Post content & earn content mining yield

placeholder

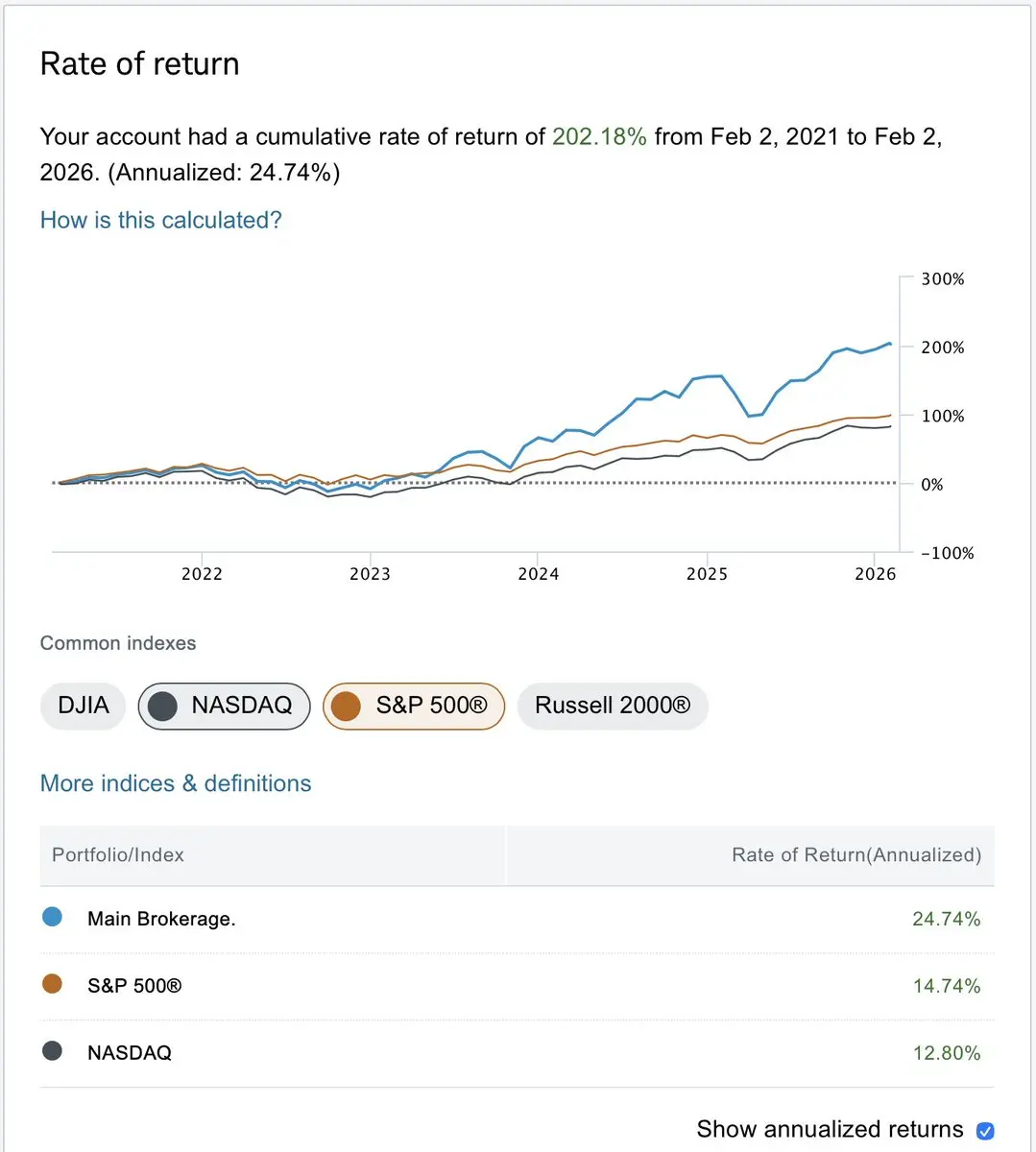

InvestingWithBrandon

If your strategy doesn't beat the S&P500 over 5+ years, what exactly are you doing...

Most “strategies” are just:

- More screen time

- More stress

- More trades

- Worse returns than the brainless SP500

We are all here to make money right?

So do yourself a favor & look at your true ROI in the last 5 years and see if what you are doing even beats the SP... I bet most people reading this did not.

Me?

I have smoked the SP500 in the last 5 years.

The screenshot is proof the system I use through bull markets & bear markets does smoke the SP500.

Anyone can get amazing ROIs in bull markets (I do too,

Most “strategies” are just:

- More screen time

- More stress

- More trades

- Worse returns than the brainless SP500

We are all here to make money right?

So do yourself a favor & look at your true ROI in the last 5 years and see if what you are doing even beats the SP... I bet most people reading this did not.

Me?

I have smoked the SP500 in the last 5 years.

The screenshot is proof the system I use through bull markets & bear markets does smoke the SP500.

Anyone can get amazing ROIs in bull markets (I do too,

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Charlie Munger says:

"Real money is not in buying and selling, but in waiting."

In financial markets, "opportunity" never comes wrapped in gifts,

but always arrives wearing a cloak of fear and pessimism.

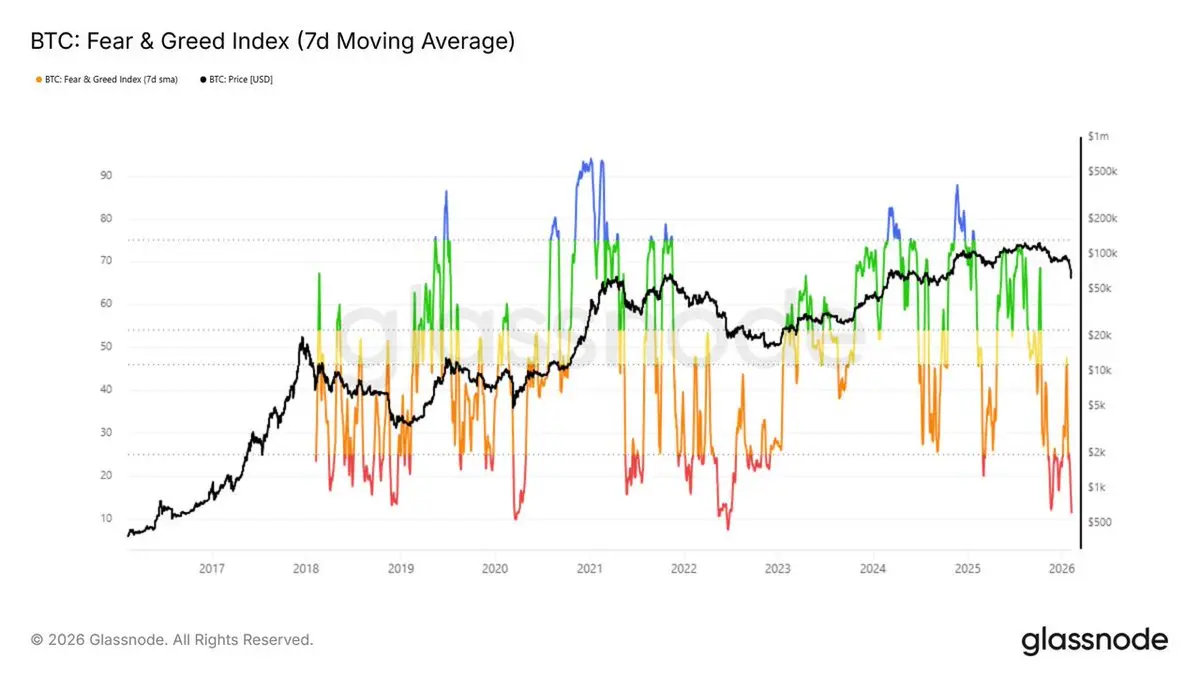

Today, the Relative Strength Index (RSI) for Bitcoin on the weekly chart drops below 30.

Historically, this has only happened 4 times in Bitcoin's entire history.

Each time the indicator reached this "scary" bottom,

it signaled the start of a wild upward journey for those who had patience.

Why does everyone run away while opportunity smiles?

Herd psychology:

When the RSI co

View Original"Real money is not in buying and selling, but in waiting."

In financial markets, "opportunity" never comes wrapped in gifts,

but always arrives wearing a cloak of fear and pessimism.

Today, the Relative Strength Index (RSI) for Bitcoin on the weekly chart drops below 30.

Historically, this has only happened 4 times in Bitcoin's entire history.

Each time the indicator reached this "scary" bottom,

it signaled the start of a wild upward journey for those who had patience.

Why does everyone run away while opportunity smiles?

Herd psychology:

When the RSI co

MC:$10.65KHolders:30

41.06%

- Reward

- like

- Comment

- Repost

- Share

汗血宝马

汗血宝马

Created By@gatefunuser_22b1

Listing Progress

100.00%

MC:

$7.9K

More Tokens

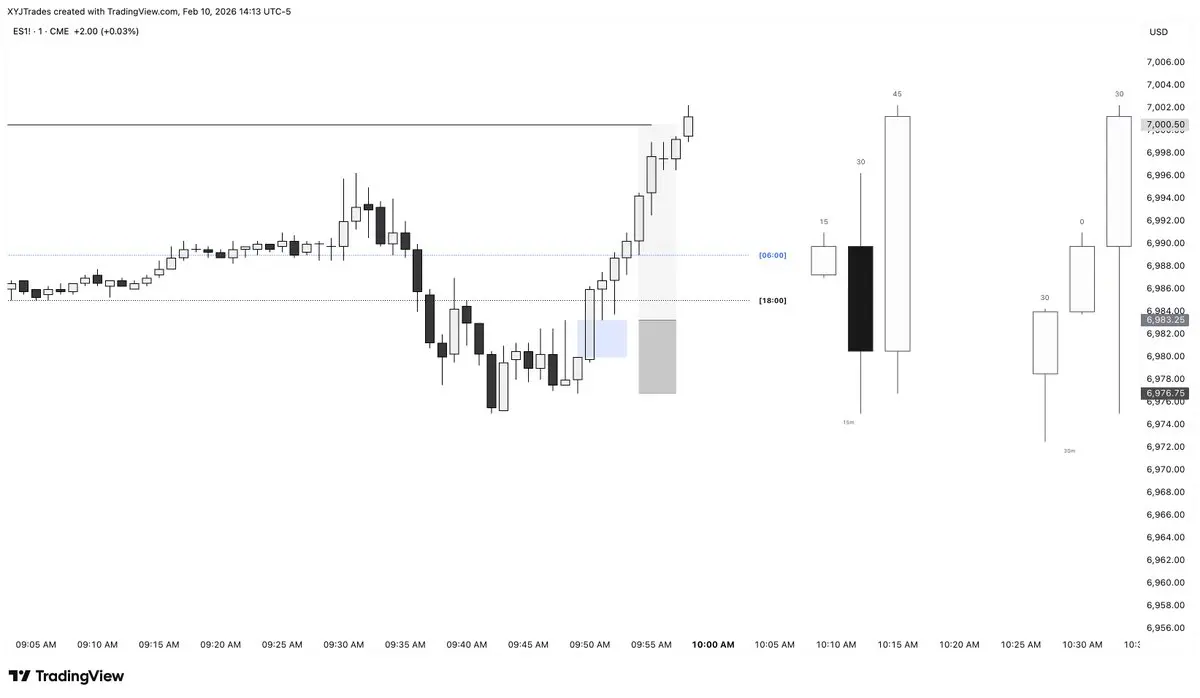

Flat today; filtered out some BS on indices.

Wanted ES longs on open didn't get filled in the m1 gap.

GG

Wanted ES longs on open didn't get filled in the m1 gap.

GG

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLVEVLPEUG

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Start the Year of the Horse with a win! Gate Square's $50,000 Red Envelope Rain is waiting for you to post and smash https://www.gate.com/campaigns/4044?ref=AwcVVV1b&ref_type=132

View Original

- Reward

- like

- Comment

- Repost

- Share

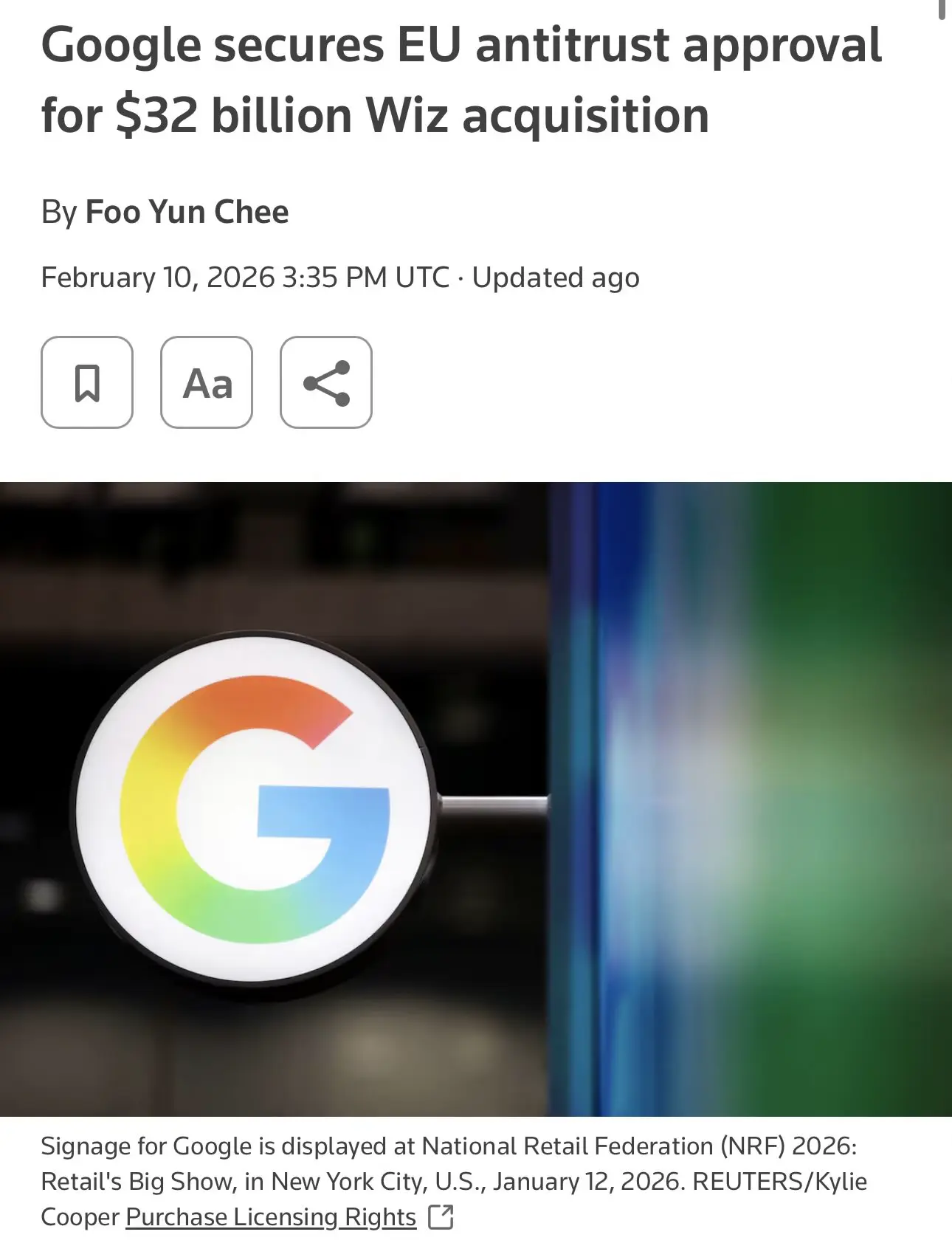

The European Union approves "unconditionally" Google's acquisition of cybersecurity company Wiz $GOOGL

The European Commission justified the approval by stating that Google still lags behind its competitors in market share, and that the deal will not prevent customers from choosing other alternatives or switching to different providers

$BTC $ETH $GT

#BuyTheDipOrWaitNow? #GoldRebounds #GateSpringFestivalHorseRacingEvent #WalshSaysToCautiouslyShrinkBalanceSheet #CelebratingNewYearOnGateSquare

View OriginalThe European Commission justified the approval by stating that Google still lags behind its competitors in market share, and that the deal will not prevent customers from choosing other alternatives or switching to different providers

$BTC $ETH $GT

#BuyTheDipOrWaitNow? #GoldRebounds #GateSpringFestivalHorseRacingEvent #WalshSaysToCautiouslyShrinkBalanceSheet #CelebratingNewYearOnGateSquare

MC:$2.42KHolders:1

0.00%

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3988?ref=BVVEVQ9c&ref_type=132

- Reward

- 7

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

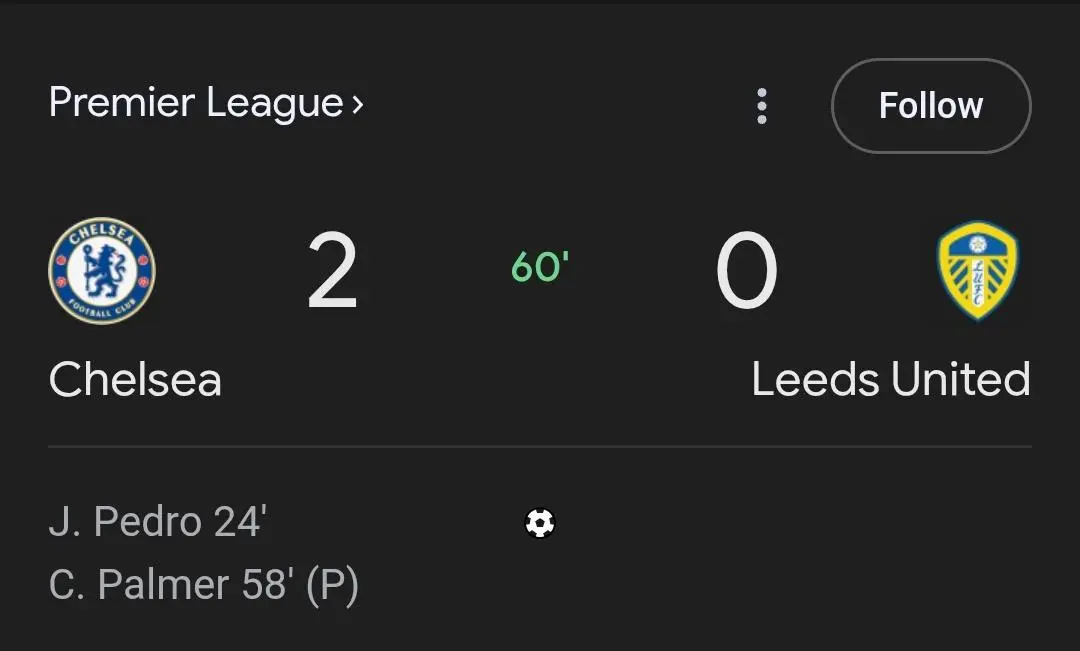

Chelsea Fans

Gather Here!!!!

Blue is the Best Color

🔵 🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵

Gather Here!!!!

Blue is the Best Color

🔵 🔵🔵🔵🔵🔵🔵🔵🔵🔵🔵

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$13.73K

More Tokens

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 8

- 5

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

🚨🇺🇸CONFIRMED:

Sam Bankman-Fried says he is seeking a new trial in the FTX case.

Sam Bankman-Fried says he is seeking a new trial in the FTX case.

- Reward

- like

- Comment

- Repost

- Share

cheers with my 2 liters of beer 🍻

- Reward

- like

- Comment

- Repost

- Share

Referral Carnival: Earn Up to $300 Cash per Referrer https://www.gate.com/uk/campaigns/4056?ref=VVEXUW1ZAQ&ref_type=132&utm_cmp=Az5y2JbZ

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More208.27K Popularity

7.73K Popularity

10.65K Popularity

11.08K Popularity

5.32K Popularity

Hot Gate Fun

View More- MC:$2.42KHolders:20.07%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.48%

- MC:$2.41KHolders:10.00%

News

View MoreThe US Dollar Index declined by 0.02%, ending at 96.799

43 m

Data: In the past 24 hours, the entire network has liquidated $227 million, with long positions liquidated at $156 million and short positions at $71.47 million.

1 h

Data: 2012.8 BTC transferred from an anonymous address, routed through a middle address, and then sent to another anonymous address

1 h

Data: If BTC breaks through $72,308, the total liquidation strength of mainstream CEX short positions will reach $1.117 billion.

2 h

Data: If ETH breaks through $2,103, the total liquidation strength of short positions on mainstream CEXs will reach $679 million.

2 h

Pin