# BitcoinFallsBehindGold

20.52K

MrFlower_

#BitcoinFallsBehindGold Global financial markets are quietly signaling a shift: the hierarchy of safe-haven assets is evolving. Recent price behavior highlights a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tensions, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is deliberate, not accidental. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocation decisions by institutions, central banks, and sovereign

Gold’s advance is deliberate, not accidental. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocation decisions by institutions, central banks, and sovereign

BTC-5.81%

- Reward

- 15

- 21

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

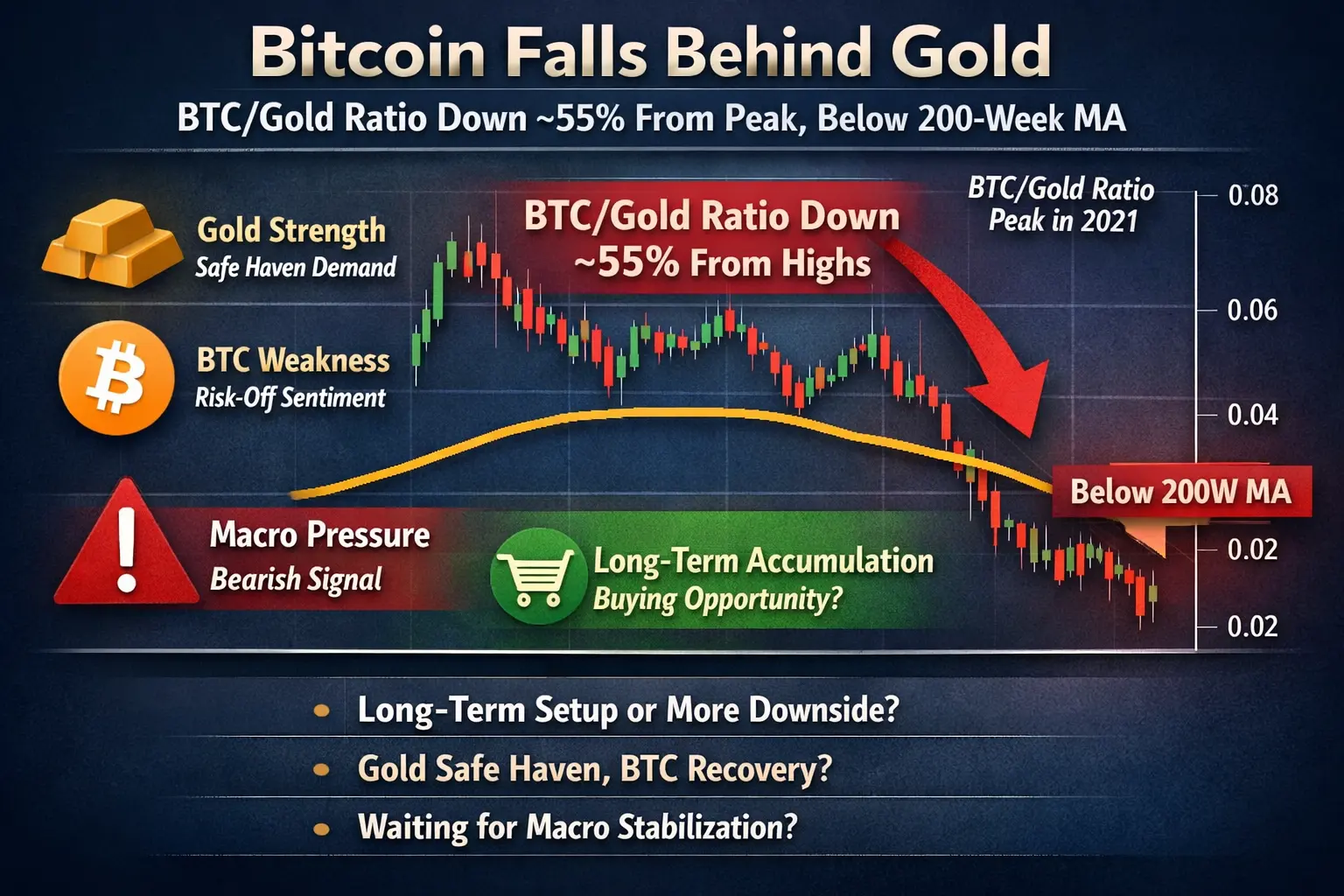

🪙 Bitcoin’s Gold Ratio Falls Below 200-Week MA — Dip-Buying Opportunity?

Bitcoin’s gold ratio has dropped roughly 55% from its peak and has fallen below the 200-week moving average (MA). This metric historically signals potential long-term buying zones, but market context remains crucial.

🔹 What to Watch

Historical precedent: Previous dips below the 200-week MA have often preceded multi-month bullish recoveries.

Market sentiment: Short-term volatility remains high; caution is advised.

Macro environment: U.S. monetary policy, inflation data, and geopolitical developments can influence BTC’s n

Bitcoin’s gold ratio has dropped roughly 55% from its peak and has fallen below the 200-week moving average (MA). This metric historically signals potential long-term buying zones, but market context remains crucial.

🔹 What to Watch

Historical precedent: Previous dips below the 200-week MA have often preceded multi-month bullish recoveries.

Market sentiment: Short-term volatility remains high; caution is advised.

Macro environment: U.S. monetary policy, inflation data, and geopolitical developments can influence BTC’s n

BTC-5.81%

- Reward

- 13

- 19

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

Bitcoin Falls Behind Gold: What the BTC/Gold Breakdown Is Really Telling Us and How I’m Positioning

Bitcoin’s gold ratio is now down roughly 55% from its peak and has slipped below the 200-week moving average, a level many long-term investors treat as a key structural signal. On the surface, that looks uncomfortable especially for those who view Bitcoin as “digital gold.” But I think it’s worth slowing down and unpacking what this move actually represents before jumping to conclusions.

First, context matters. Gold has been in a powerful price-discovery phase, driven b

Bitcoin Falls Behind Gold: What the BTC/Gold Breakdown Is Really Telling Us and How I’m Positioning

Bitcoin’s gold ratio is now down roughly 55% from its peak and has slipped below the 200-week moving average, a level many long-term investors treat as a key structural signal. On the surface, that looks uncomfortable especially for those who view Bitcoin as “digital gold.” But I think it’s worth slowing down and unpacking what this move actually represents before jumping to conclusions.

First, context matters. Gold has been in a powerful price-discovery phase, driven b

- Reward

- 7

- 4

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold #BitcoinFallsBehindGold

For the first time in years, Gold is outperforming Bitcoin.

This shift marks a powerful moment in global markets one that reflects changing risk appetite, rising geopolitical uncertainty, and a renewed flight toward traditional safe-haven assets.

The digital gold narrative is being tested.

And the world is watching.

Gold Regains Its Crown

As inflation pressures persist, central banks remain cautious, and global tensions continue to rise, investors are rotating back into physical security.

Gold has surged on:

Safe-haven demand

Central bank ac

For the first time in years, Gold is outperforming Bitcoin.

This shift marks a powerful moment in global markets one that reflects changing risk appetite, rising geopolitical uncertainty, and a renewed flight toward traditional safe-haven assets.

The digital gold narrative is being tested.

And the world is watching.

Gold Regains Its Crown

As inflation pressures persist, central banks remain cautious, and global tensions continue to rise, investors are rotating back into physical security.

Gold has surged on:

Safe-haven demand

Central bank ac

BTC-5.81%

- Reward

- 5

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

🪙 Bitcoin’s Gold Ratio Falls Below 200-Week MA — Dip-Buying Opportunity?

Bitcoin’s gold ratio has dropped roughly 55% from its peak and has fallen below the 200-week moving average (MA). This metric historically signals potential long-term buying zones, but market context remains crucial.

🔹 What to Watch

Historical precedent: Previous dips below the 200-week MA have often preceded multi-month bullish recoveries.

Market sentiment: Short-term volatility remains high; caution is advised.

Macro environment: U.S. monetary policy, inflation data, and geopolitical developments can influence BTC’s n

Bitcoin’s gold ratio has dropped roughly 55% from its peak and has fallen below the 200-week moving average (MA). This metric historically signals potential long-term buying zones, but market context remains crucial.

🔹 What to Watch

Historical precedent: Previous dips below the 200-week MA have often preceded multi-month bullish recoveries.

Market sentiment: Short-term volatility remains high; caution is advised.

Macro environment: U.S. monetary policy, inflation data, and geopolitical developments can influence BTC’s n

BTC-5.81%

- Reward

- 9

- 12

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

Despite recent bullish momentum in cryptocurrencies, Bitcoin (BTC) has started to lag behind gold, highlighting a shift in investor sentiment toward traditional safe-haven assets. This trend reflects broader macroeconomic concerns, inflation hedging, and market volatility affecting digital assets.

📍 Today’s Key Prices (January 28, 2026)

• Bitcoin (BTC): ~$89,000 — showing signs of consolidation after a strong rally, underperforming compared to gold.

• Gold (XAU/USD): ~$5,210 — breaking above key resistance levels, attracting safe-haven flows.

• Ethereum (ETH): ~$3,000

Despite recent bullish momentum in cryptocurrencies, Bitcoin (BTC) has started to lag behind gold, highlighting a shift in investor sentiment toward traditional safe-haven assets. This trend reflects broader macroeconomic concerns, inflation hedging, and market volatility affecting digital assets.

📍 Today’s Key Prices (January 28, 2026)

• Bitcoin (BTC): ~$89,000 — showing signs of consolidation after a strong rally, underperforming compared to gold.

• Gold (XAU/USD): ~$5,210 — breaking above key resistance levels, attracting safe-haven flows.

• Ethereum (ETH): ~$3,000

- Reward

- 10

- 8

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#BitcoinFallsBehindGold

Bitcoin’s relative performance against gold has reached a critical point, with the BTC/Gold ratio down roughly 55% from its peak and now trading below the 200-week moving average, a level that historically marks major regime shifts rather than short-term noise. This underperformance is happening at a time when gold is aggressively repricing geopolitical risk, central bank accumulation, and declining confidence in fiat stability, while Bitcoin is behaving more like a liquidity-sensitive macro asset, reacting to tighter financial conditions and cautious risk sentiment. T

Bitcoin’s relative performance against gold has reached a critical point, with the BTC/Gold ratio down roughly 55% from its peak and now trading below the 200-week moving average, a level that historically marks major regime shifts rather than short-term noise. This underperformance is happening at a time when gold is aggressively repricing geopolitical risk, central bank accumulation, and declining confidence in fiat stability, while Bitcoin is behaving more like a liquidity-sensitive macro asset, reacting to tighter financial conditions and cautious risk sentiment. T

BTC-5.81%

- Reward

- 5

- 7

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

When Markets Choose Memory Over Momentum: Bitcoin, Gold, and the Psychology of Capital

Financial markets are not driven solely by numbers, yields, or charts. At critical moments, they are shaped by something far more human: memory. When uncertainty rises, investors do not search for the most innovative asset — they search for the one that has survived before.

Today’s global environment is a textbook example of this instinct at work.

Across currencies, commodities, and digital assets, capital is reorganizing itself not around growth narratives, but around endurance. And

When Markets Choose Memory Over Momentum: Bitcoin, Gold, and the Psychology of Capital

Financial markets are not driven solely by numbers, yields, or charts. At critical moments, they are shaped by something far more human: memory. When uncertainty rises, investors do not search for the most innovative asset — they search for the one that has survived before.

Today’s global environment is a textbook example of this instinct at work.

Across currencies, commodities, and digital assets, capital is reorganizing itself not around growth narratives, but around endurance. And

BTC-5.81%

- Reward

- 93

- 52

- Repost

- Share

Bab谋_Ali :

:

Happy New Year! 🤑View More

#BitcoinFallsBehindGold

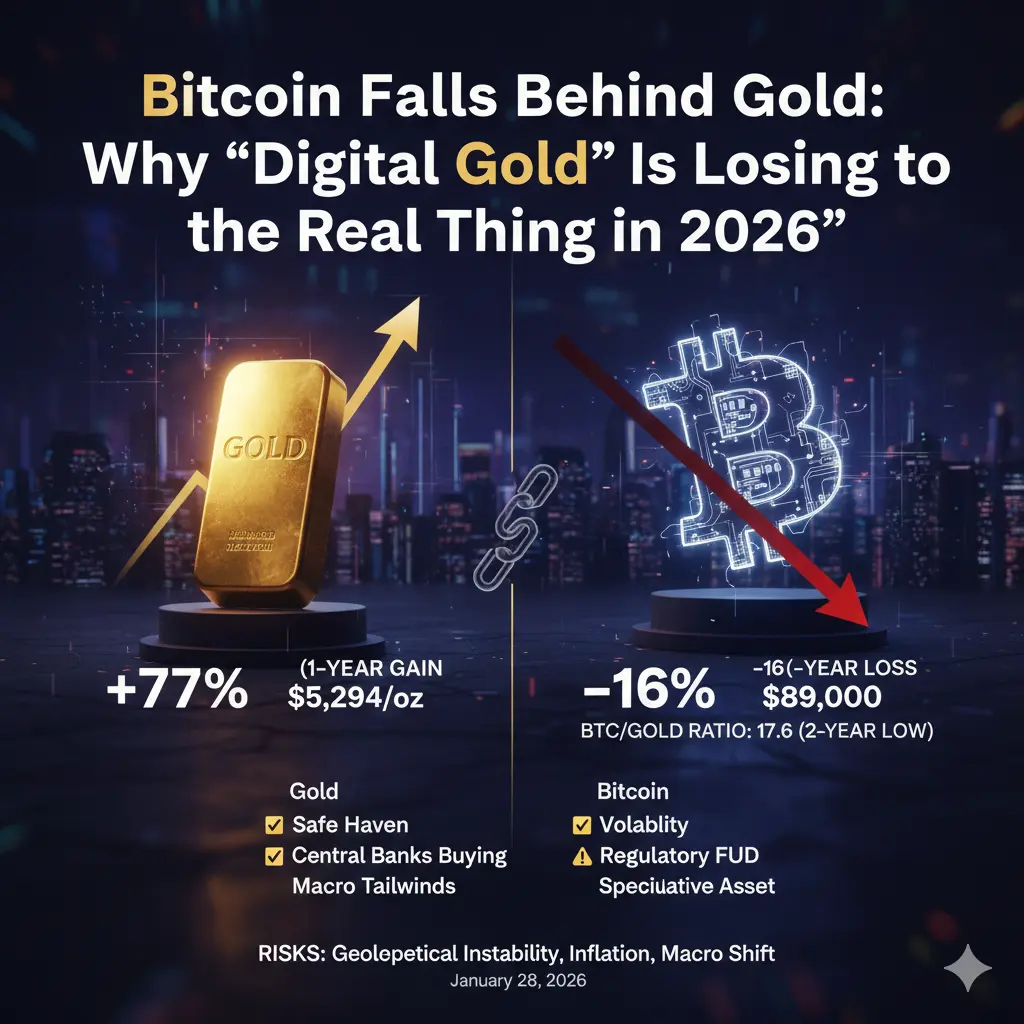

Bitcoin Falls Behind Gold: Why “Digital Gold” Is Losing to the Real Thing in 2026

For years, Bitcoin has been branded as “digital gold” — a hedge against inflation, a safe haven in times of crisis, and a modern store of value. But as we enter late January 2026, that narrative is facing serious pressure. Bitcoin is underperforming gold at a historic level, with the BTC/Gold ratio dropping to multi-year lows, signaling a structural shift in investor behavior.

This isn’t just a temporary dip — it reflects a deeper change in market trust, macro conditions, and capital flow

Bitcoin Falls Behind Gold: Why “Digital Gold” Is Losing to the Real Thing in 2026

For years, Bitcoin has been branded as “digital gold” — a hedge against inflation, a safe haven in times of crisis, and a modern store of value. But as we enter late January 2026, that narrative is facing serious pressure. Bitcoin is underperforming gold at a historic level, with the BTC/Gold ratio dropping to multi-year lows, signaling a structural shift in investor behavior.

This isn’t just a temporary dip — it reflects a deeper change in market trust, macro conditions, and capital flow

BTC-5.81%

- Reward

- 20

- 17

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#BitcoinFallsBehindGold 🏛️📉 #BitcoinFallsBehindGold

For years, Bitcoin bulls argued that BTC would act as the ultimate safe haven during geopolitical turmoil. However, January 2026 is telling a different story.

The Divergence:

Gold: Up 17% this month alone, hitting a historic $5,500/oz as central banks and cautious investors flee to physical safety.

Bitcoin: Down to $87,800, struggling with "narrative exhaustion" and behaving more like a high-beta risk asset than a stable hedge.

Why the split? Analysts suggest that while Bitcoin thrives on liquidity and "risk-on" sentiment, global investors

For years, Bitcoin bulls argued that BTC would act as the ultimate safe haven during geopolitical turmoil. However, January 2026 is telling a different story.

The Divergence:

Gold: Up 17% this month alone, hitting a historic $5,500/oz as central banks and cautious investors flee to physical safety.

Bitcoin: Down to $87,800, struggling with "narrative exhaustion" and behaving more like a high-beta risk asset than a stable hedge.

Why the split? Analysts suggest that while Bitcoin thrives on liquidity and "risk-on" sentiment, global investors

BTC-5.81%

- Reward

- 1

- 1

- Repost

- Share

MoonGirl :

:

Happy New Year! 🤑Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

12.57K Popularity

10.77K Popularity

9.02K Popularity

3.85K Popularity

44.71K Popularity

2.18K Popularity

15.99K Popularity

2.34K Popularity

79.9K Popularity

26.88K Popularity

86.75K Popularity

23.53K Popularity

16.57K Popularity

13.47K Popularity

184.04K Popularity

News

View MoreData: If ETH breaks through $2,932, the cumulative liquidation strength of short orders on mainstream CEXs will reach US$963 million

1 h

Data: If BTC breaks through $87,889, the cumulative short liquidation intensity of mainstream CEXs will reach $2.047 billion

1 h

BTC 跌破 84000 USDT

1 h

Data: 43 BTC transferred out of Cumberland DRW, worth approximately $2.8 million

1 h

数据:2000 枚 XAUt 从 Tether 转入 Abraxas Capital Mgmt (Heka Funds),价值约 1059 万美元

2 h

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889