Search results for "BUBBLE"

Behind the AI frenzy, an overlooked debt gamble

Written by: thiigth

Wall Street veteran and Oak Tree Capital's Howard Marks recently made a wake-up call. The gist is: if this AI frenzy doesn't end up becoming a classic bubble burst, it will be the only exception in human financial history.

But the problem is, most people are looking in the wrong place.

We are still debating whether Nvidia's stock price is too high, or who will be the next Cisco. Everyone is obsessively watching every flicker on the K-line chart, trying to find clues of a collapse. However, the real storm is not at the bustling stock exchanges, but in the silent, hidden corner that determines life and death — the credit market.

This is not a math problem about Price-to-Earnings (P/E) ratios, but a high-stakes gamble built on massive debt.

01 The Disappearing "Cash Cow"

In this story, our biggest mistake

TechubNews·10h ago

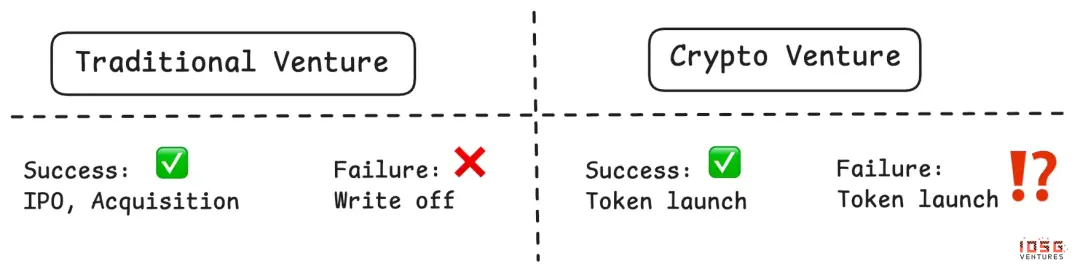

IOSG: A game with no winners—how can the altcoin market break through?

Author | Momir @IOSG

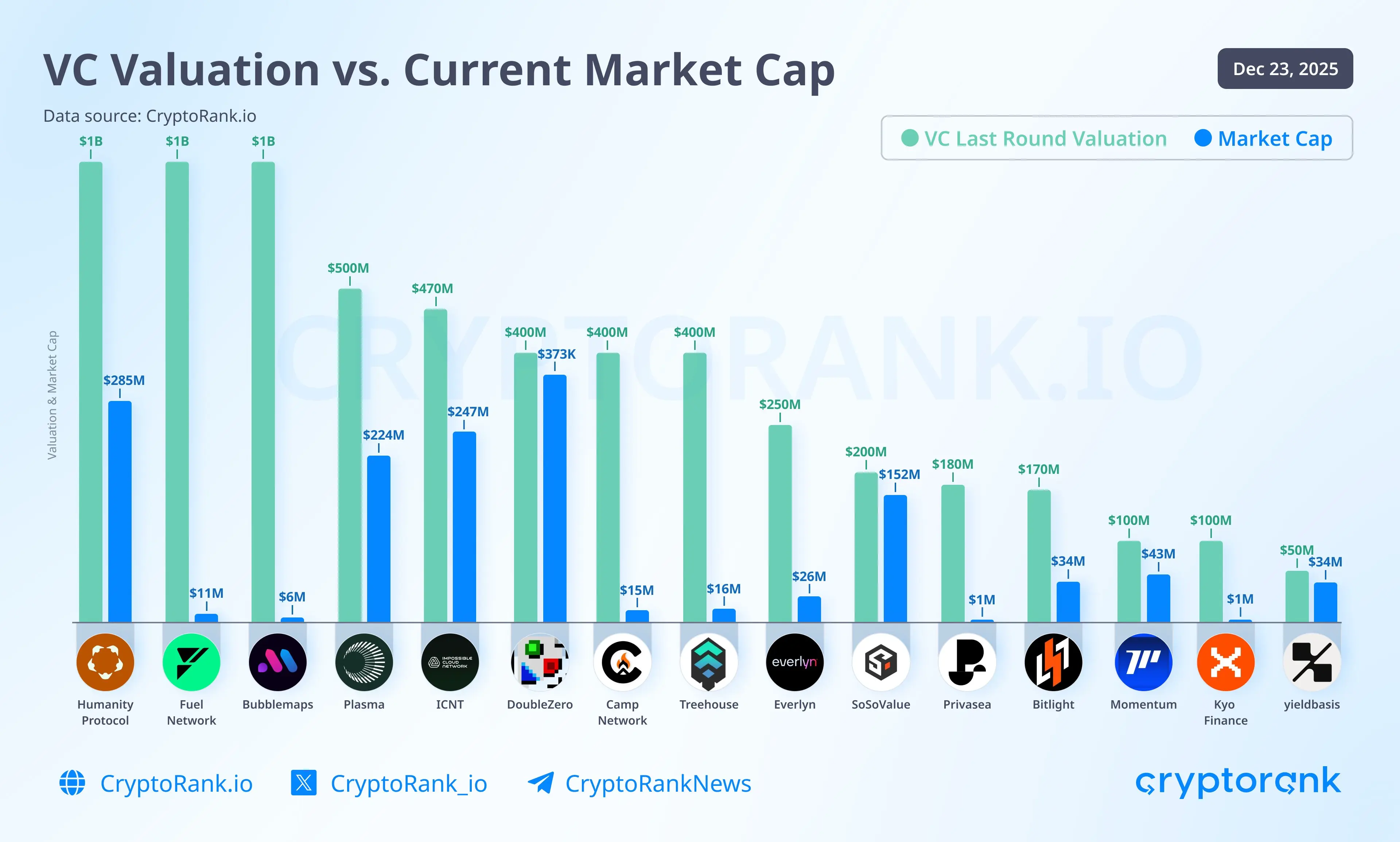

The altcoin market has experienced its most difficult period this year. To understand why, we need to go back to decisions made a few years ago. The funding bubble of 2021-2022 fueled a wave of projects that raised large amounts of money. Now, these projects are issuing tokens, leading to a fundamental problem: a massive supply flooding the market, while demand remains scarce.

The issue is not just oversupply; even more concerning is that the mechanism causing this problem has remained largely unchanged to this day. Projects continue to issue tokens regardless of whether there is a market for their products, treating token issuance as an inevitable step rather than a strategic choice. As venture capital dries up and primary market investments shrink, many teams see token issuance as the only fundraising channel or a way to create exit opportunities for insiders.

This article will analyze the "Four Losses Dilemma" that is dismantling the altcoin market, examine why past repair mechanisms have failed, and propose possible pathways for rebalancing.

1

PANews·01-06 10:52

Bridgewater's Dalio Annual Report: AI is in the early stage of a bubble. Why are US stocks underperforming non-US stocks and gold?

The world's largest hedge fund, Bridgewater Associates founder Ray Dalio, has released his annual reflection, pointing out that in 2025 the biggest winner will be gold rather than US stocks, as all fiat currencies are depreciating. He also warns that AI is in the early stages of a bubble and predicts that the five major forces—debt, currency, politics, geopolitics, and technology—will reshape the global landscape. This article is compiled, translated, and written by BitpushNews.

(Previous summary: Bridgewater's Dalio: My Bitcoin holdings have remained unchanged! Stablecoins are "not cost-effective" for preserving wealth)

(Additional background: Bridgewater's Dalio calls for dollar decline—"Gold is indeed safer": I feel the market is in a bubble)

Table of Contents

1. Changes in Currency Value

2. US Stocks Significantly Underperform Non-US Markets and Gold

3. Valuations and Future Expectations

4. Changes in Political Order

5. Global Order

動區BlockTempo·01-06 02:35

The veteran blockchain summit "NFT Paris" announces its cancellation, and the community complains that sponsors are unable to get refunds.

On January 5th, Paris time, the NFT Paris event, originally scheduled to be held at the Villette Hall and having built a four-time reputation, announced its cancellation. The 20,000 tickets along with hundreds of sponsor booths suddenly became worthless. The organizers attributed the decision to a "market crash," undoubtedly putting the NFT sector on pause and writing a calm New Year’s memo for the Web3 ecosystem in 2026.

(Background: Bear market NFT comeback! Fat penguin on the Las Vegas sphere: What phenomena are we seeing?)

(Additional background: Flow has shifted to DeFi, the former top-tier NFT momentum and dilemma)

Table of Contents

The refund dilemma highlights liquidity limits

Bitcoin rises, NFTs fall: decoupling intensifies

After the bubble bursts, where does Web3 go from here?

FLOW4.49%

動區BlockTempo·01-06 02:20

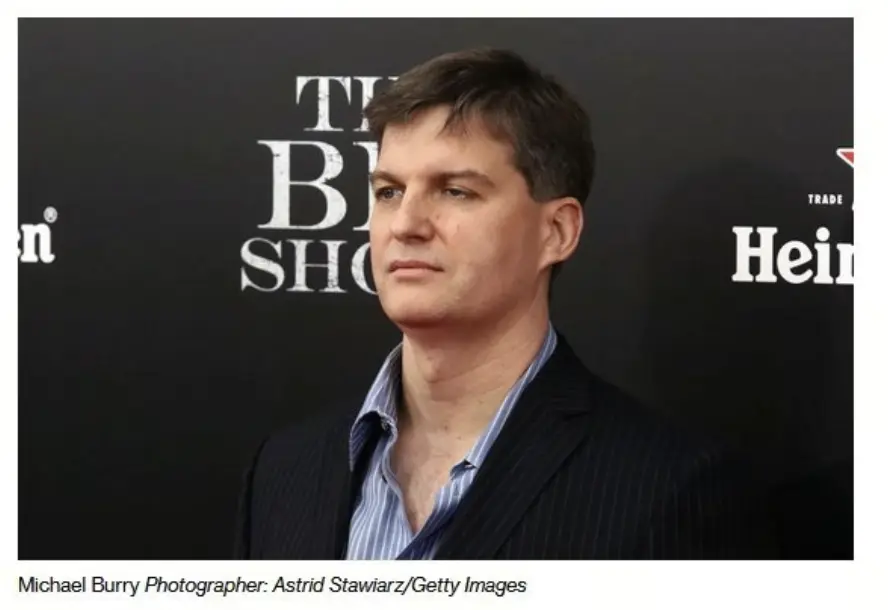

Michael Burry's $1 Billion AI Short: Betting Against the 2026 Bubble?

Michael Burry, the investor immortalized in "The Big Short" for predicting the 2008 housing crash, has placed nearly $1 billion in put options against leading AI stocks—including Nvidia and Palantir—signaling deep skepticism about the sector's valuations heading into 2026.

CryptopulseElite·01-05 10:56

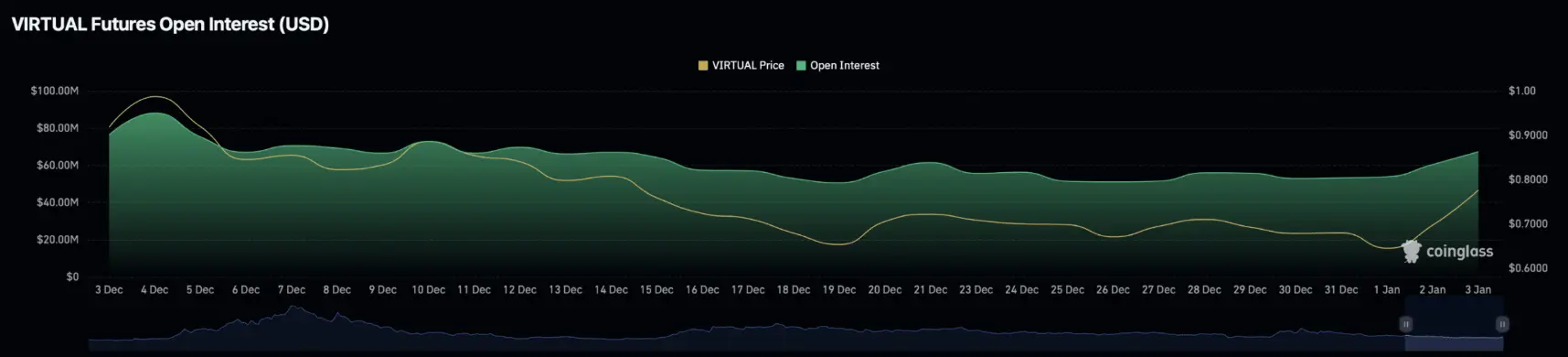

VIRTUAL Before the test: Is the growth sustainable as user activity becomes lively again?

Virtuals Protocol (VIRTUAL) – a token associated with the artificial intelligence sector – has surprised many by ignoring pessimistic forecasts about the risk of entering a "bubble" phase, continuing its impressive upward trend.

Previously, VIRTUAL experienced a correction pressure with a 12% decrease and entered a downward trend. However, n

VIRTUAL-4.24%

TapChiBitcoin·01-04 01:32

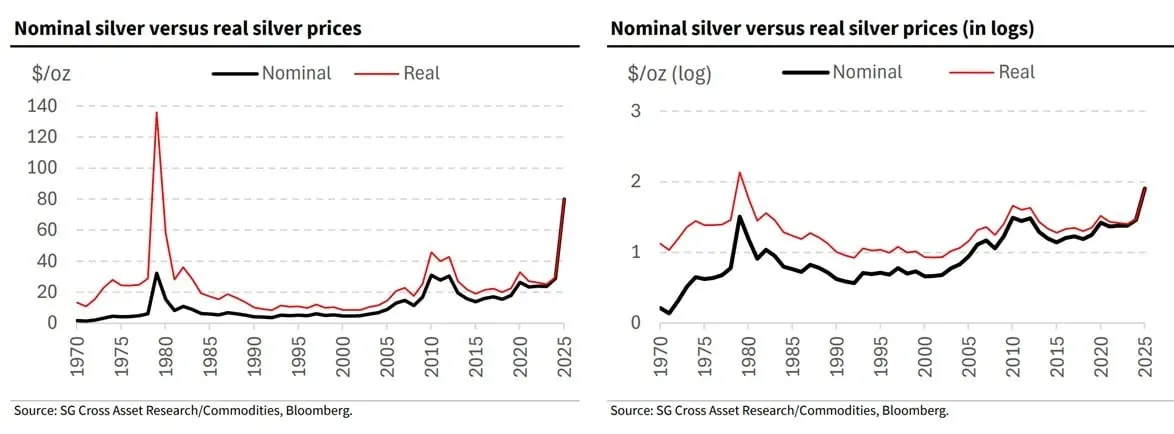

Analysts Warn Silver Bubble Signals Can Appear Without Major Trend Reversal

Silver’s explosive rally is flashing bubble warnings in quantitative models, but Societe Generale says those signals may reflect volatility and structure rather than an imminent reversal, as fundamentals continue to support higher prices.

Analysts Separate Silver Bubble Signals From Calls for

Coinpedia·01-03 22:36

Tesla Q4 vehicle deliveries drop 16%, replaced by BYD as the leading brand. Michael Burry explains why he is not shorting.

Investor Michael Burry, famous for betting against the 2008 financial crisis, has recently issued multiple warnings that signs of a bubble are emerging in AI-related topics. He has also long maintained a highly cautious stance on Tesla's valuation. However, Burry recently explained that although he still believes Tesla is severely overvalued, he has not chosen to short the stock. The main reason is that the risks and costs associated with shorting have become too high to be attractive.

Tesla Q4 Deliveries Fall Short of Expectations, BYD Becomes the World's Largest Electric Vehicle Manufacturer

Burry pointed out that from a fundamental perspective, Tesla is facing multiple pressures. Its global electric vehicle sales are showing a downward trend, market competition is intensifying, price wars are eroding margins, and growth is slowing, leading to a significant gap between the current stock price and the company's actual operational status. In his view, Tesla's overall

ChainNewsAbmedia·01-03 11:34

NFT Market Matures in 2025: Utility, Gaming, and RWA Drive Growth

In 2025, the NFT market matured beyond its speculative bubble, shifting toward functional utility and sustainable growth. Market leaders included Cryptopunks, Courtyard, Dmarket and Pudgy Penguins.

The 2025 NFT Landscape: From Hype to Utility

In 2025, the non-fungible token ( NFT) market

Coinpedia·01-03 03:35

2026 Tech Stocks Continue to Rally! Dan Ives: Jensen Huang's CES Presentation Sets the Tone

American well-known tech bull and Wedbush Securities analyst Dan Ives stated in an interview on 12/31 that he shared personal views on AI tech stocks, energy, and US-China tech competition during the upcoming consumer electronics show (CES). He frankly said that the market has underestimated the "depth and breadth" of this wave of AI revolution, and believes that the current volatility is more like a pause in the middle of a party rather than a bubble burst.

CES Becomes a Key Stage, AI Officially Moves into the Physical World

Dan Ives pointed out that the upcoming CES exhibition will be an important turning point in this round of the tech cycle. He specifically mentioned NVIDIA CEO Jensen Huang's speech during the event, which is expected to set the tone for "autonomous robots" and "physical AI" (Physical AI).

In his view, CES is no longer just a showcase.

ChainNewsAbmedia·2025-12-31 04:43

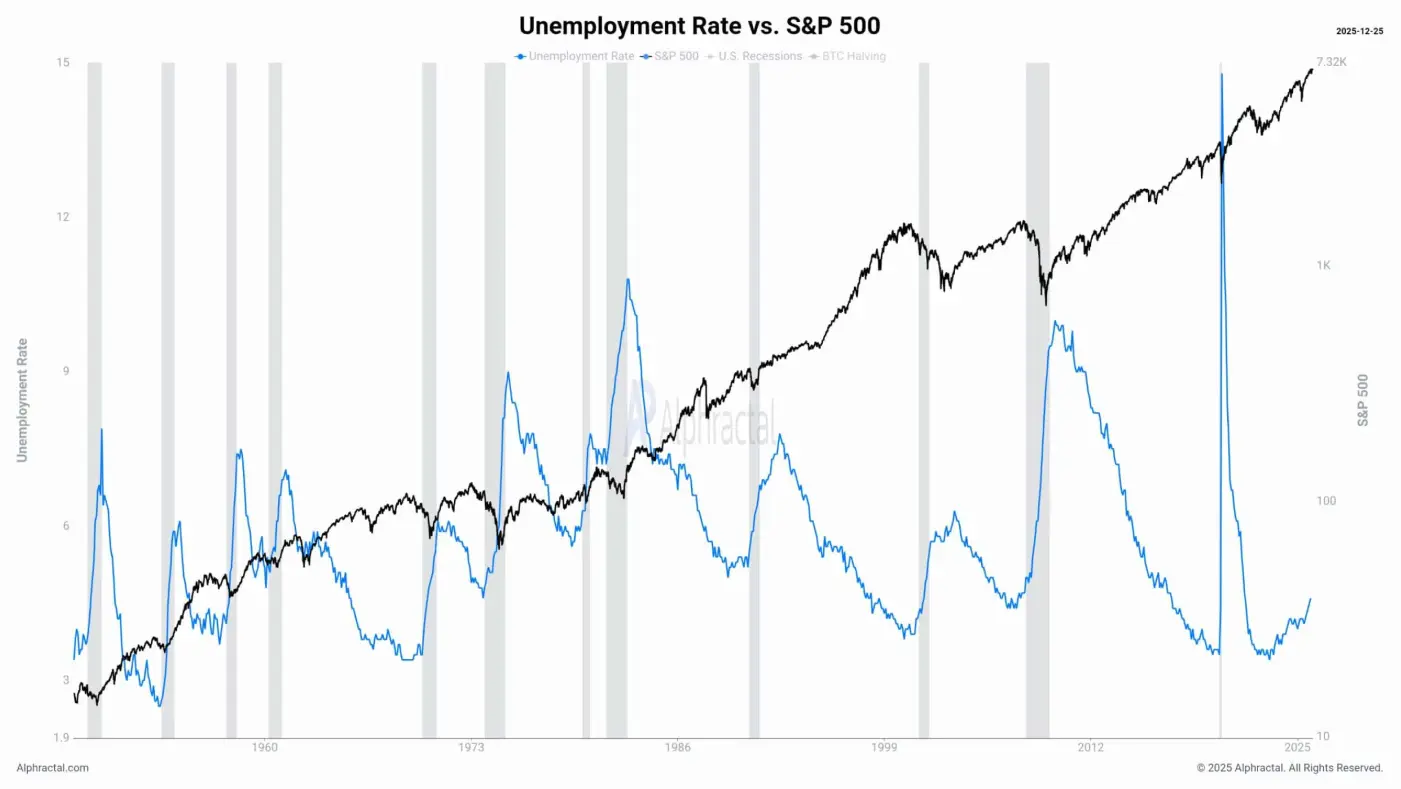

The credit bubble surpasses 1929! Stock market capitalization accounts for 225% of GDP, doomsday alarm sounds

Economist Henrik Zeberg warns that the global markets are approaching a dangerous blow-off top phase. The S&P 500 has surged 900% since 2009, with US market capitalization reaching 225% of GDP, surpassing the peaks of 1929 and 2000. This prosperity is built on the credit bubble created by zero interest rates and QE after 2008, with productivity and real growth lagging behind, signaling a severe correction marking the end of the post-2008 monetary era.

MarketWhisper·2025-12-30 06:13

Hype VC bubble bursts as crypto projects in 2025 plummet disastrously

Crypto venture capital funds have poured billions of USD into early-stage tokens during the 2025 "risk-on" recovery. However, many of these bets are now trading significantly below the notable valuation levels seen in private funding rounds.

The widening gap between the figures

TapChiBitcoin·2025-12-30 00:24

2025, How will TradFi hunt bubbles? From Trump-themed coins to AI stocks

The global market in 2025 swings dramatically between extreme narratives and cold liquidation, offering investors a profound lesson in risk management. The cryptocurrency market witnessed a complete bubble cycle where "Trump concept" assets soared in popularity before crashing over 80%, exposing the fragility of relying solely on political narratives. Meanwhile, traditional financial markets (TradFi) staged several classic duels: "Big Short" Michael Burry targeted AI giants, Jim Chanos hunted Bitcoin-listed companies, demonstrating that macro trading based on in-depth research remains effective. From the soaring European defense stocks to the collapsing Turkish arbitrage trades, capital rapidly shifts driven by politics, liquidity, and human greed, ultimately revealing an eternal truth that runs through both crypto and TradFi: when the tide goes out, only solid fundamentals and prudent risk management can survive.

MarketWhisper·2025-12-29 04:14

Collapse and Rebuild: The Explosion of DeFi 2.0 Under Disordered Restructuring in 2026

December 28, 2025, written in Singapore

In Q4 2025, under the combined influence of market and policy forces, global traditional finance and emerging open finance are colliding violently in an increasingly disordered environment. The intense changes have cleared most of the residual heat from the first curve ( Note 1), leaving emotional wreckage that is difficult to digest in a short period. Meanwhile, traditional finance is also isolated and besieged amid the bubble narrative of AI and the chaos of the golden age, reaching the end of its strength. Central banks around the world are forced to rudely satisfy the market's rigid aesthetic with textbook-like monetary and fiscal policies, compelled to make everyone believe that these outdated economic inertia can still sustain for a little longer.

In several previous articles, I have already detailed the failure of the conventional economic model at the junction of the Kondratiev wave cycle, but the real experience of being in it still feels more tangible. Amidst the numerous noises, only a market outlook published by Coinbase at the end of the year stands out.

RWA-3.5%

PANews·2025-12-29 03:00

Token AI plummets sharply after 'significant divergence': Is a tech bubble forming?

The altcoin market is experiencing a clear weakening phase as liquidity flows continue to shrink. Selling pressure is spreading but not evenly distributed across asset groups, with the Artificial Intelligence (AI) sector becoming the focal point.

TapChiBitcoin·2025-12-27 15:07

2026 AI Bubble Risks & How They Could Impact Bitcoin’s Future

Strategic Outlook: Potential 2026 Market Corrections Driven by AI Bubble Burst

Growing concerns indicate that global equity markets may be approaching another speculative peak, primarily driven by exuberance surrounding artificial intelligence (AI) advancements. Analysts warn that if this AI

BTC-2.32%

CryptoBreaking·2025-12-27 11:30

AI Bubble Fears Could Hit Bitcoin and Crypto Markets First in 2026

Analysts warn that an AI-driven market correction in 2026 could negatively affect Bitcoin and the crypto sector due to strong correlations with U.S. equities, with fund managers flagging AI bubbles as a major risk. Heavy debt financing raises concerns about systemic impacts.

BTC-2.32%

ICOHOIDER·2025-12-26 13:59

2026 AI Bubble Risks & How They Could Impact Bitcoin’s Future

Strategic Outlook: Potential 2026 Market Corrections Driven by AI Bubble Burst

Growing concerns indicate that global equity markets may be approaching another speculative peak, primarily driven by exuberance surrounding artificial intelligence (AI) advancements. Analysts warn that if this AI

BTC-2.32%

CryptoBreaking·2025-12-26 11:25

How to Choose AI Technology Stocks? Understanding Dan Ives's Market Perspective on the Tech Bull Run

American well-known tech bull and Wedbush Securities analyst Dan Ives recently shared his core reasons for long-term optimism about AI topics during an interview on the "Master Investor Podcast." He recounted his personal investment experience during the 1990s tech bubble, extended to key areas such as AI chips, cloud computing, data centers, and enterprise applications, and further explained his thinking behind selecting tech stocks, as well as how he maintains investment discipline and conviction amid market volatility.

From the 1990s to today, why choose to embrace tech and AI stocks

Dan Ives stated that he has been researching tech stocks since the late 1990s, having experienced the dot-com bubble and financial crises. However, he believes that the current transformation brought by AI is different from past speculative bubbles. He described that the current AI development

ChainNewsAbmedia·2025-12-26 08:54

In the hype of the incentive bubble, who will pay for the false prosperity of the Lighter community?

Author: Zhou, ChainCatcher

Recently, the name Lighter has been trending nonstop in the community. Whether it's valuation discussions, points farm yield calculations, TGE timing guesses, or pre-market price fluctuations, the sentiment is exceptionally intense.

Binance, OKX, and other exchanges have announced the launch of pre-market trading for the LIT token. Polymarket's prediction market shows a greater than 50% chance that its valuation will exceed $3 billion after TGE. On-chain transfer signals of 250 million LIT tokens have further ignited FOMO sentiment, making everything seem logical. Lighter is undoubtedly one of the most anticipated projects in the crypto market at the end of the year.

However, while everyone is calculating how many LIT they can exchange points for or how much it will rise after TGE, the more fundamental question is being overlooked: this airdrop frenzy

PANews·2025-12-26 05:02

Bloomberg's 2026 outlook does not mention crypto, but these four macro "powder kegs" determine the fate of the bull market.

Bloomberg recently released an authoritative economic outlook for 2026. Although it did not directly mention cryptocurrencies throughout, its in-depth analysis of four core themes—threats to Federal Reserve independence, AI stock market bubble risks, the transmission of tariffs to the real economy, and the stability of the US dollar—are all closely linked to the fate of the crypto market. The analysis points out that a change in Federal Reserve Chair in May 2026 could shake the foundations of the dollar, indirectly strengthening Bitcoin's narrative as "digital gold"; meanwhile, a potential correction in the AI sector could trigger widespread risk-off sentiment, short-term dragging down crypto assets. Institutional forecasts for Bitcoin's price in 2026 vary greatly, with bullish targets reaching as high as 250,000, while bearish scenarios could see prices drop below 75,000. The market direction may be clarified in the first quarter.

BTC-2.32%

MarketWhisper·2025-12-25 05:14

2026 Bubble Will Ultimately Burst! Top Economist: Stock Market Drops 90%, Bitcoin Falls to 30,000

HS Dent Investment Company founder Harry Dent warns that the most severe market crash in history will arrive in 2026. He predicts that the current super bubble, which has lasted nearly 17 years, will burst, leading to a 90% decline in the stock market, described as the worst market environment since the Great Depression. Dent forecasts that by the end of 2026, Bitcoin could drop to $30,000, with downside potential as low as $15,600.

MarketWhisper·2025-12-25 00:53

The Federal Reserve (FED) lowering interest rates by 100 basis points is unlikely to save the AI bubble! The renminbi has broken 7 and foreign capital is rushing in.

The Federal Reserve Board of Governors member Waller expects that the interest rate should be cut by 100 basis points in 2026, lowering the rate from the current 3.5%-3.75% to 2.5%-2.75%, but the US stock market has no reaction to this. As Bitcoin falls below 85,000 USD, the exchange rate of the Chinese Yuan against the US Dollar breaks 7.0315, appreciating over 5.3% compared to April. China's trade surplus reaches 1.18 trillion USD, setting a new historical high, with foreign capital accelerating the purchase of RMB assets for hedging.

MarketWhisper·2025-12-23 07:38

2026 crypto market life and death tribulation! After the 57 billion ETF frenzy, can the demand continue?

In 2025, the cumulative net inflow of Spot Bitcoin ETF reached 57 billion USD, but after October, funds turned to outflows, with Bitcoin experiencing a big dump of 30% and Ether crashing by 50%. In 2026, the crypto market faced three major variables: The Federal Reserve (FED) cutting rates by 100 basis points, breakthroughs in U.S. legislation, and AI bubble risks. CoinTelegraph market chief Ray Salmond warned that the first quarter will determine whether the bull run continues or reverses.

ETH-3.29%

MarketWhisper·2025-12-23 03:44

In two months, there has been a big pump of 5000%, reaching a historic high. Can the independent market of Audiera (BEAT) continue?

Against the backdrop of recent poor performance in Bitcoin and Ethereum, the game token Audiera on the BNB Chain ecosystem has staged an independent rally against the trend. Since its trading launch on November 1, 2025, BEAT has surged over 5000% in about two months, reaching an all-time high of $4.17 on December 21, with a market capitalization briefly surpassing $560 million. However, another token in the same ecosystem, Bitlight, has recently experienced a tragic drop of over 75% within 24 hours, sounding the alarm for all the "small-cap dark horses" that have surged. Is BEAT's astonishing performance based on a strong product fundamental value discovery or an impending speculative bubble? The market's attention is focused on the real user revenue and token burning mechanism behind its "dance-to-earn" model.

MarketWhisper·2025-12-23 03:26

Fed Vice Chairman: Analyzing the AI Bubble from Four Dimensions

Author: Zhang Feng

Artificial Intelligence (AI) is reshaping the global economy and financial landscape at an unprecedented pace. As capital markets continue to be enthusiastic about AI-related companies, an unavoidable question arises: Are we witnessing a speculative frenzy similar to the internet bubble of the late 1990s?

In 2025, Federal Reserve Vice Chairman Philip N. Jefferson systematically elaborated on his comparative analysis of the current AI boom and the internet bubble era at the Financial Stability Conference of the Cleveland Federal Reserve Bank, and proposed four key indicators to determine whether there is a bubble in AI. This speech not only reflects the cautious observation of emerging technologies by the world's most important central banks but also provides market participants with a clear framework for rationally assessing the AI boom.

1. The Federal Reserve's Observational Basis Points: Dual Mandate and Financial Stability

All policies and observations of the Federal Reserve revolve around its statutory "dual mandate" - maximizing employment and

金色财经_·2025-12-23 02:07

Bridgewater Fund's Ray Dalio: Bitcoin is inferior to gold, Central Banks will not choose it.

Ray Dalio, the founder of the world's largest hedge fund Bridgewater Associates, once again discussed the comparison between Bitcoin and gold. He admitted to holding a small amount of Bitcoin but pointed out that Bitcoin has structural flaws, making it less reliable than gold and more difficult to become the preferred reserve asset for central banks.

(Previous summary: Bridgewater's Dalio: My Bitcoin holding ratio has remained unchanged! Stablecoins are "not worth it" for preserving wealth)

(Background Supplement: Bridgewater's Dalio calls for dollar decline "Gold is indeed safer": I feel the market is in a bubble)

Global renowned hedge fund Bridgewater Associates founder Ray Dalio recently appeared on the podcast "WTF is" hosted by Nikhil Kamath, founder of the Indian online brokerage Zerodha.

BTC-2.32%

動區BlockTempo·2025-12-22 13:00

From CryptoQuant data, the Bitcoin Bear Market: the Crypto Assets bubble burst in 2021.

Bitcoin has fallen back after reaching an all-time high in October. In a recent report, CryptoQuant pointed out that BTC has officially entered a Bear Market and warned that the demand zone could see prices dip to $56,000. However, Simon Dedic, a partner at Moonrock Capital, views it from a long-term perspective, believing that the crypto market is now in a late stage similar to the 'dot-com bubble', ushering in unprecedented investment opportunities.

CryptoQuant Report: ETF Outflows Expose BTC Demand Gap

ETF inflow reversal

CryptoQuant data shows that U.S. Bitcoin spot ETFs reduced their holdings by approximately 24,000 BTC in Q4 2025, amounting to about 2.1 billion dollars, terminating the continuous accumulation trend of the past year.

BTC-2.32%

ChainNewsAbmedia·2025-12-22 09:14

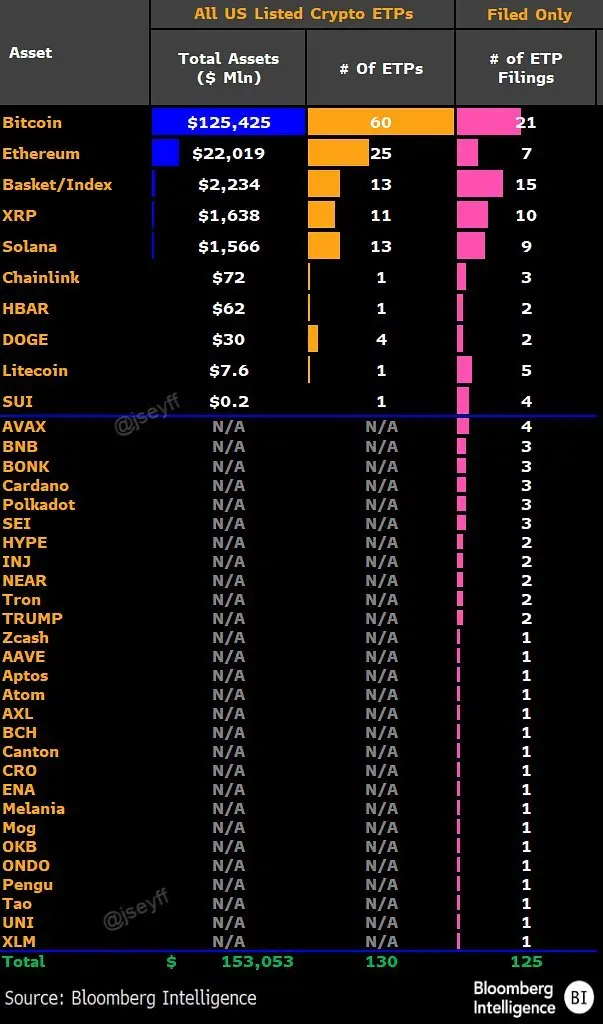

Will the cryptocurrency ETF bubble arrive? Analysts: In 2026, hundreds of products will be launched, and in 2027, a "delisting wave" may occur.

With over 100 cryptocurrency ETFs expected to emerge by 2026, the market faces significant bubble risks. Bloomberg analysts point out that many ETFs may be quickly liquidated due to insufficient capital inflows, and fierce market competition has already caused some products to exit early. While the SEC's new regulations have accelerated the listing process, long-term survival still requires following the stability of capital support.

区块客·2025-12-22 06:09

Will the encryption coin ETF bubble arrive? Analyst: In 2026, hundreds of funds will be launched, and in 2027, there may be a "delisting wave."

With over 100 cryptocurrency ETFs expected to emerge by 2026, the market faces significant bubble risks. Bloomberg analysts point out that many ETFs may be quickly liquidated due to insufficient capital inflows, and the intense market competition has already caused some products to exit prematurely. Although the SEC's new regulations have accelerated the listing process, long-term survival still requires following the stability of funding support.

区块客·2025-12-21 06:07

CryptoPunks has become an official collection of the Museum of Modern Art (MoMA) in New York.

The Museum of Modern Art in New York has announced the inclusion of CryptoPunks in its collection, providing "museum-quality" endorsement for NFTs.

(Previously: Bought CryptoPunks as a reserve, didn't expect PunkStrategy to really take off)

(Background: Yuga Labs sold CryptoPunks! Infinite Node Foundation acquired the intellectual property rights: will continue the spirit of cyberpunk)

The Museum of Modern Art in New York ( MoMA ) has announced the inclusion of the NFT avatar series CryptoPunks in its permanent collection. It has been listed on the collection page. This announcement, following the retreat of the NFT bubble, is seen as a milestone for traditional art institutions formally engaging with blockchain assets.

This batch of CryptoPunks is from multiple private collectors.

ETH-3.29%

動區BlockTempo·2025-12-21 03:15

Is the Crypto ETF bubble about to burst? Analyst: Hundreds of funds launching in 2026, and a potential delisting wave in 2027

As more than 100 Crypto ETFs are expected to launch by 2026, the market faces significant bubble risks. Bloomberg analysts point out that many ETFs may be quickly liquidated due to insufficient capital inflows, and fierce market competition has caused some products to exit early. Although the SEC's new regulations have accelerated the listing process, long-term survival still depends on the stability of funding support.

区块客·2025-12-20 06:04

CryptoPunks becomes an official collection of the Museum of Modern Art (MoMA) in New York

The Museum of Modern Art (MoMA) in New York has announced the inclusion of CryptoPunks into its permanent collection, providing a "museum-grade" endorsement for NFTs.

(Previous context: Buying CryptoPunks as reserves, unexpectedly PunkStrategy really took off)

(Additional background: Yuga Labs sold CryptoPunks! Infinite Node Foundation acquired the intellectual property rights: continuing the cyberpunk spirit)

The Museum of Modern Art (MoMA) has officially announced the addition of the NFT avatar series CryptoPunks to its permanent collection. It is now listed on the collection page. In the aftermath of the NFT bubble burst, this move is seen as a milestone for traditional art institutions to officially engage with blockchain assets.

This batch of CryptoPunks was assembled by multiple private collectors.

ETH-3.29%

動區BlockTempo·2025-12-20 03:10

CryptoQuant: Bear Market Is Coming, US Releases Epstein Case Files

Headlines

▌CryptoQuant: Bitcoin Demand Growth Has Significantly Slowed, Market Is Entering a Bear Phase

CryptoQuant stated that the growth in Bitcoin demand has markedly slowed, indicating an impending bear market. Since 2023, Bitcoin has experienced three major surges in spot demand—driven by the launch of US spot ETFs, the US presidential election results, and the Bitcoin treasury company bubble—but demand growth has fallen below trend levels. This suggests that most of the new demand in this cycle has already been realized, and the key support pillars for prices are disappearing.

Institutional and large holder demand is currently contracting rather than expanding: the US spot Bitcoin ETF turned net selling in Q4 2025, with holdings decreasing by 24,000 BTC, contrasting sharply with the strong accumulation in Q4 2024. Similarly, addresses holding 100 to 1,000 Bitcoins

BTC-2.32%

金色财经_·2025-12-20 01:55

Bitcoin Eyes a Bullish 2026, but Tether CEO Warns AI Bubble Is the Market’s Biggest Threat

The year 2026 may become a turning point for Bitcoin – at least according to Tether CEO Paolo Ardoino. He believes the leading cryptocurrency is heading into a bullish phase, but warns of a serious risk emerging from an unexpected direction: artificial intelligence.

The Risk Called “AI Bubble”

In a

Moon5labs·2025-12-19 20:00

Tether CEO says AI bubble is Bitcoin’s biggest risk in 2026

Paolo Ardoino, CEO of Tether, the issuer of the world’s largest stablecoin, has raised concerns about how a potential AI bubble could affect Bitcoin by 2026.

Ardoino shared his outlook on Bitcoin (BTC) and the broader crypto industry on Thursday during the _Bitcoin Capital_ podcast, co-hosted by Bi

Cointelegraph·2025-12-19 15:45

Bitcoin bulls eye 2026 as Tether CEO flags AI bubble as top market risk

Tether's Paolo Ardoino warns an AI bubble could hit Bitcoin in 2026 but says deeper crashes are unlikely as institutional demand and RWA tokenization grow.

Summary

Paolo Ardoino says a bursting AI bubble in U.S. equities is Bitcoin's main 2026 risk due to ongoing correlation with capital

Cryptonews·2025-12-19 08:36

Bitcoin AI Risk Could Affect Prices in 2026, Says Tether CEO

Tether CEO Paolo Ardoino warns that a potential AI bubble could pose the greatest risk to Bitcoin by 2026. However, he believes that increased institutional involvement will stabilize Bitcoin's market, preventing drastic crashes seen in past cycles.

BTC-2.32%

Coinfomania·2025-12-19 07:10

Is the Crypto ETF bubble about to burst? Analyst: Hundreds of funds launching in 2026, and a potential delisting wave in 2027

As more than 100 Crypto ETFs are expected to launch by 2026, the market faces significant bubble risks. Bloomberg analysts point out that many ETFs may be quickly liquidated due to insufficient capital inflows, and fierce market competition has caused some products to exit early. Although the SEC's new regulations have accelerated the listing process, long-term survival still depends on the stability of funding support.

区块客·2025-12-19 06:01

2026 Hundred-Index Crypto ETFs Coming! Bloomberg Warns: 2027 May See a Wave of Liquidations and Delistings

Bloomberg senior analyst warns that by 2026, over 100 Crypto ETF will be launched, but most may not survive past 2027 due to lack of funding. The market's "scattergun" strategy could trigger a new round of bubble burst.

MarketWhisper·2025-12-19 05:38

How big is the bubble in the AI market?

The article discusses the level of the AI market bubble and estimates the market size using data from ChatGPT. The author projects the C-end market at $33.75 billion, while the seven major tech giants have a combined AI market value of approximately $8.25 trillion, resulting in a price-to-sales ratio (P/S) of 244 times. The article points out that AI is currently mainly used as a productivity tool, and the capital market's valuation of it is overly high, which may lead to adjustments. The emergence of AGI in the future could change the current situation, but caution is still necessary.

金色财经_·2025-12-18 08:03

VC "dead"? No, the industry is undergoing a brutal reshuffle

As a former VC investor, what are your thoughts on the current "VC is dead" rhetoric on Crypto Twitter?

Regarding the paid question, I’ll give a serious answer. I also have quite a few thoughts on this rhetoric.

First, the conclusion -

1. The fact that some VCs are already dead is undeniable.

2. Overall, VCs will not die; they will continue to exist and push the industry forward.

3. VCs are actually similar to projects and talent—they are entering a phase of "clearing out" and "big waves washing away the sand," somewhat like during the internet bubble of 2000. This is the "debt" from the last crazy bull run. After a few years of repayment, a new phase of healthy growth will begin, but the threshold will be much higher than before.

Now, let me elaborate on each point.

1. Some VCs are already dead

Asian VCs are probably the hardest hit in this round. Starting from this year, most of the top players have shut down or disbanded. The remaining few might not even make a deal once every few months, focusing on...

PANews·2025-12-18 03:07

Pi Network hype bubble bursts! The $100 target price promotion campaign fails to succeed

Pi Network community account urges holders to "HODL Pi," warning followers not to miss the next rally, and boldly claims that Pi's price could reach 100 USD, even accompanied by exaggerated charts suggesting a market cap of 1 trillion USD. However, the community response has been lukewarm, and the market has completely ignored such predictions. The hype bubble has burst, and since its launch, the Pi token price has plummeted by approximately 92%, whale trading activity has stalled, and liquidity across various exchanges has declined.

PI-2.03%

MarketWhisper·2025-12-18 01:28

Federal Reserve Nominee Changes, AI Bubble Warning! Bitcoin Clears $527 Million in a Single Day

December 16, Bitcoin retested the $85,000 level, with over $527 million in bullish leverage positions being liquidated in a single day. This plunge was triggered by the convergence of two major systemic risks: Trump's core circle pushing for a more independent Federal Reserve Chair candidate, reducing the likelihood of Kevin Hasset replacing Powell; and hedge fund giant Bridgewater warning that tech companies' over-reliance on the debt market for AI investment financing has entered a dangerous phase.

ETH-3.29%

MarketWhisper·2025-12-16 02:26

Stock Market Fluctuations and Market Outlook: The Rise of Precious Metals and Potential Turmoil in Equity Markets

In December 2025, the US stock market experienced significant volatility, especially with tech-led sell-offs causing major indices to retreat. As of December 12, 2025, the S&P 500 closed at 6,827.41 points, down 1.07% for the day and 0.63% for the week; the Nasdaq Composite closed at 23,195.17 points, down 1.69% for the day and 1.62% for the week. This sell-off was primarily driven by concerns over tech giants' earnings: Broadcom warned of AI chip gross margin dilution, and Oracle's earnings report showed massive AI expenditures with lagging returns, prompting a market reassessment of the "AI bubble." Tech stocks like Nvidia, AMD, and Micron declined between 3%-6%, causing funds to shift from growth stocks to value and defensive sectors such as finance, healthcare, and industrials.

This wave of volatility is not an isolated event. Throughout 2025, the S&P 500 rose approximately

BTC-2.32%

金色财经_·2025-12-16 00:50

Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets

Key takeaways:

Leverage surges in the crypto market, with $527M in liquidations in 24 hours, signaling growing caution among traders.

Tighter liquidity and rising AI debt risks push traders to exit riskier assets, contributing to a market correction.

The cryptocurrency market saw a correction on

Cointelegraph·2025-12-16 00:24

CoinShares believes the (DAT) cryptocurrency treasury bubble has burst

CoinShares reports that the cryptocurrency treasury bubble has largely deflated, with companies now trading at their net asset values. Investor focus has shifted to sustainable business models and governance, while companies are adopting a more disciplined approach to managing bitcoin.

BTC-2.32%

TapChiBitcoin·2025-12-14 09:46

Google releases new browser "Disco": deeply integrated with Gemini, stunning display effects, breaking 30 years of reading and navigation logic

Google launches the Disco browser with Gemini 3 support, instantly converting tabs into interactive Web Apps, aiming to reshape web access points while maintaining content ecosystems.

(Background recap: Sister Wood states "AI is not a bubble": Facing the explosive wealth creation of the internet replication era)

(Additional background: Google officially launches "Gemini 3"! Topping the world's smartest AI models, what are the highlights?)

Table of Contents

From "Tab Stacking" to "Project-Oriented"

"Grounded Reasoning" to combat hallucinations and sustain traffic

AI-driven Software Factory

Next Stop: From Laboratory to Billions of People

Earlier this week, Google announced the experimental new browser "Disco" in Mountain View, California, leveraging the Gemini 3 model to assist users

TON-2.02%

動區BlockTempo·2025-12-13 04:35

Load More