#GrayscaleEyesAVESpotETFConversion DeFi Meets Wall Street — A New Chapter for Regulated Crypto Investing

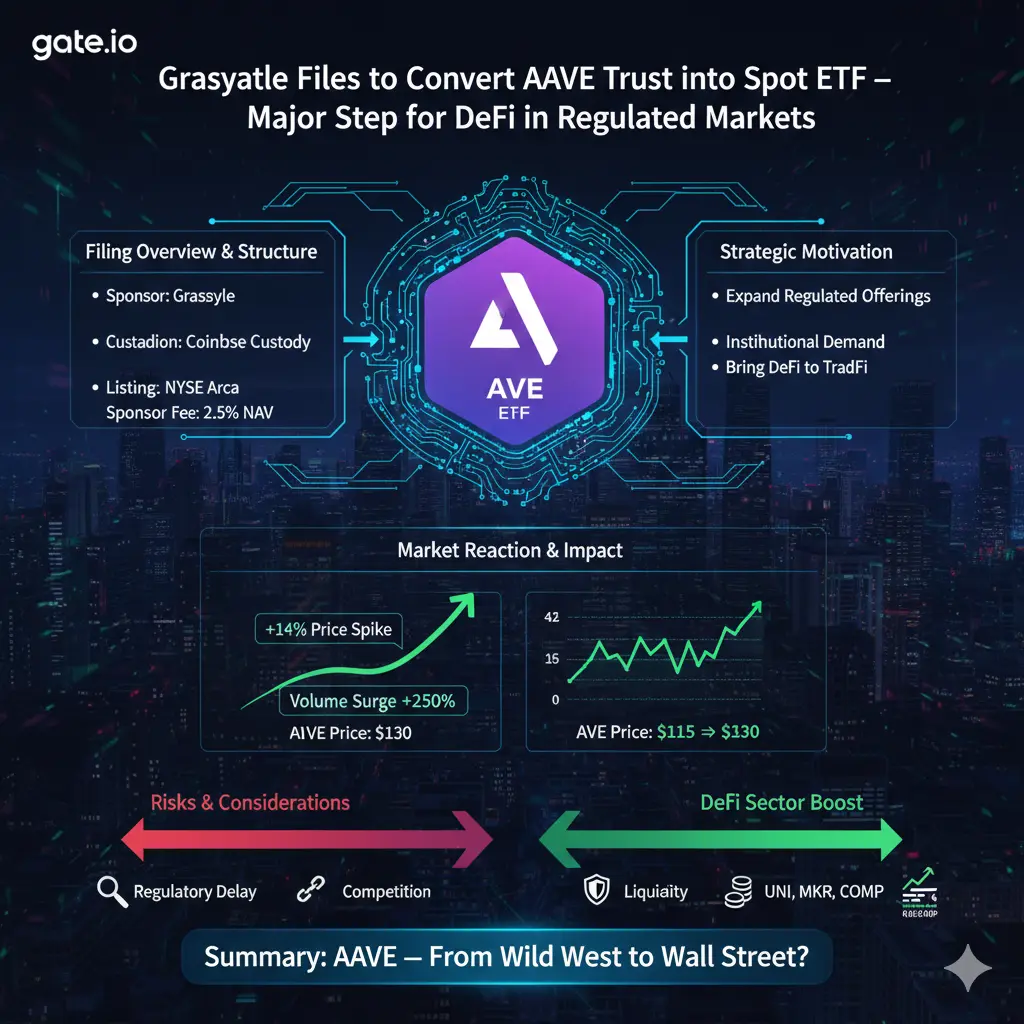

Global digital asset manager Grayscale Investments has taken another major step toward expanding regulated crypto access by filing a Form S-1 registration statement with the U.S. Securities and Exchange Commission. The filing seeks approval to convert its existing AAVE Trust into a spot exchange-traded fund (ETF), marking one of the most ambitious efforts yet to bring decentralized finance (DeFi) governance tokens into traditional financial markets.

If approved, this move would allow U.S. investors to gain direct exposure to AAVE through standard brokerage accounts, eliminating the need for self-custody, private wallets, or decentralized exchanges. It represents a major milestone in the institutionalization of DeFi assets.

🏦 Background: From Trusts to Spot ETFs

Grayscale previously set a precedent by converting its Bitcoin Trust into a spot ETF, opening the door for large-scale institutional participation in crypto markets. Building on that success, the AAVE filing signals the firm’s intention to move beyond major base-layer assets and into the DeFi governance sector.

This transition reflects growing confidence that mature DeFi protocols can meet regulatory standards related to transparency, custody, and market integrity — a critical requirement for ETF approval.

📊 About the Proposed AAVE Spot ETF

If approved, Grayscale’s AAVE ETF is expected to feature:

Direct token holdings: Physical-backed exposure to AAVE, not futures or derivatives

Primary listing venue: NYSE Arca

Custody & settlement: Institutional-grade services via Coinbase

Estimated management fee: Around 2.5% of NAV

Transparent reserves: On-chain verification and periodic audits

New disclosures in the filing also highlight enhanced compliance monitoring, real-time liquidity tracking, and upgraded risk controls designed to meet evolving SEC standards in 2026.

🌐 Understanding AAVE and Its Role in DeFi

AAVE is the native governance and utility token of Aave, one of the world’s largest decentralized lending platforms. The protocol enables users to lend and borrow digital assets through smart contracts, without traditional intermediaries.

AAVE holders participate in:

Protocol governance and voting

Risk management decisions

Staking and safety modules

Ecosystem upgrades

By targeting AAVE, Grayscale is effectively betting on the long-term sustainability of decentralized credit markets.

🔎 Strategic Significance

The proposed conversion reflects Grayscale’s broader strategy to bridge DeFi and regulated finance. By packaging governance tokens into compliant investment vehicles, the firm lowers technical and operational barriers for mainstream investors.

From an institutional perspective, this ETF could:

Enable participation in DeFi without on-chain complexity

Integrate governance assets into portfolio models

Support long-term protocol stability

Expand capital inflows into decentralized ecosystems

This also marks a shift where institutional capital begins to play a larger role in shaping protocol governance.

⚖️ Regulatory Environment in 2026

The filing comes amid gradually improving regulatory acceptance of crypto ETFs in the United States. After the approval of spot Bitcoin and Ethereum ETFs, regulators have shown greater openness — though altcoin and DeFi-linked products remain under heightened scrutiny.

Key areas under SEC review include:

Market surveillance and manipulation safeguards

Custody security

Liquidity depth

Price discovery mechanisms

Investor protection frameworks

In 2026, regulators are also placing increased emphasis on AI-driven monitoring systems and cross-market surveillance, which Grayscale has incorporated into its compliance infrastructure.

🌍 Market and Industry Implications

A spot AAVE ETF could reshape both TradFi and DeFi landscapes:

Institutional Expansion

Pension funds, hedge funds, and asset managers may gain regulated access to DeFi governance tokens, increasing long-term capital inflows.

Retail Adoption

Everyday investors can gain exposure through familiar platforms, accelerating mainstream participation.

Protocol Legitimacy

Institutional involvement may strengthen confidence in decentralized lending as a sustainable financial model.

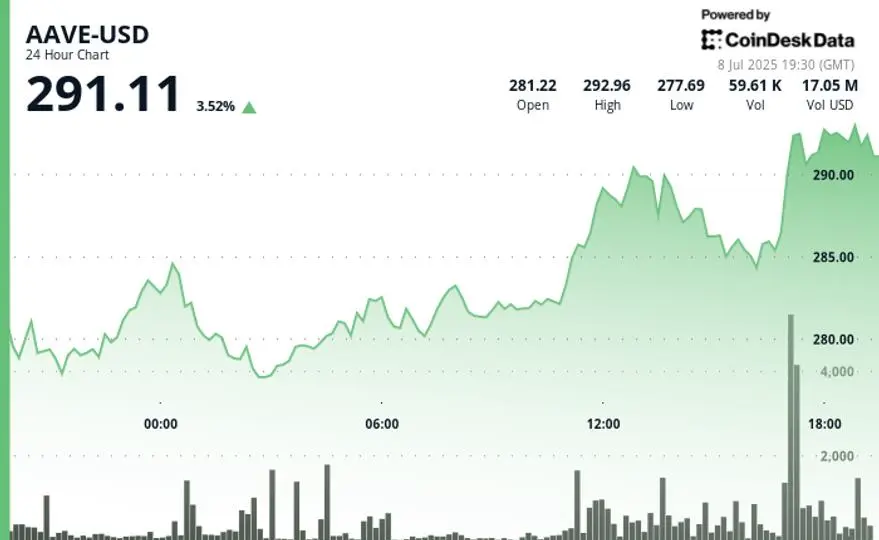

Price & Liquidity Effects

ETF accumulation could influence on-chain supply-demand dynamics, tightening circulating supply and improving market depth.

⚠️ Risks and Key Considerations

Despite its potential, several risks remain:

High volatility of governance tokens

Smart contract and protocol vulnerabilities

Regulatory delays or conditional approvals

Governance centralization risks

Dependence on ecosystem adoption

Institutional dominance in voting processes could also shift DeFi away from community-led decision-making, creating long-term structural challenges.

🔮 Broader Outlook for DeFi ETFs

Grayscale’s AAVE filing fits into a wider trend of tokenizing decentralized governance for regulated markets. If successful, it may pave the way for similar ETFs linked to:

MakerDAO (MKR)

Compound Finance (COMP)

Uniswap (UNI)

Such developments could transform DeFi tokens into recognized asset-class components within institutional portfolios.

📌 What’s New in This Filing (2026 Update)

Compared to earlier crypto ETF applications, this proposal introduces:

AI-powered risk monitoring

Real-time on-chain reserve audits

Cross-exchange liquidity safeguards

Enhanced investor disclosure frameworks

ESG-style sustainability reporting for protocol activity

These upgrades aim to align DeFi assets with modern regulatory and governance expectations.

✅ Final Takeaway

Grayscale’s push to convert its AAVE Trust into a spot ETF represents a landmark moment in crypto finance. It signals that decentralized governance tokens are moving from experimental assets into regulated investment vehicles.

If approved, this ETF could accelerate institutional adoption, strengthen DeFi legitimacy, and reshape how traditional capital interacts with blockchain ecosystems.

In essence:

DeFi + Regulation + Institutional Access = The Next Phase of Crypto Markets

The coming months of SEC review will determine whether AAVE becomes the first major governance token to enter the mainstream ETF universe — potentially setting the blueprint for the future of decentralized finance in global capital markets. 🚀📊

Global digital asset manager Grayscale Investments has taken another major step toward expanding regulated crypto access by filing a Form S-1 registration statement with the U.S. Securities and Exchange Commission. The filing seeks approval to convert its existing AAVE Trust into a spot exchange-traded fund (ETF), marking one of the most ambitious efforts yet to bring decentralized finance (DeFi) governance tokens into traditional financial markets.

If approved, this move would allow U.S. investors to gain direct exposure to AAVE through standard brokerage accounts, eliminating the need for self-custody, private wallets, or decentralized exchanges. It represents a major milestone in the institutionalization of DeFi assets.

🏦 Background: From Trusts to Spot ETFs

Grayscale previously set a precedent by converting its Bitcoin Trust into a spot ETF, opening the door for large-scale institutional participation in crypto markets. Building on that success, the AAVE filing signals the firm’s intention to move beyond major base-layer assets and into the DeFi governance sector.

This transition reflects growing confidence that mature DeFi protocols can meet regulatory standards related to transparency, custody, and market integrity — a critical requirement for ETF approval.

📊 About the Proposed AAVE Spot ETF

If approved, Grayscale’s AAVE ETF is expected to feature:

Direct token holdings: Physical-backed exposure to AAVE, not futures or derivatives

Primary listing venue: NYSE Arca

Custody & settlement: Institutional-grade services via Coinbase

Estimated management fee: Around 2.5% of NAV

Transparent reserves: On-chain verification and periodic audits

New disclosures in the filing also highlight enhanced compliance monitoring, real-time liquidity tracking, and upgraded risk controls designed to meet evolving SEC standards in 2026.

🌐 Understanding AAVE and Its Role in DeFi

AAVE is the native governance and utility token of Aave, one of the world’s largest decentralized lending platforms. The protocol enables users to lend and borrow digital assets through smart contracts, without traditional intermediaries.

AAVE holders participate in:

Protocol governance and voting

Risk management decisions

Staking and safety modules

Ecosystem upgrades

By targeting AAVE, Grayscale is effectively betting on the long-term sustainability of decentralized credit markets.

🔎 Strategic Significance

The proposed conversion reflects Grayscale’s broader strategy to bridge DeFi and regulated finance. By packaging governance tokens into compliant investment vehicles, the firm lowers technical and operational barriers for mainstream investors.

From an institutional perspective, this ETF could:

Enable participation in DeFi without on-chain complexity

Integrate governance assets into portfolio models

Support long-term protocol stability

Expand capital inflows into decentralized ecosystems

This also marks a shift where institutional capital begins to play a larger role in shaping protocol governance.

⚖️ Regulatory Environment in 2026

The filing comes amid gradually improving regulatory acceptance of crypto ETFs in the United States. After the approval of spot Bitcoin and Ethereum ETFs, regulators have shown greater openness — though altcoin and DeFi-linked products remain under heightened scrutiny.

Key areas under SEC review include:

Market surveillance and manipulation safeguards

Custody security

Liquidity depth

Price discovery mechanisms

Investor protection frameworks

In 2026, regulators are also placing increased emphasis on AI-driven monitoring systems and cross-market surveillance, which Grayscale has incorporated into its compliance infrastructure.

🌍 Market and Industry Implications

A spot AAVE ETF could reshape both TradFi and DeFi landscapes:

Institutional Expansion

Pension funds, hedge funds, and asset managers may gain regulated access to DeFi governance tokens, increasing long-term capital inflows.

Retail Adoption

Everyday investors can gain exposure through familiar platforms, accelerating mainstream participation.

Protocol Legitimacy

Institutional involvement may strengthen confidence in decentralized lending as a sustainable financial model.

Price & Liquidity Effects

ETF accumulation could influence on-chain supply-demand dynamics, tightening circulating supply and improving market depth.

⚠️ Risks and Key Considerations

Despite its potential, several risks remain:

High volatility of governance tokens

Smart contract and protocol vulnerabilities

Regulatory delays or conditional approvals

Governance centralization risks

Dependence on ecosystem adoption

Institutional dominance in voting processes could also shift DeFi away from community-led decision-making, creating long-term structural challenges.

🔮 Broader Outlook for DeFi ETFs

Grayscale’s AAVE filing fits into a wider trend of tokenizing decentralized governance for regulated markets. If successful, it may pave the way for similar ETFs linked to:

MakerDAO (MKR)

Compound Finance (COMP)

Uniswap (UNI)

Such developments could transform DeFi tokens into recognized asset-class components within institutional portfolios.

📌 What’s New in This Filing (2026 Update)

Compared to earlier crypto ETF applications, this proposal introduces:

AI-powered risk monitoring

Real-time on-chain reserve audits

Cross-exchange liquidity safeguards

Enhanced investor disclosure frameworks

ESG-style sustainability reporting for protocol activity

These upgrades aim to align DeFi assets with modern regulatory and governance expectations.

✅ Final Takeaway

Grayscale’s push to convert its AAVE Trust into a spot ETF represents a landmark moment in crypto finance. It signals that decentralized governance tokens are moving from experimental assets into regulated investment vehicles.

If approved, this ETF could accelerate institutional adoption, strengthen DeFi legitimacy, and reshape how traditional capital interacts with blockchain ecosystems.

In essence:

DeFi + Regulation + Institutional Access = The Next Phase of Crypto Markets

The coming months of SEC review will determine whether AAVE becomes the first major governance token to enter the mainstream ETF universe — potentially setting the blueprint for the future of decentralized finance in global capital markets. 🚀📊