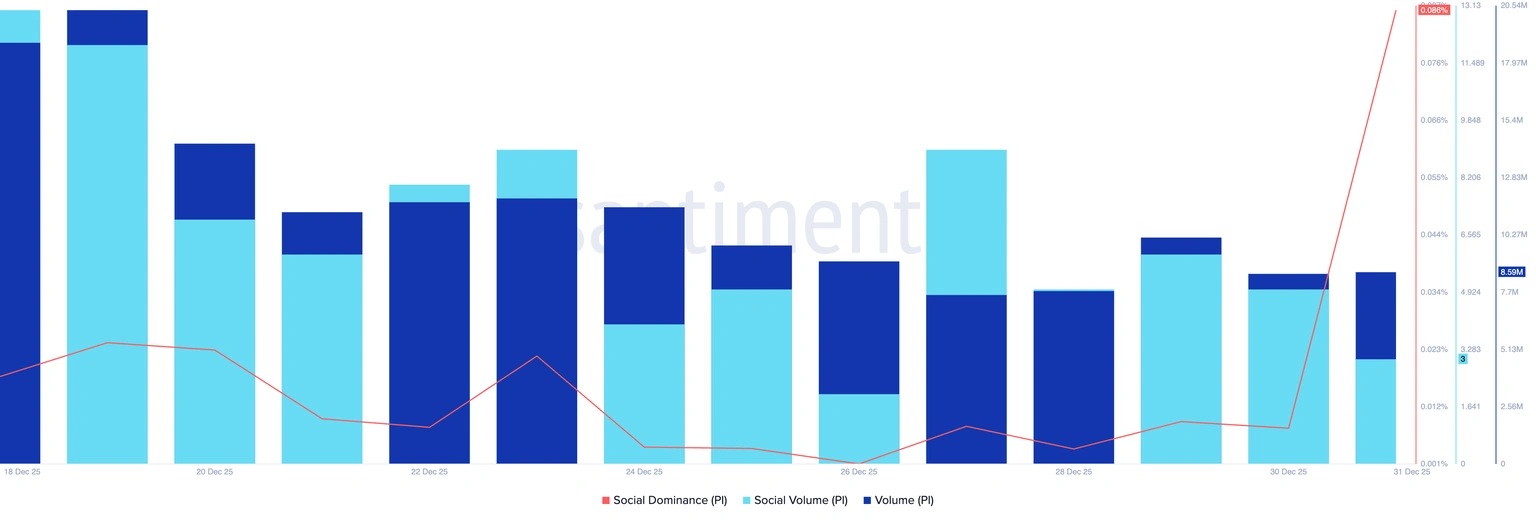

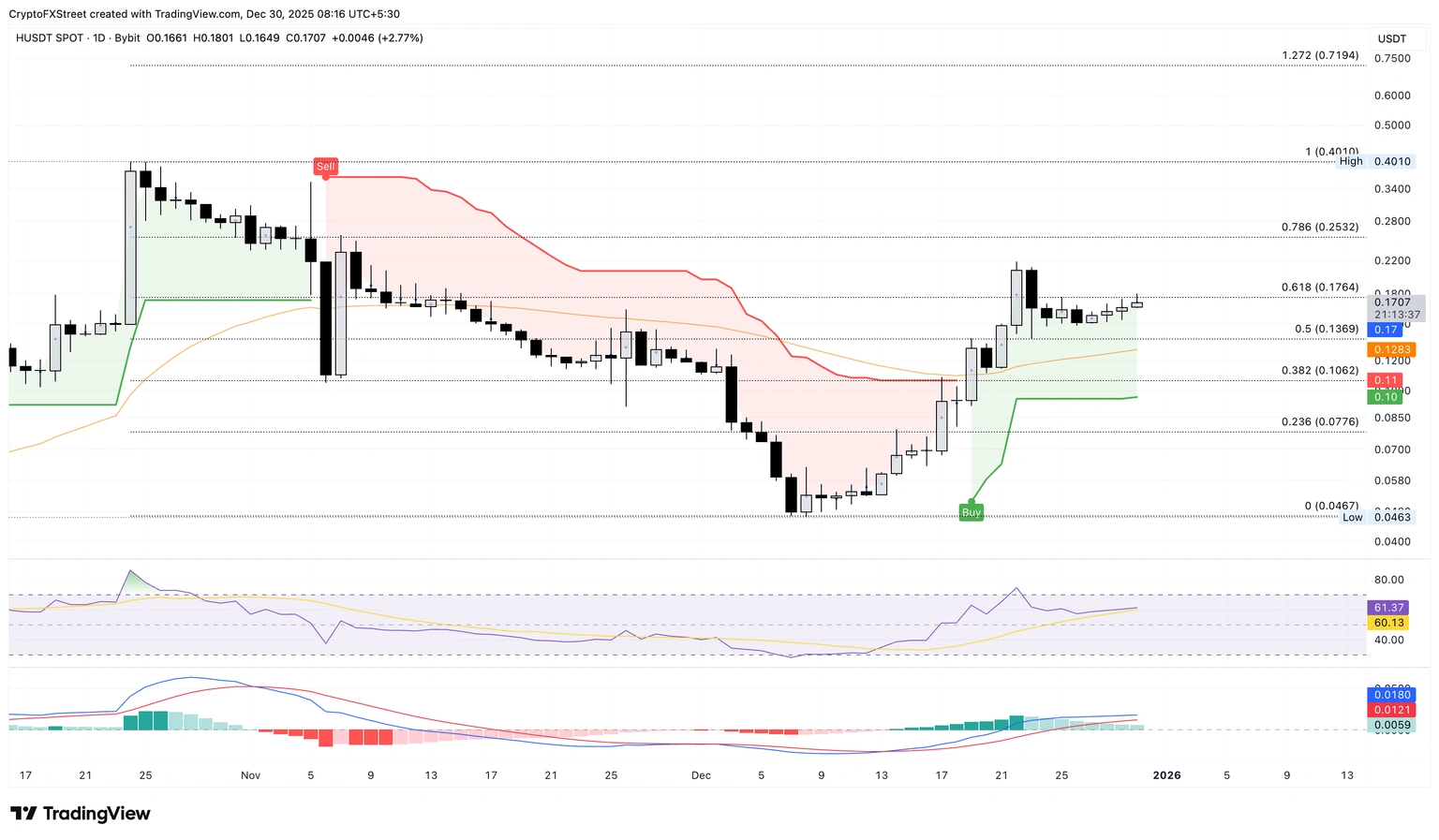

Pi Network rose nearly 1% on Wednesday, continuing its rebound momentum. Santiment data shows social media influence increased to 0.086%, and retail investor expectations are warming. On the technical side, PI held the $0.20 support level to form a morning star pattern, with a target of the 50-day EMA at $0.2191. Although the daily trading volume decreased from 38.65 million coins to 8.58 million coins, the rising MACD histogram indicates strengthening bullish momentum.

PI-0.7%

MarketWhisper·2025-12-31 07:38

U.S. stocks edge lower, Bitcoin remains steady at 88K, is DAT quietly exiting?

U.S. stock three major indices yesterday (12/30) declined slightly, silver and gold rebounded after plunging from all-time highs. The cryptocurrency market rose 1.03% in the past 24 hours, reversing the previous seven-day decline trend. Although Bitcoin (BTC) slightly recovered to 88K, digital asset financial company (DAT) still performed weakly. The health products company Prenetics Global Limited, supported by football superstar Beckham, announced abandoning its further Bitcoin purchase strategy after raising $48 million to buy 510 Bitcoins.

(Silver ranks as the best-performing asset in 2025, with "Currency Wars" author predicting it could reach $200)

U.S. stock three major indices declined slightly, silver and gold rebounded after plunging from all-time highs

U.S. stock three major indices closed lower, and the minutes from the Federal Reserve's most recent meeting indicate that if the cont

ChainNewsAbmedia·2025-12-31 00:15

Midnight 衝 0.10 美元!Humanity Protocol、MYX Finance 漲勢全解析

Midnight, Humanity Protocol, and MYX Finance lead the rally of altcoins, with Midnight rising 9% to $0.095, targeting $0.10. Humanity Protocol has increased for four consecutive days, testing the $0.1780 resistance. MYX Finance rose 4% to $3.50, approaching the key level of $3.62, with RSI reaching 61 indicating increased buying pressure.

MarketWhisper·2025-12-30 06:00

Traders Add $2.4B Leverage Despite December Fear

Despite market fears, Bitcoin and Ethereum futures rose by $3B as retail traders increased leverage while professionals exited. Accumulation continued on major exchanges, contradicting capitulation signals. Options expiry may trigger volatility, with predictions of potential dips and rebounds in Bitcoin's price.

CryptoFrontNews·2025-12-29 11:56

Silver Hits Record High, Then Crashes 10% as Bitcoin Leads Crypto Higher

Silver markets experienced a dramatic spike to $83.75 before plummeting to $75.15 in under an hour, while Bitcoin rose towards $90,000, driven by increased leverage and short-covering. The contrasting movements highlight heightened volatility in both markets.

BTC-1.17%

CaptainAltcoin·2025-12-29 10:05

[Korean Stock Market Closing行情] Korea Composite Stock Price Index and KOSDAQ Index rise for two consecutive days… Electronics, Electrical, and Pharmaceutical sectors strengthen

South Korea's stock market KOSPI rose by 2.20%, closing at 4220.56 points, driven by large-cap and electrical electronic stocks. KOSDAQ also increased by 1.40%, supported by the pharmaceutical industry. Foreign investors' net purchases were significant, the Korean won appreciated, and international oil prices rose slightly.

TechubNews·2025-12-29 07:36

Grok AI Major Prediction: End of the Gold Bull Market, the New Era of Bitcoin Begins?

The integration of artificial intelligence and financial market analysis is giving rise to entirely new insights. Recently, Grok AI, developed by xAI under Elon Musk, responded to a market analyst's question by revisiting the performance of various assets after the peak of precious metals in August 2020. It revealed a thought-provoking rotation pattern: after gold and silver reached temporary peaks, capital seemed to shift massively into digital assets represented by Bitcoin and high-growth, high-risk sectors such as U.S. tech stocks. Data shows that from August 2020 to 2025, Bitcoin's cumulative increase was approximately 500%, while the Nasdaq index rose about 150%, both significantly outperforming the stable precious metals during the same period. This historical analysis model may provide key clues for understanding current and future macro capital flows.

BTC-1.17%

MarketWhisper·2025-12-29 03:37

[Korean Stock Market Opening] KOSPI breaks through 4180 points... Hanwha Aerospace and SK Hynix lead the gains

On the 29th, the Korean stock market rose, with the KOSPI index up 1.24% to 4,180.78 points, and retail investors net buying 390 billion KRW. The KOSDAQ index increased by 0.60% to 925.15 points, with retail investors net buying 150.2 billion KRW. The Korean won against the US dollar fell by 9.1 won, and domestic gold prices declined.

TechubNews·2025-12-29 00:53

Bitcoin Cash (BCH) Rockets 61,561% in Liquidation Imbalance, Price Reacts - U.Today

Bitcoin Cash (BCH) is outperforming the broader cryptocurrency market after it rose approximately 2% higher than other assets in the last 24 hours. The asset’s market has also witnessed a severe liquidation imbalance, with bears suffering huge losses in a four-hour time frame.

Bitcoin Cash

UToday·2025-12-27 11:56

2025 Year-End Inventory and Forecast Review: The Moment for the Big Shots to "Face-Slap"?

The Christmas bells of 2025 have already rung, but for cryptocurrency investors, it seems that the gifts in Santa's bag this year contain something different. In stark contrast to the traditional stock market (S&P 500), which has seen strong year-end gains and new highs, Bitcoin (BTC) showed noticeable weakness and divergence during the 2025 Christmas period.

As the world's largest cryptocurrency by market capitalization, Bitcoin closed at around $87,800 on Christmas Day 2025. Amid light trading volume and overall market caution, it only rose slightly by 0.75%. Bitcoin's price fluctuated within a narrow range of $85,000 to $90,000, reflecting low market volatility. Investors reduced risk before the end of the year, with spot Bitcoin and Ethereum ETFs experiencing hundreds of millions of dollars in outflows in just one day on December 24.

This performance is full of challenges for Bitcoin

区块客·2025-12-27 05:55

DTCC Announces Plans to Tokenize US Treasurys on Canton Network

DTCC will tokenize US Treasurys on the Canton Network to boost institutional adoption of blockchain.

Canton Coin rose 27% as tokenized real-world assets attracted investor attention and market activity.

Tokenization allows faster settlements, lower costs and global access for

CryptoNewsLand·2025-12-26 12:41

2025 Year-End Inventory and Forecast Review: The Moment for the Big Shots to "Face-Slap"?

The Christmas bells of 2025 have already rung, but for cryptocurrency investors, it seems that the gifts in Santa's bag this year contain something different. In stark contrast to the traditional stock market (S&P 500), which has seen strong year-end gains and new highs, Bitcoin (BTC) showed noticeable weakness and divergence during the 2025 Christmas period.

As the world's largest cryptocurrency by market capitalization, Bitcoin closed at around $87,800 on Christmas Day 2025. Amid light trading volume and overall market caution, it only rose slightly by 0.75%. Bitcoin's price fluctuated within a narrow range of $85,000 to $90,000, reflecting low market volatility. Investors reduced risk before the end of the year, with spot Bitcoin and Ethereum ETFs experiencing hundreds of millions of dollars in outflows in just one day on December 24.

This performance is full of challenges for Bitcoin

区块客·2025-12-26 05:53

ZCash Price Surges 10% as Crypto Market Consolidates

_ZCash price jumps 10% to $446 as trading volumes rise. Analysts monitor $400 support and $450–$465 resistance for breakout potential._

ZCash (ZEC) defied the broader crypto market’s consolidation on December 25, price rising 10% to $446. Its market capitalization rose to over $7.3 billion, and

LiveBTCNews·2025-12-26 05:00

[Domestic Stock Market Opening] The domestic stock market is trending upward... Samsung Electronics rose more than 3%, driving the KOSPI index higher

On the 26th, the Korean stock market overall rose, with the KOSPI index up 0.76%, foreign and institutional investors net buying, and individual investors in a net selling position. The Kosdaq index also rose, with individual and institutional investors net buying. The Korean won appreciated against the US dollar, and gold prices increased.

TechubNews·2025-12-26 01:01

Shiba Inu Slips to $0.057263 as Tight Range Holds Between Key Levels

Shiba Inu is trading at $0.057263 with a fall of 2.4 percent in the last 24 hours.

Price was above the support of $0.057196 and the resistance was at $0.057439.

SHIB rose 3.1% relative to Bitcoin and 3.4 percent versus Ethereum even with the USD fallback.

Shiba Inu moved down in t

CryptoNewsLand·2025-12-25 19:40

How can a single card be valued at tens of millions of dollars? The influencer marketing effect and the 30-year fan economy of Pokémon

Author: Amin Ayan & Vanessa Perdomo

Editor: Tim, PANews

The world's most expensive Pokémon card will once again go on the auction block.

Social media influencer and WWE star Logan Paul recently announced that he will sell his collection of rare Pokémon cards. He explained that the current Pokémon collectibles market is very hot, which will provide a good "appreciation opportunity" for this collection.

Logan Paul has been active on social media for a long time and has publicly expressed a strong interest in rare Pokémon cards multiple times. His status as a collector is well known. He and his brother Jake Paul rose to fame early on through Vine and YouTube platforms, and later ventured into boxing, wrestling, and entertainment. Notably, Jake

PANews·2025-12-25 09:29

Load More