Search results for "DYDX"

Regulation to Define 2026: DYdX’s Charles d’Haussy Predicts Domestic DATs and Blockchain Governed AI

Charles d’Haussy, CEO of the DYdX Foundation, outlines eight major trends he believes will shape digital assets, DeFi, and AI in 2026.

The Rise of Onshore Digital Asset Treasuries

Charles d’Haussy, CEO of the DYdX Foundation, has released a series of predictions outlining how digital assets,

DYDX2.06%

Coinpedia·2025-12-18 05:37

dYdX Community Vote Passes: 75% of Protocol Fees Now Allocated to DYDX Buybacks

The dYdX community vote has overwhelmingly approved a landmark governance proposal, redirecting 75% of protocol revenue toward buying back and staking DYDX tokens.

CryptopulseElite·2025-11-14 08:53

Is dYdX (DYDX) Gearing Up for a Breakout? This Key Pattern Formation Suggest So!

The broader cryptocurrency market continues to remain under heavy selling pressure as Bitcoin (BTC) and Ethereum (ETH) recorded sharp declines of over 6% and 9% respectively in the past 24 hours. Despite the turbulence, dYdX (DYDX) is displaying notable strength after its latest announcement

CoinsProbe·2025-11-14 08:33

Data: ARDR fall over 10%, POLYX fall over 18%

The market has experienced significant fluctuations, with ARDR and POLYX falling by 10.61% and 18.78% respectively, while LSK and ZEC rose by 18.1% and 9.56% respectively. Other tokens such as DYDX and ETHFI also showed gains, indicating a certain bottoming and recovery state.

POLYX0.53%

MarsBitNews·2025-11-14 04:05

Decentralized Crypto Exchange Plans Year-End Debut, Reuters

dYdX (DYDX), one of the leading decentralized cryptocurrency trading platforms in the industry, is reportedly preparing to enter the US market by the end of the year, following the recent shift in crypto policies by the Trump administration

dYdX Expands Amid Supportive Legislation

In an

AsiaTokenFund·2025-10-31 12:24

Daily Market Wrap | Oct. 31

KRWQ, Korea's first won-pegged stablecoin, launches on Base while Hong Kong's SFC scrutinizes digital assets. JPMorgan enhances fund settlement via blockchain, as Bitcoin hits $109K amid market fluctuations and dYdX eyes U.S. expansion by 2025.

TokenInsight·2025-10-31 11:04

PA Daily | Bitcoin ETF experienced net outflows of $488 million yesterday; Coinbase increased Bitcoin holdings by $299 million in Q3

Reminder:

Revolut has launched 1:1 USD-pegged stablecoin swap services on 6 blockchains, supporting USDC and USDT.

Standard Chartered: It is expected that by the 2028 era, the tokenized RWA scale will reach $2 trillion, with "the vast majority" based on Ether.

After replacing AI16Z with ELIZAOS, the total token supply will be increased by 40% to 11 billion tokens.

dYdX plans to enter the US marketplace before the end of the year and will significantly reduce trading fees.

Ether.Fi community has initiated a proposal to allocate $50 million to ETHFI buyback plan.

Bitcoin Spot ETF experienced a total net outflow of $488 million yesterday, with none of the twelve ETFs showing net inflow.

Listed company SEGG Media plans to launch a $300 million digital asset program, initially focusing on Bitcoin.

Macro

Revolut has launched on 6 blockchains.

BTC1.96%

PANews·2025-10-31 09:40

Exclusive from Reuters! dYdX is entering the U.S. by the end of the year, the $1.5 trillion volume king returns.

Reuters exclusive reveals that the decentralized derivatives trading exchange dYdX plans to enter the U.S. market by the end of the year. dYdX President Eddie Zhang stated that having a platform in the U.S. is crucial, as this move aligns with the company's broader future development roadmap. According to reports, the platform plans to offer Spot Crypto Assets trading in the U.S., but due to regulatory restrictions, dYdX is unable to provide its flagship product, perpetual futures trading.

DYDX2.06%

MarketWhisper·2025-10-31 05:56

dYdX announced its entry into the US market by the end of the year, as the derivation giant aims to seize the opportunity through Spot trading.

According to a report by Reuters, the president of the decentralized cryptocurrency trading platform dYdX revealed in an interview that the platform is preparing to enter the U.S. market by the end of this year, marking a significant shift for a derivatives trading platform that was previously not open to U.S. users. dYdX plans to expand its U.S. business by offering spot trading services for Solana and other related crypto assets, and after entering the U.S. market, it will significantly reduce trading fees by half, to between 50 and 65 basis points. Although perpetual futures are currently unavailable in the U.S., this move is still seen as a key step for DeFi giants to seize the U.S. market under improving regulatory conditions.

MarketWhisper·2025-10-31 03:35

dYdX plans U.S. launch by year-end as crypto rules ease under Trump

dYdX is set to launch its trading platform in the U.S. by year-end, introducing spot trading and cutting fees by up to half. This expansion aligns with evolving crypto regulations and aims to offer users more control compared to centralized exchanges.

Cryptonews·2025-10-31 03:18

dYdX launches the "Token Buyback" initiative! The community proposes to use 100% of the transaction fees to buy back $DYDX, with the protocol treasury backing it with millions of dollars.

dYdX is going all out! The community proposes that starting from November for a duration of three months, 100% of the transaction fees will be used to buy back DYDX Tokens, with the community treasury investing millions of dollars to back it up. Voting officially kicks off on November 3rd. (Background: Helium announced daily "Token Buybacks" to replace burning, aiming to restore HNT value) (Additional background: ApeX Protocol launches "Token Buyback Program": initially investing $12 million plus 50% of protocol revenue, $APEX surged 32%) The decentralized futures trading exchange dYdX recently proposed a significant plan in the official community forum, suggesting that starting from November 1, 2025, 100% of the net transaction fees of the protocol will be fully used for DYDX Token buybacks, lasting for three months. The proposal emphasizes that this is an experiment, and this experimental plan is expected to kick off on November 3.

DYDX2.06%

動區BlockTempo·2025-10-30 13:32

dYdX Announces 3-Month Experimental Token Buyback Plan - Coinspeaker

Key Notes

dYdX community has proposed a 3-month buyback plan to improve DYDX price performance.

Validator and staker rewards to be funded by the community treasury during the trial.

Initiative aims to test improved price-to-earnings ratios and market efficiency.

The dYdX community has

Coinspeaker·2025-10-29 12:49

A $19 billion liquidation wave is here! dYdX only provided $460,000, sparking intense discussions in the community.

The decentralized exchange dYdX experienced an outage for about 8 hours on October 10, due to "incorrect processing order in the code, and the latency from validators restarting the Oracle Machine Sidecar service exacerbated the duration of the interruption." The dYdX governance community will vote to decide on compensation of up to $462,000 from the protocol insurance fund to the affected traders, which has sparked intense discussion in the community about the amount being too low.

MarketWhisper·2025-10-28 02:56

The DYdX community will vote on the proposal to "compensate affected traders with a total of $462,000".

According to Mars Finance news on October 28, Cointelegraph reported that the dYdX community will vote on a compensation proposal of $462,000, which aims to compensate traders affected by an 8-hour service interruption during last month's historic liquidation event.

DYDX2.06%

MarsBitNews·2025-10-28 01:42

dYdX Offers $462K Compensation to Traders After October 10 Chain Halt

The recent turbulence in the cryptocurrency markets has exposed vulnerabilities both in blockchain infrastructure and trading platforms. Notably, dYdX, a prominent decentralized exchange (DEX), is addressing the aftermath of an unexpected chain halt that impacted traders, while Binance’s response to

DYDX2.06%

CryptoBreaking·2025-10-28 00:08

dYdX Mobile App Now Supports Fiat Payments via MoonPay

Decentralized derivatives exchange dYdX has taken another major step toward mainstream adoption. By enabling fiat payments in its mobile app. The new feature allows users to deposit funds using bank cards, Apple Pay or Google Pay through MoonPay. It simplifies the process of funding accounts and ent

Coinfomania·2025-10-25 07:03

dYdX launches "2025 World Series Perpetual" – Connecting DeFi with the prediction market for sports

dYdX has just launched a new market called "2025 World Series Perpetual", allowing users to predict whether the Los Angeles Dodgers, the team of Shohei Ohtani, will win the Major League Baseball (MLB) 2025 championship or not. This contract works similarly to perpetual contract trades in the cryptocurrency field.

DYDX2.06%

TapChiBitcoin·2025-10-22 09:51

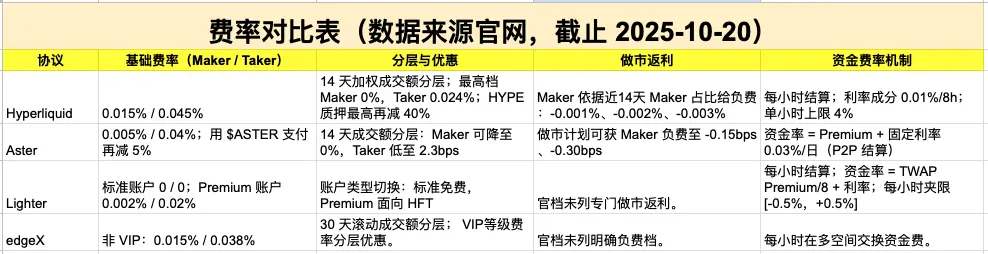

Part Four | In-Depth Analysis of PERP DEX: Hyperliquid, Aster, Lighter, edgeX

edgeX - Perp DEX incubated by well-known crypto market maker Amber Group

This generation of Perp DEX is fundamentally different from the previous generation of Perp DEXs like GMX and DYDX. Since it remains a Perp DEX at its core, we will continue to refer to it as a Perp DEX in this discussion.

This article is the concluding piece of a one-month series on Perp DEXs, focusing on the last member of the top four Perp DEXs according to DefiLlama data — edgeX — and extending the discussion to the current state and trends of the entire Perp DEX sector.

As the landscape of mainstream players has largely taken shape, Perp DEX

PANews·2025-10-21 02:03

The integration path of TradFi experience and Decentralization innovation

Abstract

Traditional platforms, while mature in "compliance + experience + coverage", are constrained by centralized custody, insufficient transparency, settlement delays, and regional barriers. Web3 approaches this with self-custody, on-chain verifiability, and global accessibility, enhancing capital efficiency through oracle services, partial settlement, unified collateral, and fund reuse. The landscape is becoming multi-polar: dYdX (order book), GMX (GLP pool), Hyperliquid (high-performance matching), Avantis (multi-asset synthesis/RWA). The characteristics of Web3 leverage trading lie in the CEX-level low latency experience + institutional-level risk control compliance + multi-asset integration. By 2030, it is expected to grow into a hundred billion dollar level infrastructure.

1. Industry Status and Overview

In the development process of global capital markets, leveraged trading has always been an important tool for promoting liquidity and risk pricing efficiency. Since the 1970s IG

金色财经_·2025-10-09 07:56

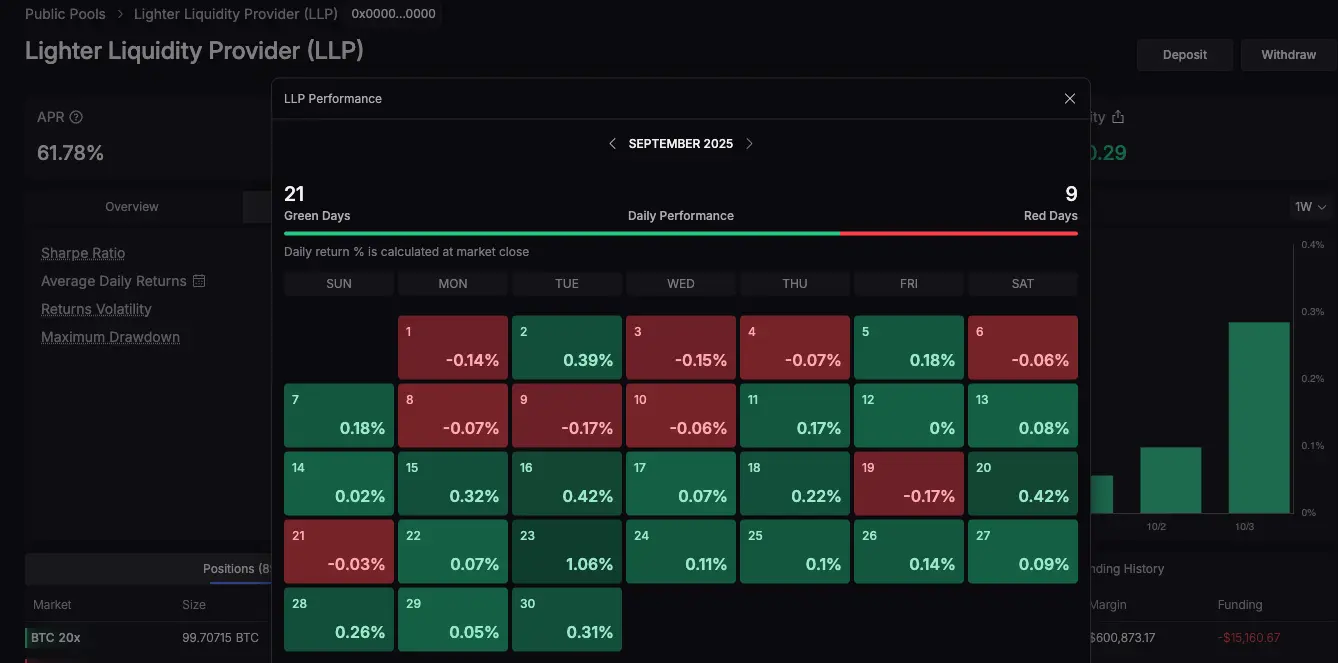

Part Three丨Depth Analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX

Lighter - Don’t trust—verify

This generation of Perp DEX has fundamentally differed from the previous generation represented by "GMX, DYDX". Since it is still a Perp DEX, the title will continue to discuss it as a Perp DEX.

Lighter is a Perp DEX invested by the well-known American venture capital firm a16z, based on Ethereum's ZK Rollup, and it also follows the order book (CLOB) model.

During the AMA at the end of August this year, the team mentioned some future plans for Lighter. For example, the launch of RWA derivatives and Pre-launch.

PANews·2025-10-07 00:55

dYdX Launches Telegram Perps With Pocket Pro Bot And Announces $100K Trading Competition

dYdX has launched its first Telegram trading bot in partnership with Pocket Pro Bot, integrating social trading features and offering a $100,000 competition to engage crypto communities. This initiative aims to enhance trading interactions within Telegram groups.

MpostMediaGroup·2025-10-01 13:11

DYdX Teams Up With Pocket Pro Bot to Launch Telegram Perps Trading

Trading crypto perpetual futures – yep, perps – has just gotten a little easier thanks to a neat collab between dYdX and Pocket Pro Bot. The former is of course the leading onchain perps protocol, while Pocket Pro Bot specializes in creating crypto-based trading infra for Telegram users. No

CryptoDaily·2025-09-30 11:53

In-depth interpretation: PerpDEX reshuffling moment, how else can Hyperliquid play?

Original author: Biteye

Reprint: Luke, Mars Finance

Global Overview of the Sustainable DEX Market and Industry Transformation

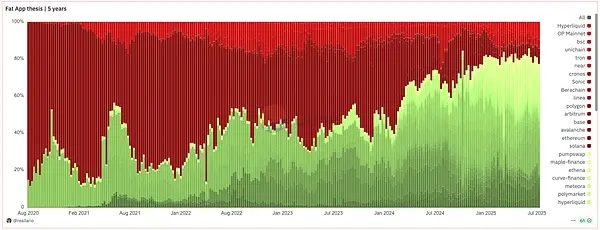

The decentralized perpetual trading market is experiencing an unprecedented wave of growth and a reshaping of the competitive landscape. As of September 2025, the global daily trading volume of perp DEX has surpassed $52 billion, a 530% increase compared to the beginning of the year, with a cumulative monthly trading volume reaching $13 trillion. This growth is driven by breakthroughs in technological innovation, an increase in user demand for decentralized financial products, and regulatory pressure on centralized trading platforms. The entire sector now accounts for approximately 26% of the crypto derivatives market, achieving a qualitative leap compared to the single-digit share in 2024.

Perp DEX Total Trading Volume Change

The rapid differentiation of the market is reshaping the competitive landscape. Traditional order book models (such as dYdX, H

HYPE0.08%

MarsBitNews·2025-09-28 06:44

2025's Perp DEX Wars: New Money, New Tech, No off-Switch

Perpetual futures have become crypto’s main event, and the perp DEX wars—led by Hyperliquid, Aster, GMX, DYdX, ApeX, Drift, Jupiter, EdgeX, and Sunperp—are where the action won’t quit.

From Order Books to Onchain: Inside 2025’s Perp DEX Dogfight

Perpetuals are derivatives without an expiry;

Coinpedia·2025-09-26 03:37

Is a FDV of 45 billion for Hyperliquid a reasonable valuation?

I want to ask, what does everyone think @HyperliquidX is? If it’s just a pure Perp Dex application, then a 45B FDV is already too high. If it’s a new innovative species L1, then a circulating market capitalization of 15B might still be undervalued? What’s even more confusing is how should Hyperliquid's followers benchmark their expectations?

1) If we consider HL as a Perp Dex, its valuation is already quite high compared to its predecessors like dYdX and GMX, but if we view it as an on-chain Binance and compare it to the valuations of other L1s like Solana and BNBChain, HL still has substantial growth potential.

Objectively speaking, although HL currently has a leading effect in the market share of Perp Dex that is bound to create a premium valuation, the overall on-chain

HYPE0.08%

金色财经_·2025-09-24 08:30

Depth Analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX

Original Author: JV

Reprint: White55, Mars Finance

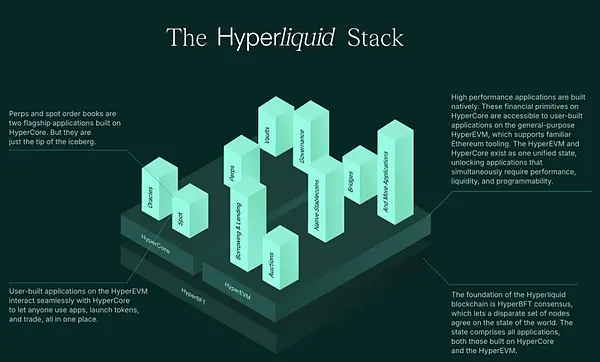

Hyperliquid

This generation of Perp DEX has fundamentally differentiated itself from the previous generation of Perp DEXs like "GMX, DYDX". Since its main focus is still on Perp DEX, the title will continue to discuss it as Perp DEX.

with 'Perp

MarsBitNews·2025-09-21 02:25

Article 1 | Depth Analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX

Hyperliquid

This generation of Perp DEX has fundamentally changed compared to the previous generation of Perp DEX represented by "GMX, DYDX". Because it is still fundamentally a Perp DEX, we will continue to discuss it under the title of Perp DEX.

Starting with "Perp DEX", it quickly rose to prominence and became known to many.

Hyperliquid is an L1 public chain, similar to Ethereum and Solana. Hyperliquid has a grand vision to serve as a blockchain for all finance and to provide a high-performance on-chain financial trading infrastructure. Hyperliquid offers both perpetual contract trading and spot trading, and is currently promoting the stablecoin USDH.

Its development path can be glimpsed from the HIP, from HIP-1, HIP-2 to HIP-3, and recently the community has proposed HIP-4. HIP-4 aims to do

PANews·2025-09-20 13:42

21Shares launches dYdX ETP amid a wave of institutional interest in crypto derivatives

21Shares, a Switzerland-based company and one of the largest cryptocurrency exchange product issuers in Europe, has officially launched its first fund linked to dYdX — the decentralized exchange (DEX) specializing in perpetual derivative contracts.

dYdX has processed a total trading volume

DYDX2.06%

TapChiBitcoin·2025-09-12 02:52

21Shares Launches DYDX ETP: New Opportunities for Institutional Access to On-Chain Derivatives

21Shares, one of the leading European issuers of cryptocurrency-related financial products, has announced the launch of the 21Shares DYDX Exchange-Traded Product (ETP).

This new regulated and physically-backed instrument offers institutional investors secure and compliant access to DYDX (ticker: DY

DYDX2.06%

TheCryptonomist·2025-09-11 17:34

The entire DEX track is waiting for QuBitDEX to launch, as it addresses the problem that no one else has solved.

Author: Leo

If you observe the DEX track closely, you will find a strange calmness, a "calm before the storm."

dYdX traded sovereignty and performance for application chains, but paid the price of ecological fragmentation. Hyperliquid achieved extreme speed with its self-built L1, yet raised new concerns in the community regarding its level of decentralization and security. Even AMM giants like Uniswap are constantly seeking a balance in the quagmire of capital efficiency and trader experience.

Every project deserves respect; they have all excelled on their own paths. But they have also tacitly made a "compromise" in the face of a most fundamental and core issue.

The question is: Can we achieve results that are completely consistent with or even surpass those of Web2 (centralized exchanges) without sacrificing the soul of Web3 (decentralization and asset security)?

ZK4.26%

TechubNews·2025-08-27 16:11

The "Infinite War" of Perptual Futures: Why is it said that the DEX market in 2025 still has opportunities for a hundredfold rise?

Author: Sicily

As we examine the current Perp DEX space, a suffocating sense of "involution" seems to be approaching.

The narrative of GMX's "real yield" has set a precedent, while the application chain paradigm of dYdX has become a dominant force. Hyperliquid has further escalated the "arms race" of performance to a fever pitch. The names on the leaderboard chase each other, and every new project seems to be struggling to find its foothold in this crowded and blood-soaked battlefield.

As a result, a pessimistic tone began to spread: Has the war of Perp DEX entered the "garbage time"? The pattern is set, opportunities have passed, and what remains is just the brutal melee of the existing market?

If you think so too, then you might be making a serious temporal mistake similar to believing that the end of the internet is portals.

Because the DEX we see today

PERP-0.01%

TechubNews·2025-08-27 16:05

dYdX changes skin: rebranding, spotlight on Solana, and free deposits — the new phase of the DEX ...

dYdX inaugurates a new phase: the rebranding into dYdX Labs marks a change in strategy, accompanied by free instant deposits for amounts over $100 on Ethereum, Arbitrum, Optimism, Base, Polygon, and Avalanche, and by the introduction of trading via Telegram – a feature based on Pocket Protector

TheCryptonomist·2025-08-27 15:25

dYdX announces the 2025 Roadmap with Telegram trading and expansion into the spot market

Sàn giao dịch phi tập trung dYdX đã công bố tầm nhìn của mình cho năm 2025, giới thiệu các nâng cấp nhằm cải thiện khả năng tiếp cận và tiện ích. Các tính năng chính bao gồm giao dịch qua Telegram, đăng nhập xã hội, đơn đặt hàng theo lô và các ưu đãi staking, nhằm kết nối giao dịch truyền thống với Web3.

DYDX2.06%

TapChiBitcoin·2025-08-27 10:25

DYdX Rebounds Strongly as $0.6127 Support Holds and Resistance Caps Further Gains

dYdX has rebounded 9.5% to $0.6948, maintaining support at $0.6127, but faces resistance at $0.7215, limiting further gains. The token shows strength, gaining 7.1% against Bitcoin, but remains range-bound until resistance levels are overcome.

CryptoFrontNews·2025-08-26 02:32

DYDX Slides Below $0.65, Eyes on $0.55 Support Amid Heavy Pressure As Market Cap Loses $90M

DYDX has formed a bearish ABCD pattern, with key support at $0.55–$0.57. The market cap dropped significantly, and bulls need to reclaim $0.70 for a bullish reversal while bears target $0.50 amidst mixed technical signals.

DYDX2.06%

CryptoNewsLand·2025-08-20 06:24

The end of the wool-pulling era: Hyperliquid redefines Token value with buybacks.

The golden age of the wool-pulling party is over.

In two years, Hyperliquid surged from a 0.3% market share to 66%, defeating dYdX with a simple and straightforward promise: 97% of trading fees are used to buy back tokens. It's no longer about completing tasks on Galaxy for airdrops, but rather holders directly share in the real profits.

When Uniswap started profit sharing and Aave launched its buyback plan, the entire DeFi ecosystem is undergoing a historic transition from "spending money to gain volume" to "value accumulation." The era of token economics 2.0 has arrived, and the rules of the game have been completely rewritten.

While we are still marveling at the former glory of dYdX, Hyperliquid has quietly completed a perfect "coup."

In just two years, Hyperliquid's market share skyrocketed from 0.3% to a peak of 66%, currently stabilizing at a market dominance of 64.8%. However,

HYPE0.08%

金色财经_·2025-08-14 02:40

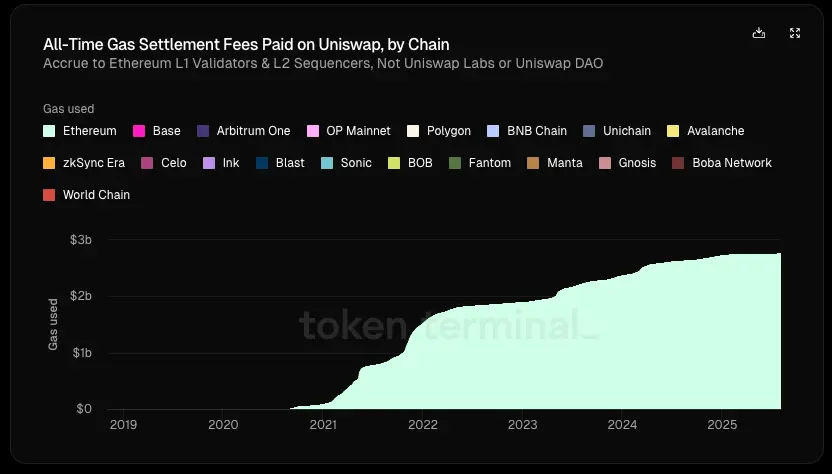

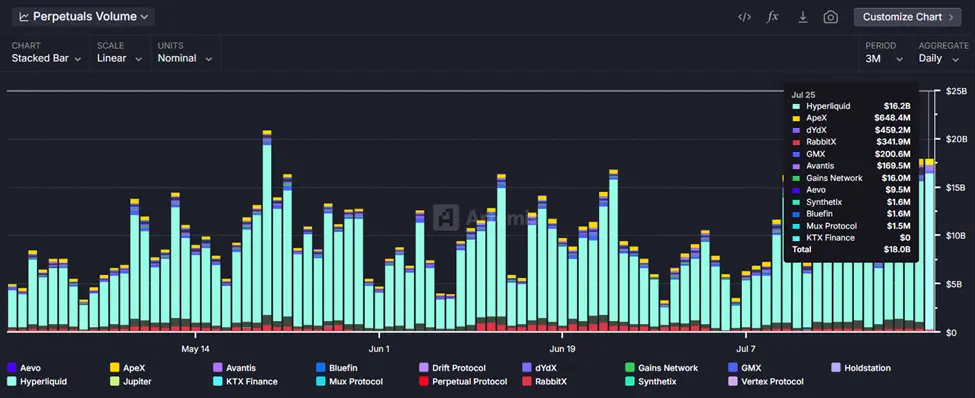

IOSG: From 'Fat Protocol' to 'Fat Application', Interpreting the Appchain Narrative of 2025

Author | Jiawei @IOSG

Three years ago, we wrote an article about Appchain, triggered by dYdX's announcement to migrate its decentralized derivatives protocol from StarkEx L2 to the Cosmos chain, launching its v4 version as an independent blockchain based on the Cosmos SDK and Tendermint consensus.

In 2022, Appchain may have been a relatively marginal technological option. As we move into 2025, with the introduction of more Appchains, especially Unichain and HyperEVM, the competitive landscape of the market is quietly changing, forming a trend centered around Appchains. This article will start from this point to discuss our Appchain Thesis.

PANews·2025-08-12 05:17

Betrayal and Independence: Re-examining the AppChain Argument

Author: Jiawei @IOSG

Three years ago, we wrote an article about Appchain, triggered by dYdX's announcement to migrate its decentralized derivatives protocol from StarkEx L2 to the Cosmos chain, launching its v4 version as an independent blockchain based on the Cosmos SDK and Tendermint consensus.

In 2022, Appchain was likely a relatively niche technology option. As we approach 2025, with the launch of more Appchains, particularly Unichain and HyperEVM, the competitive landscape of the market is quietly changing, and a trend around Appchain is forming. This article will start from this point to discuss our Appchain Thesis.

金色财经_·2025-08-11 13:54

dYdX Foundation Raises $8M to Accelerate Ecosystem Growth - The Daily Hodl

The dYdX Foundation has launched a new Grants Program with $8 million in funding to enhance ecosystem growth and efficiency. This program prioritizes infrastructure, growth initiatives, and research, transitioning to in-house management for better precision and accountability.

DYDX2.06%

GateUser-299f2bac·2025-08-11 04:48

ATOM Jumps 4% on Institutional Demand Before Late-Hour Reversal

ATOM experienced a 4% rise to $4.55 driven by strong institutional buying, linked to Coinbase's dYdX support. However, selling pressure led to a reversal as trading volume dropped and resistance emerged at $4.55-$4.67.

YahooFinance·2025-08-08 19:50

dYdX Proposes $8M Funding Allocation To Support Revised Grants Program

In Brief

dYdX has proposed allocating $8 million in DYDX tokens from its community treasury to fund a revised Grants Program, aiming to support ecosystem developers, researchers, and contributors over the next 12 to 18 months.

Decentralized exchange dYdX introduced a new proposal seeking

DYDX2.06%

MpostMediaGroup·2025-07-29 00:29

Hyperliquid surpasses competing DEX platforms in trading volume.

Hyperliquid has rapidly emerged in the decentralized exchange (DEX) space, particularly in perpetual trading, surpassing established competitors like DYDX and Synthetix. Despite ranking 11th overall in DEX market share, its impressive growth indicates significant future potential.

HYPE0.08%

TapChiBitcoin·2025-07-27 05:04

DYDX Price Holds Above $0.67 Despite 4.6% Drop as Network Upgrades Show Technical Strength

James Ding

Jul 22, 2025 04:27

DYDX trades at $0.67 after a 4.58% decline, but recent network upgrades and bullish technical indicators suggest potential recovery ahead for the decentralized exchange token.

Quick Take

• DYDX currently trading at $0.67 (-4.58% i

DYDX2.06%

AsiaTokenFund·2025-07-21 20:27

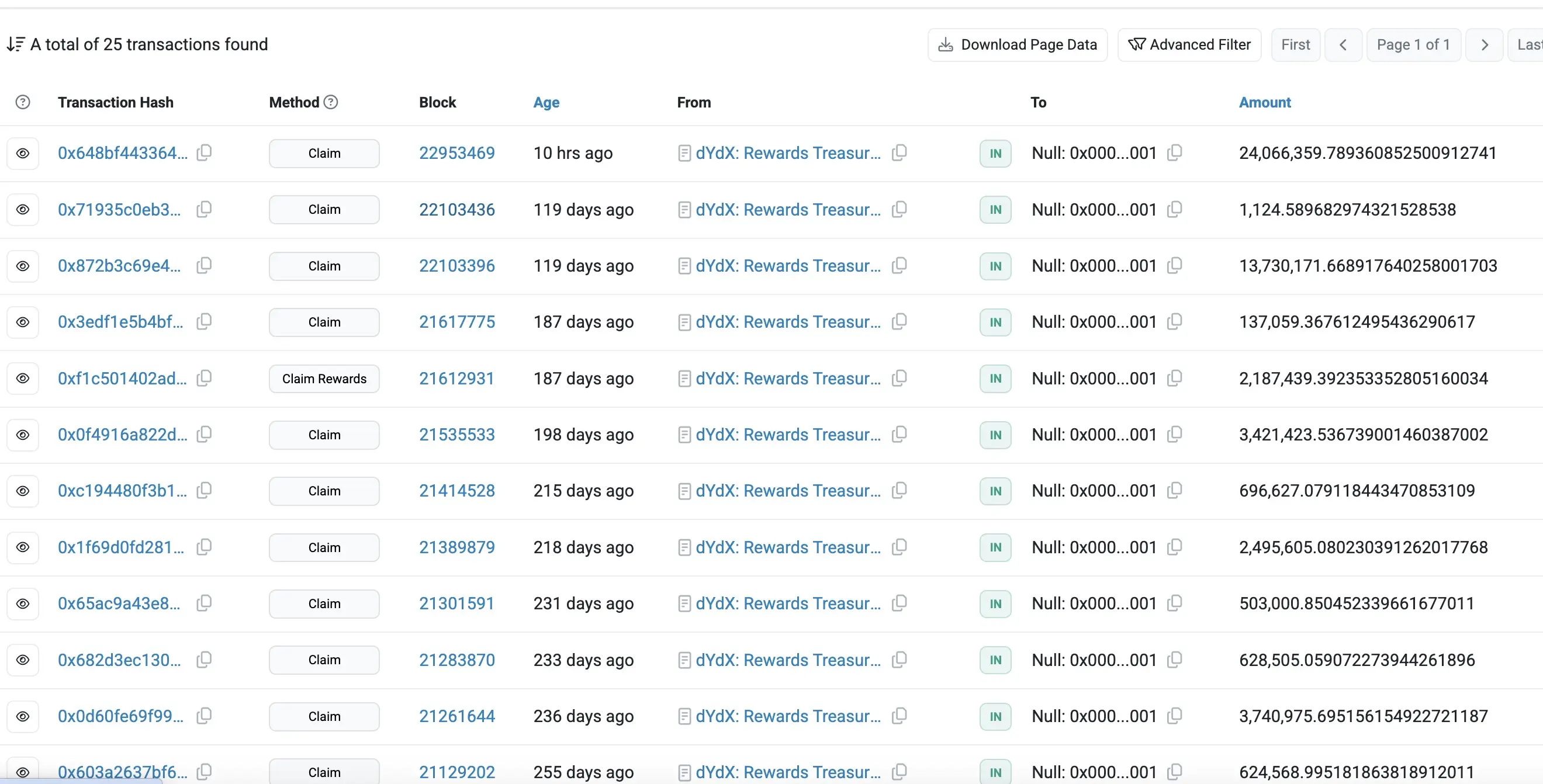

dYdX burned more than 24 million DYDX tokens, worth 15.7 million USD

dYdX treasury burned 24.066 million DYDX tokens, valued at approximately $15.7 million, after nearly 4 months of inactivity. To date, a total of about 123 million DYDX tokens have been burned, totaling around $79.42 million in value.

TapChiBitcoin·2025-07-19 16:02

Decentralized Derivatives Exchange dYdX Acquires Crypto Social Trading Platform Pocket Protector

dYdX has acquired Pocket Protector, enhancing its social trading capabilities and bringing key talent into leadership roles. The deal, funded through cash and dYdX tokens, follows a strategic restructuring aimed at future growth.

DYDX2.06%

ICOHOIDER·2025-07-18 12:54

Developers of the Surprise Altcoin Announced the Completion of the Token Buyback Program!

The dYdX Foundation has repurchased 2.86 million DYDX tokens worth $1.87 million as part of its buyback program. An additional 593,570 DYDX will be purchased for staking. The program allocates 25% of net transaction fees for buybacks, supporting network security.

TOKEN-5.62%

Bitcoinsistemi·2025-07-17 22:42

Why Traders Are Turning to dYdX for BTC and ETH Perpetuals: Report

Key Insights:

dYdX Chain reaches 267 perpetual futures markets with instant listing capabilities.

Bitcoin and Ethereum account for 80% of $200 million open interest total.

Platform combines order book performance with on-chain transparency benefits.

Cryptocurrency traders increasingly turn to

TheCoinRepublic·2025-07-02 17:41

Load More